Osseointegration Implants Market Outlook:

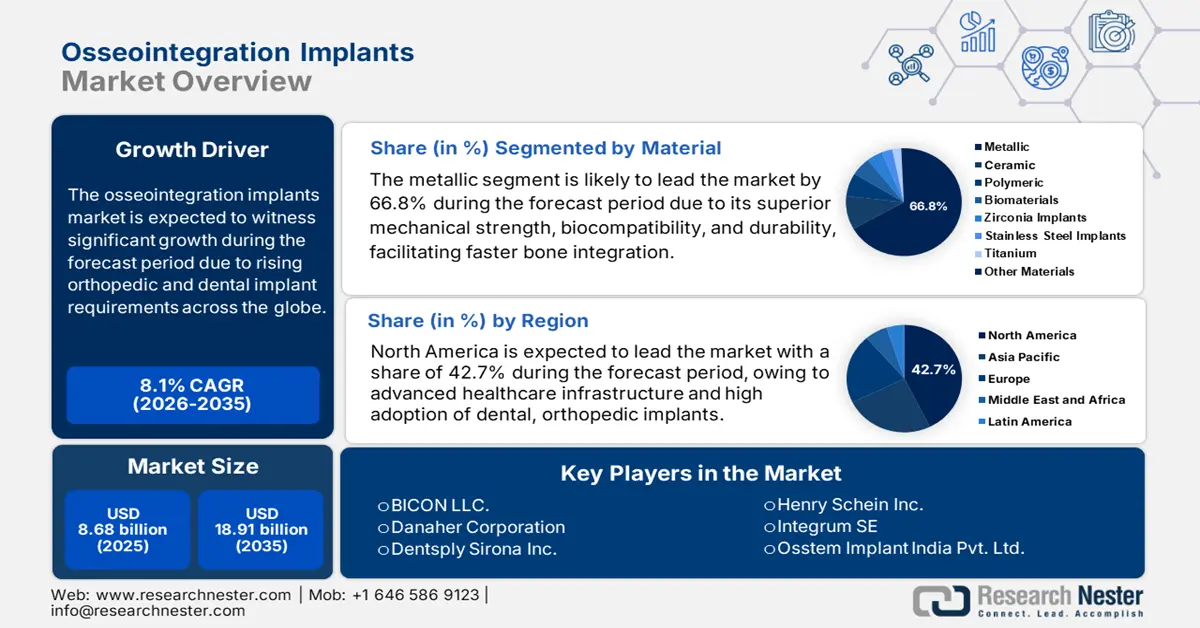

Osseointegration Implants Market size was over USD 8.68 billion in 2025 and is poised to exceed USD 18.91 billion by 2035, witnessing over 8.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of osseointegration implants is estimated at USD 9.31 billion.

The global osseointegration implants market is expanding rapidly, driven by the increasing burden of dental and orthopedic disorders, advancements in medical technology, and the rising adoption of osseointegration procedures. These implants, which form a structural and functional connection between living bone and artificial implant, are widely used in dental implants, joint replacements, and prosthetic limbs. Furthermore, the ongoing innovations in biomaterials and surface modifications are enhancing implant durability and success rates, thus driving market expansion.

Additionally, the growing geriatric population and rising awareness about treatment procedures are significantly contributing to the market to boost further. According to WHO reports published in July 2023, approximately 528 million people worldwide have been diagnosed with osteoarthritis, an increase of 113% over the past few decades. It further stated that 73% of those diagnosed are above 55 years old, and 60% are female. The knee is the most frequently affected joint, followed by the hip and the hand. Thus, the high prevalence of the disorder increases the demand for joint replacements, driving the growth of the market.

Key Osseointegration Implants Market Insights Summary:

Regional Highlights:

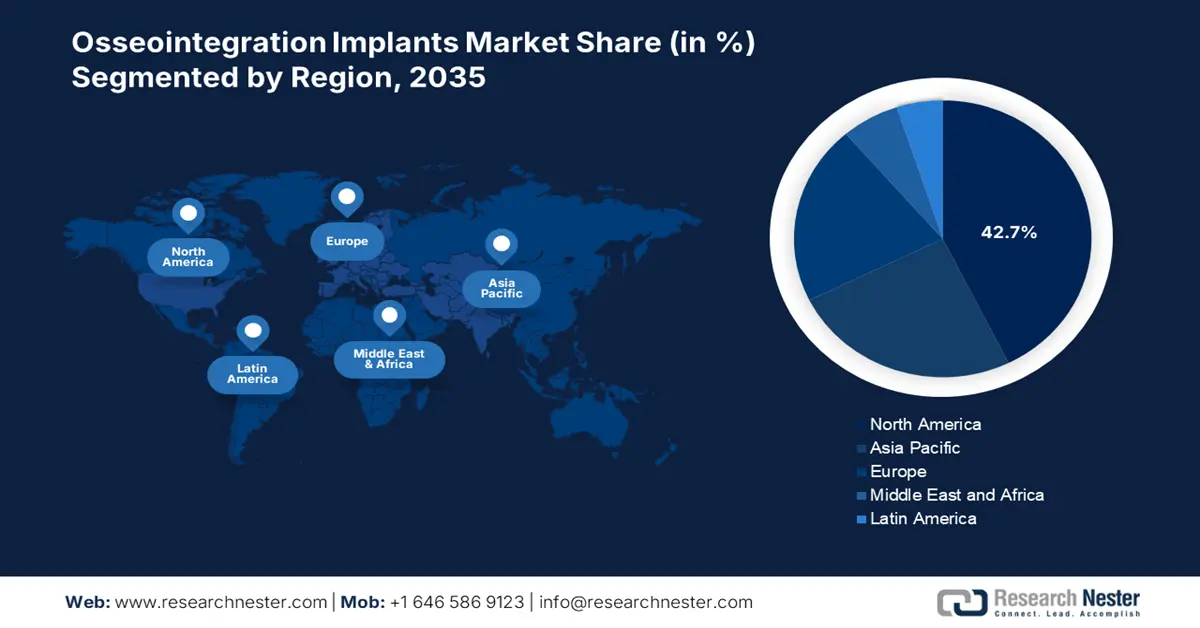

- North America leads the Osseointegration Implants Market with a 42.7% share, propelled by well-established healthcare infrastructure and rising adoption of dental, spine, and orthopedic implants, ensuring strong growth through 2035.

Segment Insights:

- Metallic implants segment are projected to hold a 66.8% share by 2035, fueled by their superior mechanical strength, biocompatibility, and durability.

- The dental implants segment is expected to capture a 52.4% share by 2035, fueled by the rising prevalence of tooth loss and advancements in implant technology.

Key Growth Trends:

- Rising burden of dental and orthopedic disorders

- Technological advancements

Major Challenges:

- High cost of implants and procedures

- Risk of implant failures

- Key Players: Danaher Corporation, Dentsply Sirona Inc., Henry Schein Inc., Integrum SE.

Global Osseointegration Implants Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.68 billion

- 2026 Market Size: USD 9.31 billion

- Projected Market Size: USD 18.91 billion by 2035

- Growth Forecasts: 8.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 12 August, 2025

Osseointegration Implants Market Growth Drivers and Challenges:

Growth Drivers

- Rising burden of dental and orthopedic disorders: The increased prevalence of dental and orthopedic disorders and the adoption of implants is the key driver for the osseointegration implants market to showcase lucrative growth opportunities. In March 2021, according to a study published in NLM, the survival rate of osseointegration implants was 98.9% at 3 years, 98.5% at 5 years, 96.8% at 10 years, and 94.0% at 15 years. Additionally, at the patient level, the success rates were 97.1% at 3 years, 96.7% at 5 years, 92.5% at 10 years, and 86% at 15 years. Therefore, the high success rates highlight the reliability of implants, necessitating the high demand further.

- Technological advancements: Continuous innovations in implant technology are significantly driving growth in the osseointegration implants market. The development of biocompatible materials such as titanium and zirconia enhances implant bonding and reduces the risk of rejection. For instance, in March 2023, Dentsply Sirona Inc. announced the launch of the DS OmniTaper Implant System. The purpose was to expand its EV implant family with advanced technology for higher efficacy, accelerating bone healing with a premounted tempbase. Such innovations strengthen the market with diverse clinical applications.

Challenges

- High cost of implants and procedures: The increasing costs of osseointegration implants and the complicated procedures pose significant challenges. These expenses are further exacerbated by the high prices of materials such as titanium and zirconia, making it difficult for particular groups of patients to afford them. Additionally, post-surgical rehabilitation, long recovery periods, and follow-up treatments create a challenge in the OI market, limiting the industry's expansion.

- Risk of implant failures: Infections, peri-implantitis, mechanical loosening, and poor osseointegrations lead to the risk of implant complications remaining as a key challenge, thereby straining the osseointegration implants market growth. Furthermore, poor bone quality, smoking, diabetes, and improper implant placements can lead to additional surgical procedures, long recovery times, and higher costs, affecting adoption rates.

Osseointegration Implants Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.1% |

|

Base Year Market Size (2025) |

USD 8.68 billion |

|

Forecast Year Market Size (2035) |

USD 18.91 billion |

|

Regional Scope |

|

Osseointegration Implants Market Segmentation:

Material (Metallic, Ceramic, Polymeric, Biomaterials, Zirconia Implants, Stainless Steel Implants, Titanium)

Metallic segment is poised to hold more than 66.8% osseointegration implants market share by 2035. Due to their superior mechanical strength, biocompatibility, and durability, metallic implants are widely preferred. In March 2025, Zimmer Biomet Holdings, Inc. announced FDA clearance for Persona Revision SoluTion Femur, a knee implant designed for patients with metal sensitivities. It is made with a tivanium alloy that eliminates common metal allergens such as nickel, cobalt, and chromium. This has promoted the demand for metallic implants, in turn boosting its role in metal durability in osseointegration implants.

Product (Dental Implants, Bone-Anchored Prostheses, Knee Implants, Spinal Implants)

By the end of 2035, dental implants segment is estimated to capture around 52.4% osseointegration implants market share. The growing demand for dental implants due to the prevalence of tooth loss, and advancements in implant technology drives the need for efficient implant solutions. For instance, in January 2021, Nobel Biocare Services AG announced the launch of Xeal and TiUltra surfaces in the U.S., enhancing soft tissue attachment and early osseointegration. The patient pool in developing economies around the world is adopting dental implants; such innovations, in turn, are boosting the market growth further.

Our in-depth analysis of the global osseointegration implants market includes the following segments:

|

Product |

|

|

Material |

|

|

End users |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Osseointegration Implants Market Regional Analysis:

North America Market Analysis

North America osseointegration implants market is expected to hold revenue share of more than 42.7% by 2035. The region benefits from a well-established healthcare infrastructure and rising adoption of dental, spine, and orthopedic implants. For instance, in January 2025, Stryker Corporation announced an agreement to sell its U.S. spinal implants business to VB Spine LLC. This deal will allow VB Spine to operate independently with exclusive access to key technologies. Thus, such a move aims to drive focused innovation in the region’s OI market.

The osseointegration implants market in the U.S. is driven by the presence of a strong medical device industry, rising healthcare investments, and partnerships between companies. In January 2025, SMAIO (Software, Machines, and Adaptative Implants in Orthopaedics) announced an update on its partnership with NuVasive, Inc., confirming its focus on the U.S. market. It further stated that they have worked on a development and license agreement for advanced surgical planning. As part of this collaboration, NuVasive, Inc. invested USD 5 million at the time of the IPO of SMAIO in April 2022. The collaboration was aimed at expanding the company’s surgical planning solutions and commercialization efforts.

Canada’s osseointegration implants market is witnessing steady growth due to its emphasis on improving healthcare access across its vast landscape. The demand for osseointegration implants has surged, particularly with 3D printing and biocompatible materials in implant manufacturing. For instance, in March 2025, THINK Surgical, Inc. announced the first successful use of Waldemar Link GmbH & Co. KG’s LinkSymphoKnee with its TMINI Miniature robotic system. The advancement enhances precision in knee surgeries, supporting better implant technologies and further driving demand for implants in the country.

Asia Pacific Market Statistics

The Asia Pacific osseointegration implants market is projected to witness the fastest growth during the forecast period. Emerging economies in the region are focusing on improving healthcare infrastructure and acquisitions to enhance access to the dental and orthopedic implants market. For instance, in May 2023, Zimmer Biomet Holdings, Inc. announced the acquisition of Ossis Corporation for patient-specific 3D-printed titanium hip joint replacements and other pelvic bone replacement surgery. Thus, such strategic acquisitions strengthen the market landscape, driving innovations in the region.

India's osseointegration implants market is expanding majorly due to the increasing number of orthopedic and dental implant procedures in the country. The advancements in indigenous implant manufacturing and expanding healthcare access in rural areas further support market expansion. In January 2025, IIT Guwahati announced a collaboration with Miraclus Orthotech Pvt. Ltd. to advance research and development in orthopedic implants and instruments. Such factors are significantly boosting market innovation and expansion for a greater outcome by the end of 2035.

China’s osseointegration implants market is witnessing growth owing to its large patient population and government investments in healthcare. The country’s strong manufacturing capabilities and technological advancements are accelerating market growth and transforming this sector. In September 2024, Regenity Biosciences announced the approval of China NMPA for its dental membrane Matrixflex, an implantable collagen dental membrane for use in oral surgical procedures which showcased its efficacy with 174 patients. Furthermore, the aging demographic of the country demands efficient and reliable solutions, primarily for bone regeneration and implant stability.

Key Osseointegration Implants Market Players:

- BICON LLC.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Danaher Corporation

- Dentsply Sirona Inc.

- Henry Schein Inc.

- Integrum SE

- Osstem Implant India Pvt. Ltd.

- Smith and Nephew Plc.

- Straumann AG Group

- Exactech, Inc

- Stryker Corporation

- UNIK Orthopedics, Inc.

- Zimmer Biomet Holdings Inc.

- Dentsply Sirona Inc.

- NuVasive Inc.

- Paonan Biotech Co., Ltd.

- Delta Electronics

- William Demant Holding A/S

- Cochlear Ltd.

- Medtronic plc

- Keystone Dental Inc.

- Maxx Orthopedics, Inc.

Key companies in the osseointegration implant market are focusing on regional expansion by establishing manufacturing hubs in emerging markets and making acquisitions to improve implant use efficiency. For instance, in February 2024, Zeda, Inc. announced the acquisition of The Orthopaedic Implant Company (OIC) to expand its global presence in orthopedic implants to meet the increasing demand for specialized healthcare solutions. This strategic acquisition is a significant leap forward to strengthen the company’s commitment to revolutionizing the manufacturing and distribution of medical devices globally. These acquisition strategies are boosting companies’ growth and significantly maintaining competition in the market.

Below is the list of some prominent players in the industry:

Recent Developments

- In March 2025, Exactech, Inc. announced the first successful surgery using its Vantage Ankle3D and 3D+tibial implants with GPS Ankle navigation, advancing the industry with better patient outcomes.

- In February 2025, Delta Electronics announced a partnership with Paonan Biotech Co., Ltd. to upgrade its spinal implant production line with smart software solutions by improving quality, efficiency, and global supply chain integration.

- In September 2024, Maxx Orthopedics, Inc. announced the U.S. FDA clearance for the new Freedom Titan PCK Revision Knee System and partnership with UNIK Orthopedics, Inc. The company focused on delivering premium quality medical devices, robotics, and medical software for joint replacement procedures.

- In September 2021, Keystone Dental Inc. announced USD 25 million in financing to accelerate growth in the dental implant market focusing on innovation and digital capabilities.

- Report ID: 7467

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Osseointegration Implants Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.