Organic Food and Beverages Market Outlook:

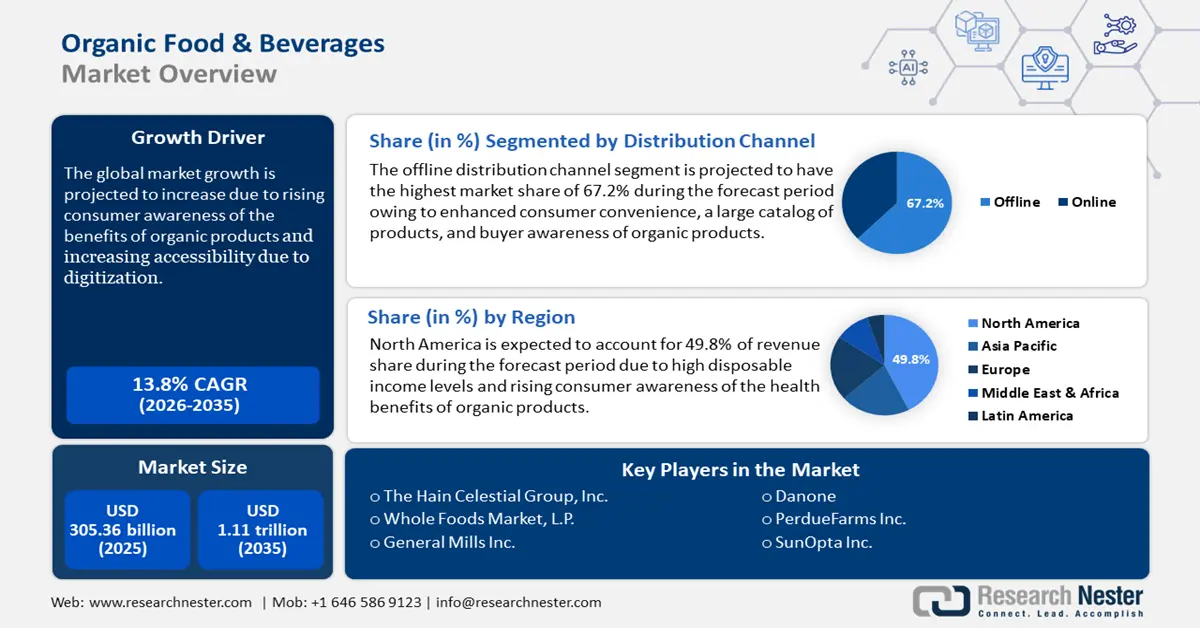

Organic Food and Beverages Market size was over USD 305.36 billion in 2025 and is poised to exceed USD 1.11 trillion by 2035, growing at over 13.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of organic food and beverages is estimated at USD 343.29 billion.

Globally, consumer awareness of health and wellness has seen a significant boost leading to the rapid growth of the organic food and beverages market. In 2022, the World Health Organization (WHO) published a report that global health is the best investment that one can make especially in the wake of the COVID-19 pandemic. As per a United Nations (UN) report, there will be a 90% increase in global health issues by 2048. These trends have increased awareness of health and wellness among consumers, resulting in rising demand for organic food products and beverages. In addition, consumer accessibility to organic products has improved manifolds which is paramount for organic food and beverages market growth.

Organic food and beverages are products that do not contain synthetic chemicals or genetically modified organism (GMO) components. As per a Research Gate publication on consumer behavior trends, there has been an increasing belief that organic food is less harmful to the environment and much healthier. The increased focus on sustainability has impacted the trends of key market players to incorporate sustainable practices such as ethical sourcing in their products. As product innovation continues, the market is poised for continued robust expansion.

Key Organic Food and Beverages Market Insights Summary:

Regional Highlights:

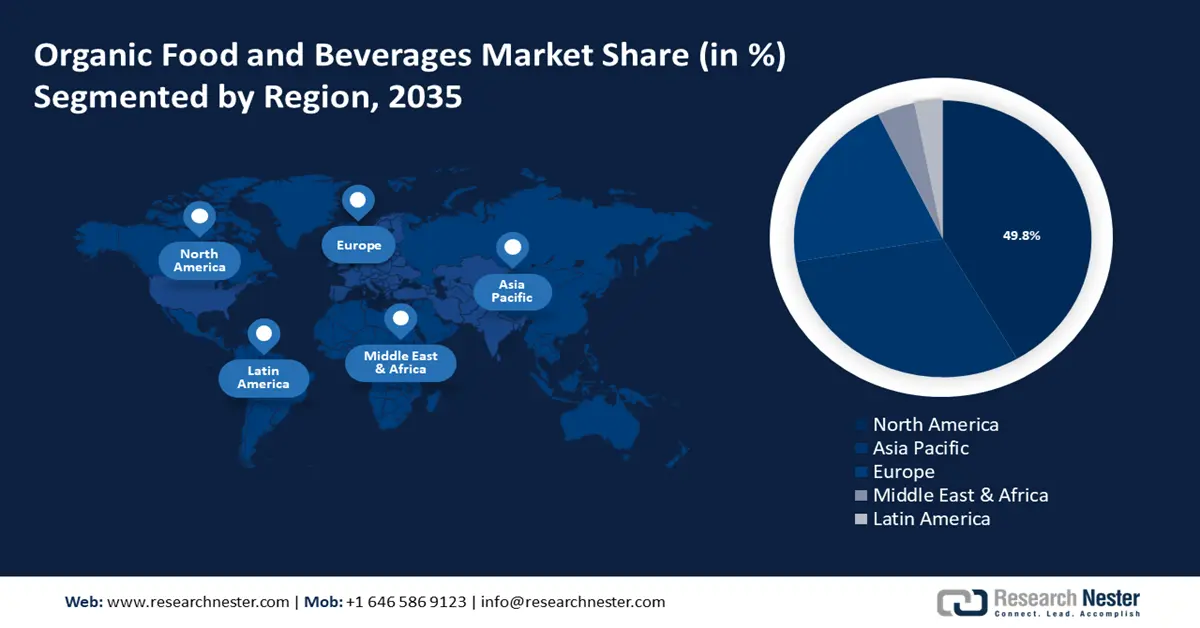

- North America organic food and beverages market achieves a 49.80% share by 2035, driven by rising public awareness and demands for organic food and beverages.

Segment Insights:

- The offline segment in the organic food and beverages market is anticipated to experience significant growth till 2035, driven by the convenience of personal inspection and established retail networks.

- The online segment in the organic food and beverages market is projected to experience considerable growth till 2035, driven by increased digitization and a post-pandemic shift to online shopping.

Key Growth Trends:

- Increased accessibility and expansion of distribution channels

- Growing demand for non-GMO products

Major Challenges:

- High costs in production

- Shorter shelf lives

Key Players: SunOpta, Inc., Whole Foods Market L.P., Dole plc, Dairy Farmers of America, Inc., General Mills, Inc., Danone S.A., Eden Foods, Inc., Organic Valley, Nestlé S.A., Ito En, Ltd..

Global Organic Food and Beverages Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 305.36 billion

- 2026 Market Size: USD 343.29 billion

- Projected Market Size: USD 1.11 trillion by 2035

- Growth Forecasts: 13.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (49.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, France, China, Italy

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 17 September, 2025

Organic Food and Beverages Market Growth Drivers and Challenges:

Growth Drivers

- Increased accessibility and expansion of distribution channels: The expansion of distribution channels, both online and offline has improved the accessibility of organic food and beverages, thereby driving market growth. The rapid rise of online marketplaces that capitalize on providing organic products is a testament to the market growth. Additionally, new organic products are being launched in different segments to capitalize on the growth.

For instance, in March 2024, Pip Organic launched Pipstick, a 100% organic fruit bar without added sugar or preservatives, while REBBL launched Smoothie Starter in May 2024 which allows consumers to blend a protein smoothie conveniently. - Growing demand for non-GMO products: Due to increasing awareness of the potential ramifications on health associated with GMO products, the preference for non-GMO products has increased leading to an uptick in the market. As per a study conducted by the International Food Information Council Foundation’s Food and Health Survey in June 2020, consumer interest aligned with products that had non-GMO ingredients. The survey also highlighted that consumers choose non-GMO as the third most influential marker behind natural and steroid-free labels when choosing a product. In June 2024, Organic India launched regenerative Tulsi tea which was organic certified.

- Rising impact of social media in promotion: The positive promotion of social media has played a huge role in the market growth. As per google trends data, the search terms for organic food and organic beverages have seen a steady rise in the last 5 years. Social media platforms such as Instagram, Facebook, X, TikTok, and Reddit have been instrumental in increasing the demand for organic food and beverages by highlighting the benefits and fostering a sense of community among like-minded consumers.

As per a study published on Research Gate in July 2023, 52% of consumers stated that social media impacted their awareness of organic products. Due to this, key market players are actively investing in social media presence to take advantage of the engagement.

Challenges

- High costs in production: A key factor impeding the market is the high cost of production which increases the cost of the final product which affects accessibility. Since sourcing raw materials requires significant investments in labor and sustainable practices, the eventual retail price can be affected. Additionally, obtaining the organic certification may turn out to be costly for small-scale businesses. The higher price of organic food and beverages due to rising operational costs can be a challenge for consumers in emerging economies.

- Shorter shelf lives: Since organic food and beverages are preservative-free, they have shorter shelf lives. This affects buyer behavior as organic products are bought in lower quantities. The use of organic products in long journeys is also impacted due to this.

Organic Food and Beverages Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

13.8% |

|

Base Year Market Size (2025) |

USD 305.36 billion |

|

Forecast Year Market Size (2035) |

USD 1.11 trillion |

|

Regional Scope |

|

Organic Food and Beverages Market Segmentation:

Product

The vegetables and fruits segment is expected to register rapid revenue growth during the forecast period driven by rising consumer awareness of the health benefits of integrating organic vegetables and fruits in the diet and demand for environmental sustainability. There is a high rate of demand for organic vegetables and fruits free of chemicals in North America and Europe.

The beer and wine segment is expected to register rapid revenue CAGR during the forecast period. Many governments have identified the potential of local organic drinks and have started the process to market them. The demand for organic beer and wine is fueled by a greater sense of cultural pride and demands for sustainability. For instance, in 2021, the organic rice wine Judima was presented with the geographical indication tag by the Government of India, and its commercialization process was given a green light.

Distribution Channel

Offline segment is projected to dominate over 67.2% organic food and beverages market share by 2035. Convenience stores, supermarkets, farmers markets, and hypermarkets offer a plethora of choices in organic foods and beverages. Since a considerable portion of organic sales depends on buyer awareness of health, offline channels are convenient for personal inspection to consumers.

There are several organic food and beverages market players in the offline distribution segment such as Whole Foods, Sprouts Farmers Market, and Fresh Market, and their sales have been growing steadily. For instance, in 2023, Walmart which focused more on mass-market products has been steadily increasing its catalog of organic products from emerging brands.

The online distribution channel segment has been expanding at a staggering rate since the COVID-19 pandemic where consumers did the bulk of their shopping via online retailers. Major players including Amazon have added an Amazon fresh section in their catalog that exclusively sells organic products. With increased digitization, especially in emerging economies, this segment is expected to see a considerable growth during the forecast period.

Our in-depth analysis of the organic food and beverages market includes the following segments:

|

Product |

|

|

Distribution Channel |

|

|

Process |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Organic Food and Beverages Market Regional Analysis:

North America Market Insights

North America industry is estimated to dominate majority revenue share of 49.8% by 2035, owing to rising public awareness and demands for organic food and beverages to supplement healthier living and increasing levels of disposable income allowing consumers to purchase premium organic products.

The U.S. is poised to remain the organic food and beverages market leader in North America. The demand for organic vegetables and fruits is considerably high in the country. As per a Research Nester report, in 2022, 30% of American customers preferred to buy organic over conventionally produced goods. The demand for organic meat is also growing in the country. For instance, in 2020, Craft Cow, renowned for organic meat announced a USD 8 million funding. Another marker of consumer preference for organic food and beverages in the U.S. is the Pew Research Center report that stated 73% of Americans preferred to buy locally grown food and vegetables while 44% bought food that was labeled as non-GMO free. These trends are expected to continue to drive the demand for organic products.

In Canada, the demand for organic products is rising owing to consumer awareness of health, growing calls for sustainability, and a high rate of import of organic products. As per an Export Development Canada report, the demand for organic products in Canada is growing at 8% annually. The farming of organic vegetables has grown in the country with Quebec accounting for three-quarters of certified organic vegetables. There is also a surge in the import of organic vegetables to Canada since the demand is surging more than the produce within the country. New product launches have been boosted due to consumer demand. For instance, in August 2024, Guru Organics released an organic Peach Mango Punch in Canada.

APAC Market Insights

Asia Pacific is projected to witness a massive surge in the organic food and vegetables market due to rising disposable incomes, improving the affordability of premium organic products, large population numbers, and increasing demand for organic produce due to wellness concerns.

India is the leading organic food producer in the world. The consumer base in India has a growing awareness of health which has boosted the demand for organic food along with a trend in consumer behavior to support local organic produce. In addition, there has been a sustained effort by the government to promote organic farming in the country. For instance, Paramparagat Krishi Vikas Yojana promotes organic farming with certification and monetary grants.

The startup ecosystem in the country has also seen the foray of new emerging players in the organic food and beverages market by leveraging the rich organic history of various regions. For instance, Diaspora Co. raised USD 2 million in financing in 2021. In 2022, NE Origins, a Sikkim-based startup raised USD 2 million pre-seed funding.

In China, the organic farming market is export-oriented with 28% of its agricultural land devoted to organic farming. Health is a key issue in China that boosts the demand for organic products. As per the U.S. Agricultural Trade Office in Guangzhou, most supermarkets in China have doubled floor space for organic goods.

Japan is a significant player in APAC that is poised to grow its revenue share during the forecast period, owing to increasing public awareness of organic products and a robust regulatory framework that ensures quality control. The government has focused on promoting organic consumption by planning to convert 1 million hectares of agricultural land to dedicated organic farming by 2050.

South Korea is a bourgeoning market, expected to steadily expand during the forecast period. The driving factors are a high focus on health and well-being and a call for ethical consumption by the millennial and Gen Z demographics. Key players in the market are focused on increasing their production and acquisitions to increase market share. For instance, in 2021, Maeil Dairies purchased land and assets from Corio Bay Dairy Group for USD 13.5 million.

Organic Food and Beverages Market Players:

- The Hain Celestial Group, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Whole Foods Market, L.P.

- General Mills Inc.

- Danone

- Organic India

- SunOpta, Inc.

- Organic Valley

- Dairy Farmers of America, Inc.

- Eel River Brewing Company

- Perdue Farms, Inc.

Organic food and beverages market growth is predicted to have a lucrative share during the forecast period. It is a competitive market with the presence of local and global players. The surge in market growth is credited to the rise in consumer awareness of health leading to the demand for organic products that are chemical-free..

Recent Developments

- In July 2024, Amul launched Organic Shoppe in Delhi, India. Amul targets expansion to 100 stores. Amul stated that the products in Organic Shoppe will be certified organic and sourced from certified organic farmers.

- In October 2023, Budweiser China launched Brewmaster Organic as its first-ever organic beer. The beer is free of pesticides, genetically modified seeds, and fertilizers.

- In September 2023, UNLIMEAT ramped its expansion to the U.S. market by launching plant-based products such as Mandu, Korean BBQ, and Pulled Pork. Their products resemble real meat and are vegan alternatives.

- Report ID: 6167

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Organic Food and Beverages Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.