Medical Waste Management Market Outlook:

Medical Waste Management Market size was valued at USD 31.7 billion in 2025 and is likely to cross USD 62.94 billion by 2035, expanding at more than 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of medical waste management is assessed at USD 33.73 billion.

The production of biomedical waste has increased significantly across the globe over the last 30 years, which has increased the significance of medical waste management initiatives in creating an environmentally friendly, long-lasting healthcare setting. As per the World Health Organization, (WHO), each hospital bed in high-income nations produces up to 0.5 kilograms of hazardous waste on average each day, compared to 0.2 kg in low-income nations.

Key Medical Waste Management Market Insights Summary:

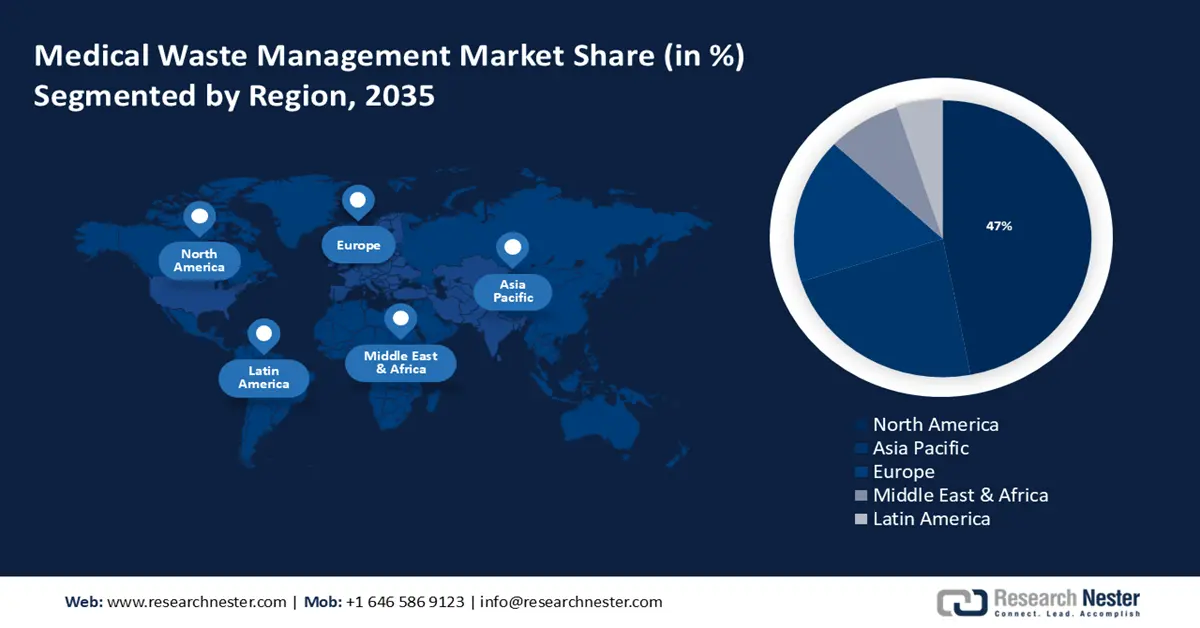

Regional Highlights:

- North America medical waste management market will secure over 47% share by 2035, driven by growing awareness about waste management and increasing healthcare spending in the United States.

- Asia Pacific market will achieve robust growth during the forecast timeline, attributed to increasing medical tourism in countries like Thailand, Malaysia, and Singapore, driving demand for medical waste management.

Segment Insights:

- The treatment and disposal segment in the medical waste management market is forecasted to see substantial growth till 2035, driven by the increasing number of hospitals resulting in a rise in medical waste production.

- Off-site segment in the medical waste management market is expected to secure the largest share by the forecast year 2035, driven by regulations forcing healthcare facilities to employ contractors for waste disposal off-site.

Key Growth Trends:

- Rising burden of HIV/AIDS

- Growing focus on sustainability

Major Challenges:

- Challenges in safely disposing of medical waste

- Absence of education and training

Key Players: Republic Services, Inc., CLEAN HARBORS, INC., GreenTech Environ Management, MedPro Disposal, REMONDIS Medison GmbH, Stericycle, Triumvirate Environmental, Veolia Environmental Services, GRP & Associates, Inc.

Global Medical Waste Management Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 31.7 billion

- 2026 Market Size: USD 33.73 billion

- Projected Market Size: USD 62.94 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (47% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, France

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 17 September, 2025

Medical Waste Management Market Growth Drivers and Challenges:

Growth Drivers

- Rising burden of HIV/AIDS - The most often distributed disease in the world as a result of inappropriate handling of medical wastes is HIV, thus the adoption of medical waste management plans is rising to determine whether wastes pose a significant enough danger of infection.

According to the data from the World Health Organization (WHO), HIV continues to be a serious global public health concern, having taken 40.4 million lives to date, and it is still spreading throughout all nations in the world. - Growing focus on sustainability - Waste management is essential to sustainable industrialization, including managing medical waste, which may foster innovation and is critical to advancing sustainability and halting climate change by recycling and recovering resources.

In an attempt to live more sustainably, more than 70% of customers worldwide are changing the things they purchase and the way they live.

Challenges

- Challenges in safely disposing of medical waste- Improper medical waste management can spread infectious diseases, especially when animals or insects come into contact with the trash, and harms the environment specifically, landfilling and incineration cause pollution in the air and water.

- Absence of education and training - Hospitals are now hubs for the transmission of disease because healthcare personnel lack proper training in medical waste management.

It is discovered that trash handlers and healthcare personnel lack the necessary understanding, and this is owing to no training programs, lack of mechanisms for managing and disposing of garbage, inadequate funding and personnel, and the subject's low importance.

Medical Waste Management Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 31.7 billion |

|

Forecast Year Market Size (2035) |

USD 62.94 billion |

|

Regional Scope |

|

Medical Waste Management Market Segmentation:

Service Offered Segment Analysis

Treatment and disposal segment is anticipated to dominate medical waste management market share of over 35% by 2035. The segment growth can be accredited to the increasing number of hospitals. For instance, there are more than 15,000 hospitals worldwide.

This has caused a rise in the production of medical waste, which has encouraged the majority of healthcare facilities to either use methods other than burning or export their generated biomedical waste to huge, centralized incinerators for treatment and disposal.

Incineration of medical waste is a traditional medical waste disposal management procedure that entails burning medical waste generated by hospitals, veterinary clinics, and medical research organizations by heating the garbage to high temperatures.

Waste Generator Segment Analysis

The hospitals segment in medical waste management market is foreseen to gather the highest CAGR during the forecast through 2035. The growing incidence of hospital-acquired infections is the main driver of the segment's growth. Viral, bacterial, and fungal pathogens are the sources of healthcare-associated infections, which have extremely high rates of morbidity and mortality.

Moreover, every day, the quantity of garbage produced in hospitals grows geometrically, which necessitates the adoption of medical waste management services for lowering hospital infections and following infection control policies and procedures.

Hospital waste is a possible source of germs, with over 20% of it classified as hazardous. Worldwide, the projected rate of universal hospital-acquired infections is around 0.13, with an annual growth rate of 0.05.

Treatment Site Segment Analysis

By the end of 2035, the off-site segment is slated to have the largest medical waste management market share. Hospital-produced medical waste used to be mostly handled on-site, however, regulations have forced clinics and other healthcare facilities to employ contractors to remove their waste for treatment and disposal off-site.

Our in-depth analysis of the medical waste management market includes the following segments:

|

Service Offered |

|

|

Type of Waste |

|

|

Treatment Site |

|

|

Treatment Method |

|

|

Category of Waste |

|

|

Waste Generator |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Medical Waste Management Market Regional Analysis:

North American Market Insights

North America in medical waste management market is expected to dominate over 47% revenue share by 2035. The market growth in the region is also expected on account of the growing awareness about waste management. Over time, "disposal in open dumps" gave way to "integrated waste management" in North America as the method of garbage management, leading to higher demand for smart waste management techniques.

The increasing spending on healthcare in the US is likely to fuel medical waste management market demand. For instance, healthcare spending in the United States increased by around 4% in 2022 to reach over USD 4 trillion, exceeding the 3% increase in 2021.

More than 45 infectious diseases exist in Canada among them are food poisoning, the flu, and measles, which rank fifth in terms of premature mortality and are a significant contributor to lost productivity.

APAC Market Insights

The Asia Pacific region will also register a robust share of the medical waste management market during the forecast period and will hold the second position owing to the increasing medical tourism in this region. Asia's medical tourism industry is about to take off, with Thailand, Malaysia, and Singapore emerging as key international travel destinations.

This has led to a rise in the number of international patients visiting for medical treatment, leading to a higher requirement for managing and properly disposing of medical waste.

With over 5% of the global pharmaceutical industry, Japan is still one of the biggest medical waste management market in the world. As a result, medical waste management is an ongoing issue that is becoming more prevalent in the region.

China's fast urbanization has resulted in an annual rise in the generation of medical waste, which is dangerous and contagious and can have negative consequences on humans, and the environment.

The majority of medical waste processing in Korea takes place at specialized incinerators, which are monitored by the government using radio frequency identification (RFID).

Medical Waste Management Market Players:

- Republic Services, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- CLEAN HARBORS, INC.

- GreenTech Environ Management

- MedPro Disposal

- REMONDIS Medison GmbH

- Stericycle

- Triumvirate Environmental

- Veolia Environmental Services

- GRP & Associates, Inc.

The medical waste management market consists of many key players. These key players are launching various strategic initiatives to expand their market position in the medical waste management industry.

Recent Developments

- Republic Services, Inc. announced the acquisition of US Ecology, Inc. a leading provider of environmental solutions to generate substantial value for the stakeholders while offering clients one of the broadest ranges of products in the environmental services industry and quicken the implementation of their shared plan to improve the planet.

- CLEAN HARBORS, INC. acquired HEPACO, a leading environmental provider of field and emergency response services in the Eastern United States to reach the cost synergies set out in areas like procurement, asset rents, branch network, subcontracting, and transportation.

- Report ID: 6054

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Medical Waste Management Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.