Metabolic Syndrome Market Outlook:

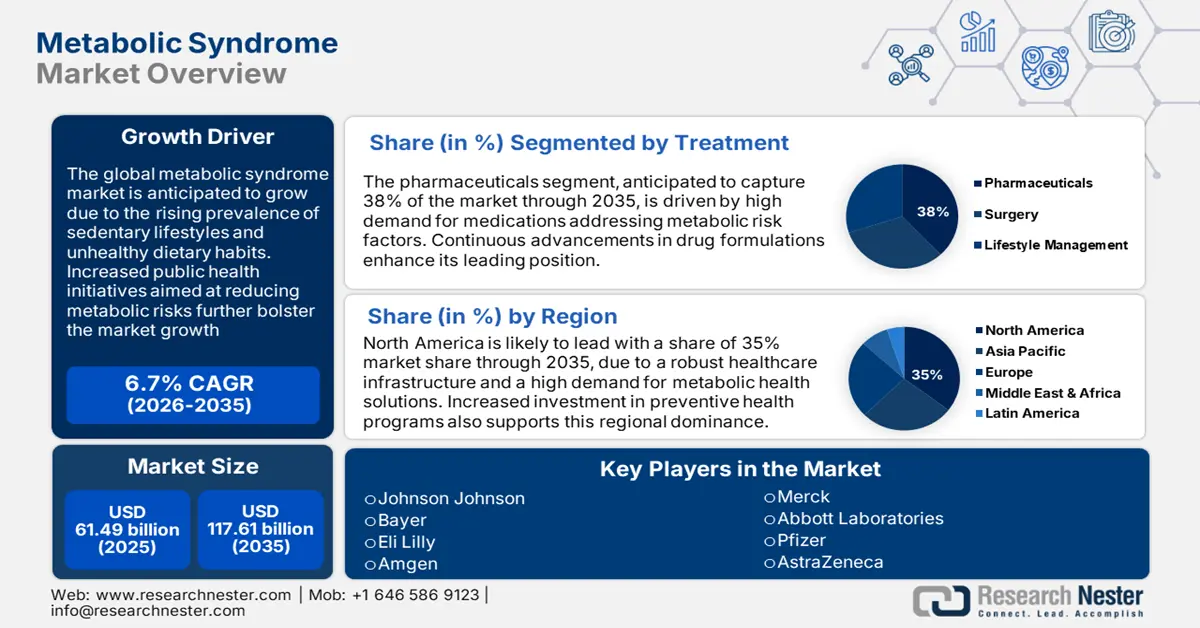

Metabolic Syndrome Market size was over USD 61.49 billion in 2025 and is poised to exceed USD 117.61 billion by 2035, growing at over 6.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of metabolic syndrome is estimated at USD 65.2 billion.

The metabolic syndrome market is likely to expand at a steady rate due to rising diseases among people, such as obesity, type 2 diabetes, and cardiovascular diseases. Due to these complex diseases, the need for novel therapeutic strategies to cover early intervention and personalized care is rising. In November 2023, Cleerly launched the TRANSFORM trial, a major study of patients with metabolic syndrome, pre-diabetes, or type 2 diabetes, to demonstrate personalized care strategies. Such initiatives are reflecting the industry's focus on preventive care and personalized treatment approaches while underlining opportunities for growth, as health systems show a keen interest in managing metabolic health.

Governments around the world consider metabolic syndrome a top-priority public health issue, and this forms the purpose of education campaigns along with periodic health checkups. For example, Japan Ministry of Health started a ten-year campaign in March 2023 to reduce metabolic syndrome's prevalence through healthier lifestyles and preventing the risk factors associated with metabolic syndrome. Such government programs are driving the adoption of lifestyle interventions and pharmaceutical treatments, thereby driving demand in the metabolic syndrome market. The global focus on public awareness and preventive measures entails a call for metabolic health management as one of the priorities in healthcare systems.

Key Metabolic Syndrome Market Insights Summary:

Regional Highlights:

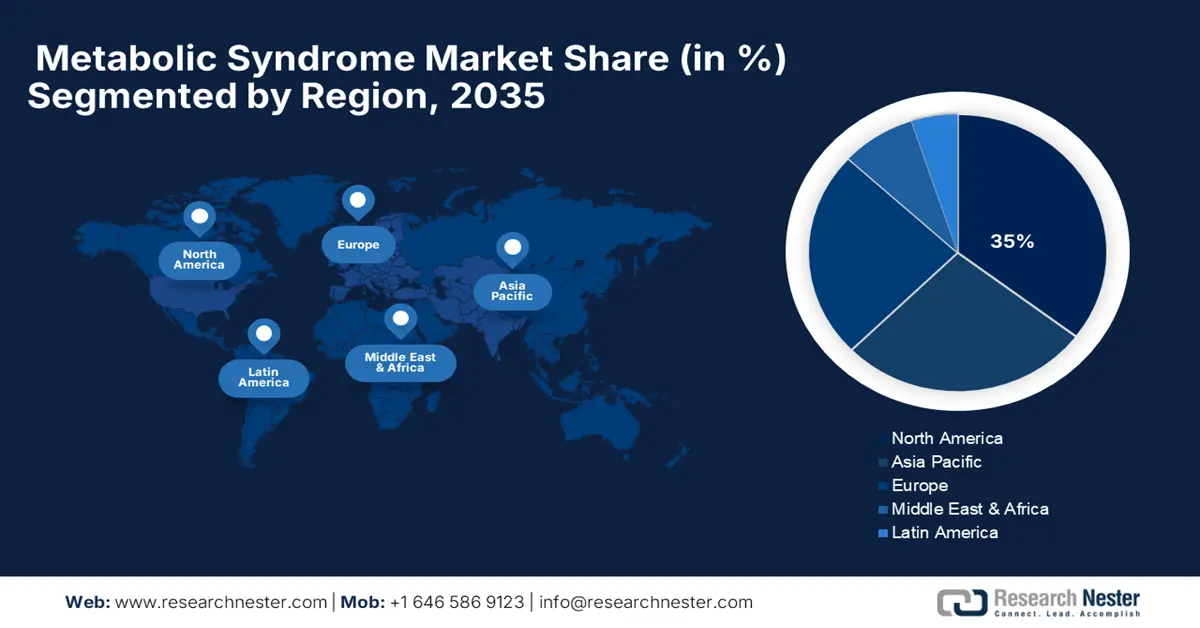

- North America metabolic syndrome market will account for 35% share by 2035, driven by the presence of advanced healthcare infrastructure and strong emphasis on metabolic health management.

- Asia Pacific market will register substantial growth during the forecast period 2026-2035, attributed to the increasing instances of lifestyle diseases and rising healthcare expenditures in countries like India, China, and Japan.

Segment Insights:

- The type 2 metabolic syndrome segment in the metabolic syndrome market is projected to capture a 54.50% share by 2035, fueled by the wide prevalence of type 2 diabetes worldwide.

- The pharmaceuticals segment in the metabolic syndrome market is expected to achieve significant growth till 2035, driven by demand for medicines addressing obesity, diabetes, and high cholesterol.

Key Growth Trends:

- Rising prevalence of obesity and diabetes

- Enhanced diagnostic technologies

Major Challenges:

- Data privacy concerns in digital health solutions

- Limited access in some regions

Key Players: Johnson Johnson, Bayer, Eli Lilly, Amgen, Merck, Takeda, Abbott Laboratories, Pfizer, AstraZeneca, Roche, Novartis, GlaxoSmithKline, Boehringer Ingelheim, Sanofi, Novo Nordisk.

Global Metabolic Syndrome Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 61.49 billion

- 2026 Market Size: USD 65.2 billion

- Projected Market Size: USD 117.61 billion by 2035

- Growth Forecasts: 6.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Japan, Germany, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 18 September, 2025

Metabolic Syndrome Market Growth Drivers and Challenges:

Growth Drivers

-

Rising prevalence of obesity and diabetes: The growing prevalence of obesity and diabetes worldwide remains one of the major growth drivers in the metabolic syndrome market. Among the critical conditions closely associated with metabolic syndrome, the early detection and intervention of obesity and diabetes are paramount. For example, Sun Pharma launched Bempedoic Acid, an innovative oral drug for targeting LDL cholesterol, in India in May 2022, which targeted one of the critical elements of metabolic syndrome. This launch is a good example of the industry's response to the increasing prevalence of obesity and diabetes, thus supporting market growth.

-

Enhanced diagnostic technologies: Improved diagnostic technologies enable the early diagnosis of metabolic syndrome, which improves outcomes for the patient by minimizing the chances of serious complications. For example, Lumen raised USD 62 million in December 2022 for its handheld device, which analyzes metabolic fuel usage by measuring CO2 levels and aids in personalizing dietary and lifestyle changes. This further emphasizes the role of diagnostics in managing metabolic syndrome.

- Increased emphasis on preventive care: The growing level of awareness in people regarding the risks and further complications linked to metabolic syndrome propels the demand for prevention programs associated with this syndrome. Awareness programs like Think Liver Think Life by the American Liver Foundation, which was launched in May 2022, suggest the need for early-stage diagnosis and the required precautionary measures. These programs advocate lifestyle changes and early diagnosis, adding to market growth as people look for preventive measures for metabolic syndrome.

Challenges

-

Data privacy concerns in digital health solutions: The rapidly developing digital health solutions for managing metabolic syndrome bring new levels and scales of data privacy concerns, challenging companies to adhere to strict data regulations that can complicate product development and deployment. In addition, since the data breach issue requires strong cybersecurity measures, this increases the cost and technical difficulty for companies looking either to enter or expand their operations in this area.

-

Limited access in some regions: The treatment and diagnosis of metabolic syndrome are still restricted in low-income areas due mainly to limits in healthcare infrastructure. Many of these regions have not realized easy access to advanced treatments despite awareness and efforts by the government. This is due to the fact that the costs are high and qualified healthcare workers are in short supply. Poor access to diagnostic facilities further constrains early detection, underlining the need for scalable and low-cost healthcare interventions to address such gaps.

Metabolic Syndrome Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.7% |

|

Base Year Market Size (2025) |

USD 61.49 billion |

|

Forecast Year Market Size (2035) |

USD 117.61 billion |

|

Regional Scope |

|

Metabolic Syndrome Market Segmentation:

Treatment Segment Analysis

The pharmaceuticals segment is expected to capture metabolic syndrome market share of over 38% by 2035. The demand for strong medicines that can address major factors like obesity, diabetes, or high cholesterol is expected to boost this growth. In March 2023, Regeneron Pharmaceuticals, Inc. announced that the U.S. Food and Drug Administration had extended the indication of the usage of Evkeeza (evinacumab-dgnb) in addition to other lipid-lowering therapies in pediatric patients 5–11 years of age with homozygous familial hypercholesterolemia. This underlines new medicines that aim particularly at managing metabolic risk factors.

Type of Metabolic Syndrome Segment Analysis

In metabolic syndrome market, Type 2 metabolic syndrome segment is set to capture revenue share of over 54.5% by 2035 due to the coverage of obesity, high cholesterol, and insulin resistance. The wide prevalence of type 2 diabetes worldwide accelerates demand for its comprehensive management. For example, Eli Lilly announced in April 2023 that data from the SURMOUNT-2 study were presented in patients with type 2 diabetes and obesity who saw a weight reduction. The presented data underlined the demand for targeted solutions in the management of type 2 metabolic syndrome.

Our in-depth analysis of the metabolic syndrome market includes the following segments

|

Treatment |

|

|

Type of Metabolic Syndrome |

|

|

Risk Factors |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Metabolic Syndrome Market Regional Analysis:

North America Market Insights

North America industry is poised to account for largest revenue share of 35% by 2035. The presence of advanced healthcare infrastructure in the region, with a strong emphasis on managing metabolic health especially, drives the market forward. Early detection and curative treatment are driving the growth in both the U.S. and Canada market.

The U.S. metabolic syndrome market is driven by huge investments in R&D and significant awareness programs related to obesity and diabetes. In February 2022, AliveCor introduced the KardiaMobile Card which is a thin, credit-card-sized ECG device offering a medical-grade, single-lead ECG in 30 seconds in a single tap that makes heart health monitoring even easier and accessible. Globally, many awareness programs highlight early testing and options for the treatment of metabolic diseases. This underlines the stress on novelty and early management of health in the U.S.

Canada represents a growing metabolic syndrome market, with government-backed public health campaigns aimed at early screening and preventive care. The public health campaigns initiated by Health Canada on obesity and diabetes reflect the government's commitment to ensure the control of metabolic syndrome prevalence. With the increasing adoption of lifestyle and pharmaceutical solutions, Canada continues to be one of the strong contributors to the metabolic syndrome market in North America.

Asia Pacific Market Insights

Asia Pacific region is projected to register substantial growth through 2035, due to growing instances of lifestyle diseases and rising healthcare expenditures in countries like India, China, and Japan. Government initiatives regarding obesity and diabetes also act as an added factor that can enhance the potential growth of the market. Additionally, advancements in healthcare infrastructure and increasing accessibility to diagnostic tools are likely to fuel further growth.

The metabolic syndrome market is also gaining momentum in India, with increasing trends of obesity and diabetes, supplemented by government investments in public health. The government of India commitment to preventive care can be seen in initiatives aimed at metabolic health awareness. In May 2022, Sun Pharma launched Brillo, an LDL-lowering drug, in India. This underlined the pharmaceutical industry's contribution toward the reduction of metabolic syndrome risk factors. All these factors mentioned above push the market toward accessible treatments and open lucrative investment prospects for players.

China is also witnessing steady growth in the metabolic syndrome market as addressing lifestyle-related diseases remains one of the key focuses. The market growth is supported by healthcare reforms, coupled with improved public health awareness campaigns. The increasing prevalence of diabetes and obesity in China increased the demand for metabolic health solutions. In October 2022, InBody presented its BWA 2.0 body water analyzer for metabolic health management through the assessment of body composition. Such developments align with the country's attention toward advanced diagnostic tools to address metabolic syndrome.

Metabolic Syndrome Market Players:

- Johnson Johnson

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bayer

- Eli Lilly

- Amgen

- Merck

- Abbott Laboratories

- Pfizer

- AstraZeneca

- Roche

- Novartis

- GlaxoSmithKline

- Boehringer Ingelheim

- Sanofi

The metabolic syndrome market is highly competitive, comprising multinational companies such as Johnson & Johnson, Bayer, Eli Lilly, Amgen, Merck, Takeda, Abbott Laboratories, Pfizer, AstraZeneca, Roche, Novartis, GlaxoSmithKline, Boehringer Ingelheim, Sanofi, and Novo Nordisk driving the industry. Thus, these firms have emphasized R&D for the development of new methods of treatment focused on pharmaceuticals, lifestyle management, diagnostics, and the development of tools. Strategic partnerships by leading players can enable them to further increase their presence within the market and widen access to better treatments for patients.

In November 2022, Provention Bio made history when its teplizumab became the world's first-ever preventive treatment for type 1 diabetes approved by the FDA. New, targeted, and preventive treatments are increasingly confronting troublesome symptoms of metabolic disease. Competition is anticipated to increase even more with innovative approaches from major players as they try to provide comprehensive solutions that address metabolic syndrome and improve outcomes.

Recent Developments

- In July 2024, the Institute of Liver and Biliary Sciences (ILBS) partnered with France's National Institute of Health and Medical Research (INSERM) to launch the Indo-French Node for Liver and Metabolic Disease Network (InFLiMeN). This collaborative initiative aims to drive innovation and research focused on liver and metabolic disorders. The launch event, held at the APJ Abdul Kalam Auditorium at ILBS, featured Union Minister of Science and Technology and Earth Sciences Jitendra Singh as the chief guest. InFLiMeN seeks to strengthen Indo-French ties in medical research, advancing solutions for metabolic diseases impacting both nations.

- In November 2023, AstraZeneca unveiled a comprehensive strategy targeting the cardiometabolic market, specifically addressing obesity and related comorbidities. This approach combines its newly acquired GLP-1 receptor agonist therapy, ECC5004 from Eccogene, with existing cardiometabolic treatments like the SGLT2 inhibitor Farxiga (dapagliflozin). AstraZeneca’s integration of these therapies is designed to improve outcomes for patients with complex cardiometabolic conditions by offering more tailored and effective treatment options.

- Report ID: 6696

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Metabolic Syndrome Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.