Paint Protection Film Market Outlook:

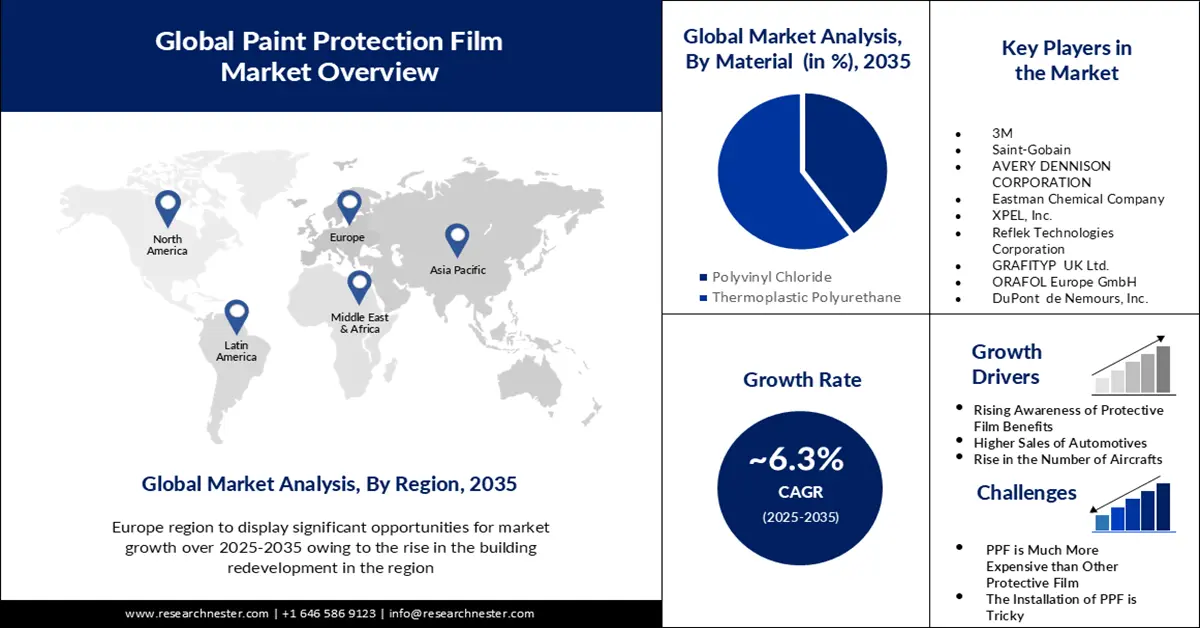

Paint Protection Film Market size was valued at USD 575.62 million in 2025 and is expected to reach USD 1.06 billion by 2035, registering around 6.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of paint protection film is evaluated at USD 608.26 million.

The paint and varnishes segment held a trade value of USD 904 million, expanding at an export growth rate of 0.13% between 2022 and 2023. The other paints contribute 0.004% of the overall trade. In 2023 the top exporters were Germany (USD 166 million), South Korea (USD 73.7 million), the U.S. (USD 71.2 million), Italy (USD 59.6 million), and the Netherlands (USD 51.3 million). In 2023 the top importers comprised China (USD 113 million), UK (USD 39.8 million), France (USD 39.2 million), Turkey (USD 38 million), and Poland (USD 35.4 million). The presence of strong trade dynamics is fostering a strong paint protection film supply chain.

Monthly Producer Price Index: Paint and Coating Manufacturing

|

Month |

PPI |

|

January 2025 |

415.897 |

|

December 2024 |

415.586 |

|

November 2024 |

415.957 |

|

October 2024 |

415.463 |

|

September 2024 |

415.243 |

|

August 2024 |

414.336 |

|

July 2024 |

413.362 |

|

June 2024 |

412.946 |

|

May 2024 |

412.724 |

|

April 2024 |

412.351 |

|

March 2024 |

413.303 |

|

February 2024 |

413.559 |

|

January 2024 |

414.175 |

Source: U.S. Bureau of Labor Statistics

Key Paint Protection Film Market Insights Summary:

Regional Highlights:

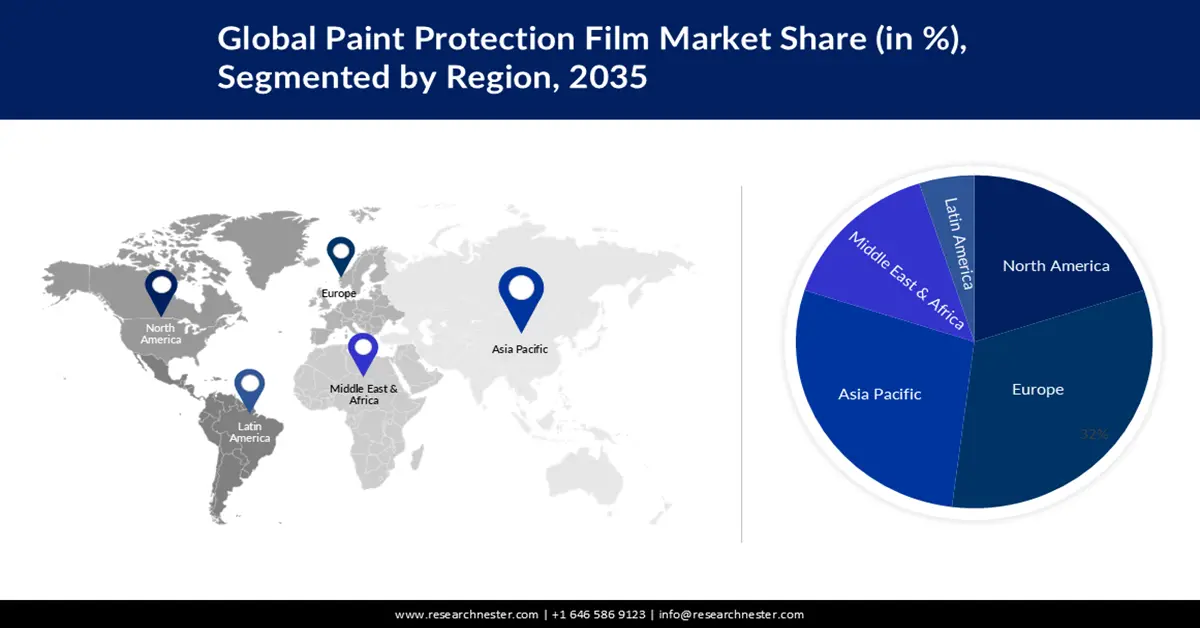

- The Europe paint protection film market is projected to capture a 35% share by 2035, attributed to demand from the automotive sector and expanding car fleet.

- The Asia Pacific market is expected to secure a 24% share by 2035, driven by cadmium supply and rising R&D in chemical sectors.

Segment Insights:

- The thermoplastic polyurethane segment in the paint protection film market is anticipated to capture a 60% share by 2035, driven by its self-healing properties and new product development.

- The automobile segment in the paint protection film market is projected to capture a 49% share by 2035, driven by the increasing demand for electric vehicles and protective film applications.

Key Growth Trends:

- A growing shift from traditional polyurethane to sustainable alternatives

- Massive boom in polyurethane global trade

Major Challenges:

- High prices of paint protection films

Key Players: IVIOS, 3M, Saint-Gobain, AVERY DENNISON CORPORATION, Eastman Chemical Company, XPEL, Inc., Reflek Technologies Corporation, GRAFITYP UK Ltd., ORAFOL Europe GmbH, DuPont de Nemours, Inc.

Global Paint Protection Film Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 575.62 million

- 2026 Market Size: USD 608.26 million

- Projected Market Size: USD 1.06 billion by 2035

- Growth Forecasts: 6.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 11 September, 2025

Paint Protection Film Market Growth Drivers and Challenges:

Growth Drivers

-

A growing shift from traditional polyurethane to sustainable alternatives: Government bodies play a vital role in fostering the adoption of sustainable processes in the market. The U.S. DOE-funded Algenesis Corporation in June 2024 to formulate biodegradable and high-quality polyurethane for adhesives and coatings. Algenesis Corporation and the University of California San Diego, with the DOE’s support, have identified that plant-based polymers demonstrate 75% theoretical biodegradation in roughly 150 days. This is estimated to emerge as a breakthrough development in the quest for petroleum-based plastic alternatives.

-

Massive boom in polyurethane global trade: Polyurethane, the main raw material for manufacturing paint protection films, garnered a worldwide trade worth USD 7.45 billion in 2023. The top five exporters in the same year were Germany (USD 1.62 billion), China (USD 944 million), the U.S. (USD 781 million), Italy (USD 573 million), and Chinese Taipei (USD 359 million). Whereas, the top importers comprised China (USD 720 million), the U.S. (USD 446 million), Germany (USD 446 million), Italy (USD 369 million), and Vietnam (USD 363 million). As per OEC, between 2022 and 2023, polyurethane exports expanded fastest in Canada (USD 27 million), Gambia (USD 3.8 million), Hong Kong (USD 3.69 million), Romania (USD 3.07 million), and Greece (USD 2.96 million).

- Rising employment in the paints and coating sector: The U.S. chemical sector contributes 25% to the country’s GDP, valued at USD 486 billion in 2020. 13% of the global chemicals come from the U.S., including polyurethane. The North America market share for specialty chemicals is relatively higher than the world average which is 23.4% and the cumulative value in shipments distributed was USD 77.2 billion in 2020. The adhesives and sealants sector (acrylates/anaerobic adhesives, amino resins, animal glue, polyurethane, paints, silicone, and polyvinyl acetate, among others) in the specialty chemicals industry employed 64,423 individuals in 2020. The median pay in 2023 for the painters, construction, and maintenance was USD 47,700 per year or USD 22.94 per hour. According to the U.S. Bureau of Labor Statistics, employment in this segment is projected to surge at 4% between 2023 and 2033.

Challenges

-

High prices of paint protection films: PPF can be relatively expensive compared to traditional methods of paint protection or repairs. The higher upfront cost can be a barrier for price-sensitive consumers, impacting the adoption of paint protection films. Manufacturers and industry players need to emphasize the long-term cost-saving benefits and value proposition to address this challenge.

Paint Protection Film Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.3% |

|

Base Year Market Size (2025) |

USD 575.62 million |

|

Forecast Year Market Size (2035) |

USD 1.06 billion |

|

Regional Scope |

|

Paint Protection Film Market Segmentation:

Material Segment Analysis

The thermoplastic polyurethane segment is estimated to account for 60% of the global paint protection film market in 2035. Thermoplastic polyurethane has high elasticity and self-healing properties. Moreover, the protective paint of thermoplastic polyurethane does not lose its luster over time, driving the segment growth. Furthermore, developing new products is also expected to augment the segment's growth. In 2021, Huntsman launched a new thermoplastic polyurethane grade (TPU) grade for technical filament parts and blown film applications that outperform previous-generation technology in terms of resilience, manufacturing effectiveness, and minimizing waste.

End user Segment Analysis

In 2035, the automobile segment is predicted to have a substantial proportion of roughly 49%. The rising demand for vehicles especially electric vehicles is expected to augment the segment growth. With the rapid expansion, electric automobiles now account for a significant portion of the overall car market. Over ten million electric vehicles were sold globally in 2023, with sales predicted to increase by 35%. Paint protective film is a great coating and has excellent scratch resistance properties, shielding the vehicle’s paint from scratches caused by everyday wear and tear, such as keys, brushes, or branches. Moreover, vehicle exposure to sunlight can cause the paint to fade or become discolored. Paint protective film has UV inhibitors that help block harmful UV rays, preserving the color and finish of the paint.

Our in-depth analysis of the global paint protection film market includes the following segments:

|

Material |

|

|

Finish |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Paint Protection Film Market Regional Analysis:

Europe Market Insights

The paint protection film market in Europe is projected to be the largest, with a share of about 35% by the end of 2035, owing to its strong positioning in the automotive industry and its subsequent demand for paint and coating films. The passenger car fleet has grown exponentially in the past few years and surpassed 256 million cars overall. In 2023, the uppermost number of cars per 1,000 people was the highest in the descending order of Italy, Luxembourg, and Cyprus. Battery-only electric passenger cars also crossed 4 million in the same year, with a CAGR of 77.5% in 2020-2021.

The Germany automotive industry is the country’s largest sector, ascribed for roughly a quarter of cumulative revenues and supporting 780,000 jobs. Germany is the EU’s top market in terms of production and sales. The Germany auto sector garnered USD 611 billion in sales, underscoring an 11% rise from 2022. This comprises trailers (USD 15.7 million), motor vehicles (USD 496.3 million), and parts (USD 99.8 million). Vehicle and engine manufacturers contribute over three-quarters of the cumulative turnover. Suppliers account for approximately 16.3% of the sector's turnover and bodies and trailers manufacturers contribute 2.6%. Notably, around two-thirds of the German automotive industry's annual turnover comes from international markets, especially in countries outside the EU.

APAC Market Insights

The Asia Pacific paint protection film market is estimated to be the second largest, registering a share of about 24% by the end of 2035. Asia Pacific is a major hub for cadmium production, a vital pain protective material, where China, South Korea, and Japan are the main suppliers. A smaller quantity of secondary cadmium is also recovered from NiCd batteries. Some primary uses of cadmium and its compounds are in polyvinyl chloride (PVC) stabilizers, alloys, pigments, and anti-corrosive coatings. China, between 2020 and 2023, accounted for 34% of cadmium pigments and coatings based on its compound exports to the U.S. According to the OECD, China dominated with 29.1% in 2020 of the chemicals segment value-added output and was worth USD 334 billion.

China market is driven by the presence of a strong raw material supply chain. China is ranked among the top five exporters of polyvinyl chloride, amounting to USD 2 billion in outbound trade in 2023 and 15.6% in terms of global export share. Furthermore, rising R&D capacity is factoring in the development of the overall chemicals sector in the country. For instance, in 2022, China’s chemical companies spiked to 16.8% of the world’s industry R&D.

Paint Protection Film Market Players:

- IVIOS

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- 3M

- Saint-Gobain

- AVERY DENNISON CORPORATION

- Eastman Chemical Company

- XPEL, Inc.

- Reflek Technologies Corporation

- GRAFITYP UK Ltd.

- ORAFOL Europe GmbH

- DuPont de Nemours, Inc.

The paint protection film market players are seeking strategic collaborations, mergers and acquisitions, geographical expansions, and R&D to strengthen their industry positioning and consolidate their market share. A major shift toward sustainability also impacts and shapes market trends. Some of the companies operating in the space comprise:

Recent Developments

- In April 2024, Hyundai Motor announced the launch of a nano-cooling film, that helps to block external heat and energy while emitting internal radiant heat to the outside. This window tint offers better interior cooling performance as compared to conventional tint films.

- In August 2022, BASF launched a thermoplastic polyurethane paint protection film for enhanced car paint protection. The product provides superior resistance against high temperatures and extended exposure to the sun.

- Report ID: 5057

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Paint Protection Film Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.