Nucleic Acid Labeling Market Outlook:

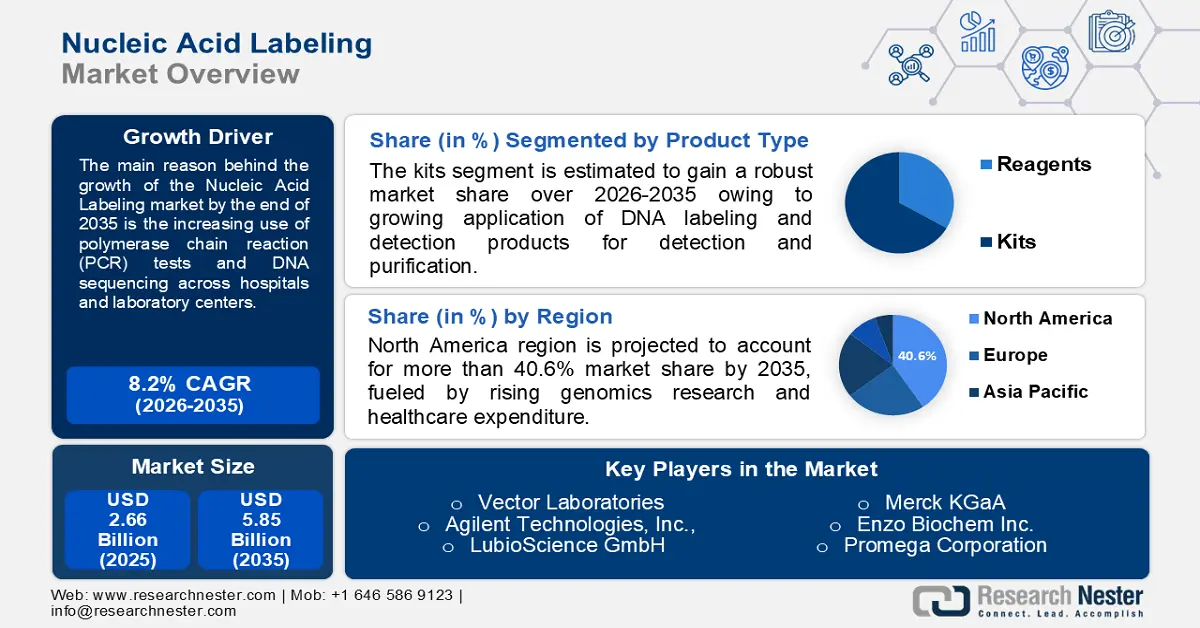

Nucleic Acid Labeling Market size was valued at USD 2.66 Billion in 2025 and is likely to cross USD 5.85 Billion by 2035, registering more than 8.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of nucleic acid labeling is assessed at USD 2.86 Billion.

The growth of the market can be attributed to the increasing use of polymerase chain reaction (PCR) tests and DNA sequencing across hospitals and laboratory centers owing to the outbreak of various infectious diseases such as the COVID-19 pandemic. For instance, in February 2021, more than 1 million PCR tests were performed in the United States as a consequence of the COVID-19 pandemic. The PCR test is used to determine the genetics of an organism to find out whether it is a virus, bacteria, or any other organism. It is used to find the type of disease or infection a patient is suffering from, so that appropriate treatment is indicated to the patient. The prevalence of infectious diseases across the world that are both contagious and asymptomatic is estimated to drive market growth.

Moreover, the development of healthcare facilities, increasing awareness of early disease diagnosis, along with increasing per capita income are anticipated to propel the demand for nucleic acid labeling during the forecast period. The World Bank reported a 4.8% increase in worldwide income per capita in 2021, compared with 1.5% in 2019. People are becoming more aware of their health with the adoption of early diagnosis tests. The spread of COVID-19 made people more conscious of getting tested if they saw any symptoms that were not common. The government is also paying much attention to the healthcare sector, as it is crucial for a healthy community. Also, the spread of genetic disorders is something that cannot be changed after their incidence. Therefore, it is better to prevent the cause through genetic material testing. Thus, the growth of the market is expected to grow during the forecast period.

Key Nucleic Acid Labeling Market Insights Summary:

Regional Highlights:

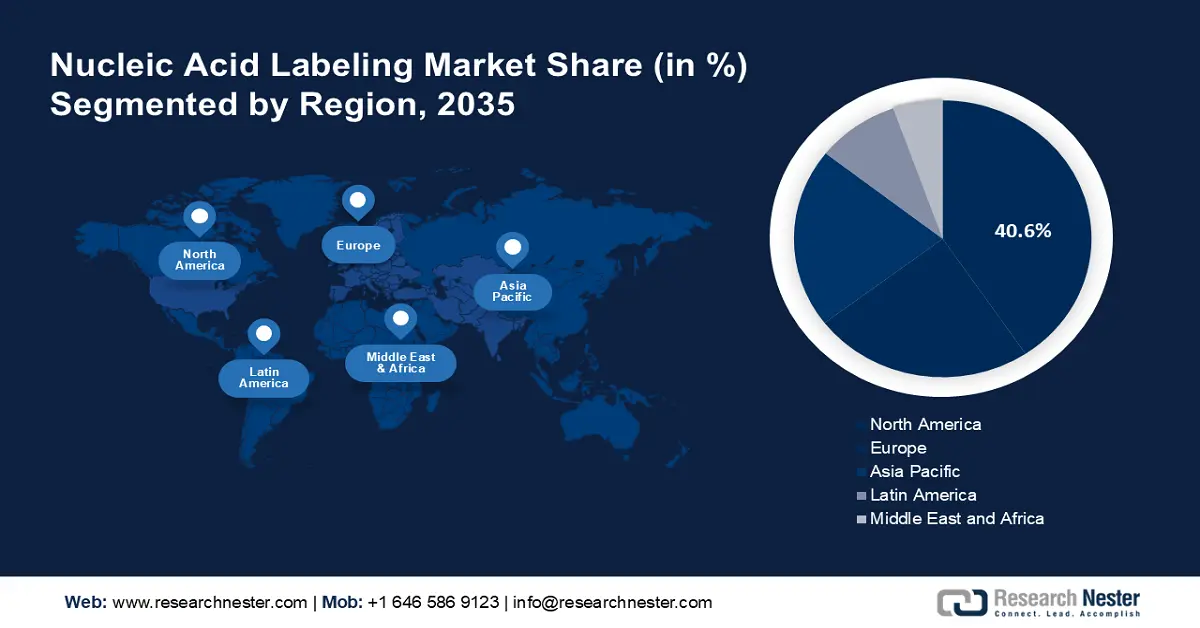

- North America’s nucleic acid labeling market will secure around 40.6% share by 2035, fueled by rising genomics research and healthcare expenditure.

Segment Insights:

- The kits (product type) segment in the nucleic acid labeling market is expected to capture the largest share by 2035, driven by the growing use of DNA detection kits and increased demand for COVID-19 diagnostics.

- The in-situ hybridization segment in the nucleic acid labeling market is expected to secure the largest share by 2035, fueled by rising genetic disorders and demand for targeted diagnostics.

Key Growth Trends:

- Increase in the Number of Laboratory Experiments and Research Institutes

- Growing Cases of Infectious Diseases Worldwide Among People

Major Challenges:

- Increase in the Number of Laboratory Experiments and Research Institutes

- Growing Cases of Infectious Diseases Worldwide Among People

Key Players: Thermo Fisher Scientific Inc., New England Biolabs, PerkinElmer Inc., F. Hoffmann La-Roche AG, GENERAL ELECTRIC COMPANY, Merck KGaA, Enzo Biochem Inc., Promega Corporation, Vector Laboratories, Agilent Technologies, Inc., LubioScience GmbH.

Global Nucleic Acid Labeling Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.66 Billion

- 2026 Market Size: USD 2.86 Billion

- Projected Market Size: USD 5.85 Billion by 2035

- Growth Forecasts: 8.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 9 September, 2025

Nucleic Acid Labeling Market - Growth Drivers and Challenges

Growth Drivers

-

Increase in the Number of Laboratory Experiments and Research Institutes - Data from the World Bank shows that as of 2018, there were 1597 researchers engaged in research and development activities per 1,000,000 people, a significant increase from 1412 researchers per million in 2015 across the globe. Government organizations are increasing funding for research activities and drug discovery purposes, which is resulting in the development of advanced and innovative treatments for disease diagnosis. There are few companies that offer specific reagents and kits for nucleic acid labeling specifically for research applications, which in turn is expected to enlarge the global nucleic acid labeling market size during the forecast period.

-

Growing Cases of Infectious Diseases Worldwide Among People - It was observed that in China, the reportable infectious disease cases accounted for more than 6,300,170 in 2020.

- Rapid Growth of the Life Science Industry Including Cell and Gene Therapy - According to estimates, nearly USD 10 billion in investment was made in CGT (cell and gene therapy) in 2020 and the investment is expected to grow to USD 45 billion by the end of 2027 across the globe.

- Increasing Health Care Expenditures Worldwide to Improve Health Facilities - According to the World Bank, global healthcare expenditures totaled USD 9.83 billion in 2019, an increase of USD 9.7 billion from 2018.

- Rise in Genomic Research and Development Initiatives - For instance, by increasing the diversity of people participating in genomics research, the National Human Genome Research Institute (NHGRI) is engaged in improving understanding of human genomic variation and genomic information in general.

Challenges

-

Inadequacies in the Professional and Medical Expertise - There is always advancement in any sector to improve the services provided to the people. Sometimes, it becomes difficult for people to get adopted to new equipment or technology. It is necessary to learn everything about the change to use it efficiently. Moreover, lack of experienced or skilled professionals is estimated to hinder the growth of the market, as per the market analysis.

-

High Treatment Procedure Costs

- Complications Associated with the Techniques

Nucleic Acid Labeling Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.2% |

|

Base Year Market Size (2025) |

USD 2.66 Billion |

|

Forecast Year Market Size (2035) |

USD 5.85 Billion |

|

Regional Scope |

|

Nucleic Acid Labeling Market Segmentation:

Product Type Segment Analysis

The global nucleic acid labeling market is segmented and analyzed for demand and supply by product type into reagents, and kits. Among these segments, the kits segment is anticipated to capture the largest market size in the global nucleic acid labeling market. The growing application of DNA labeling and detection products for detection and purification is expected to drive segment growth during the forecast period. Moreover, the surge in cases of COVID-19 along with the development of advanced labeling kits by key manufacturers for COVID- 19 diagnostics, is further anticipated to fuel segment growth. For instance, Perkin Elmer Inc's new COVID-19 nucleic acid detection kit is an in vitro real-time RT-PCR diagnostic kit for detecting nucleic acid from SARS-CoV-2 in humans with 48 tests included in the kit. The kits help to avoid long waiting times in lines at hospitals and the risk of infections is more in health facilities. The home-tested kits also help to prevent traveling chargers. Even health professionals will save time as everything is assembled in the kit which is disposable after use.

Application Segment Analysis

The global nucleic acid labeling market is also segmented and analyzed for demand and supply by application into DNA sequencing, PCR, FISH, microarray, In situ hybridization, botting, and others. The In-situ hybridization segment is estimated to garner the largest share. The rising prevalence of genetic disorders and increasing use of In-situ hybridization in the manufacturing of cancer and genetic disorder drugs or medicines. The increasing growth of infections among people as well as research and development funds to improve the market segment growth is estimated to drive the growth of the market. It is also used to understand the disease such as the DNA or chromosomal abnormalities that cause the disorder. Rising pharmaceutical, diagnostic, and biopharmaceutical companies boost the growth of the segment. As per the estimations of the World Health Organization, about 10 in 1000 people are affected by the monogenic disease across the world.

Our in-depth analysis of the global market includes the following segments:

|

By Product Type |

|

|

By Labeling Technique |

|

|

By Application |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Nucleic Acid Labeling Market Regional Analysis:

North America region is projected to account for more than 40.6% market share by 2035, The growth of the market can be attributed majorly to the growing genomics research, attractive reimbursement policies, and convenient access to new diagnostic solutions owing to the presence of key emerging companies in the region. Furthermore, the increasing spending on healthcare and Medicare along with increased R&D expenditures are expected to drive the nucleic acid labeling market growth in the region during the forecast period. According to the Centers for Medicare & Medicaid Services, a total of USD 4.1 trillion was spent on health care in the United States in 2020, representing an increase of 9.7 percent. Also, in 2020, Medicare expenditures increased by 3.5% to USD 829.5 billion. The study of the genetic material of an organism is helpful in determining the protein structure and building mechanism. Therefore, it is an active ingredient or drug is developed to prevent its growth in or on the human body. DNA is the key to many medicinal discoveries that help to treat diseases that are chronic and harmful.

Nucleic Acid Labeling Market Players:

- Thermo Fisher Scientific Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- New England Biolabs

- PerkinElmer Inc.

- F. Hoffmann La-Roche AG

- GENERAL ELECTRIC COMPANY

- Merck KGaA

- Enzo Biochem Inc.

- Promega Corporation

- Vector Laboratories

- Agilent Technologies, Inc.,

- LubioScience GmbH

Recent Developments

-

ThermoFisher Scientific Inc., announced the launch of the Thermo Scientific SpeciMAX Stabilized Saliva Collection Kit. To ensure sample safety, this kit inactivates common respiratory viruses to preserve viral nucleic acids.

-

New England Biolabs (NEB) released Monarch Genomic DNA Purification Kit, by expanding its Monarch Nucleic Acid Purification portfolio. This kit provides extremely high yields of DNA fragment purification and prevents contamination of RNA.

- Report ID: 4299

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Nucleic Acid Labeling Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.