Monoethylene Glycol Market Outlook:

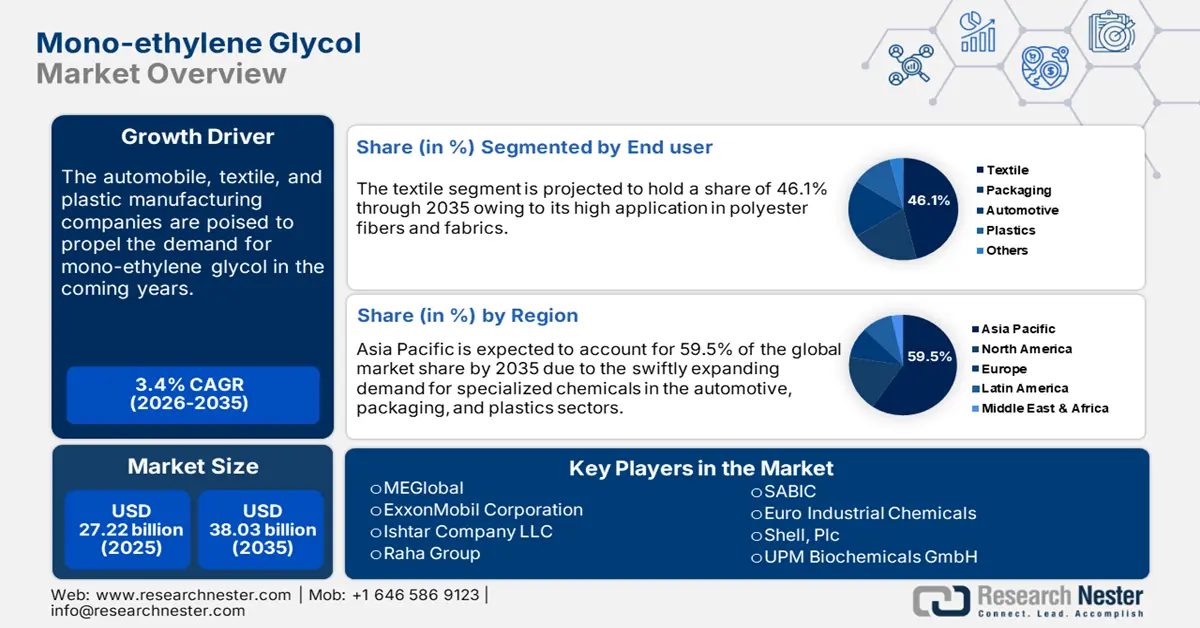

Monoethylene Glycol Market size was valued at USD 27.22 billion in 2025 and is set to exceed USD 38.03 billion by 2035, expanding at over 3.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of monoethylene glycol is estimated at USD 28.05 billion.

Monoethylene glycol (MEG) being derived from non-renewable fuels is finding wide applications in several end use industries such as automotive, packaging, textiles, and more. The dependency of end users on monoethylene glycol is contributing to its growing consumption. Monoethylene glycol’s increasing use in antifreeze and coolants for automobile and industrial applications is poised to drive the overall trade activities in the coming years. The expansion of automotive and heavy machinery manufacturing across the world is set to propel the consumption of monoethylene glycol. The booming electric vehicle trend and increasing integration of automation and robotics are also propelling the consumption of monoethylene glycol.

The 3D printing trend is driving high investments in the industrial machinery manufacturing market. Caterpillar, Inc., Volvo Group, and John Deere are leading the heavy equipment machinery production and sales. This highlights that the expanding commercialization of heavy commercialization is set to uplift the sales of monoethylene glycol during the foreseeable period. The International Council on Clean Transportation (ICCT), stated that in the early phase of 2024, the EV sales surpassed 7 million units, out of which nearly 17.0% were new light-duty vehicles. The market is dominated by China, Europe, the U.S., and India, collectively accounting for 86.0% of EV sales and around 68% of LDV sales. The swift EV sales are also creating a profitable environment for monoethylene glycol producers.

Key Monoethylene Glycol Market Insights Summary:

Regional Highlights:

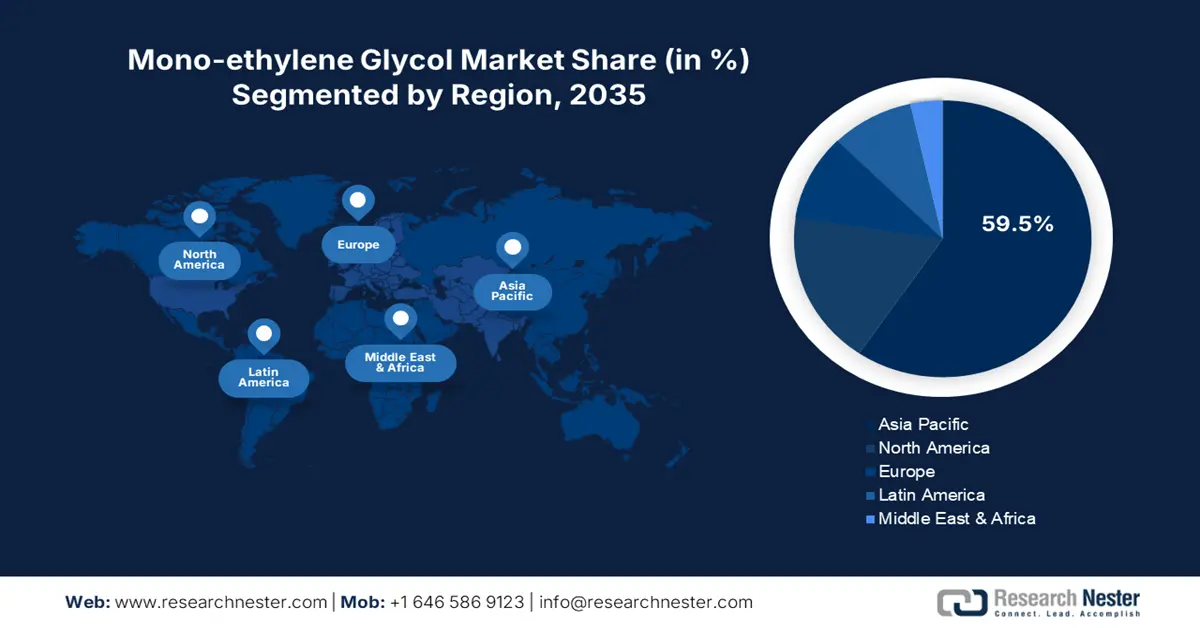

- Asia Pacific monoethylene glycol market will dominate more than 59.50% share by 2035, driven by a swiftly expanding chemical sector and FDI inflows.

Segment Insights:

- The textile segment in the monoethylene glycol market is expected to achieve a 46.10% share by 2035, driven by the growing demand for polyester fibers in the textile sector.

- The pet segment in the monoethylene glycol market is forecasted to achieve the largest share by 2035, driven by the increasing popularity of PET bottles and containers.

Key Growth Trends:

- Food and beverage sector’s increasing demand for MEG packaging materials

- Growing use in pharma and cosmetic solutions

Major Challenges:

- Strict environmental regulations barrier to sales

Key Players: SABIC, The Dow Chemical Company, Royal Dutch Shell PLC, Reliance Industries Limited, Mitsubishi Chemical Corporation, Lotte Chemical Corporation, LyondellBasell Industries N.V., ExxonMobil Corporation, Sinopec, INEOS Group.

Global Monoethylene Glycol Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 27.22 billion

- 2026 Market Size: USD 28.05 billion

- Projected Market Size: USD 38.03 billion by 2035

- Growth Forecasts: 3.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (59.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Saudi Arabia, India, Germany

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 10 September, 2025

Monoethylene Glycol Market Growth Drivers and Challenges:

Growth Drivers

- Food and beverage sector’s increasing demand for MEG packaging materials: Monoethylene glycol is finding wide applications in packaging materials, particularly bottles, and containers. The increasing demand for innovative materials in the food and beverage sector is anticipated to boost the consumption of monoethylene glycol. The growth in the food service market and the rising popularity of online food ordering applications are likely to propel the sales of monoethylene glycol-based bottles and containers in the coming years.

- Growing use in pharma and cosmetic solutions: MEG being a carrier of active ingredients and moisture retainer is exhibiting increasing demand in pharmaceuticals and cosmetic product manufacturing, respectively. The fueling demand for cosmetics, personal care products, and pharmaceuticals in both developing and developed countries is expected to generate high-earning opportunities for monoethylene glycol manufacturers. For instance, the International Federation of Pharmaceutical Manufacturers & Associations (IFPMA) states that the biopharmaceutical market offers employment to over 5.5 million people, globally. The global pharmaceutical market is poised to cross USD 1.2 trillion in 2025. The Research Nester report states that the global beauty and personal care market is likely to surpass USD 1.5 trillion by 2035.

Challenges

- Price and demand create challenges at times: The pricing of monoethylene glycol depending on their adequacy and scarcity potentially influences the overall trade activities. Higher volumes of MEG lead to low profitability owing to the low selling prices and on the other hand, loud prices limit sales. For instance, Shell, Plc one of the leading market players states that the current presence of huge volumes of monoethylene glycols is leading to a downturn in prices relative to demand. This challenges the ethylene oxide, ethylene glycol, and monoethylene glycol manufacturers’ revenue growth.

- Strict environmental regulations barrier to sales: The monoethylene glycol is produced from fossil fuel feedstocks such as natural gas, petroleum, and naphtha, which has a negative influence on the environment. The strict implementation of emission and disposal regulations is expected to affect the production of monoethylene glycol to some extent. Furthermore, the governments’ increasing focus on climatic commitments is driving a high demand for bio-based alternatives, challenging the sales of monoethylene glycol.

Monoethylene Glycol Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.4% |

|

Base Year Market Size (2025) |

USD 27.22 billion |

|

Forecast Year Market Size (2035) |

USD 38.03 billion |

|

Regional Scope |

|

Monoethylene Glycol Market Segmentation:

End user Segment Analysis

The textile segment is predicted to capture over 46.1% monoethylene glycol market share by 2035. The consistent demand for advanced and innovative materials in textile and apparel manufacturing is augmenting the sales of monoethylene glycol. The boasting demand for polyester fibers and fabrics is propelling the application of monoethylene glycol in apparel production. The growth in the textile industry directly influences monoethylene glycol consumption.

Application Segment Analysis

PET is the most dominating segment in the monoethylene glycol market owing to its high demand across various end use industries. Monoethylene glycol’s increasing use in PET product manufacturing is positively backing the overall market growth. PET bottles and containers are widely being used at commercial as well as consumer scales. In the food and beverage sector, PET products are majorly used for safe and leak-free transportation. To store food grains or other related items, many consumers are using PET products. Thus, the increasing popularity of PET bottles and containers is foreseen to uplift the sales of monoethylene glycol in the years ahead.

Our in-depth analysis of the global monoethylene glycol market includes the following segments:

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Monoethylene Glycol Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific monoethylene glycol market is anticipated to account for revenue share of around 59.5% by 2035. The swiftly expanding chemical sector is expected to create a lucrative environment for monoethylene glycol manufacturers. The increasing foreign direct investments, supportive government policies, and strong presence of end use industries are set to propel the sales of monoethylene glycol in the coming years. China, India, South Korea, and Japan hold dominating shares in the Asia Pacific monoethylene glycol market.

China being the robust producer of plastics is likely to positively fuel the sales of monoethylene glycol. The expanding production and commercialization of plastic products including PET are further propelling the consumption of monoethylene glycol. Research Nester’s study estimates that China’s production of plastic products was evaluated at 7.66 million metric tons in December 2024. Ongoing innovations and an increasing need for specialized materials are poised to propel the overall monoethylene glycol market growth in the years ahead.

India is the fastest-expanding market for electric vehicles owing to supportive government policies and emission regulations. Monoethylene glycol is finding extensive application in automotive coolants. The rise in EV registrations is estimated to propel the sales of monoethylene glycol in the coming years. For instance, the India Brand Equity Foundation (IBEF) study reveals that by 2030, the country is foreseen to become the largest EV market, increasing at a CAGR of 23.4%. The country’s electric vehicle sales rose by 20.8% to 1.3 million units in May 2024.

North America Market Insights

The North America monoethylene glycol market is estimated to rise at a robust pace by 2035. The fueling production of automobiles as heavy machinery is augmenting the consumption of monoethylene glycol in coolants and antifreeze solutions. The development in the food service sector is also amplifying the sales of monoethylene glycol in the region. The U.S. and Canada’s fueling construction activities are also driving the sales of monoethylene glycol. The booming need for specialized chemicals and materials is poised to uplift the revenues of monoethylene glycol producers in the years ahead.

The U.S. expanding industrial and construction activities focused on the use of heavy machinery are set to fuel the use of monoethylene glycol in coolant and antifreeze applications. For instance, in January 2025, the Federal Reserve Bank of St. Louis estimated that the producer price index of construction machinery manufacturing stood at 349.088. Furthermore, the U.S. Census Bureau states that over 1,483,000 residential buildings were permitted and 1,651,000 housing were completed in January 2025.

Canada’s increasing registrations of electric vehicles are driving the overall monoethylene glycol market growth. The report by Statistique Canada reveals that the number of zero-emission vehicles increased from 52,685 in the fourth quarter of 2023 to 75,363 in the third quarter of 2024. The strict emission regulations are fueling the sales of electric vehicles and subsequently the applications of monoethylene glycol in coolants and antifreeze. Furthermore, similar to the U.S., the increasing construction activities are further set to propel the consumption of monoethylene glycol in the country.

Monoethylene Glycol Market Players:

- MEGlobal

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ExxonMobil Corporation

- Ishtar Company LLC

- Raha Group

- India Glycols Ltd.

- Kimia Pars Co.

- LyondellBasell N.V.

- Arham Petrochem Pvt. Ltd.

- Indian Oil Corporation Ltd.

- Pon Pure Chemicals Group

- Acuro Organics Ltd.

- SABIC

- Euro Industrial Chemicals

- Shell, Plc

- UPM Biochemicals GmbH

- THe DOW Chemcials

- Lotte Chemical Corporation

- Huntsman International LLC

- BASF SE

The global monoethylene glycol market is characterized by the presence of existing players and the increasing emergence of start-ups. The leading companies are employing several organic and inorganic marketing strategies to maintain their position in the global landscape and earn high returns. Continuous technological innovations are anticipated to maintain the market dominance of the company. The strategic collaborations and partnerships to expand their operations or to introduce new products are uplifting the revenue shares of key market players. Mergers & acquisitions and global expansions are further aiding the monoethylene glycol companies to maximize their reach.

Some of the key players include in monoethylene glycol market:

Recent Developments

- In February 2025, MEGlobal announced its Asian Contract Price (ACP) for monoethylene glycol (MEG) is set to be USD 850/MT CFR Asian main ports for arrival in March 2025. This ACP reflects a short-term supply/demand situation in the Asia market.

- In January 2022, ExxonMobil Corporation and SABIC entered into a strategic agreement for a start-up Gulf Coast Growth Ventures a material manufacturing facility in San Patricio County, Texas. This unit produces an ethane steam cracker, two polyethylene, and monoethylene glycol used in agricultural film, packaging, clothing, construction materials, and automotive coolants.

- Report ID: 4650

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Monoethylene Glycol Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.