Neurology Devices Market Outlook:

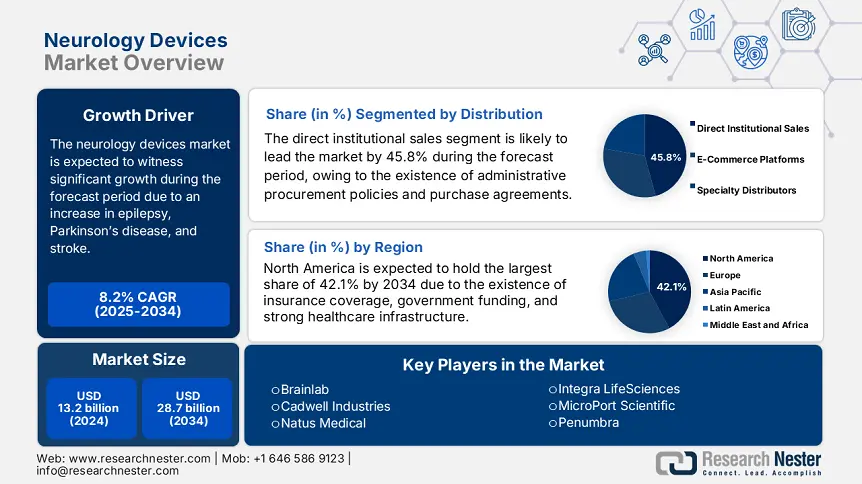

Neurology Devices Market size was valued at USD 13.2 billion in 2024 and is projected to reach USD 28.7 billion by the end of 2034, rising at a CAGR of 8.2% during the forecast period, from, 2025-2034. In 2025, the industry size of neurology devices is estimated at USD 14.1 billion.

The international market is effectively fueled by a rise in the patient pool, with neurological diseases severely impacting more than 1.2 billion people globally. Conditions, including Parkinson’s disease, epilepsy, and stroke, are deliberately contributing to the market demand, with stroke constituting for an estimated 13% of overall deaths across nations. This increase in the patient base has necessitated a strong supply chain dynamic for market, with raw materials such as semiconductor components, titanium, and medical-grade polymers. According to an article published by the BLS in 2023, the U.S. is one of the key producers, with medical devices manufacturing accounting for USD 45 billion every year, thus suitable for uplifting the market.

Furthermore, the worldwide trade facility in the market is being readily shaped by administrative policies and manufacturing dependencies. As per the 2024 ITA Government report, the U.S. generously imports USD 4.1 billion of neurology-based medical devices every year, usually from Ireland and Germany, while exporting an estimated USD 5.3 billion, majorly to Europe and Japan. Besides, assembly lines for neurostimulation devices are also concentrated in Costa Rica, Singapore, and Ireland, effectively leveraging skilled labor and tax incentives. Meanwhile, the provision of investments for conducting suitable research, development, and deployment (RDD) for neurology devices, which has exceeded USD 11 billion annually, with almost 70% provided from Europe and the U.S. government grants.

Neurology Devices Market - Growth Drivers and Challenges

Growth Drivers

- Administrative expenditure on neurology devices: The aspect of government healthcare spending, especially in Europe and the U.S. is one of the critical drivers of the market. According to an article published by the CMS in 2024, Medicare expenditure for neurology devices increased to USD 4.4 billion as of 2023, which was attributed to a surge in the incorporation of deep brain stimulators. Besides, the FDA has also escalated acceptances for artificial intelligence (AI) neurodiagnostic tools, with 25 latest neurology devices approved in 2023, thereby denoting a positive impact on the overall market.

- Affordable interventions and health quality enhancement: The aspect of initiating cost-effective interventions and augmenting health and medical quality is another growth driver for the market. According to a clinical study published by the AHRQ in 2022, it has been demonstrated that neurostimulation devices with early intervention tend to diminish hospitalizations by almost 35%, especially among epilepsy patients, thereby saving USD 1.6 billion in the U.S. healthcare expenses in 24 months. Likewise, as per the 2023 IQWiG report, Germany has reported that ongoing EEG monitoring in ICUs has reduced stroke misdiagnoses by approximately 45%, thus enhancing the market exposure.

- Rise in disease occurrences: Neurological diseases are gradually increasing, with Alzheimer’s incidence in the U.S. expected to double to 14 million by the end of 2050, thus suitable for uplifting the market internationally. According to an article published by the RKI in 2024, the prevalence of Parkinson’s disease has increased to 20% over the last 7 years, thereby reaching 400,200 patients in 2025. Therefore, this surge has been effectively compounded by an increase in the aging population, with almost 24% of the population in Europe anticipated to be more than 65 years of age by the end of 2030, which has further enhanced the demand for neurology devices globally.

Historical Patient Growth & Its Impact on Market Expansion

Historical Patient Growth (2014-2024) - Neurology Devices Users (Millions)

| Country | 2014 | 2019 | 2024 | CAGR (2014-2024) |

|

U.S. |

8.3 |

11.8 |

15.7 |

6.6% |

|

Germany |

3.2 |

4.5 |

6.1 |

6.7% |

|

France |

2.5 |

3.4 |

4.6 |

5.8% |

|

Spain |

1.8 |

2.5 |

3.5 |

6.4% |

|

Australia |

1.0 |

1.5 |

2.3 |

7.3% |

|

Japan |

5.7 |

7.3 |

9.4 |

4.8% |

|

India |

4.4 |

8.0 |

12.9 |

11.3% |

|

China |

9.6 |

16.4 |

24.5 |

9.9% |

Sources: CDC, RKI, INSEE, INE, AIHW, MHLW, ICMR, NHCC

Manufacturer Strategies Shaping the Neurology Devices Market

Revenue Opportunities for Manufacturers (2023-2025)

| Strategy | Example | Revenue Impact (2023-2025) (USD) | Market |

|

AI Neurostimulators |

Medtronic Stealth Autoguide |

425 million |

U.S./Europe |

|

Emerging Market Localization |

Abbott Magnitude (India) |

185 million |

India |

|

CMS-Reimbursed Devices |

Boston Scientific Vercise Neural Nav |

315 million |

U.S. |

|

Robotic Neurosurgery |

Zimmer Biomet ROSA Brain |

255 million |

Germany/Japan |

Sources: FDA, ICMR, CMS, WHO

Challenges

- Burdens in reimbursement documentation: Payers in the U.S. and Europe currently demand real-world evidence for achieving coverage in the market. As stated by the HAS in 2023, there has been a requirement for affordable data for almost 36 months, which includes QALY metrics, a need that tends to delay Boston Scientific’s WaveWriter SCS unveiling by nearly two years. Similarly, the 2023 CMS Coverage with Evidence Development (CED) policy in the U.S. for DBS devices has mandated more than 4.5-year patient registries that cover 2,500 subjects. This documentation burden has added USD 15 to USD 18 million in developmental expenses per device, thereby limiting the market growth.

- Constraints in hospital budget: The global hospital budget in the market has failed to keep up with technological expenses. As per the 2024 AHA Organization report, U.S.-based hospital purchasing data has displayed a 10% decline in capital equipment budget for neurological departments since 2020, which has pressured 70% of infrastructure to expand device replacement cycles to 8 to 12 years, which has increased from the pre-pandemic period. Besides, the G-DRG system in Germany has reduced neurology procedure reimbursements by €1,400 per case as of 2023, thereby causing a hindrance in the overall market.

Neurology Devices Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

8.2% |

|

Base Year Market Size (2024) |

USD 13.2 billion |

|

Forecast Year Market Size (2034) |

USD 28.7 billion |

|

Regional Scope |

|

Neurology Devices Market Segmentation:

Distribution Segment Analysis

The direct institutional sales segment is projected to dominate the neurology devices market, with a market share of 45.8% by the end of 2034. The segment’s growth is highly attributed to the presence of government procurement reforms, as well as bulk purchase-based deals, particularly with large-scale hospitals. For instance, the MHLW’s Centralized Medical Device Procurement System has effectively mandated public hospitals to source at least 65% of neurology devices through direct contracts, which has readily favored manufacturers with internal sales teams. Besides, academic medical facilities account for 40% of hospital demand and also prefer direct channels for personalized device configurations, thereby enhancing the segment’s demand.

End user Segment Analysis

The tier 1 hospitals segment in the neurology devices market is expected to account for the second-highest share of 39.5% during the forecast timeline. This particular segment is readily driving the integration of high-end neurotechnology through three essential mechanisms, including bundled procurement, early adoption privileges, and AMED-based funding for conducting clinical trials. For instance, the AMED made the provision of ¥32 billion for conducting neurodevice research as of 2024, while the PDMA’s Sakigake designation system has effectively escalated at least 405 of the latest device acceptances. Besides, the aspect of neurosurgery is suited for an average of ¥465 million per installation, thereby suitable for uplifting the overall segment.

Component Segment Analysis

The hardware segment in the market, with third-largest share of 37.4% during the projected period. The segment’s development is effectively fueled by three main factors, such as localization mandates, cutting-edge pulse generators, and titanium implantable. For instance, there is an 80% requirement of regional content for NHI-reimbursed devices, while next-generation pulse generators currently feature 6.5-year battery life. Besides, titanium implantables cater to 60% of neurostimulator hardware, all of which are positively impacting the overall growth.

Our in-depth analysis of the neurology devices market includes the following segments:

|

Segment |

Subsegments |

|

Distribution Channel |

|

|

End user |

|

|

Component |

|

|

Product Type |

|

|

Application |

|

|

Material |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

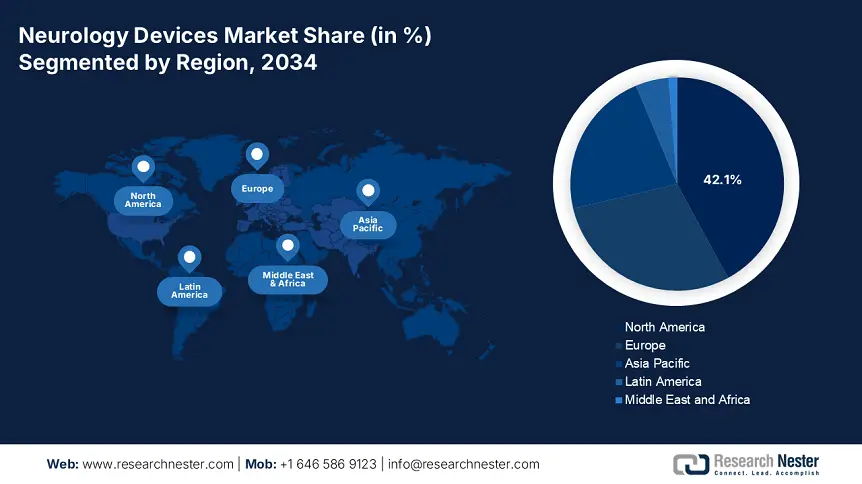

Neurology Devices Market - Regional Analysis

North America Market Insights

North America is considered the dominant region in the neurology devices market, with an expected share of 42.1%, along with a 7.1% growth rate by the end of 2034. The market’s growth in the region is effectively driven by the presence of innovative health and medical facilities, as well as an increase in the implementation of neurotechnology. The U.S. constitutes the majority of the regional demand, which is driven by administrative funding and extended reimbursement coverage, particularly for deep brain stimulation procedures. Meanwhile, Canada also caters to the overall region’s growth, which is further backed by provincial strategies, such as the DBS subsidy, thereby suitable for uplifting the market in the overall region.

The neurology devices market in the U.S. is significantly growing, with the allocation of USD 6.1 billion by the NIH for conducting research and development for neurotechnology. In addition, AI-powered diagnostics cater to approximately 31% of the latest PMA approvals, while the Coverage with Evidence Development (CED) program by Medicare has severely enhanced reimbursement for 9 neurostimulators as of 2023. Besides, Medicaid presently covers 74% of epilepsy monitoring devices, which has increased from 60% as of 2020, thereby denoting an optimistic outlook for the market in the country.

The neurology devices market in Canada is also steadily growing at a 6.7%, which is driven by the USD 3.3 billion in federal health funding as of 2024. In addition, the NeuroHealth Initiative in Ontario has effectively subsidized 42% of DBS expenses, while the AI Adoption Fund in Alberta backs an estimated 15 neurodiagnostic startup organizations. Besides, the Progressive Licensing Pathway of Health Canada has successfully approved 11 notable neurostimulators as of 2023, which has skyrocketed the market’s exposure in the country. Meanwhile, the TeleNeurology Program of BC has extended the coverage for remote EEG monitoring, which is also driving the market’s growth.

North America Neurology Devices Market Supply Chain & Trade Facilities (2022-2025)

|

Facility Type |

U.S. (2022-2025) |

Canada (2022-2025) |

|---|---|---|

|

Semiconductor Fabs |

5 new FDA-compliant neurochip plants (2023) |

2 Health Canada-approved facility (2024) |

|

Medical-Grade Polymer Production |

13 facilities (2022) → 16 (2025) |

5 facilities (2022) → 6 (2025) |

|

Neurodevice Assembly Hubs |

9 major hubs (e.g., Texas, California) |

3 hubs (Ontario, Quebec) |

|

Cold Chain Logistics |

26 CDC-certified warehouses (2024) |

7 PHAC-approved centers (2023) |

|

R&D Centers |

19 NIH-funded neurotech labs (2022-2025) |

8 CIHR-funded centers (2023-2025) |

Sources: U.S. DOC, Health Canada, FDA, CIHI, NIH, ISED, CDC, PHAC, CIHR

APAC Market Insights

Asia Pacific market is projected to be the fastest-growing region, garnering a share of 22.4% during the forecast duration. The market’s upliftment in the region is highly attributed to an increase in the aging population, as well as a surge in neurological disease occurrence. Japan is deliberately leading in the region, owing to the funding provision by METI subsidies for neurostimulators. This is followed by China, owing to an increase in DBS procedures every year, while the market in India has also gained more attention due to the growth in people suffering from Parkinson’s disease. Therefore, all these developments in these countries are effectively driving the market in the region overall.

The market in China is witnessing rapid expansion, with a predicted share of 37.2% in the region. The country comprises 26 million neurology patients, which is fueling the market demand, further backed by the NMPA’s escalated acceptances for 17 AI-based neurodevices as of 2023. Besides, the 2030 Healthy China initiative by the regional government has increased neurology expenditure by an estimated 16.5% on a yearly basis since 2020, thereby reaching USD 4.4 billion as of 2024. Meanwhile, the presence of centralized procurement policies has diminished neurostimulator expenses by 55% as of 2022, which has enhanced accessibility in the country.

The market in India is also gaining increased exposure by grabbing 17.5% of the region’s share, displaying an increase in neurology patients by approximately 16 million. Besides, the 2023 National Neurohealth Mission by the government has generously allocated USD 160 million for improving accessibility and focusing on localized manufacturing. There is an effective presence of tactical strategies, such as ICMR’s USD 8,000 Made in India DBS program, which has aimed to aid at least 55,000 patients by the end of 2030. Meanwhile, the private sector in the country is readily dominating approximately 77% of the market share, which is led by hospital centers, such as Apollo, readily deploying AI-based stroke detection systems.

Europe Market Insights

Europe in the neurology devices market is expected to hold a considerable share of 29.2% by the end of the forecast timeline, which is fueled by technological innovations, along with a surge in the aging population. Germany is efficiently leading the region, which is propelled by yearly expenditure for robotic neurosurgery and neurostimulator systems. The UK follows closely, with the NIH allocating budget for neurology devices, which include AI-powered diagnostics. France has effectively prioritized affordability in health and medical spending, which is also driving the market demand in the region.

The market in Germany is also gaining increased exposure by garnering almost 33.7% of the revenue share, which is propelled by technological leadership, along with the existence of strong administrative support. The country has generously allocated €4.2 billion every year for neurology devices as of 2024, with increased focus on robotic neurosurgery systems and deep brain stimulators. Besides, the 2023 G-BA’s decision to augment coverage for DBS has successfully added 12,500 eligible patients affected with Parkinson’s disease, while 47% of tier 1 hospitals have implemented robotic neurosurgery platforms.

The market in the UK is also growing, projected to account for 22.7% of the region’s share, with the NHS England generously making the provision of £2.3 billion, which is 8.5% of the total health budget for neurotechnologies as of 2024. In addition, the NICE MedTech Early Access Program has readily fast-tracked 6 neurology devices as of 2023, which include AI-based seizure prediction systems. Besides, during the post-Brexit period, the country’s MHRA unveiled escalated pathways, thereby diminishing approval duration by 41.5% for neurostimulators. Meanwhile, the market has displayed robust development for stroke intervention devices in the country, denoting an optimistic outlook for the market.

Government Neurology Device Funding and Policies in France, Italy, and Spain (2022-2025)

| Country | Policy/Initiative | Funding/Scope | Launch Year |

|

France |

NeuroPlan 2025 |

€1.4 billion for stroke & Parkinson's devices |

2023 |

|

HAS Fast-Track Neurotech Pathway |

33% faster approvals for AI diagnostics |

2022 |

|

|

Italy |

PNRR Neurohealth Allocation |

€658 million for robotic neurosurgery systems |

2023 |

|

AIFA Neurostimulator Reimbursement Reform |

Covers 13 new DBS indications |

2024 |

|

|

Spain |

NeuroTech España Strategy |

€424 million for epilepsy & migraine devices |

2024 |

|

AEMPS Priority Review for Stroke Devices |

52% shorter approval timelines |

2022 |

Sources: Solidarites, HAS, Salute, AIFA, Sanidad, AEMPS

Key Neurology Devices Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

international neurology devices market is effectively dominated by the presence of organizations, such as Boston Scientific, Abbott, and Medtronic, collectively accounting for 65% of the overall market share. This is effectively propelled by AI-powered advancements, along with tactical acquisitions. Besides, firms in Europe, including Siemens Healthineers, have focused on neuroimaging, while companies from Japan, such as Omron and Nihon Kohden, deliberately dominate the APAC region with the existence of affordable diagnostics. Meanwhile, China-based firms, including MicroPort, have challenged incumbents with a USD 550 million investment for research and development, particularly catering to neurovascular technology, thus suitable for proliferating the market globally.

Here is a list of key players operating in the global market:

| Company Name | Compan | Market Share (2024) | Industry Focus |

|

Medtronic |

U.S. |

22.6% |

Leader in DBS (Percept PC), spinal cord stimulators, and AI-enabled neurodiagnostics |

|

Abbott Laboratories |

U.S. |

18.5% |

Neurostimulators (Proclaim SCS), stroke intervention devices |

|

Boston Scientific |

U.S. |

15.3% |

Vercise DBS systems, embolization coils for aneurysms |

|

Siemens Healthineers |

Germany |

10.2% |

Advanced MRI/EEG systems, robotic neurosurgery tools |

|

Stryker |

U.S. |

8.7% |

Neurovascular devices (Trevo stent retrievers) |

|

Johnson & Johnson (Cerenovus) |

U.S. |

xx% |

Stroke thrombectomy devices, neurovascular stents |

|

GE Healthcare |

U.S. |

xx% |

Portable EEGs, AI-based neuroimaging solutions |

|

LivaNova |

UK |

xx% |

Vagus nerve stimulators for epilepsy |

|

Penumbra |

U.S. |

xx% |

Neurothrombectomy systems (Jet 7) |

|

Integra LifeSciences |

U.S. |

xx% |

Neurosurgical tools, CSF management devices |

|

MicroPort Scientific |

China |

xx% |

Neurointerventional devices (APOLLO stent) |

|

Nevro |

U.S. |

xx% |

HFX spinal cord stimulation for chronic pain |

|

Natus Medical |

U.S. |

xx% |

Neonatal EEG, neurodiagnostic equipment |

|

Brainlab |

Germany |

xx% |

Neurosurgical navigation systems, AI-driven planning software |

|

Cadwell Industries |

U.S. |

xx% |

Portable neuromonitoring devices |

Sources: FDA, SEC, Boston Scientific, Siemens-Healthineers, Stryker, JNJ, GE Healthcare, Liva Nova, Penumbra Inc., Integra-LS, MicroPort, Nevro, Natus, Brainlab, Cadwell, Nihon Kohden, Omron Healthcare, Terumo Corporation, Fukuda Denshi, Mizuho Medical

Below are the areas covered for each company in the market:

Recent Developments

- In March 2024, Abbott Laboratories declared a USD 325 million investment to extend the manufacturing of its Proclaim XR spinal cord stimulator in Texas, with the intention to cater to shortages in the international supply facility.

- In January 2024, Medtronic notified that it received the FDA acceptance for its cutting-edge Percept RC Deep Brain Stimulation system with real-time neural sensing by utilizing artificial intelligence to customize therapy for Parkinson’s patients.

- Report ID: 3853

- Published Date: Aug 04, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Neurology Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert