Next-Generation Biomanufacturing Market Outlook:

Next-Generation Biomanufacturing Market size was over USD 25.71 billion in 2025 and is projected to reach USD 57.6 billion by 2035, growing at around 8.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of next-generation biomanufacturing is evaluated at USD 27.65 billion.

The enormous expansion in biologics and biosimilars in recent years has increased the need for biomanufacturing technologies. As per a report, currently, the development of biologics accounts for around 40% of all pharmaceutical R&D spending. It is essential to advancing healthcare since it provides cutting-edge cures and treatments. Additionally, biomanufacturing accelerates scientific research, boosts economic growth, and provides jobs. Because it promotes the creation of environmentally friendly technology and lowers industrial waste, its importance goes beyond environmental preservation. The advantages of biomanufacturing include its affordability, scalability, and potential for growth.

Furthermore, businesses that are adopting next-generation biomanufacturing can collaborate with organizations like Danaher Corporation's life sciences divisions to create adaptable, novel processes for every phase of production, from research and development to cGMP manufacturing. The array of flexible manufacturing services and products is expanding quickly, providing pharmaceutical companies with multiple choices to maximize the production of genetically modified medications.

Key Next-Generation Biomanufacturing Market Insights Summary:

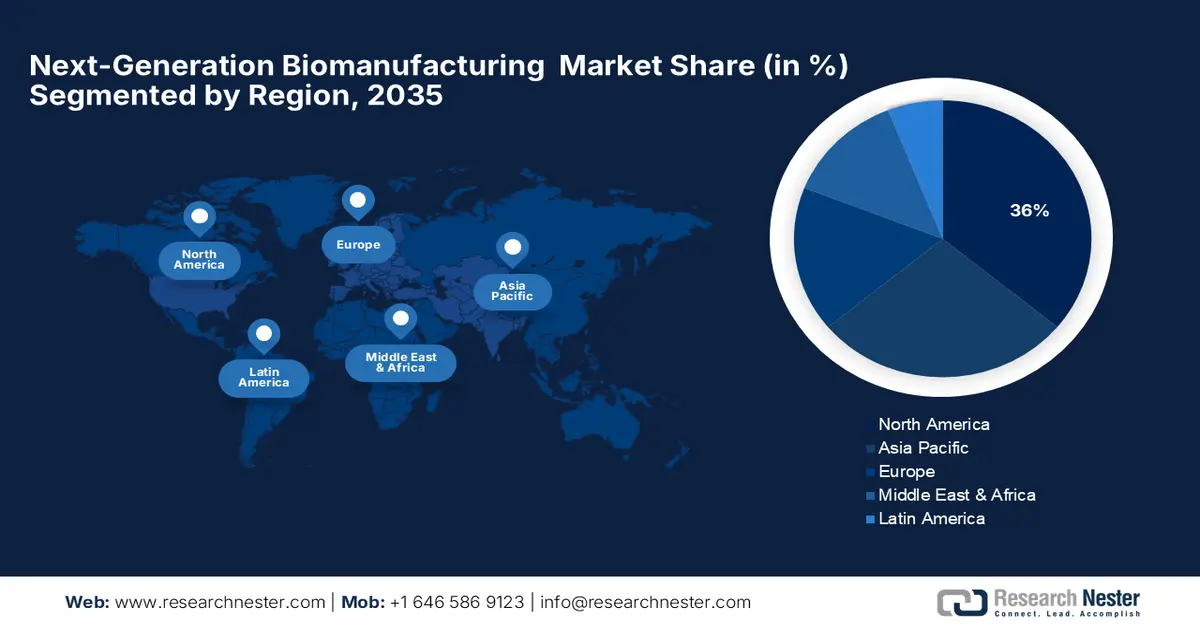

Regional Highlights:

- North America in the next-generation biomanufacturing market is projected to secure a 36% share, owing to its strong concentration of leading biopharmaceutical companies and robust R&D

- The Asia Pacific region is anticipated to capture a 28% share by 2035, attributed to rising demand for advanced biomanufacturing capabilities supporting gene and cell therapy expansion.

Segment Insights:

- By 2035, the Monoclonal Antibodies segment in the next-generation biomanufacturing market is expected to hold a 48% share, propelled by the increasing adoption of next-generation biotechnological methods that accelerate and streamline mAb production.

- The Biopharmaceutical Companies segment is projected to account for a 44% share by 2035, supported by the escalating need for advanced manufacturing strategies aligned with personalized medicine.

Key Growth Trends:

- Increased Technological Advancements

- Increased Government Initiatives for the Advancement of Biomanufacturing

Major Challenges:

- High Cost of Biologic Therapies and Complexity in Manufacturing These Drugs

- Lack of Skilled Professionals may Hinder the Market Growth

Key Players: Sartorius AG, Regeneron Pharmaceuticals, Inc., GEA Group Aktiengesellschaft, PBS Biotech Inc., Applikon Biotechnology BV, Danaher Corporation, Merck KGaA, Shanghai Bailum Biotechnology Co., Ltd., Solaris Biotechnology Srl., ZETA GmbH.

Global Next-Generation Biomanufacturing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 25.71 billion

- 2026 Market Size: USD 27.65 billion

- Projected Market Size: USD 57.6 billion by 2035

- Growth Forecasts: 8.4%

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Singapore, Brazil, Australia

Last updated on : 1 December, 2025

Next-Generation Biomanufacturing Market - Growth Drivers and Challenges

Growth Drivers

- Increased Technological Advancements - Biomanufacturing is a perfect fit for the pharmaceutical and medical industries. In response, the industry has developed a wide range of uses, including the manufacturing of antibacterial, regulated, on-demand molecules, medications, and vaccines. The most interesting aspect may be the possibility of creating customized, ideal suits for individual patients with "3D printed drugs" including, tissues and even organs on demand. Promising opportunities are expected for next-generation biomanufacturing market participants providing bioprocessing 4.0 services, driven by innovations including real-time operational access and growing interest in paperless manufacturing among innovators. It is anticipated that this will contribute to the development of a standardized procedure, which can lessen the variation in quality across batches.

- Increased Government Initiatives for the Advancement of Biomanufacturing - Governments globally are launching various programs and initiatives for the advancements of biomanufacturing, which is accelerating the next-generation biomanufacturing market growth. For instance, an executive order on "Advancing Biotechnology and Biomanufacturing Innovation for a Sustainable, Safe, and Secure American Bioeconomy" was signed by the US government on September 12, 2022. The government outlined its vision for a comprehensive strategy to advance biotechnology and biomanufacturing in the E.O. by outlining the fundamental and application-driven research needs that will result in ground-breaking solutions in the areas of health, energy, agriculture, food security, supply chain resilience, and national and economic security.

- Growing Demand for Drugs and Therapies – With the growing demand and spending on drugs and therapies, many biopharmaceutical companies prefer adopting next-generation biomanufacturing services to balance the process design, performance, and efficiency with time and cost. As per a report, the total amount spent on pharmaceutical purchases from manufacturers is predicted to reach USD 1.9 trillion by 2027, growing at a rate of 3-6% annually. This development is estimated to propel the growth of the next-generation biomanufacturing market over the forecast period. In addition to this, increased collaboration between the government and key players for the development of biomanufacturing is also accelerating the growth of the market. For instance, with project partners the governments of Canada and Prince Edward Island, BIOVECTRA celebrates the completion of its USD 90 million plus biologics expansion at the company's new state-of-the-art Biomanufacturing Center.

Challenges

- High Cost of Biologic Therapies and Complexity in Manufacturing These Drugs - Biologics are strong medications that can be difficult to produce. They can target dangerous things, like some cancer cells, with exceptional accuracy since they often resemble proteins and other chemicals found in living organisms. Many of the most promising new treatments for cancer and other disorders belong to this family. Compared to medications made by chemical reactions, biologics are often larger, more complex molecules, which increase the difficulties in synthesis and increase their cost. Certain biological medicines can cost USD 10,000 for a single dose. Therefore, this factor may hamper the growth of the next-generation biomanufacturing market.

- Lack of Skilled Professionals may Hinder the Market Growth

- Regulatory Compliance and Standardization may Hamper the Market Growth

Next-Generation Biomanufacturing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.4% |

|

Base Year Market Size (2025) |

USD 25.71 billion |

|

Forecast Year Market Size (2035) |

USD 57.6 billion |

|

Regional Scope |

|

Next-Generation Biomanufacturing Market Segmentation:

Application Segment Analysis

Monoclonal antibodies segment in the next-generation biomanufacturing market is expected to hold a share of 48% during the forecast period. Throughout the forecast period, the global market for next-generation biomanufacturing is predicted to witness a consistently rapid expansion in the monoclonal antibodies segment. This is so because monoclonal antibodies are a class of biopharmaceuticals that are routinely employed to treat a wide range of illnesses. The production of monoclonal antibodies, which has a number of advantages compared to traditional manufacturing methods, is increasing with the use of next-generation biotechnological techniques. Furthermore, the development of monoclonal antibodies in a variety of diseases is being increasingly pursued by companies. For instance, Acumen Pharmaceuticals, Inc., a clinical-stage biopharmaceutical company, is developing a novel therapeutic for the treatment of Alzheimer's disease that targets soluble amyloid beta oligomers. The company recently announced that it had won the prestigious "Monoclonal Antibody Solution of the Year" award from the BioTech Breakthrough Awards program. In addition, the time it takes for mAbs to reach the market can be reduced by next-generation biotechnologies, which allow for a faster and more efficient manufacturing process.

End-user Segment Analysis

Biopharmaceutical companies segment in the next-generation biomanufacturing market is poised to hold a share of 44% during the forecast period. This is because next-generation biomanufacturing strategies are needed for customized medication and protein production, which are the current areas of concentration for biopharmaceutical businesses. Biologic medications play a major role in the quickly expanding field of personalized medicine. As per a report, personalized medications made up 21% of all FDA-approved novel molecular entities in 2014; by 2022, however, that percentage had risen to 34%. It is anticipated that biopharmaceutical companies will need to modify their manufacturing processes to fulfill the demands of this industry as the desire for personalized medication continues to rise. This might involve creating personalized biologic medications for each patient using cutting-edge biomanufacturing methods.

Our in-depth analysis of the global next-generation biomanufacturing market includes the following segments:

|

Workflow Type |

|

|

Application |

|

|

End-user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Next-Generation Biomanufacturing Market - Regional Analysis

North American Market Insights

North American next-generation biomanufacturing market is anticipated to hold the largest share of 36% during the foreseen period. Many of the top biopharmaceutical businesses in the world are based in North America, and they will probably use next-generation biomanufacturing technology to boost productivity and enhance their production processes. Along with having a robust R&D infrastructure, North America is home to numerous universities, research centers, and government organizations that are engaged in the development of novel biomanufacturing techniques and procedures. These organizations will probably be crucial in propelling the next-generation biomanufacturing market revenue expansion by creating innovative technologies and procedures that biopharmaceutical businesses and other end users can use.

APAC Market Insights

Next-generation biomanufacturing market in the Asia Pacific region is expected to hold a share of 28% during the forecast period. The increase in approved treatments and the growing demand for sophisticated biomanufacturing infrastructures that can support an increasing number of target indications for gene & cell therapies are factors that are attributed to the next-generation biomanufacturing market growth. The APAC region is witnessing unprecedented advances in medical treatments due to the substantial investments made by governments, pharmaceutical companies, and academic institutions. For instance, compared to 2008, greenfield FDI in the Asia-Pacific health sector decreased by 49% in 2021. However, with a 78% growth in the first quarter of 2022, things appear more promising. This is driving up demand for advanced biomanufacturing solutions.

Next-Generation Biomanufacturing Market Players:

- Sartorius AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Regeneron Pharmaceuticals, Inc.

- GEA Group Aktiengesellschaft

- PBS Biotech Inc.

- Applikon Biotechnology BV

- Danaher Corporation

- Merck KGaA

- Shanghai Bailum Biotechnology Co., Ltd.

- Solaris Biotechnology Srl.

- ZETA GmbH

Recent Developments

- June 2023 - Extending their cooperative agreement that started with upstream bioprocessing analytics, Waterways Corporation and Sartorius announced a new collaboration to develop integrated analytical solutions for downstream biomanufacturing. Bioprocess engineers will have access to more thorough analytical data for downstream batch and continuous manufacturing through software and hardware integrations between the SartoriusTM Resolute® BioSMBTM multi-column chromatography platform and the WatersTM PATROLTM UltraPerformance Liquid Chromatography (UPLCTM) Process Analysis System. This will improve yields while lowering waste and biomanufacturing costs.

- August 2023 - Regeneron Pharmaceuticals, Inc. announced that it has reached a collaborative agreement with the Biomedical Advanced Research & Development Authority (BARDA) to facilitate the clinical development, clinical manufacturing, and regulatory licensure process of a novel COVID-19 monoclonal antibody therapy aimed at preventing SARS-CoV-2 infection. The deal is a component of the U.S. Department of Health and Human Services (HHS) "Project NextGen," which aims to develop a pipeline of novel COVID-19 vaccines and treatments.

- Report ID: 5958

- Published Date: Dec 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.