Osteoarthritis Drugs Market Outlook:

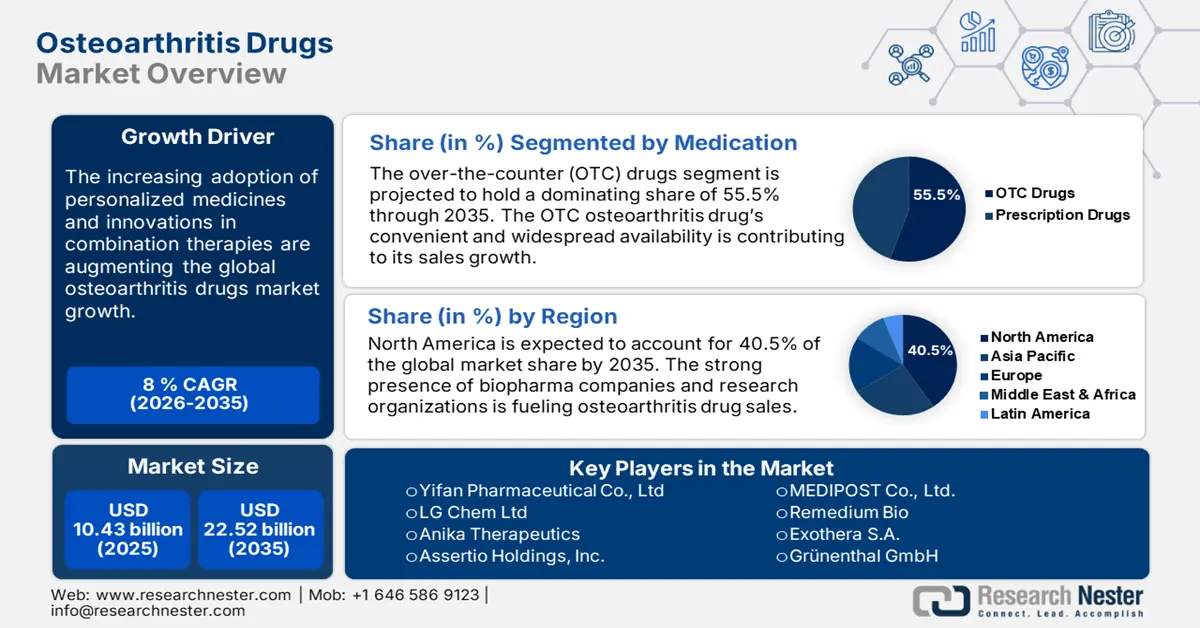

Osteoarthritis Drugs Market size was over USD 10.43 billion in 2025 and is poised to exceed USD 22.52 billion by 2035, witnessing over 8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of osteoarthritis drugs is evaluated at USD 11.18 billion.

The rising prevalence of osteoarthritis is augmenting a high demand for advanced medications. Several factors such as genetics, injury, pre-existing joint disease, and obesity contribute to osteoarthritis growth. For instance, according to the World Health Organization (WHO) report, around 70% of people living with osteoarthritis are over 55 years of age. Furthermore, the Institute of Health Metrics and Evaluation estimates that by 2050, around 1 billion people are expected to have osteoarthritis. Presetly, over 15% of people above 30 years of age are experiencing osteoarthritis issues. Thus, as the prevalence of osteoarthritis is increasing, the demand for modern therapeutics including drugs is set to boom.

Many players in the osteoarthritis drugs market are investing heavily in R&D for the production of advanced and effective drug formulations. Such moves are expanding their pharmaceutical product offerings, and maximizing revenue shares, leading to an uplift in their position in the competitive space. For instance, Sanofi SA’s Third Quarter 2024 report reveals that the pharma sales in Q3 2024 reached USD 8842 million. Also, the pharma segment of the company accounted for 62.2% of total biopharma sales.

Key Osteoarthritis Drugs Market Market Insights Summary:

Regional Highlights:

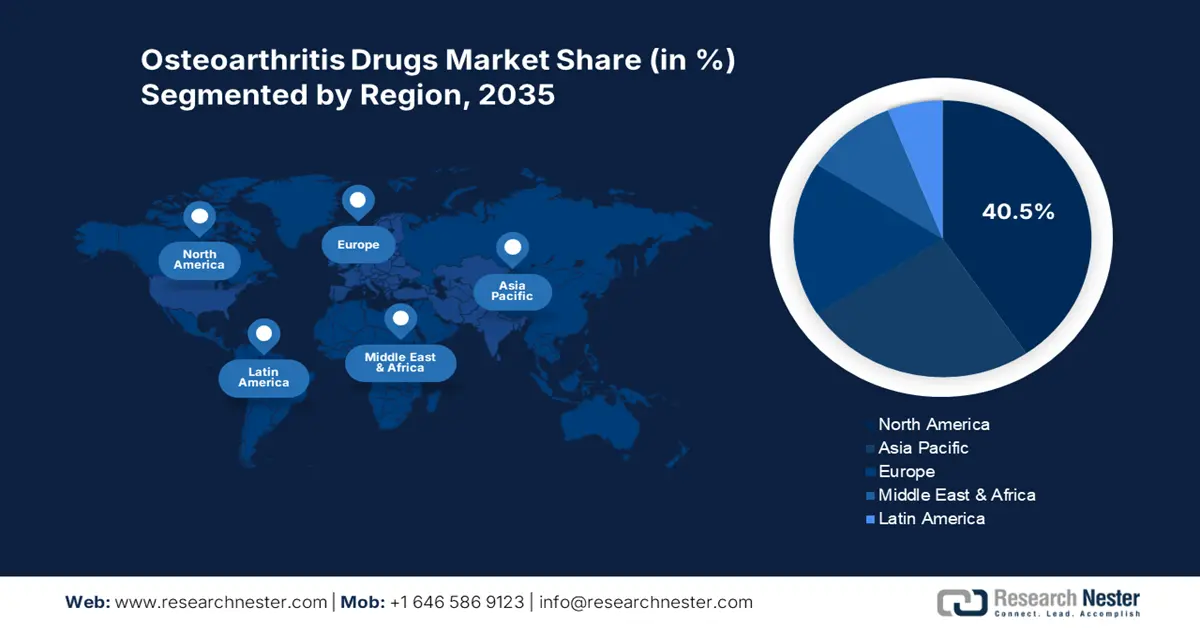

- North America holds a 40.5% share in the osteoarthritis drugs market, led by supportive reimbursement policies, advanced biotech presence, and modern healthcare facilities, supporting growth through 2026–2035.

Segment Insights:

- The Viscosupplementation Agents segment is expected to secure around 34% market share by 2035, driven by their effectiveness in reducing pain and improving joint mobility in osteoarthritis patients.

- Over-the-counter (OTC) Drugs segment are expected to capture around 55.5% share by 2035, fueled by easy access, retail availability, and online pharmacy promotions.

Key Growth Trends:

- Personalized medication trends

- Combination of osteoarthritis drugs an effective approach

Major Challenges:

- Side effects associated with excess intake

- Lack of awareness

- Key Players: LG Chem Ltd, Anika Therapeutics, Assertio Holdings, Inc., Novartis AG, Pacira Pharmaceuticals, Inc., Pfizer Inc., Bayer AG, and GlaxoSmithKline Plc.

Global Osteoarthritis Drugs Market Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.43 billion

- 2026 Market Size: USD 11.18 billion

- Projected Market Size: USD 22.52 billion by 2035

- Growth Forecasts: 8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 14 August, 2025

Osteoarthritis Drugs Market Growth Drivers and Challenges:

Growth Drivers

- Personalized medication trends: Personalized medicines are gaining traction among osteoarthritis patients majorly due to their effective results in pain relief and bone care. The ongoing advancements in genomics and biomarker discovery are contributing to the efficiencies of personalized medicines. Also, precision medication tactics help to offer individuals with specific therapies, which are formulated based on their genetic makeup, disease severity, and response to treatment. For instance, in 2022, the University of Alabama at Birmingham revealed that a large multi-ancestry genetics study of osteoarthritis was conducted by their researchers in which they found that 10 new cases linked with genetic loci and Fibulin -3 levels in serum and urine and can be used as biomarkers for predictive analysis and progression. Such studies are aiding in the formulation of personalized medications for osteoarthritis treatment.

- Combination of osteoarthritis drugs an effective approach: The innovations in combination therapies are expected to offer a pain-relieving approach to osteoarthritis patients. Combination therapies offer comprehensive care that analyzes symptoms and disease progression. Osteoarthritis is a complex condition that involves tremendous pain and progressive joint degeneration. Patients consuming conventional drugs don’t find much relief, on the other hand, combination of different classes of drugs such as pain relievers, anti-inflammatory, and disease-modifying osteoarthritis drugs (DMOADs) offers multi-pronged pain relief and mitigates disease progression. According to the analysis by the New England Journal of Medicine, glucosamine and chondroitin sulfate in combination offer effective results in patients with moderate-to-severe osteoarthritis knee pain.

Challenges

- Side effects associated with excess intake: Side effects such as cardiovascular risks, gastrointestinal problems, and kidney issues associated with osteoarthritis drugs including non-steroidal anti-inflammatory drugs (NSAIDs) and corticosteroids can hamper their sales. The consumption of these drugs in the long term can lead to several health issues, creating challenges for both consumers and manufacturers.

- Lack of awareness: Many patients across the world, particularly in underdeveloped and developing countries are unaware of advanced medications and treatment approaches for osteoarthritis. Lack of knowledge often keeps these patients inaccessible from innovative drugs and therapeutic approaches, hindering the osteoarthritis drugs market growth to some extent.

Osteoarthritis Drugs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8% |

|

Base Year Market Size (2025) |

USD 10.43 billion |

|

Forecast Year Market Size (2035) |

USD 22.52 billion |

|

Regional Scope |

|

Osteoarthritis Drugs Market Segmentation:

Drug Type (Viscosupplementation Agents, Nonsteroidal anti-inflammatory Drugs, Analgesics, Corticosteroids)

Viscosupplementation agents’ segment is anticipated to capture around 34% osteoarthritis drugs market share by the end of 2035. Viscosupplementation agents effectively reduce pain, swelling, and stiffness, which makes them an effective choice for osteoarthritis treatment. Viscosupplementation agents particularly hyaluronic acid injects are administrated into the patients to enhance joint mobility, mitigate pain, and improve overall function. Key players in the market are investing in R&D to introduce advanced hyaluronic acid solutions for joint care. For instance, in July 2024, Bloomage BioTechnology Corporation Limited revealed its Hyaluronic Acid Research at IFT FIRST Expo 2024. The company also showcased UltraHA J, a hyaluronic acid product designed to support joint health.

Medication (Prescription Drugs, Over-the-counter (OTC) Drugs)

By the end of 2035, over-the-counter (OTC) osteoarthritis drugs segment is set to dominate around 55.5% osteoarthritis drugs market share. The easy access and widespread availability of OTC osteoarthritis drugs in retail pharmacies and supermarkets have made it convenient for patients to purchase these drugs. The online drug pharmacies’ growing awareness among people at large is also contributing to high sales of OTC osteoarthritis drugs. Online pharmacies offer attractive discounts and the availability of multiple brands including international products with reviews and recommendations appeals to patients, which further fuels the sales of OTC drugs.

Our in-depth analysis of the global market includes the following segments:

|

Drug Type |

|

|

Route of Administration |

|

|

Anatomy |

|

|

Medication |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Osteoarthritis Drugs Market Regional Analysis:

North America Market Forecast

North America industry is poised to hold largest revenue share of 40.5% by 2035, The supportive reimbursement policies, the presence of advanced biotech companies, and next-gen healthcare facilities are contributing to the osteoarthritis drug sales growth. Pharma manufacturers are focused on the production of advanced osteoarthritis drugs that offer effective and efficient results, which further potentially influences the market growth.

In the U.S., the high prevalence of osteoarthritis and the aging population is driving the market growth. The study by the Osteoarthritis Action Alliance reveals that osteoarthritis is the most common type of arthritis among Americans affecting around 32.5 million adults. In the country, 43% of osteoarthritis patients are over 65 years of age. Thus, to combat this issue market players are concentrating on innovations in osteoarthritis drug formulations.

In Canada, the strong presence of research organizations such as Arthritis Research Canada, the Institute of Musculoskeletal Health and Arthritis (IMHA), and Arthritis Society Canada contributes to the production of advanced osteoarthritis drugs. The continuous research and innovations in these institutions are anticipated to strongly uplift the position of Canada in the North America market.

Asia Pacific Market Statistics

The Asia Pacific osteoarthritis drugs market is projected to evolve at a high pace during the projected period. The increasing investments in healthcare infrastructure development, growing cases of osteoarthritis, and expansion of pharma companies in the region are supporting the market growth. As per the study by the Institute of Health Metrics and Evaluation, the prevalence of osteoarthritis is 8632.7 (7852.0-9469.1) per 100,000 in Asia Pacific.

India is emerging as a hub for medical tourism, the prime factors contributing to this are the presence of cost-effective treatment approaches and the latest technologies. Osteoarthritis patients in the country are benefiting from these aspects owing to easy accessibility to advanced and innovative treatment options. According to the India Brand Equity Foundation, the government is focusing on increasing the Pradhan Mantri Bhartiya Jan Aushadhi Kendras to 10,500 by March 2025. The product basket of PMBJP includes 1,451 drugs and 240 surgical instruments. Such initiatives are estimated to boost the sales of osteoarthritis drugs in the coming years.

In China, the increasing population of senior citizens and technological advancements in drug formulation and administration are set to fuel the market growth. Older people are more susceptible to chronic disorders including osteoarthritis, which drives a high need for advanced therapeutic approaches such as modern drugs. The increasing expansion of pharma companies in the country is also expected to positively influence the sales of osteoarthritis drugs.

Key Osteoarthritis Drugs Market Players:

- Yifan Pharmaceutical Co., Ltd

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- LG Chem Ltd

- Anika Therapeutics

- Assertio Holdings, Inc.

- Novartis AG

- Pacira Pharmaceuticals, Inc.

- Pfizer Inc.

- Bayer AG

- GlaxoSmithKline Plc

- Sanofi SA

- Zimmer Biomet Holdings, Inc.

- Bioventus

- Ferring Pharmaceuticals Inc.

- MEDIPOST Co., Ltd.

- Remedium Bio

- Exothera S.A.

- Grünenthal GmbH

Key players in the osteoarthritis drugs market are employing several strategies such as new product launches, technological advancements, partnerships & collaborations, mergers & acquisitions, and regional expansion to earn more. The industry giants are collaborating with biotech firms to develop innovative osteoarthritis drugs. This move is aiding them to attract a wider consumer base and earn high profits. Leading companies are also focusing on expanding their manufacturing units in high-potential economies due to low labor costs and tax benefits. Also, acquiring smaller firms with advanced technologies aids industry giants in expanding their market reach and mitigating the time in R&D.

Some of the key players include:

Recent Developments

- In July 2024, LG Chem Ltd in partnership with Yifan Pharmaceutical Co., Ltd announced the launch of Synovian a single-injection for osteoarthritis treatment. With this launch, LG Chem Ltd is expanding its position in the Chinese market.

- In July 2023, Arthritis Foundation announced that its Phase II study is focused on the results of metformin, a drug used to treat type 2 diabetes can be effective in the treatment of patients with osteoarthritis. The trial aims to reduce the progression of osteoarthritis in patients who are at elevated risk for developing post-traumatic osteoarthritis.

- In March 2023, Remedium Bio and Exothera S.A. signed a collaborated agreement for the production of Remedium’s AAV2-FGF18. Remedium’s AAV2-FGF18 is a first-in-class gene therapy for osteoarthritis.

- Report ID: 6703

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Osteoarthritis Drugs Market Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.