Multiomics Market Outlook:

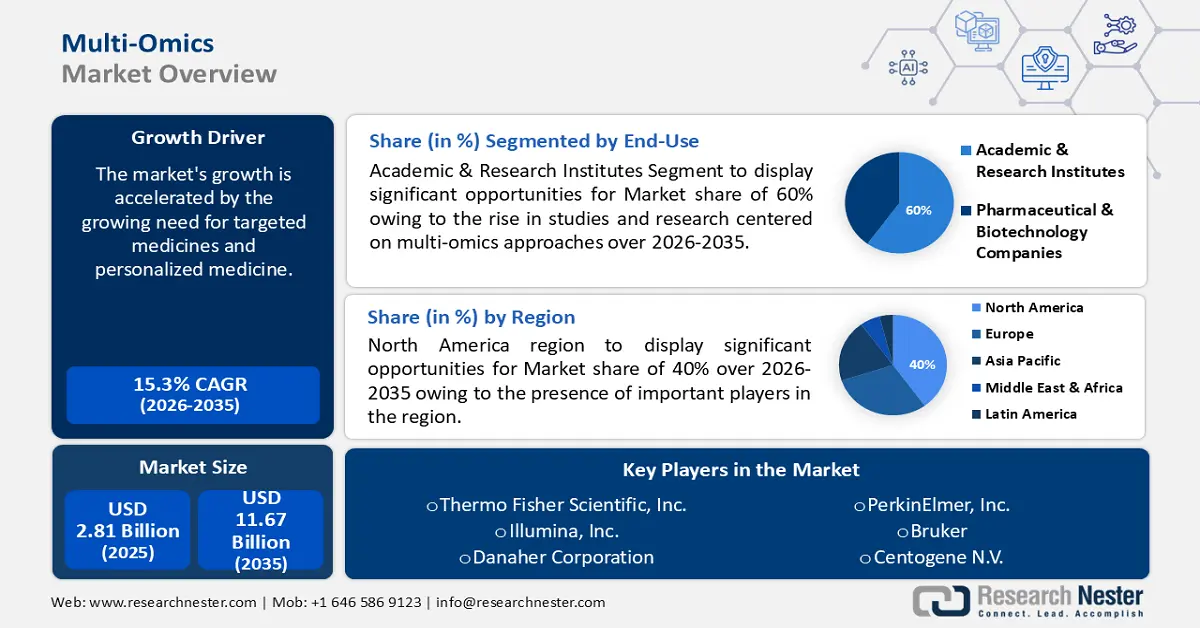

Multiomics Market size was valued at USD 2.81 billion in 2025 and is expected to reach USD 11.67 billion by 2035, expanding at around 15.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of multiomics is evaluated at USD 3.2 billion.

The multiomics market's growth is accelerated by the growing need for targeted medicines and personalized medicine. Together, all of the previously listed elements support the market's growth. The predicted response for genome-targeted therapy by European Society for Medical Oncology was 2.73% in 2006, rose to 5.48% by the end of 2018, and has now risen to 7.04% in 2020. The anticipated response for genome-informed therapy was 3.33% in 2006, 7.68% in 2018, and 11.10% in 2020.

Key Multiomics Market Insights Summary:

Regional Highlights:

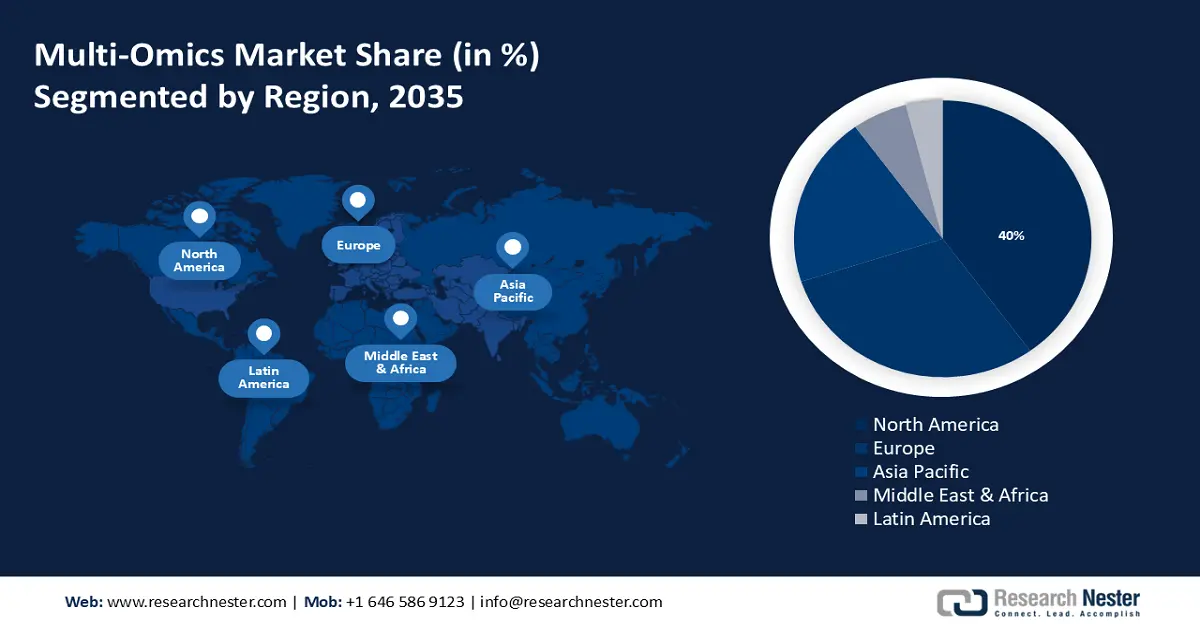

- North America multiomics market will hold more than 40% share by 2035, attributed to the presence of important players and increased business efforts to expand visibility in the market.

Segment Insights:

- The academic & research institutes segment in the multiomics market is expected to capture a significant share by 2035, driven by rising research and funding focused on multiomics approaches.

- The oncology segment in the multiomics market is expected to exhibit exponential growth till 2035, influenced by increasing cancer prevalence and expanding multiomics applications in oncology.

Key Growth Trends:

- Artificial intelligence and cloud computing's emergence in multiomics data analysis

- Potential of multiomics in the creation of biomarkers for illness diagnosis

Major Challenges:

- Exorbitant setup and infrastructure expenses for multiomics platforms

- Obstacles posed by regulations to multiomics adoption

Key Players: Thermo Fisher Scientific, Inc., Illumina, Inc., Danaher Corporation, PerkinElmer, Inc., Bruker, Centogene N.V., Element Biosciences, QIAGEN, Agilent Technologies, Inc.

Global Multiomics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.81 billion

- 2026 Market Size: USD 3.2 billion

- Projected Market Size: USD 11.67 billion by 2035

- Growth Forecasts: 15.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, Singapore, Brazil

Last updated on : 17 September, 2025

Multiomics Market Growth Drivers and Challenges:

Growth Drivers

- Artificial intelligence and cloud computing's emergence in multiomics data analysis - The field of life sciences is witnessing a significant opportunity for multiomics data analysis due to the rise of cloud computing and artificial intelligence. Large and sophisticated multiomics datasets have been created in unprecedented quantities as a result of advances in DNA sequencing technologies and other omics methods.

For laboratories and researchers, evaluating these enormous volumes of heterogeneous biological data with conventional on-premise computing techniques is difficult and time-consuming. Large scalable computing resources that are simple to deploy on demand are provided via cloud computing. Without needing to make significant upfront financial investments in their own IT equipment, researchers can easily analyze petabytes of multiomics datasets by utilizing elastic cloud infrastructures.

- Potential of multiomics in the creation of biomarkers for illness diagnosis - The application of multiomics in the creation of biomarkers for disease diagnosis offers the multiomics market a lot of potential. Integrating multiomics techniques such as transcriptomics, proteomics, metabolomics, genomes, and epigenomics offers a more thorough understanding of biological systems and disease pathways.

The development of biomarkers utilizing multiomics may make it possible to diagnose illnesses accurately and early. Since most diseases are now discovered late in life, with few alternatives for treatment, there is a significant clinical need that is currently unmet. Multiomics research offers insights that are not achievable with individual omics techniques alone by merging several forms of omics data.

As a result, unique biomarker signatures made up of protein, genetic, and metabolic components are found. For instance, a 2021 study that combined information from over 28,000 patient samples with 11 different cancer kinds found indicators based on molecular subtypes that might be used to tailor cancer treatment.

- Accurate Farming and Safety of Food - Multiomics technologies have a lot to offer the agricultural sector in terms of improving crop yield, sustainability, and food security. Researchers can learn more about plant genetics, metabolism, and environmental responses by combining genomics, metabolomics, and other omics techniques. This knowledge can be used to design robust crop varieties that have higher yields, better nutritional quality, and more stress tolerance.

Targeted breeding, precision fertilization, and crop management techniques that are adapted to particular environmental conditions and agronomic requirements are examples of precision agriculture practices made possible by the identification of biomarkers for disease resistance, nutrient uptake, and crop performance made easier by multiomics analysis. About 80% of the total emissions that cause CC, 88% of the FPMF impact, 55% of the FET impact, 44% of the HTnC impact, 96% of the FE impact, 93% of ME, and 96% of the TA impact are produced during the fertilization process.

Challenges

- Exorbitant setup and infrastructure expenses for multiomics platforms - The multiomics market's potential for expansion is constrained by the costly infrastructure and setup costs of these platforms, which provide a major obstacle to the systems' wider adoption. Large sums of money must be spent in order to establish a multiomics center and buy the several pricey tools required to carry out multiomics analyses.

These could include mass spectrometers, flow cytometers, microarrays, next-generation sequencing systems, and other specialized tools. The entire cost to build a multiomics lab can reach millions of dollars when factoring in other costs including laboratory space, data storage systems, qualified staff, and maintenance contracts.

- Obstacles posed by regulations to multiomics adoption - The use of multiomics technology is hampered by regulations, which is making it difficult for the multiomics market to expand. Integrating vast volumes of disparate "omics" data, such as proteomics, metabolomics, and genomes, is known as multiomics. It is still early in the process of creating solid analytical frameworks and validation procedures for the meaningful interpretation of such large and complicated datasets.

Multiomics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

15.3% |

|

Base Year Market Size (2025) |

USD 2.81 billion |

|

Forecast Year Market Size (2035) |

USD 11.67 billion |

|

Regional Scope |

|

Multiomics Market Segmentation:

End-Use (Academic & Research Institutes, Pharmaceutical & Biotechnology Companies)

By 2035, academic & research institutes segment is estimated to capture over 60% multiomics market share. Over the projected time, it is expected that a rise in studies and research centered on multiomics approaches such as transcriptomics, proteomics, metabolomics, and genomics will propel the segment's expansion. Additionally, funds and investments are being provided to this segment in order to carry out research in this area.

For example, the Multiomics for Health and Disease Consortium was founded in September 2023 by the National Institutes of Health, which also funded USD 50.3 million for multiomics research. Professionals from a number of universities, including Washington University, Columbia University, and the University of California, are part of this consortium.

Application (Cell Biology, Oncology, Neurology, Immunology)

Through 2035, oncology segment in the multiomics market is anticipated to grow at exponential CAGR. Growth in this market is expected to be driven by the increasing prevalence of cancer and the expanding application of multiomics for cancer. Numerous initiatives are being made by businesses and researchers to use multiomics techniques to aid cancer sufferers. For example, the biotech startup Freenome initiated the Sanderson Study in September 2022, utilizing real-world data and its multiomics platform to detect certain malignancies. Segment growth is further supported by strategic expenditures made by major players in cancer research.

Product & Service (Products {Instruments, Consumables, Software}, Services)

In multiomics market, products segment is poised to grow substantially till 2035. The increasing number of product launches and the spike in developments are expected to fuel the segment's expansion. Businesses are collaborating to innovate and develop new tools and platforms for multiomic research and analysis. For example, Bio-Techne and Lunaphore announced in April 2023 that they would be working together to build a fully automated spatial multiomics solution.

Over the course of the projection period, these developments are anticipated to support the segment's growth in multiomics market. Furthermore, the creation of more effective, user-friendly goods as a result of technical improvements has improved accessibility for researchers.

Our in-depth analysis of the multiomics market includes the following segments:

|

Product & Service |

|

|

Type |

|

|

Platform |

|

|

Application |

|

|

End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Multiomics Market Regional Analysis:

North America Market Statistics

North America industry is likely to hold largest revenue share of 40% by 2035. Its greatest revenue share is supported by the presence of important players in the area. Additionally, businesses are making attempts to increase their visibility, which is fostering the expansion of the regional multiomics market.

For example, in February 2023, Actuate Therapeutics and the U.S.-based company Tempus worked together to identify and further validate biomarker profiles in cancer patients. In this initiative, Tempus is utilizing the multiomics technique to enhance research and increase new scientific understandings.

The U.S. multiomics market is quite competitive because of the rising need for thorough biological insights driven by omics technology developments. Active R&D initiatives in academia and business, where organizations compete for funds and ground-breaking discoveries, heighten this competitiveness. For example, the University of Southern California (USC) Keck School of Medicine was awarded a major 5-year research grant from the National Institutes of Health (NIH) in 2023, totaling USD 50.3 million.

European Market Analysis

The Europe region will also encounter huge growth for the multiomics market witduring the forecast period. The expanding use of cutting-edge technologies in proteomics, metabolomics, and genomics is fueling Europe's market's strong growth. The proteomics industry in Europe was valued at USD 5,356 million in the base year.

Through supporting programs like Genome UK and the NHS Genomic Medicine Service, the United Kingdom government has demonstrated its commitment to advancing research in genomics and multiomics. To launch the Genome Research Experiences, the National Human Genome Research Institute (NHGRI) awarded around USD 3.35 million over a five-year period in September 2022.

Due to several government efforts that are encouraging the implementation of NGS technologies in the nation, the multiomics market in France is anticipated to increase in the near future. Targeted NGS has been supported by the French National Cancer Institute (INCa) as a standard therapeutic practice since 2013. Furthermore, the 2025 France genetic Medicine Initiative was a national plan put into action by France to guarantee that all patients have sufficient access to genetic medicine.

Germany's multiomics market is expanding significantly due to the active involvement of government financing for research initiatives, biotech and pharmaceutical businesses, and prestigious university institutions. In 2021, the European Molecular Biology Laboratory (EMBL) in Germany organized a number of seminars and workshops with the main objective of integrating and analyzing multiomics data.

Multiomics Market Players:

- Becton, Dickinson and Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Thermo Fisher Scientific, Inc.

- Illumina, Inc.

- Danaher Corporation

- PerkinElmer, Inc.

- Bruker

- Centogene N.V.

- Element Biosciences

- QIAGEN

- Agilent Technologies, Inc.

Important companies apply for product approvals in order to expand as a means of improving production and development efforts as well as to broaden the product's appeal and availability in a variety of geographic locations. Furthermore, a number of businesses are purchasing smaller competitors in an effort to improve their market share.

Recent Developments

- Element Biosciences, Inc., innovative scientific technology supplier announced a collaboration with Precision Health Data Cloud leader DNAnexus. Customers can now easily transfer data from Element's AVITITM System to their DNAnexus accounts thanks to this partnership. Customers can leverage a powerful combination of capabilities by combining the outstanding performance of AVITI sequencing with the safe and extensive multi-omic analysis platform offered by DNAnexus.

- Centogene N.V. has announced the addition of cutting-edge transcriptome analysis to its MOx diagnostic portfolio. This single-step multi-omic system, called MOx 2.0, combines biochemical testing, DNA sequencing, and recently introduced RNA sequencing to provide healthcare practitioners with an unmatched depth of diagnostic capabilities.

- Report ID: 6091

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Multiomics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.