Neurotech Devices Market Outlook:

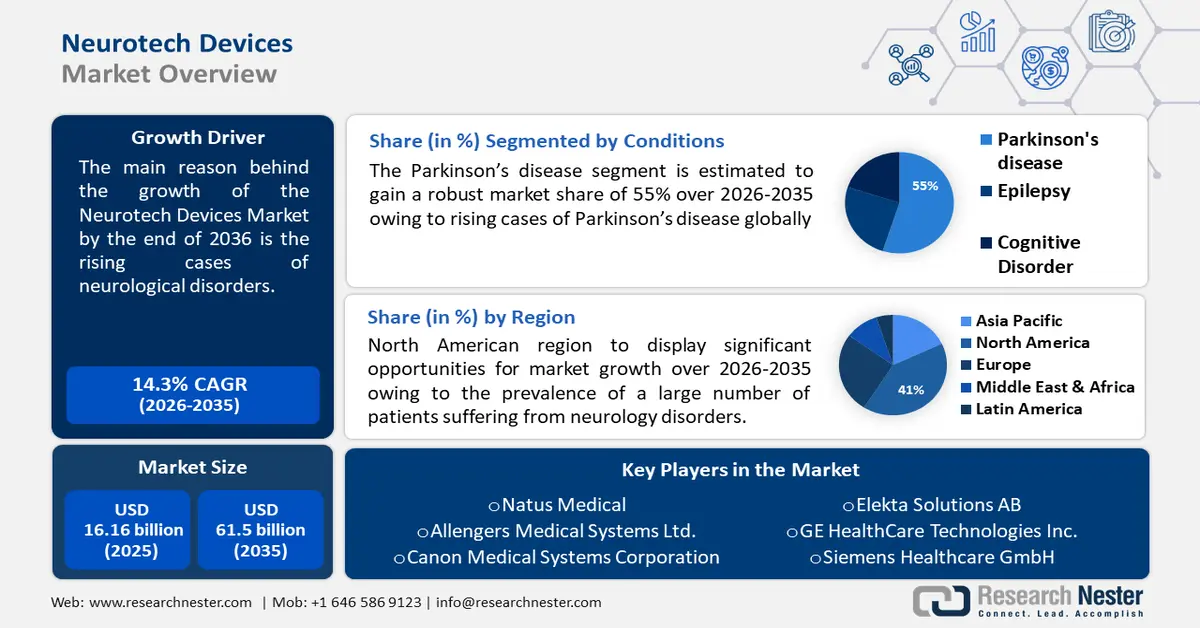

Neurotech Devices Market size was valued at USD 16.16 billion in 2025 and is expected to reach USD 61.5 billion by 2035, expanding at around 14.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of neurotech devices is evaluated at USD 18.24 billion.

The reason behind the growth is the rising cases of neurological disorders, leading to more options in the neurotech devices landscape. According to the World Health Organization (WHO), there is a significant disparity in access to treatment: high-income nations have up to 70 times more neurological experts per 100,000 people than low- and middle-income countries. Over 80% of neurological fatalities and health loss occur in low- and middle-income countries.

Key Neurotech Devices Market Insights Summary:

Regional Highlights:

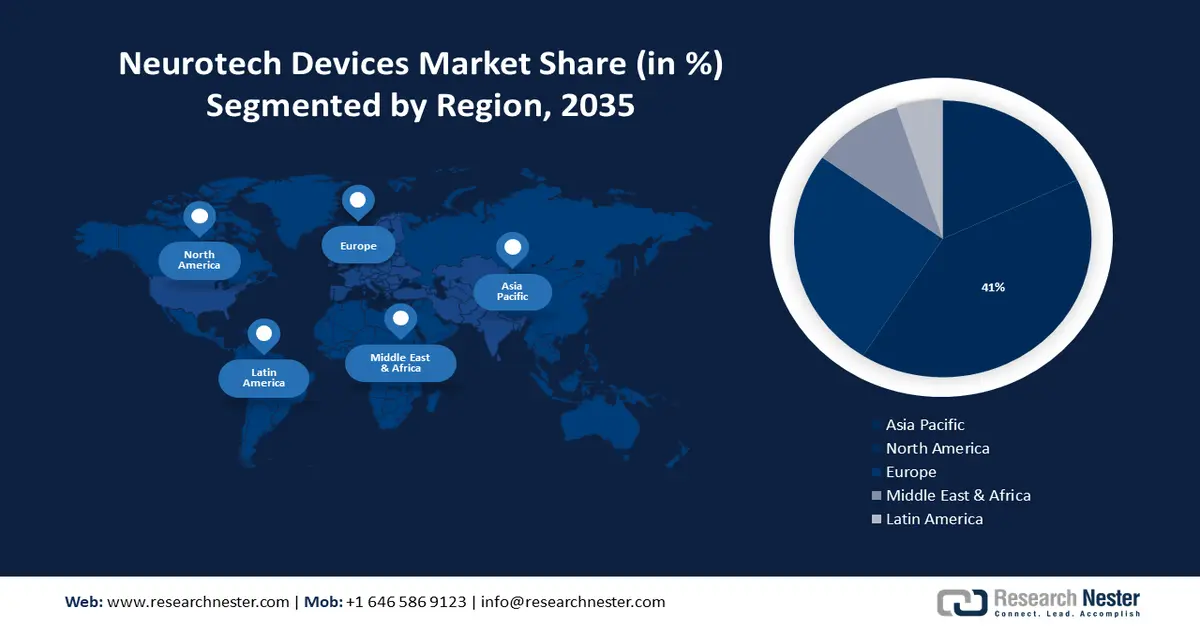

- North America neurotech devices market will dominate around 41% share by 2035, fueled by high prevalence of neurological disorders and rising patient numbers.

Segment Insights:

- The parkinson’s disease segment in the neurotech devices market is projected to hold a 55% share by 2035, driven by rising cases of Parkinson’s disease globally and the increasing use of cholinesterase inhibitors that can treat Parkinson’s disease.

- The hospitals segment in the neurotech devices market is expected to hold a 45% share by 2035, fueled by the rising number of hospitals globally along with favorable compensation policies.

Key Growth Trends:

- Rising investments in brain research

- Increasing cases of disease, incapacity, and early deaths

Major Challenges:

- Volatility in the end-use industry

- Shortage of competent neuroscientists

Key Players: EndoStim Inc., Natus Medical, Allengers Medical Systems Ltd., Canon Medical Systems Corporation, Elekta Solutions AB, GE HealthCare Technologies Inc., Siemens Healthcare GmbH, The Magstim Company Limited, Tristan Technologies Inc., Abbott Laboratories Inc.

Global Neurotech Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 16.16 billion

- 2026 Market Size: USD 18.24 billion

- Projected Market Size: USD 61.5 billion by 2035

- Growth Forecasts: 14.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Malaysia

Last updated on : 17 September, 2025

Neurotech Devices Market Growth Drivers and Challenges:

Growth Drivers

- Rising investments in brain research - Already the greatest cause of disability and death worldwide, neurological illnesses are also the fastest-growing cause of mortality, and their expected burden of disease is poised to rise faster than that of the majority of other non-communicable conditions. These results focused funding on locations with the greatest levels of burden and encouraged research into the most debilitating illnesses.

For instance, leading neuroscientists and authorities in public health convened at the World Congress of Neurology organized by the World Federation of Neurology aimed to translate research findings into practical applications and underscore the global significance of brain health. From October 15–19, 2023, Montreal hosted the 26th biennial conference, which the Canadian Neurological Society (CNS) co-hosted. - Increasing cases of disease, incapacity, and early deaths - Men are generally more disabled and experience health loss from neurological illnesses than women are, yet there are certain conditions, such as dementia or migraine, where women are disproportionately afflicted.

According to an analysis, the total amount of neurological conditions-associated disability, illness, and premature death (careful in disability-adjusted life years, or DALYs) increased by 18% globally over the earlier 31 years, from nearly 375 million years of healthy life lost in 1990 to 443 million years in 2021. - Increasing use of neurological devices worldwide - Over the past 30 years, there has been a significant increase in the number of people living with or passing away from neurological conditions such as meningitis, stroke, Alzheimer's disease, and other dementias worldwide. This increase can be attributed to a combination of factors including increased exposure to environmental, metabolic, and lifestyle risks, as well as population growth and aging.

A study titled "New Advances in Neurostimulation for Chronic Pain" that was published in February 2021 by the IEEE Engineering in Medicine and Biology Society also revealed that Mainstay Medical was the designer of the ReActiv8 implantable restorative neurostimulation system, which is used to treat intractable chronic lower back pain.

Challenges

- Volatility in the end-use industry - Furthermore, neuroimaging technologies such as electroencephalography (EEG) and functional magnetic resonance imaging (fMRI) are fundamental to the knowledge of how the brain functions because they enable researchers to interpret brain activity and design individualized therapies.

However, these neurotech devices are really expensive. Therefore, not all people can afford these devices which can further impede the market expansion. - Shortage of competent neuroscientists - A recent study from the American Academy of Neurology (AAN) describes the shortage of neurologists in the US as a "grave threat" to the specialty of neurology and the provision of high-quality patient care.

Neurotech Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

14.3% |

|

Base Year Market Size (2025) |

USD 16.16 billion |

|

Forecast Year Market Size (2035) |

USD 61.5 billion |

|

Regional Scope |

|

Neurotech Devices Market Segmentation:

Product Segment Analysis

Neurostimulation segment is poised to account for around 40% neurotech devices market share by 2035. The segment growth can be attributed to the increasing R&D activities and rising launch of better and more creative devices for the treatment of neurological disorders.

According to the National Library of Medicine, the US Food and Drug Administration (FDA) and the Critical Path Institute (C-Path) arranged the Neuroscience Annual Workshop in October 2022. Attendees included representatives from academia, government agencies, the patient community, and the drug development industry. The purpose of the workshop was to discuss the future development of therapies and tools for neurological disorders.

Conditions Segment Analysis

By the end of 2035, parkinson’s disease segment is estimated to hold over 55% neurotech devices market share. This expansion will highly depend on rising cases of Parkinson’s disease globally, and the increasing use of cholinesterase inhibitors that can treat Parkinson’s disease.

According to the World Health Organization (WHO), An estimated 8.5 million people worldwide have Parkinson's disease (PD) in 2020. According to current estimates, Parkinson's disease (PD) caused 329,000 deaths in 2019, an increase of over 100% since 2000, and 5.8 million disability-adjusted life years (DALYs), an increase of 81% since 2000.

End-Use Segment Analysis

In neurotech devices market, hospitals segment is poised to account for more than 45% revenue share by the end of 2035 owing to the rising number of hospitals globally along with favorable compensation policies.

Columbia had the highest number of hospitals in the OECD in 2022 with close to 11,000, followed by Japan with 8,205 hospitals. This figure depicts the total number of hospitals in a few chosen nations throughout the globe in 2022.

Our in-depth analysis of the global neurotech devices market includes the following segments:

|

Product |

|

|

Stimulators |

|

|

Conditions |

|

|

End-Use |

|

|

Type |

|

|

End-Use Industry |

|

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Neurotech Devices Market Regional Analysis:

North American Market Insights

North America region in neurotech devices market is poised to account for around 41% revenue share by 2035. The region’s neurotech devices sector is thriving, because of the prevalence of a large number of patients suffering from neurology disorders. According to research by the World Federation of Neurology, over 40% of people in North America recently have a neurological ailment, and by 2050, this number is set to almost quadruple.

The market for neurotech devices has expanded in the U.S. as a result of the increasing cases of stroke, migraine, AD, and other types of dementia in this country. TTH (121 [95% UI, 110-130] million people), migraine (69 [95% UI, 64-74] million people), stroke (8 [95% UI, 7.5-8.2] million people), AD and other dementias (3 [95% UI, 2.8-3.5] million people), and SCI (3 [95% UI, 2.0-2.3] million people) were the five most common neurological disorders.

The Canadian neurotech devices development mainly lies in the rising investment of the Canadian government in the advancement of neurotech devices and dementia care products in this country. The OECD Council approved a recommendation on responsible innovation in neurotechnology in December 2019, right before the pandemic.

European Market Insights

Europe region in neurotech devices market size is estimated to witness significant growth through 2035, owing to the rising cases of Alzheimer's in this region. According to the National Library of Medicine, there were 7.5 million AD patients in the EU in 2013 out of a total population of 508 million. According to the forecast, there will be 13.1 million AD sufferers worldwide in 2040 out of 524 million EU citizens.

Neurotech devices are especially in actual demand in the United Kingdom, driven by the rising technological advancement of neurological devices in this country. For instance, wales-based Magstim is now leading the advancement of transcranial magnetic stimulation (TMS), a successful non-invasive outpatient therapy option for those with depression that was developed in the UK.

In Germany, neurotech devices will encounter massive growth because this country belongs to the five biggest robot markets globally driven by the rising cases of mental diseases in this country. The Federal Ministry of Health reports that the percentage of people between the ages of 25 and 30 who use antidepressant medications climbed from 0.1% in 1986 to 1.1% in 2019.

The neurotech devices sector will also be huge in France due to the increasing cases of chronic disease in this country. In France in 2020, the two most common illness-specific causes of death were stroke (5.4%) and ischemic heart disease (5.6%).

Neurotech Devices Market Players:

- EndoStim Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Natus Medical

- Allengers Medical Systems Ltd.

- Canon Medical Systems Corporation

- Elekta Solutions AB

- GE HealthCare Technologies Inc.

- Siemens Healthcare GmbH

- The Magstim Company Limited

- Tristan Technologies Inc.

- Abbott Laboratories Inc.

The primary participants in the neurotech devices market have consolidated, as seen by the rise in patent transfers, mergers and acquisitions, product launches, joint ventures, higher R&D expenditures, and product consolidation among domestic and international companies. Some of the prominent participants working in the neurotech devices industry are:

Recent Developments

- EndoStim Inc. is a medical device company that is creating and distributing a first-in-class implantable neurostimulation treatment for drug-refractory gastroesophageal reflux disease (GERD). The U.S. Food and Drug Administration (FDA) recognized EndoStim's EndoStim System as a breakthrough device today, October 25, 2022.

- EndoStim Inc., a medical device organization growing and commercializing a first-in-class embeddable neurostimulation therapy for drug-refractory gastroesophageal reflux disease (GERD), currently connected with the U.S. Food and Drug Administration (FDA) for a device preliminary draft meeting ahead of time of a Premarket Approval (PMA) submission for the Organization’s EndoStim System.

- Report ID: 6050

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Neurotech Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.