Over-the-Counter Hearing Aids Market Outlook:

Over-the-Counter Hearing Aids Market size was valued at USD 996.36 million in 2025 and is expected to reach USD 1.8 billion by 2035, registering around 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of over-the-counter hearing aids is assessed at USD 1.05 billion.

The market has grown massively owing to the innovation in technologies, regulatory changes, and shifts in consumer preference. The major online retail platforms are also making it easier to reach broader markets. Therefore, the need for convenience, cost-effectiveness, and advanced features in hearing aid products will increase with time.

Furthermore, the growth is essentially driven by a higher incidence rate of age-related hearing loss and a further increasing need for even more affordable, friendly hearing solutions. For instance, in March 2023, according to the reports of the U.S. Food & Drug Administration, approximately 30 million adults in the U.S. suffer from partial or some degree of hearing impairments. In addition, technological innovations such as bluetooth connectivity, rechargeable batteries, and much-enhanced sound processing are creating customer interest. For instance, in October 2024, Apple made AirPods Pro 2 as a low-cost hearing aid. It has an updating software that will transform millions of its AirPods into the FDA-approved hearing aid.

Key Over-the-Counter (OTC) Hearing Aids Market Insights Summary:

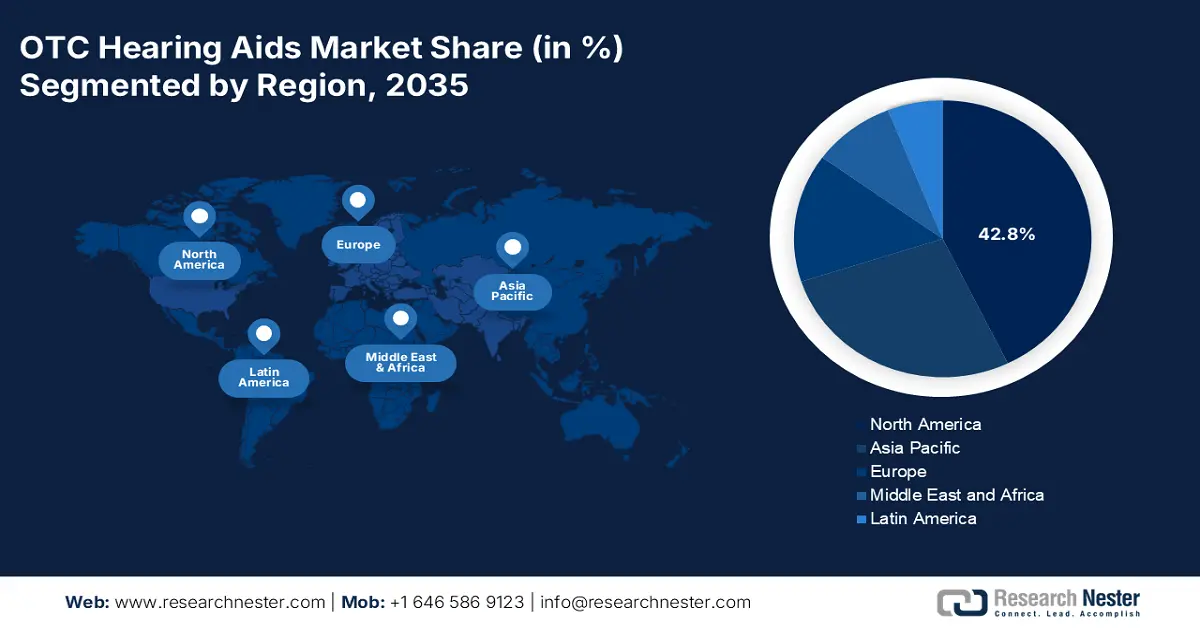

Regional Highlights:

- North America commands a 42.8% share in the Over-the-Counter Hearing Aids Market, fueled by growing awareness about hearing loss and FDA approval increasing accessibility, driving strong growth through 2026–2035.

Segment Insights:

- The Preset Hearing Aids segment is expected to dominate with significant CAGR growth from 2026 to 2035, fueled by ease of use and affordability.

- The Receiver in canal (RIC) segment of the Over-the-Counter Hearing Aids Market is expected to capture over 34.2% share by 2035, fueled by its higher comfort, discreet design, and advanced performance.

Key Growth Trends:

- Technological advancements in hearing aids

- Increased awareness of hearing health

Major Challenges:

- Variable quality and efficacy

- Insurance coverage and reimbursement issues

- Key Players: Sonova Holding AG, GN Hearing A/S, Audien Hearing, Audicus, Eargo Inc..

Global Over-the-Counter (OTC) Hearing Aids Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 996.36 million

- 2026 Market Size: USD 1.05 billion

- Projected Market Size: USD 1.8 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, Japan, South Korea, India, Singapore

Last updated on : 14 August, 2025

Over-the-Counter Hearing Aids Market Growth Drivers and Challenges:

Growth Drivers

-

Technological advancements in hearing aids: Development in the field of hearing aid technology has improved functionalities to make them effective and user-friendly. The introduction of digital signal processing (DSP) has made sound more dominant and crystal clear. It has further reduced background noise and personalizes the hearing experience. For instance, in June 2024, Synopsys, Inc. announced that Oticon has taped out part of its next-generation digital signal processor (DSP) chipset for hearing-aid devices. Thus, hearing aids have emerged as much more programmable with solutions for a great variety of hearing impairments with better overall user comfort.

-

Increased awareness of hearing health: The more individuals realize how untreated hearing loss can affect overall health, the more awareness for hearing aids has been increasing. The public health campaigns and media coverage informed society of the need for early diagnoses and treatment thus persuading individuals, especially in aging populations, to seek hearing solutions earlier. For instance, in March 2024, Signia unveiled a stigma-busting awareness campaign that aimed to fight social stigma around hearing loss and empower hearing care. This shift in awareness will make people readily adopt the use of hearing aids, proactively manage their hearing health, and thus lead to over-the-counter (OTC) hearing aids market growth.

Challenges

-

Variable quality and efficacy: The availability of products at low-cost prices often results in unreliable performance. Moreover, a lack of standardized legislation and quality control by hundreds of manufacturers that pour into the over-the-counter (OTC) hearing aids market market disrupts the growth. Without proper monitoring, some apparatuses may fail to meet the minimum standards for clarity in hearing experiences, resulting in less-than-optimal auditory experiences for its users. This inconsistency dents consumer trust, which means limited widespread adoption of OTC hearing aids since some potential buyers might feel that these devices are less effective or unreliable than professionally fitted ones.

-

Insurance coverage and reimbursement issues: For the over-the-counter hearing aids market, insurance coverage and reimbursement are a significant challenge since most insurance plans do not include it. Furthermore, it comes under the classification of hearing aids as consumer electronics rather than as medical devices, which limits their options for reimbursement. This can make the barrier to OTC hearing aids harder to climb over, for individuals with more severely impaired hearing or fixed income as it may be difficult to afford the up-front cost. Thus, a lack of insurance coverage could push the over-the-counter (OTC) hearing aids market a bit slower and inhibit entry for a significant part of the potential users.

Over-the-Counter Hearing Aids Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 996.36 million |

|

Forecast Year Market Size (2035) |

USD 1.8 billion |

|

Regional Scope |

|

Over-the-Counter Hearing Aids Market Segmentation:

Product (Receiver in canal (RIC), Completely-in-the-canal (CIC), Earbuds, Other products)

Based on the product, the receiver in canal (RIC) segment is projected to dominate over-the-counter (OTC) hearing aids market share of over 34.2% by 2035, owing to its capacity to offer a higher comfort level, discreet design, and developed performance attributes. In addition, the RIC model offers a balance of high-quality sound processing with user-friendly design, making it appealing to a wide cross-section of consumers. For instance, in October 2023, Phonak introduced the RIC line, ActiveVent receiver through its new platform, Lumity to widen its existing portfolio. Furthermore, Bluetooth connectivity and rechargeable batteries are also widely utilized in RIC hearing aids, convincing mature and price-sensitive customers, and further energizing the demand in the OTC market.

Type (Preset, Self-fitting)

The preset hearing aids segment will witness a lucrative opportunity of dominating the over-the-counter hearing aids market, throughout 2035. This growth is attributable to the ease of use and its affordability. In addition, preset hearing aids are equipped with preprogrammed settings given for typical profiles of hearing loss, making them very appropriate for people who suffer from relatively mild hearing impairments. For instance, in November 2024, Rexton announced the Rexton Reach inoX-CIC Li, a rechargeable completely-in-canal (CIC) hearing aid. With its instant-fit design, fits into the ear canal, proving fitting for use by people afflicted with mild to moderate hearing loss who require discretion and rechargeability.

Our in-depth analysis of the global OTC hearing aids market includes the following segments:

|

Products |

|

|

Type |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Over-the-Counter Hearing Aids Market Regional Analysis:

North America Market Statistics

North America industry is predicted to hold largest revenue share of 42.8% by 2035. The growing awareness about hearing loss has increased with better technology. Moreover, the consumer's inclination toward alternatives to prescription hearing aids, which are relatively expensive and require professionals to be fitted is fueling the market growth. However, FDA approval of OTC hearing aids has also increased the market growth by opening up more avenues for making these products consumable to the greater public.

In the U.S., the regulatory landscape is changing the dynamism in the OTC hearing aid market. The FDA in October 2022 established OTC hearing aid regulation which has stimulated market growth. Under the legislation, adults with mild to moderate hearing loss can buy hearing aids over the counter or from the store without necessarily going to an audiologist or getting a prescription. This has made hearing aids more accessible to and affordable for a greater section of the population than before, especially those who would have otherwise avoided or could not afford the traditional ones.

The increasing aging population in Canada with an ever-rising prevalence of age-related hearing loss is one major reason the over-the-counter (OTC) hearing aids market is growing. The key players are focusing on expanding their operations in hearing aid solutions through collaborations and leveraging expertise. For instance, in December 2023, Amplifon has grown over 130 stores across Canada and remains on an expansion course. In addition, it has acquired Living Sounds Hearing Centre, Alberta which operates 20 clinics throughout the province.

Asia Pacific Market Analysis

Asia Pacific is rapidly expanding in the over-the-counter (OTC) hearing aids market owing to the growing concerns over hearing loss clubbed with the growing capacity of people affording hearing aid solutions. In addition, increased awareness of the need to treat hearing loss, with noise pollution in societies. Therefore, as familiarity grows and regulatory frameworks are updated, OTC hearing aids will be a very practical solution for filling in the gap in accessibility with the growing demand for hearing solutions.

China OTC hearing aids market is stimulated by the advancements in hearing aid technologies. For instance, in October 2024, Sonova planned to expand its AI-powered hearing aids in China to cater to the needs of the population suffering from hearing impairment to render efficient solutions. Thus, OTC hearing aids are not only cheap but also accessible to self-diagnose thus addressing major unmet needs. The trend is further backed by rising digital literacy and increasing e-commerce penetration, making it easier for customers to buy OTC hearing aids online.

In India, the major growth driver of the over-the-counter hearing aids market is the demand for cost-effective healthcare solutions. Thus, market players are focusing on relentless innovations and advancements in hearing aids. For instance, in February 2024, Starkey announced the launch of its innovative Genesis AI hearing aids in India. This is a cutting-edge hearing solution designed to address the increasing prevalence of hearing loss in India. This is further fueled by the escalating rate of age-related hearing loss, which demands these more inexpensive, self-adjustable hearing aids.

Key Over-the-Counter Hearing Aids Market Players:

- Eargo Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Audicus

- Audien Hearing

- Austar Hearing Science and Technology Co. Ltd.

- Starkey

- Sonova Holding AG

- SoundWave Hearing, LLC

- Nuvomed Inc.

- Neuheara Limited

- InnerScope Hearing Technologies Inc.

- MD Hearing

The competitive environment in the over-the-counter (OTC) hearing aids market is witnessing a remarkable transformation. This change is largely driven by the focus of manufacturers, and tech-driven companies to consumer-centric hearing aid solutions. Furthermore, the increasing prevalence of e-commerce platforms by companies to expand their reach is fueling market growth. For instance, in November 2022, GN expanded its Jabra Enhance hearing offering with Lively. It rebranded to Jabra Enhance and launched JabraEnhance.com as an online destination for better hearing, enabling consumers to discover, buy, and receive hearing care from home.

Here’s the list of some key players:

Recent Developments

- In July 2024, Concha Labs launched its FDA-cleared Concha Sol Hearing Aids, an OTC solution that enables users to personalize their hearing profiles in a matter of minutes using their iPhones.

- In April 2023, Softone Speech and Hearing Clinics Private Limited released Re-Hear, India's first ultra-modern hearing machine with advanced capabilities. It is a rechargeable and affordable device and can be connected to phones.

- Report ID: 6704

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Over-the-Counter (OTC) Hearing Aids Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.