Medical Network Solution Market Outlook:

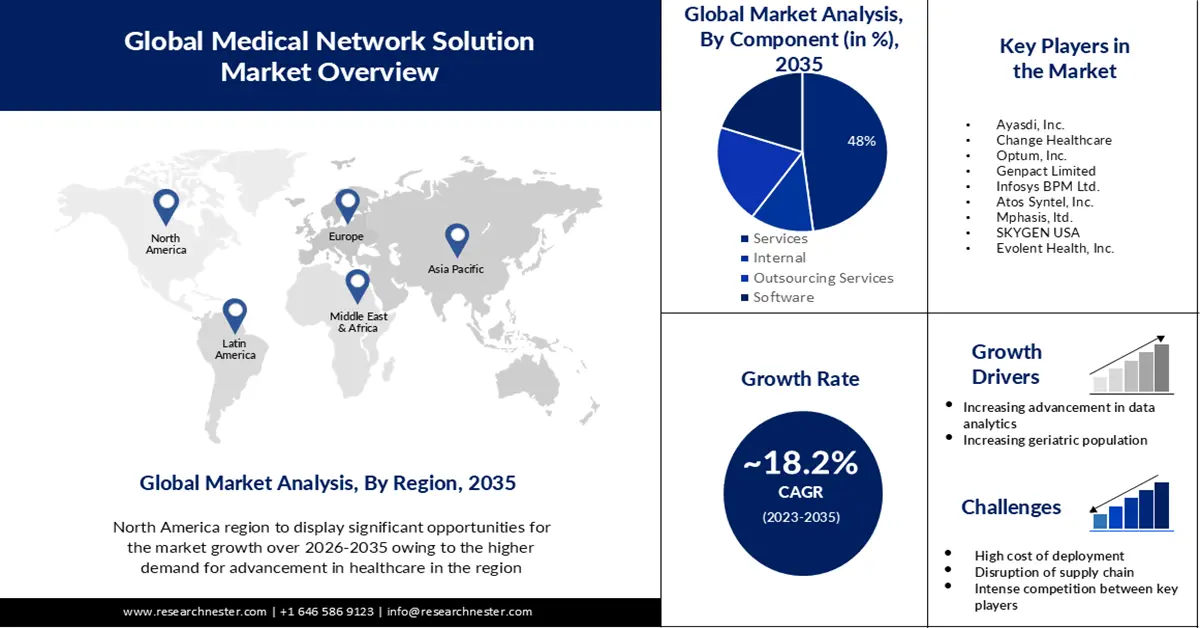

Medical Network Solution Market size was valued at USD 5.46 billion in 2025 and is set to exceed USD 29.06 billion by 2035, expanding at over 18.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of medical network solution is estimated at USD 6.35 billion.

The demand for provider network management payer services, which are expected to drive market growth, is supported by the increased use of healthcare insurance in managing medical expenses such as treatments, hospitalizations, and health checks. In November 2022, the Indian Brand Equity Foundation released a report on the Insurance Sector, which indicated an increased number of persons purchasing insurance policies. From 2021 to 2022, the net first-year premium increases for life insurers rose by 6,94%, amounting to USD 29.54 billion in India. According to the report, in May 2021 new business premiums of life insurance increased by 88.64% from USD 3.12 billion.

In addition, in the event of acquisition, merger or expansion medical network solutions are helping to connect new locations in these organizations. Therefore, an important contributor to the growth of medical network solutions markets is that healthcare organizations are able to operate as a single unit much more quickly with this type of medical network solutions.

Key Medical Network Solution Market Insights Summary:

Regional Highlights:

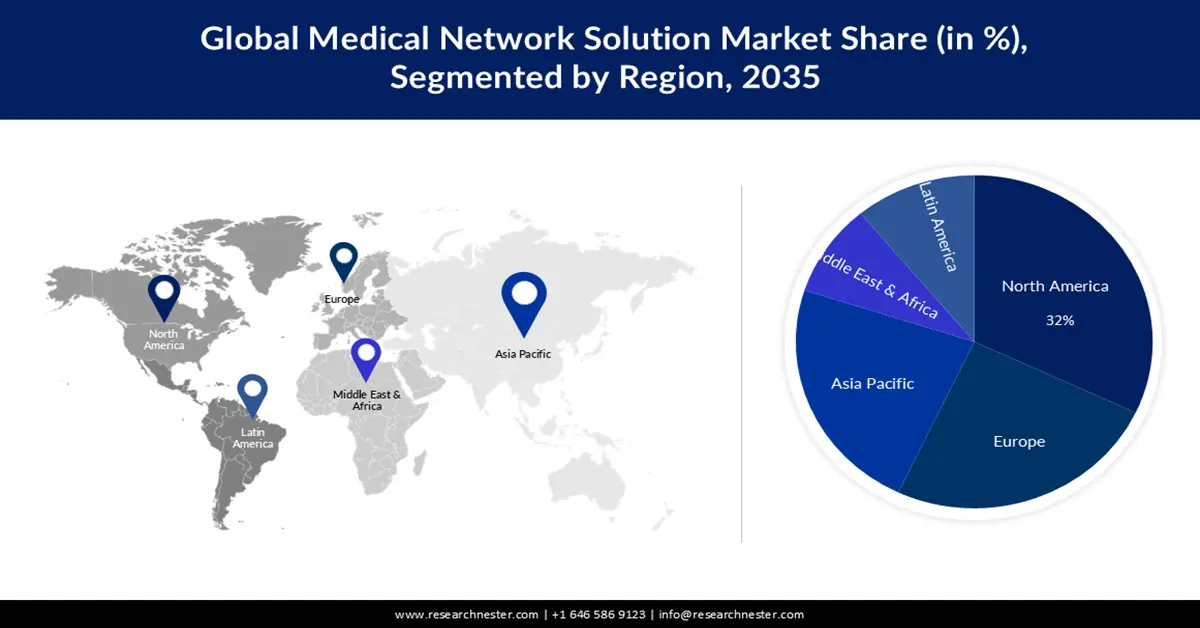

- By 2035, North America is projected to secure a 32% share of the medical network solution market as technology-enabled software and electronic health record adoption accelerate in line with rising healthcare expenditure owing to the wider integration of digital payment and management systems.

- Europe is anticipated to command a 25% share by 2035 as massive investments in healthcare technologies and growing adoption of cloud-based IT solutions stimulate regional expansion.

Segment Insights:

- By 2035, the cloud segment in the medical network solution market is expected to capture a 65% share, bolstered by the expanding availability of cloud software and rising adoption among healthcare providers.

- Across 2026–2035, the services segment is estimated to hold a 48% share, supported by lower health system service costs, enhanced auto-adjudication rates, and strengthened provider relationships.

Key Growth Trends:

- Implementation of Stringent Federal Mandates

- Advanced Data Analytics

Major Challenges:

- IT infrastructure constraints in developing countries

Key Players: Ayasdi, Inc., Change Healthcare, Optum, Inc., Genpact Limited, Infosys BPM Ltd., Atos Syntel, Inc., Mphasis, ltd., SKYGEN USA.

Global Medical Network Solution Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.46 billion

- 2026 Market Size: USD 6.35 billion

- Projected Market Size: USD 29.06 billion by 2035

- Growth Forecasts: 18.2%

Key Regional Dynamics:

- Largest Region: North America (32% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, Brazil, South Korea, Singapore, United Arab Emirates

Last updated on : 25 November, 2025

Medical Network Solution Market - Growth Drivers and Challenges

Growth Drivers

-

Implementation of Stringent Federal Mandates- In order to reduce operating costs while simultaneously improving the coverage of benefits and increasing customer satisfaction, the implementation of healthcare mandates such as the Patient Protection and Affordable Care Act, including the Medical Loss Ratio and the Administrative Loss Ratio, has forced payer organizations to effectively manage their provider networks. Additionally, under regulations like Medical Loss Ratio (MLR) health insurance, issuers are required to spend 80% to 85% on medical care and efforts to improve the quality of healthcare; the remaining portion can be used for administrative expenses. Payers are turning to provider network management as a result of the implementation of strict federal regulations, an expanding customer base, and a growing demand to reduce operational and administrative expenses.

-

Advanced Data Analytics- Owing to the dynamic nature of the healthcare industry, payers face various challenges in maintaining provider networks and managing medical loss ratios. As a result, healthcare payers are increasingly focusing on employing highly advanced IT technologies such as data analytics. With a focus on managing medical loss ratios, it is critical for payers to use data analytics to retain current members and implement effective care management programs. Payers can use analytics in clustering, optimization, unbiased predictive modeling, and propensity score shaping. Many payers have started using patient data analytics, which makes extensive use of data, enables statistical and quantitative analysis, and use predictive models to drive better fact-based decision-making. This improves performance in areas such as provider contracting.

-

Rising patient population- The rising patient population is expected to propel the growth of the medical network solution market going forward. The number of patients going to hospitals is also increasing because of the growing patient population. The network solution facilitates the monitoring of patients' records to predict their hospitalization and readmissions, which enables healthcare providers to manage healthcare management programs. For example, more than 33.35 million hospital admissions were registered in the United States during the year 2020, according to the American Hospital Association, a US-based organization representing all types of hospitals and healthcare networks in its annual 2020 survey.

-

IT infrastructure constraints in developing countries- One of the biggest obstacles to implementing HCIT solutions is cost issues. There are significant costs associated with network management software provided by the provider. The costs associated with maintaining and updating the network management systems provided by providers can be higher than that of software. The recurrent cost of support and maintenance is nearly 30% of the total ownership costs, which includes software upgrades. Moreover, training for end users is necessary in order to maximize the effectiveness of providers' network management systems due to a lack of internal information technology expertise within the healthcare sector. This, in turn, leads to higher costs of ownership for such systems. It is difficult to assess information systems in the healthcare sector. Consequently, smaller healthcare organizations are precluded from investing in medical network solutions due to the heavy costs associated with deployment and maintenance.

-

There is intense competition in the market for medical network solutions. In order to differentiate and succeed, it is necessary to face competition pressures and understand the strategies of competitors.

-

The disruption of the supply chain may lead to interruptions in operations, which can have an impact on product availability. To maintain a smooth operation, it is essential that these interruptions are anticipated and mitigated.

Medical Network Solution Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

18.2% |

|

Base Year Market Size (2025) |

USD 5.46 billion |

|

Forecast Year Market Size (2035) |

USD 29.06 billion |

|

Regional Scope |

|

Medical Network Solution Market Segmentation:

Deployment Type Segment Analysis

The cloud segment is anticipated to account for 65% share of the global medical network solution market during the forecast period. The growth of the segment is due to the high number of cloud software and services available in the market and healthcare providers' increasing use of these technologies. In addition, market growth is expected to be driven by increased company involvement in the development of software and solutions that are increasingly sophisticated. Furthermore, cloud computing offers cost-efficient solutions for the administration and storage of healthcare data to smaller hospitals by giving them strong computing capacity, effective storage, or advanced analytics about healthcare data. It is estimated that the benefits of cloud computing software are enabling healthcare institutions to adopt it, which in turn will support segment growth. In 2022, 66% of healthcare professionals plan to migrate their technology infrastructure to the cloud, and this number will grow to 96 % by 2024 according to a report published in June 2022.

Component Segment Analysis

Medical network solution market from the services segment is expected to hold the largest share of about 48% during the forecast period. The reduction in the cost of health system services, improved claims auto judication rates, efficiency, and provider relationship are reasons why this segment holds a significant share.

Our in-depth analysis of the global market includes the following segments:

|

Deployment Type |

|

|

Organization Size |

|

|

Component |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Medical Network Solution Market - Regional Analysis

North American Market Insights

North America industry is estimated to account for largest revenue share of 32% by 2035. The adoption of technology-enabled software and solutions such as electronic health records that facilitate various payment processes by reducing time and costs as compared to traditional manual procedures is expected to increase market growth due to the increasing expenditure on healthcare in the region. The national health expenditure (NHE) increased by 2.7% to USD 4.3 trillion, accounting for 18.3% of GDP, according to data from the Centres for Medicare &Medicaid Services (CMS) 2021. In addition, in 2021 private health insurance spending increased by 5.8% to USD 1.2 trillion. In 2021 another USD 596.6 billion will be paid by third parties and programs and public health activities, with hospital expenditures increasing by 4.2 percent to USD 1.3 trillion. Moreover, there has been a strong government focus on healthcare IT solutions in countries such as Canada, boosting the growth of the market in the region.

European Market Insights

The medical network solution market in Europe is estimated to hold 25% revenue share during the forecast period. In view of the massive investments and spending in healthcare technologies, as well as the adoption of cloud-based IT solutions. The UK has around a hundred new start-ups in the area of health solutions, based on Tech Nation's Data Commons research. In addition, it is estimated that in the country there could be as much as 1 billion dollars’ worth of business created by entrepreneurs. A package of GBP 1.25 billion is also set up for the development of entrepreneurship by the United Kingdom Government

Medical Network Solution Market Players:

- Cognizant

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ayasdi, Inc.

- Change Healthcare

- Optum, Inc.

- Genpact Limited

- Infosys BPM Ltd.

- Atos Syntel, Inc.

- Mphasis, ltd.

- SKYGEN USA

- Evolent Health, Inc.

Recent Developments

In the News

- Change Healthcare today announced it has acquired PROMETHEUS Analytics from Altarum. PROMETHEUS Analytics is a leading reimbursement approach based on medical episodes of care, used by payer-provider collaborations nationwide, uniquely providing a fair and realistic blueprint for value-based payments. It includes more than 90 episode of care definitions outlining the entire range of treatment that include all covered services across providers that would typically treat a patient for a single procedure, illness or condition.

- Cognizant has been named a Leader of healthcare cloud-based core administration in a new report by Everest Group. In its review of 14 IT healthcare service providers, Everest Group recognized Cognizant's TriZetto practice as a Leader for its extensive portfolio of services, strong vertical and technical capabilities, and positive client feedback.

- Report ID: 5307

- Published Date: Nov 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Medical Network Solution Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.