Perfume Market Outlook:

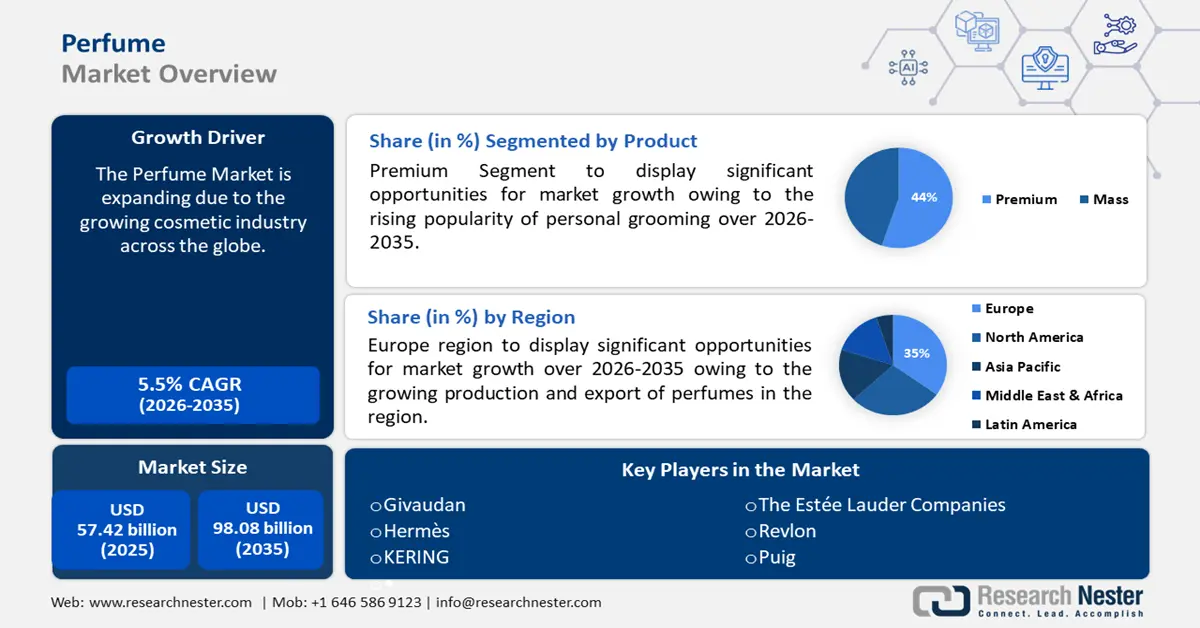

Perfume Market size was valued at USD 57.42 billion in 2025 and is likely to cross USD 98.08 billion by 2035, registering more than 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of perfume is assessed at USD 60.26 billion.

The market is flourishing as a result of the augmenting cosmetic sector across the globe. Given the surge in the newest generation of consumers, the skincare sector will undoubtedly see a rapid rise, particularly with the emergence of social media. For instance, in 2022, the global cosmetics business generated over USD 100 billion in sales. Additionally, the beauty and personal care industry is expected to expand by more than 3% between 2024 and 2028 globally, reaching market revenue of USD 736 billion by 2028.

On the other hand, components that are believed to fuel the market growth of perfume include shifts in consumer preferences. The fragrance sector relies heavily on customer satisfaction as market trends and customer tastes change along with society and other factors, including cost, aroma, packaging, reviews, and recommendations from others. These turn out to be significant deciding factors for the market to have a strong position in the future.

Key Perfume Market Insights Summary:

Regional Highlights:

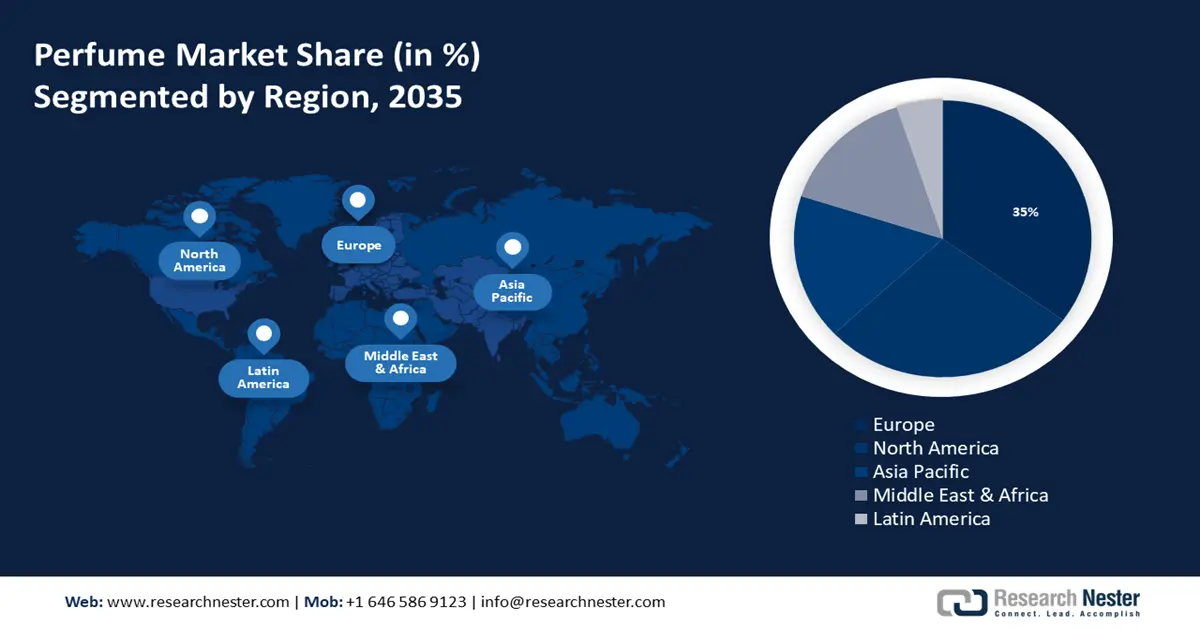

- Europe perfume market will secure over 35% share by 2035, driven by increased production and export of perfumes, along with Europe’s strong influence on global fragrance trends.

Segment Insights:

- The premium segment in the perfume market is anticipated to experience lucrative growth through 2035, propelled by the booming popularity of improving one’s appearance and evolving self-care trends.

Key Growth Trends:

- Increasing popularity of e-commerce

- Surging need for eco-friendly perfumes

Major Challenges:

- Environmental and health concerns associated with perfumes

- Supply chain disruptions can impact the production and sourcing of raw materials.

Key Players: CHANEL, The Avon Company, Coty Inc., LVMH Moet Hennessy-Louis Vuitton, Givaudan, Hermès, KERING, The Estée Lauder Companies, Revlon, Puig, L'Oréal Groupe.

Global Perfume Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 57.42 billion

- 2026 Market Size: USD 60.26 billion

- Projected Market Size: USD 98.08 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: France, United States, Italy, Germany, China

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 17 September, 2025

Perfume Market Growth Drivers and Challenges:

Growth Drivers

-

The expanding influence of celebrity endorsements and social media - Celebrity endorsements foster a relationship between the brand and the customer and, in comparison to non-celebrity endorsers, can elicit a more favorable reaction and a higher propensity to purchase perfumes. Consumers are more likely to follow the advice of celebrity influencers as they often convey ideas that are more credible and engaging, thus broadening the perfume market demand. One of the most cited studies on the subject revealed that celebrity endorsements are linked to an over 25% rise in sales and trust.

- Increasing popularity of e-commerce - There is a rising tide of people purchasing perfumes from online retail sites owing to variables related to convenience and since it provides easy ways for people to buy perfume. More than 770 million customers worldwide now purchase their preferred colognes and perfumes through e-commerce sites.

- Surging need for eco-friendly perfumes - Consumers are turning back to perfumes created with more naturally derived chemicals as they become more conscious of how their decisions may affect the environment. Customer behavior needs, and preferences for such fragrances are helping the perfume market boom and meet customer demands.

Challenges

-

Environmental and health concerns associated with perfumes - Musk is an aromatic substance found in animals that is frequently utilized as perfumery base notes and might interfere with wildlife's ability to expel poisons from their bodies, causing problems for the creatures. Additionally, perfumes, soaps, shampoos, and disinfectants often contain synthetic musk scents, which are held accountable for harming the environment and are known to contaminate aquatic life.

Fragrances these days are stronger, longer-lasting, and comprise a greater number of synthetic compounds, and exposure to them may result in various health issues. Moreover, the hormone system and reproductive system may be disturbed by them, and both adults and children may experience allergic reactions to scent compounds. - Adherence to industry norms and legal compliance are essential for the marketing of perfumes and cosmetic products to make sure the goods are safe and appropriately labeled. This can pose a challenge for manufacturers, which is anticipated to impede market expansion.

- Supply chain disruptions can impact the production and sourcing of raw materials.

Perfume Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 57.42 billion |

|

Forecast Year Market Size (2035) |

USD 98.08 billion |

|

Regional Scope |

|

Perfume Market Segmentation:

Product

The premium segment will hold over 56% of the perfume market by the end of 2035. The segment growth can be credited to the booming popularity of improving one’s appearance as the way people practice self-care has drastically changed in the beauty and cosmetic business in recent years. Grooming is important these days and was identified as one of the biggest fashion styles for 2023, pushing the boundaries of ultra-luxury and allowing women to show their individuality and sense of elegance in creative ways.

Additionally, manufacturers are concentrating on expanding their product lines to include luxury products. Because of growing worries about allergies and toxicity in synthetic fragrances, big businesses are putting more of an emphasis on presenting natural fragrances in premium products. More opportunities for innovation would be present in premium brand products, which are expected to boost product revenues in the upcoming years.

End-User

The women segment in the perfume market is expected to exhibit a notable share during the analysis period. Perfume sales are predicted to increase among women, despite their high price points, because they consider it a necessary aspect of personal care, thus accounting for a significant share of the global market. According to reports, it has been observed that in the United States, women are 37% more likely than men to let their moods define the perfume they will wear every day, fostering a greater emotional bond to fragrance than their male counterparts.

These scents are specifically intended to meet the interests and needs of women. They cover a wide spectrum of scents, from flowery and sweet-fruity to aromatic and dense, providing options for a variety of occasions and personal preferences. The increased interest in specialized and artisanal fragrances, which provide distinctive and exclusive aromas for women seeking uniqueness, adds to the diversity of the women's market.

Our in-depth analysis of the market includes the following segments:

|

Product |

|

|

End-User |

|

|

Distribution Channel |

|

|

Type |

|

|

Ingredient |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Perfume Market Regional Analysis:

European Market Insights

Europe will hold a major share of around 35% in the global perfume market by the end of 2035. The increased production and export of perfumes is driving the rise of the market in the region. Since contemporary perfumery is thought to have originated in Europe, especially in France, the continent continues to shape consumer preferences and hold a dominant position in the worldwide market.

European fragrances are renowned for their exquisite aroma combinations, fine ingredients, and skillful craftsmanship. Many of the top fashion and luxury businesses in the world, many of which have perfume lines of their own, are also based in Europe. These companies frequently establish industry trends in the perfume industry, and both European and global consumers greatly value the items they provide.

France is regarded as one of the world's biggest perfume exporters. Perfume exports continue to be the driving factor behind the growth of the French market. For instance, France became the world's top perfume exporter in 2022, with around USD 7 billion in exports.

North American Market Insights

The increase in consumer expenditure on beauty and personal care items in the region is the primary driver of market growth. Besides, one of the biggest advancements in the region is a growing demand for a diversity of perfumes rather than a single distinctive aroma. This transition, particularly visible among the younger generation, has resulted in higher consumer expenditure on both mass and premium products. Further increasing demand for on-the-go, natural, and value-added products is driving market expansion.

Perfume Market Players:

- CHANEL

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- The Avon Company

- Coty Inc.

- LVMH Moet Hennessy-Louis Vuitton

- Givaudan

- Hermès

- KERING

- The Estée Lauder Companies

- Revlon

- Puig

- L'Oréal Groupe

Recent Developments

- CHANEL announced the launch of a new variant in its popular Chance fragrance line with the brightness of an Eau de Toilette with the heaviness of an Eau de Parfum to raise customer awareness of the well-liked Chance pillar of the French luxury brand in front of the holiday season.

- Coty Inc.introduced Chloé Rose Naturelle Intense which has a lower environmental impact for supporting their company strategy “Beauty That Lasts”.

- Report ID: 6022

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Perfume Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.