Menstrual Hygiene Management Market Outlook:

Menstrual Hygiene Management Market size was valued at USD 26.02 billion in 2025 and is likely to cross USD 42.79 billion by 2035, expanding at more than 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of menstrual hygiene management is assessed at USD 27.21 billion.

This anticipated growth reflects the rising demand for cutting-edge menstrual hygiene products and increasing recognition and awareness about menstrual hygiene among women. Manufacturers are evolving to meet the changing needs and preferences of consumers while coping with global challenges such as sustainability and accessibility using several strategic alliances such as partnerships and mergers and acquisitions. For instance, in February 2022, Kimberley Clark Corporation acquired Thinx, Inc. to expand the company’s product portfolio into the personal care category.

Governments worldwide are promoting the use of menstrual hygiene products through several campaigns. The Supreme Court of India advocated a “Uniform National Policy” in April 2023, to guarantee that all girls in grades 6th to 12th have access to free sanitary pads and that schools have separate restrooms for females. A similar policy was launched in November 2023 to eliminate the social stigma regarding menstruation guaranteeing access to period products advanced health system, and honoring international committees pertaining to gender equality and women’s welfare.

Key Menstrual Hygiene Management Market Insights Summary:

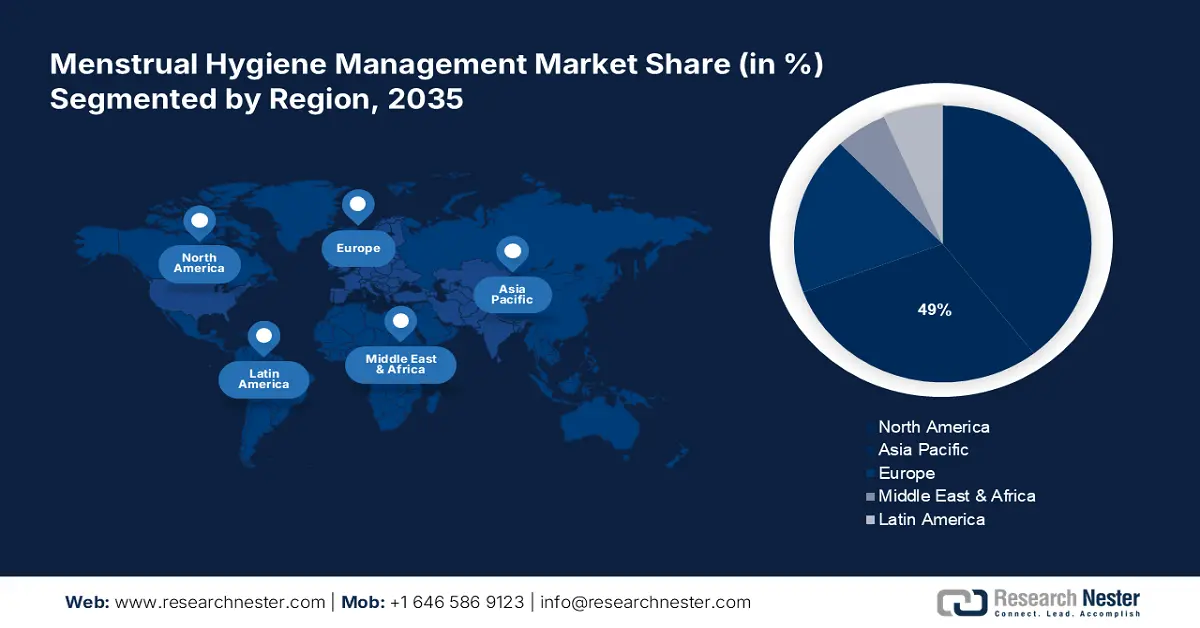

Regional Highlights:

- The North America menstrual hygiene management market will dominate around 49% share by 2035, driven by the presence of well-established healthcare systems and high awareness about menstrual hygiene and health.

- The Asia Pacific market grows rapidly with a strong CAGR during 2026-2035, driven by growing awareness about menstrual hygiene and favorable government schemes to promote menstrual health in rural areas.

Segment Insights:

- The supermarkets segment in the menstrual hygiene management market is projected to hold a significant share by 2035, driven by broad product availability, competitive pricing, and sales-driven retail strategies.

- The sanitary pads segment in the menstrual hygiene management market is projected to hold a significant share by 2035, attributed to high global adoption and continuous product innovation in hygiene and comfort.

Key Growth Trends:

- Rapid urbanization and growing awareness of menstrual health & hygiene

- Increasing inclination towards adoption of organic and eco-friendly menstrual products

Major Challenges:

- Lack of awareness about menstrual health and education in remote areas

- Social taboo, stigma, and economic barrier

Key Players: Procter & Gamble, Kimberly-Clark, Unicharm Corporation, Premier FMCG, Ontex, Hengan International Group Company Ltd., and Drylock Technologies.

Global Menstrual Hygiene Management Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 26.02 billion

- 2026 Market Size: USD 27.21 billion

- Projected Market Size: USD 42.79 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (49% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, India, Japan, Germany

- Emerging Countries: China, India, Brazil, Mexico, Indonesia

Last updated on : 18 September, 2025

Menstrual Hygiene Management Market Growth Drivers and Challenges:

Growth Drivers

- Rapid urbanization and growing awareness of menstrual health & hygiene: Global agencies and organizations such as the United Nations, Educational, Scientific and Cultural Organization (UNESCO) and United Nations Children’s Fund (UNICEF) have been actively boosting literacy levels among females in underdeveloped nations by providing resources and funding to support literacy initiatives, by advocating modifications in literacy and education, by conducting numerous and consistent researches for assessing the progress and identify areas of improvement.

For instance, UNESCO & UNICEF are collaboratively working to support the Bangladesh Government’s initiatives to enhance access to education for girls. Urban women are more conscious about seeking medical attention for menstrual-related issues which consequently helps in timely intervention and improved health outcomes. - Increasing inclination towards adoption of organic and eco-friendly menstrual products: There’s a global shift towards sustainability and environmental responsibility, leading to increased demand for eco-friendly menstrual hygiene alternatives such as reusable menstrual cups, cloth pads, biodegradable tampons, and period underwear. These alternatives significantly mitigate waste and help lessen the burden on landfills, oceans, and ecosystems.

- Government initiatives & programs: Government initiatives and policies, collaborations with private organizations, NGOs, and communities play vital roles in promoting women's menstrual health and hygiene. As an illustration, South Korea’s ‘Menstrual Hygiene Vending Machine’ provides easy access to sanitary products. These measures demonstrate the commitment of government towards tackling menstrual hygiene management in the world.

Challenges:

- Lack of awareness about menstrual health and education in remote areas: Without adequate knowledge about hygiene practices, women and young girls, especially in remote areas may not have access to affordable menstrual products, limiting the menstrual hygiene management market growth.

- Social taboo, stigma, and economic barrier: Social norms and expectations can lead to a lack of communication about menstruation. Fear of judgment, ridicule, and isolation can prevent open discussions and education giving rise to insufficient acknowledgment of apt menstrual practices and facilities. Moreover, economic constraints are a major obstacle to menstrual hygiene. The scarcity and high cost of menstrual products make them unaffordable particularly in low-income communities.

Menstrual Hygiene Management Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 26.02 billion |

|

Forecast Year Market Size (2035) |

USD 42.79 billion |

|

Regional Scope |

|

Menstrual Hygiene Management Market Segmentation:

Product Segment Analysis

The sanitary pads segment in the menstrual hygiene management market is expected to account for a significantly larger revenue share during the forecast period owing to high usage of various types of sanitary pads across the globe and its rising availability in supermarkets, pharmacies, and online stores. Sanitary pads have undergone significant innovations over time, transforming from basic absorbent products to sophisticated, comfortable, and sustainable solutions. Key advancements in these products range from ultrathin designs, antimicrobial materials for odor control, reusable and washable options, and customizable sizes and shapes to organic and natural materials for sensitive skin.

End use Segment Analysis

Among these, the supermarket segment in the menstrual hygiene management market is expected to account for a significantly larger revenue share by 2035. Economies of scale enable supermarkets/hypermarkets to offer competitive pricing, making products affordable and durable. The supermarkets render a wide range of products from various brands and companies catering diverse needs of consumers. Strategies to escalate business operations such as regular promotions, discounts, and loyalty programs to drive sales are heavily used by supermarket owners.

Our in-depth analysis of the menstrual hygiene management market includes the following segments:

|

Product

|

|

|

Usability |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Menstrual Hygiene Management Market Regional Analysis:

North America Market Insights

North America industry is likely to hold largest revenue share of 49% by 2035. owing to presence of well-established healthcare systems, high awareness about menstrual hygiene and health, and availability of various types of menstrual hygiene products. The U.S. and Canada have well-established markets for menstrual hygiene products, with a strong foundation and existence of leading brands and retailers.

The U.S. menstrual hygiene management market is driven by increasing awareness about menstrual health and high demand for sustainable products. Sanitary pads are the dominant segment followed by tampons in this region. The waves of multiple trends across the country such as online shopping and subscription services gaining traction, growing attention towards period panties and menstrual cups, and maintaining menstrual health and hygiene.

The key details about the menstrual hygiene management market in Canada are the driving forces categorized into distribution channels, key players, and government initiatives. For Example, “British Columbia” has made menstrual products free in public schools. Canada has also implemented policies to address period poverty, including a 2019 bill to make menstrual products accessible and affordable.

Asia Pacific Market Insights

The menstrual hygiene management market in Asia Pacific is expected to register rapid revenue growth during the forecast period owing to growing awareness about the importance of menstrual hygiene and favorable government schemes to promote menstrual health, hygiene, and products in rural areas.

Over the years, menstrual products have gained significance and intimate hygiene has become a vital concern among females in India. For instance, in 2022, the Ministry of Health and Family Welfare promulgated a female-centric scheme for the promotion of menstrual hygiene among adolescent girls in the age group of 10-19 years in rural areas known as the Menstrual Hygiene Scheme (MHS).

Private and public funds for educating and spreading awareness amongst females and young girls are expected to be the key components to boost the inclination towards menstrual hygiene products. Also, government bodies and other significant organizations focusing on strategies and plans to be implemented to expect favorable outcomes to enhance accessibility and affordability of products across underdeveloped areas.

Menstrual Hygiene Management Market Players:

- Johnson & Johnson Private Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Procter & Gamble

- Kimberly-Clark

- Premier FMCG

- Ontex

- Hengan International Group Company Ltd.

- Drylock Technologies

- Natracare LLC

- Redcliffe Hygiene Private Limited

- The Keeper, Inc.

- STERNE

The increasing focus on sustainable goods and more customer awareness drive the menstrual hygiene management market to be increasingly competitive. Major companies, such as Procter & Gamble, and Kimberly Clark, among others, compete with innovative startups focused on eco-friendly and organic products. These key players also employ strategic alliances such as mergers and acquisitions, partnerships, product launches, and joint ventures to retain their market position and enhance their product base. Here is a list of key players operating in the global menstrual hygiene management market:

Recent Developments

- In August 2024, Procter & Gamble announced the launch of a new line of environment-friendly menstruation products, which shows a giant rise in the commitment of the company towards sustainability. Materials used are degradable and form part of general company efforts towards minimization of the carbon footprints by the use of more recycled materials in packing.

- In July 2024, Luna Pads, a top brand in the market of sustainable mensuration products, has launched its usable period underwear and organic cotton pads. The company is, therefore, targeting to meet this increasing consumer demand for more environment & budget-friendly, health-sustainable menstrual products.

- In May 2023, Flex, a company well-known for its menstruation cups, launched a new menstrual disc designed to last longer and be more comfortable. The disc offers a substitute for conventional menstruation products and follows the industry trend of offering a range of solutions to meet various consumer needs.

- Report ID: 6353

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Menstrual Hygiene Management Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.