Microreactor Technology Market Outlook:

Microreactor Technology Market size was valued at USD 169.58 billion in 2025 and is expected to reach USD 982.06 billion by 2035, expanding at around 19.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of microreactor technology is evaluated at USD 198.88 billion.

The microreactor technology market is emerging with supportive investments by regional governments to address critical energy demand while promoting sustainability and innovation. By funding research, manufacturing, and pilot projects, governments are boosting the commercialization of this technology for applications such as remote energy generation, military operations, and industrial processes.

In the UK, the government established the Advanced Nuclear Fund, which will spend up to USD 398.1 million on the next generation of nuclear technologies, in its Ten Point Plan. This comprises up to USD 175.8 million for a research and development program to create an Advanced Modular Reactor (AMR) demonstration by the early 2030s, and up to USD 222.3 million for Small Modular Reactors (SMRs) to develop a homegrown smaller-scale power plant technology design. Similarly, Canada’s Saskatchewan Research Council (SRC) received USD 80 million from the Government of Saskatchewan to demonstrate a unique eVinciTM microreactor in the province.

The International Energy Agency (IEA) reported that in France, the government invested USD 1.03 billion in research and development initiatives to develop local SMR technology as part of the France 2030 national investment strategy, to provide low-carbon heat for industrial use, thus reducing reliance on gas. Meanwhile, in the U.S., to enable the first domestic deployment of Generation III+ (Gen III+) SMR technology, the U.S. Department of Energy (DOE) is accepting submissions for up to USD 900 million in funding. Also, the Invest Korea Organization published that in South Korea, to address the increasing demand for safe and reasonably priced power generation for carbon neutrality and energy security, the government plans to invest USD 320 million over the next six years to construct a next-generation SMR), an advanced nuclear power generator. These investments highlight the crucial role of government support in advancing microreactor technologies, driving innovation, and ensuring a sustainable energy future.

Key Microreactor Technology Market Insights Summary:

Regional Highlights:

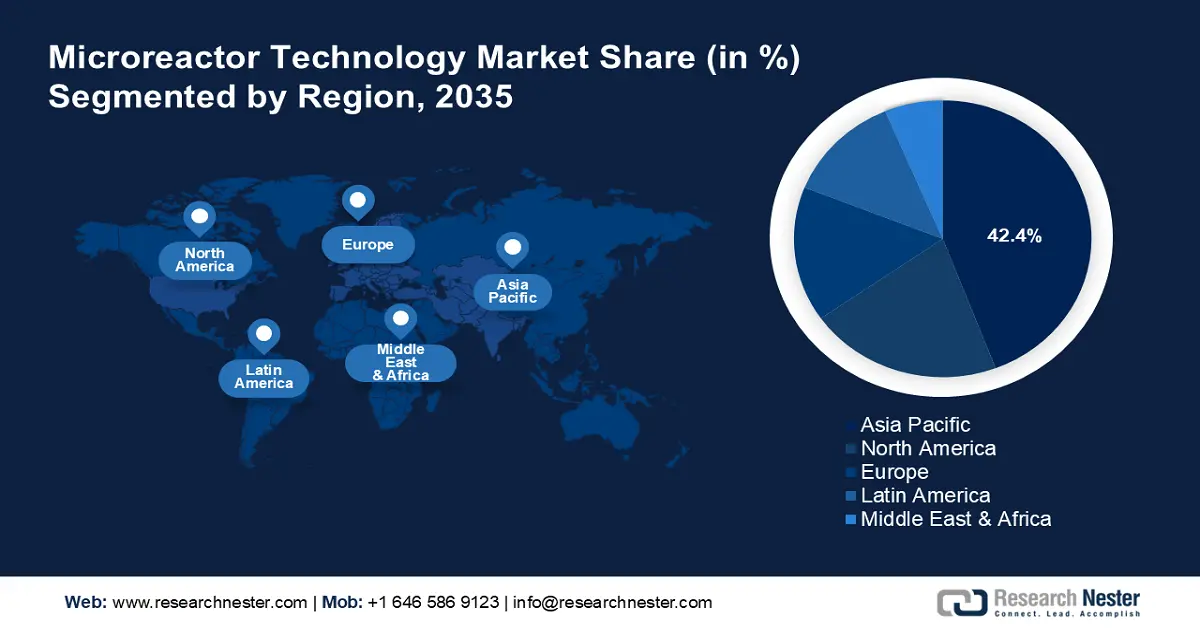

- Asia Pacific leads the Microreactor Technology Market with a 42.4% share, propelled by rapid economic expansion, modernization, and growing research capacities, ensuring robust growth through 2026–2035.

Segment Insights:

- The Specialty Chemicals segment of the Microreactor Technology Market is projected to maintain over 38.7% share by 2035, driven by the ability of microreactor technology to improve selectivity and yield in chemical synthesis.

Key Growth Trends:

- Advancements in pharmaceuticals and chemical industries

- Increasing trade activities of nuclear reactors

Major Challenges:

- High initial investment

- Limited Scalability

- Key Players: Rolls-Royce plc, Westinghouse Electric Company LLC, Ultra Safe Nuclear, NANO Nuclear Energy Inc., BWX Technologies, Inc., Corning Incorporated, Chemtrix BV, AM Technology, Ehrfeld Mikrotechnik BTS, Microinnova Engineering GmbH.

Global Microreactor Technology Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 169.58 billion

- 2026 Market Size: USD 198.88 billion

- Projected Market Size: USD 982.06 billion by 2035

- Growth Forecasts: 19.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 13 August, 2025

Microreactor Technology Market Growth Drivers and Challenges:

Growth Drivers

- Advancements in pharmaceuticals and chemical industries: The use of microreactor technology is propelled by the ongoing developments in the chemical and pharmaceutical sectors. Personalized medicine and complicated medication formulations, which need exact control over chemical reactions and production processes, are driving change in the pharmaceutical industry. The synthesis of new drug compounds and the accelerating drug discovery process are made possible by microreactors, which carry out complex and effective reactions on a smaller scale.

Microreactor technology is also used by the chemical sector to increase process safety and produce more specialized chemicals. Moreover, automation and sensor integration have the potential to completely transform the production and reaction development processes, resulting in shorter lead times. The field of microfluidics has developed to encompass a wide range of uses, including biological analysis, reaction kinetics research, high-throughput screening, and the usage of portable energy devices. - Increasing trade activities of nuclear reactors: The nuclear reactors’ expanding trade activities significantly drive the microreactors technology market by fostering global collaboration, driving technological innovation, and creating new opportunities for deployment in diverse sectors. As countries seek efficient, scalable, and low-carbon energy solutions, the import and export of microreactor technology have become critical to meet energy demands, especially in remote areas. Moreover, the growing demand for clean energy in industrial sectors has spurred the trading of nuclear technologies, with governments and private companies actively negotiating deals to manufacture or purchase microreactors.

The Observatory of Economic Complexity (OEC) reported that at USD 80.2 million, nuclear reactors were the 4210th most traded product in the world in 2022. Nuclear reactor exports increased 311% between 2021 and 2022, from USD 19.5 million to USD 80.2 million. Nuclear reactor trade accounts for 0.00034% of global trade. The microreactor technology market concentration in 2022, as determined by the Shannon Entropy, was 1.4. The UK and Russia accounted for the majority of nuclear reactor exports.

Top Exporters and Importers of Nuclear Reactors in 2022

|

Country |

Export Value |

Country |

Import Value |

|

Russia |

USD 43.9 million |

Turkey |

USD 43.9 million |

|

UK |

USD 32.2 million |

Switzerland |

USD 10.9 million |

|

U.S. |

USD 1.1 million |

United Arab Emirates |

USD 10.7 million |

|

Poland |

USD 915,000 |

Luxembourg |

USD 8.91 million |

|

Nambia |

USD 566,000 |

Angola |

USD 957,000 |

Source: OEC

Challenges

- High initial investment: The high initial investment and implementation expenses of microreactor technology are among the major barriers to its widespread adoption. The incorporation and deployment cost into current manufacturing processes is high since it requires precise engineering and specialized equipment. It may be difficult for small and medium-sized businesses (SMEs) and businesses with limited funding to invest in this technology, which will restrict its broad industry adoption.

- Limited Scalability: Although microreactors are efficient at certain functions, they might not be appropriate for high-output or large-scale industrial processes. It can be technically difficult and not necessarily cost-effective to scale up microreactors to fulfill the demands of mass production. The broad use of microreactor technology in various industries is therefore limited because conventional batch reactors or other large-scale manufacturing techniques may still be chosen in some circumstances.

Microreactor Technology Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

19.2% |

|

Base Year Market Size (2025) |

USD 169.58 billion |

|

Forecast Year Market Size (2035) |

USD 982.06 billion |

|

Regional Scope |

|

Microreactor Technology Market Segmentation:

End use (Specialty Chemicals, Pharmaceuticals, Commodity Chemicals)

The specialty chemicals segment is likely to hold microreactor technology market share of more than 38.7% by 2035. Micro reactor-based chemical synthesis has shown widespread applicability to the vast field of chemical reactions. Higher selectivity and better yields are frequently achieved predictably. To generate shorter and more cost-effective chemical research, development, and manufacture of functional molecules, current research strives to unravel and utilize steeper energy gradient synthesis regimes. Specialty chemicals serve specialized markets with particular performance needs and are distinguished by their distinctive qualities and significant value addition. The synthesis of specialty compounds can benefit greatly from using microreactor technology, which provides exact control over reaction conditions and the creation of intricate molecular structures with remarkable consistency and purity.

Application (Chemical Synthesis, Polymer Synthesis, Process Synthesis, Material Analysis)

The chemical synthesis segment in microreactor technology market will garner a notable share in the forecast period. For the synthesis of chemicals with high yield, stability, selectivity, reduced energy consumption, enhanced sample consistency, low reaction volume, and homogeneity, these miniature chemical reactors primarily provide high-throughput, controllable approaches. Material can be synthesized more efficiently in microreactors than with existing batch methods. The primary elements that enable these improvements include mass transfer, thermodynamics, a high surface area-to-volume ratio, and engineering advantages in handling unstable intermediates. Microreactors are applied in combination with photochemistry, electrosynthesis, multicomponent reactions, and polymerization. It can involve liquid-liquid systems but also solid-liquid systems.

Our in-depth analysis of the global microreactor technology market includes the following segments:

|

Type |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Microreactor Technology Market Regional Analysis:

APAC Market Statistics

By 2035, Asia Pacific microreactor technology market is anticipated to capture over 42.4% share. Rapid economic expansion and modernization in the region drive demand for high-value products using microreactor technology, such as pharmaceuticals and specialized chemicals. Furthermore, the region's growing population and healthcare costs lead to a greater need for creative approaches to d rug discovery and manufacture, where microreactors provide notable benefits in effectiveness, scalability, and affordability. Furthermore, the region’s status as a major microreactor technology market is cemented by its growing research capacities, highly qualified workforce, and robust manufacturing base. Asia Pacific is well-positioned to emerge as a significant center for the development and uptake of microreactor technology in the years to come due to advantageous market conditions and rising knowledge of the advantages of microreactors.

One of the biggest producers of nuclear energy worldwide is China. The nation produces about a tenth of the world's nuclear power, placing it third in the world in terms of installed nuclear power capacity and energy production. According to the U.S. Energy Information Administration, China has 55 nuclear reactors in operation, with a total net capacity of 53.2 GW as of April 2024, having installed more than 34 gigawatts (GW) of nuclear power capacity in the last ten years. In China, 23 more reactors are currently being built. There is an increased investment in nuclear power to reduce the reliance on coal and oil to improve energy security and reduce CO2 emissions.

In India, specialty chemicals are gaining traction due to their growing demand in industries such as automotive, pharmaceuticals, and construction. To meet the increasing demand from both domestic and foreign markets, India's specialized chemical businesses are increasing their capacity. Also, to encourage commerce in specialty chemicals, in February 2023, the Indian Specialty Chemical Manufacturer' Association (ISCMA) and USIIC signed a Memorandum of Understanding. Moreover, microreactor technology adoption is growing in popularity as Indian businesses seek to reduce their environmental effect and maximize production costs.

North America Market Analysis

North America microreactor technology market will hold a significant share in the forecast period. The microreactor technology market growth can be attributed to firmly established chemical and pharmaceutical industries, the widespread use of cutting-edge technology, and advantageous government programs that encourage innovation and research in these fields. The need for microreactor technology in the region is further fueled by strict laws on environmental and safety issues in enterprises.

Furthermore, in the U.S., the government is supporting the advancement of microreactor technology to provide resilient, low-carbon energy solutions across various sectors. To help them obtain the data they require to support the design and licensing of their concepts. The U.S. Department of Energy (DOE) recently chose three businesses to carry out operations that would support possible future testing in the NRIC DOME, the first-ever microreactor test bed at Idaho National Laboratory (INL). For instance, with assistance from DOE's Advanced Reactor Demonstration Program (ARDP), Westinghouse Electric Company is creating this transportable microreactor, which will use TRISO fuel and cutting-edge heat pipe technology to help increase access to clean energy in communities worldwide. Also, Ultra Safe Nuclear is developing Pylon, a 1-megawatt, 10-ton microreactor capable of producing electrical and thermal power both on Earth and in space. Moreover, a portable 1.2-megawatt gas-cooled microreactor called Kaleidos is being developed by Radiant as a possible diesel generator substitute.

Canada has one of the most potential domestic markets in the world for the safe and responsible development of SMR technology, and it is a leader in nuclear energy and nuclear safety. SMRs can help Canada's attempts to reach net-zero greenhouse gas emissions by 2050 and offer significant economic benefits to the country's economy. To promote Westinghouse Electric Canada Inc.'s USD 57 million effort to successfully license its next-generation SMR, the eVinci micro-reactor, in Canada, the Minister of Innovation, Science, and Industry, announced a USD 27.2 million investment in the company. This technology could offer a more portable and easily accessible low-carbon energy source.

Key Microreactor Technology Market Players:

- Rolls-Royce plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Westinghouse Electric Company LLC

- Ultra Safe Nuclear

- NANO Nuclear Energy Inc.

- BWX Technologies, Inc.

- Corning Incorporated

- Chemtrix BV

- AM Technology

- Ehrfeld Mikrotechnik BTS

- Microinnova Engineering GmbH

The microreactor technology market is marked by fierce competition between major competitors vying for a sizable portion of the industry. In order to meet the increasing need for effective and affordable manufacturing solutions across a range of industries, businesses are concentrating on developing new products, forming strategic alliances, and increasing their global footprint. The competitive landscape is also being further fueled by the adoption of microreactor technology, which is being driven by developments in the pharmaceutical and nanotechnology sectors.

Recent Developments

- In December 2023, Rolls-Royce presented a nuclear Space Micro-Reactor Concept Model at the UK Space Conference in Belfast. It is part of a UK Space Agency-funded research initiative to provide the first demonstration of a UK lunar modular nuclear reactor.

- In June 2022, BWX Technologies, Inc. was granted a contract by the US Department of Defense's Strategic Capabilities Office (SCO) to create the country's first advanced nuclear microreactor. In 2024, the full-scale transportable microreactor prototype for Project Pele was built and brought to the Idaho National Laboratory for testing.

- Report ID: 6976

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Microreactor Technology Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.