Medical Manifolds Market Outlook:

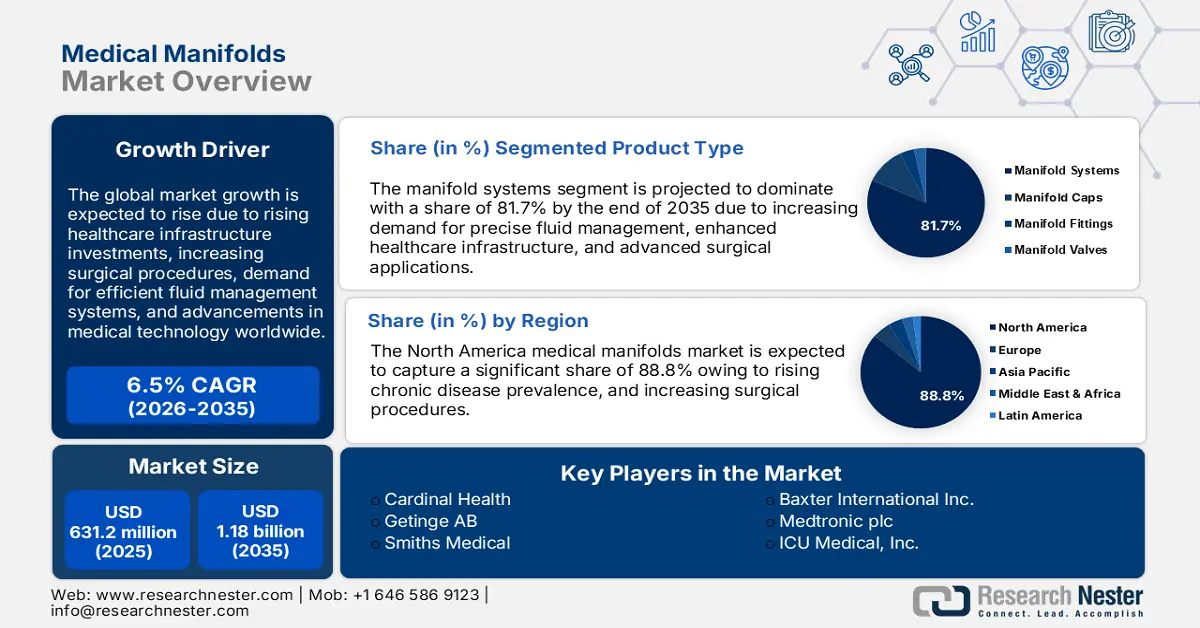

Medical Manifolds Market size was valued at USD 631.2 million in 2025 and is expected to reach USD 1.18 billion by 2035, registering around 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of medical manifolds is evaluated at USD 668.13 million.

The global emphasis on enhancing healthcare infrastructure has driven higher demand for advanced medical equipment, including manifolds, in hospitals and clinics. Simultaneously, the rising prevalence of chronic illnesses such as cardiovascular diseases, respiratory diseases, and diabetes has intensified the need for sophisticated medical devices. A 2023 study found that 18% of CVD patients and 26% of people at risk used wearable devices, compared to 29% of the general population in the US. These devices often rely on medical manifolds for efficient fluid management and monitoring, further propelling the growth of the medical manifolds market across developed and developing regions.

Additionally, the global aging population is leading to an increased demand for efficient and reliable medical equipment to manage a wide range of age-related health conditions, such as cardiovascular diseases, diabetes, and respiratory disorders. In November 2023, the World Health Organization estimated that 392 million people had chronic obstructive pulmonary diseases, causing over 3 million deaths annually. This demographic shift has resulted in a higher need for advanced medical devices that ensure precise fluid management and monitoring. As a result, the adoption of medical manifolds in healthcare settings, especially for critical care and surgical procedures, is experiencing significant medical manifolds market growth.

Key Medical Manifolds Market Insights Summary:

Regional Highlights:

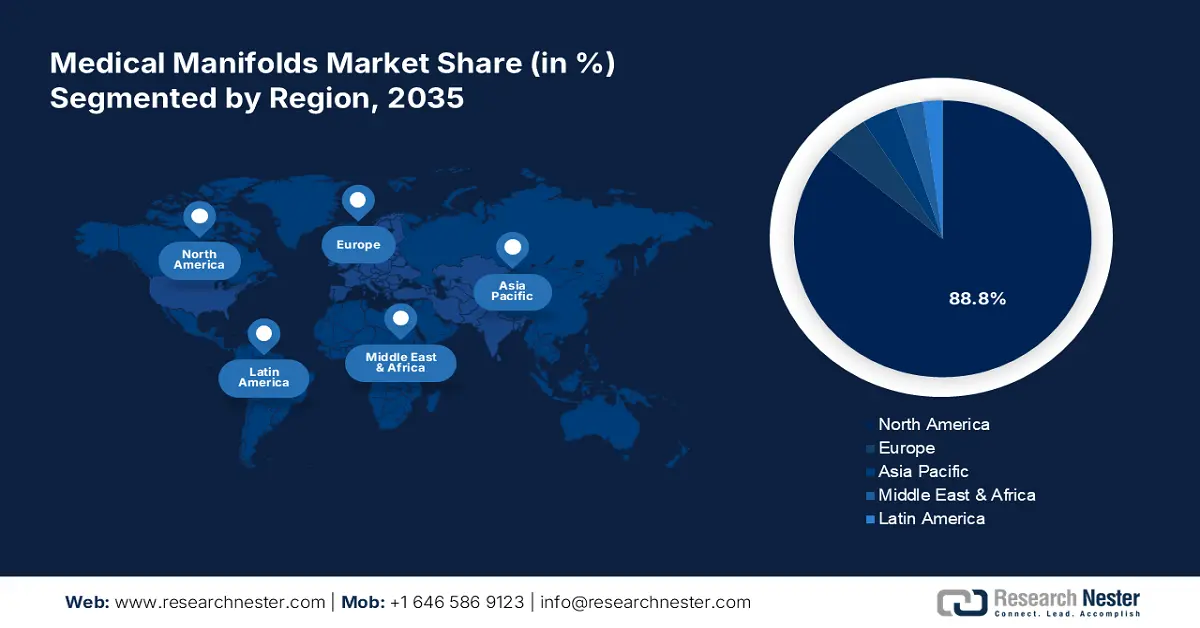

- North America commands the Medical Manifolds Market with an 88.8% share, driven by a well-established healthcare system and high adoption of advanced medical technologies, sustaining leadership through 2026–2035.

- Asia Pacific’s medical manifolds market is witnessing significant share growth, driven by increased healthcare budgets and demand for advanced medical devices, with strong prospects through 2035.

Segment Insights:

- The Manifold Systems segment is expected to secure 81.70% market share by 2035, driven by their key role in fluid control across critical care and surgical procedures.

- The Plastic segment is poised for notable growth from 2026 to 2035, fueled by its lightweight, cost-effective, and versatile applications in medical settings.

Key Growth Trends:

- Rising focus on minimally invasive surgeries

- Healthcare tech investment

Major Challenges:

- Complexity in manufacturing

- Stringent regulatory compliance

- Key Players: Cardinal Health, Getinge AB, Smiths Medical.

Global Medical Manifolds Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 631.2 million

- 2026 Market Size: USD 668.13 million

- Projected Market Size: USD 1.18 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (88.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, Japan, India, South Korea, Singapore

Last updated on : 13 August, 2025

Medical Manifolds Market Growth Drivers and Challenges:

Growth Drivers

-

Rising focus on minimally invasive surgeries: The rise in surgical procedures, driven by accidents, chronic illnesses, and elective surgeries, has increased the demand for precise fluid control systems, particularly medical manifolds. The trend toward minimally invasive techniques requires advanced, compact, and reliable medical systems for accurate fluid delivery and monitoring. According to the 2020 National Library of Medicine report, from 2003 to 2018, the representation of minimally invasive surgeries rose significantly, with residency case volumes increasing by 36%. This shift further heightens the need for high-performance manifolds in modern healthcare settings. Thus, propelling the medical manifolds market.

- Healthcare tech investment: governments and private entities are making substantial investments in healthcare innovations, driving the adoption of advanced fluid management systems integrated with medical manifolds. At the same time, original equipment manufacturers (OEMs) are increasingly demanding customized manifold solutions tailored to meet specific application needs. This growing demand for innovation and personalized solutions is fueling the expansion of the medical manifolds market, fostering new partnerships, and advancing the development of more efficient healthcare technologies.

Challenge

-

Complexity in manufacturing: Medical manifolds are highly specialized components that require precise engineering, careful design, and stringent quality control to ensure they meet the rigorous standards of the healthcare industry. The complexity of manufacturing these systems involves advanced technologies and sophisticated production methods, which can lead to a higher cost. For smaller manufacturers, these requirements can be a significant barrier, limiting their ability to compete effectively in medical manifolds market where precision and reliability are paramount.

- Stringent regulatory compliance: The medical industry operates under strict regulatory standards, such as FDA approval and ISO certifications, designed to ensure safety, performance, and reliability. For medical manifolds, meeting these rigorous requirements can be a lengthy process, often causing delays in product development. Manufacturers must invest considerable time and resources into testing, documentation, and certification, which can significantly increase compliance costs. These challenges can hinder innovation and slow the introduction of new products to the medical manifolds market.

Medical Manifolds Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 631.2 million |

|

Forecast Year Market Size (2035) |

USD 1.18 billion |

|

Regional Scope |

|

Medical Manifolds Market Segmentation:

Product Type (Manifold Systems, Manifold Caps, Manifold Fittings, Manifold Valves)

By product type, the manifold systems segment is projected to capture medical manifolds market share of around 81.7% by the end of 2035. The market is growing due to their key role in fluid control across various applications, including critical care and surgical procedures. These systems enhance precision, efficiency, and reliability. The rise in minimally invasive techniques and advancements in manifold designs, such as compact and multi-port systems, drive demand, leading to better patient outcomes and operational efficiency. The value of minimally invasive operations is anticipated to exceed USD 44 billion by 2030, according to a February 2024 article in the IOSR Journal of Dental and Medical Sciences.

Material (Stainless Steel, Aluminum, Titanium, Plastic)

Based on material, the plastic segment is expected to hold the majority of revenue share in the medical manifolds market due to its lightweight, cost-effectiveness, and versatility. Recent advancements in plastic manufacturing have greatly improved the ability to create durable, corrosion-resistant, and biocompatible manifolds, making them ideal for various medical applications. These innovative plastic manifolds not only support customization to meet specific needs but are also easily integrated with advanced technologies. As a result, they have become increasingly desirable in modern healthcare settings, particularly for disposable and single-use medical devices, where safety and efficiency are paramount.

Our in-depth analysis of the global market includes the following segments:

|

Product Type |

|

|

Material |

|

|

Application |

|

|

Modality |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Medical Manifolds Market Regional Analysis:

North America Market Statistics

North America medical manifolds market is set to hold revenue share of over 88.8% by the end of 2035. North America has a well-established healthcare system, coupled with a high adoption rate of advanced medical technologies, which drives demand for efficient fluid management solutions such as medical manifolds in hospitals, clinics, and surgical centers. Additionally, the rising prevalence of chronic conditions such as cardiovascular diseases, diabetes, and respiratory disorders increases the need for advanced medical equipment. Medical manifolds play a vital role in managing these conditions by enabling precise fluid control in treatments and monitoring systems.

Innovations in manifold design, including the use of plastics and bonded multilayer systems, have significantly improved performance, reliability, and cost-efficiency. As a global leader in medical technology, the U.S. rapidly adopts these advancements, driving medical manifolds market growth. According to a report published in January 2022, between 2019 and 2020, federal investment in medical and health research and development increased by USD 9.8 billion, or 19.0%. Additionally, the growing preference for minimally invasive procedures, known for shorter recovery times and reduced risks, has increased the demand for compact, precise medical systems where manifolds play a crucial role in fluid management and monitoring. Thus, propelling the medical manifolds market.

The healthcare system in Canada, government-funded initiatives, and growing investments in healthcare infrastructure drive the demand for advanced medical devices such as manifolds. According to government data, released in July 2024, Canada invested nearly USD 200 billion over 10 years to improve healthcare, including USD 25 billion for province-specific health priorities. These efforts aim to modernize hospitals and diagnostic centers, improve patient care, and meet the increasing healthcare needs of a growing population. Supportive policies further encourage the adoption of innovative medical technologies in both public and private healthcare settings, creating a favorable environment for the expansion of the medical manifolds market.

Asia Pacific Market Analysis

In Asia Pacific, the medical manifolds market is established to garner significant revenue share over the forecast period. Governments in the Asia-Pacific region are boosting healthcare budgets to enhance access to quality medical services, increasing demand for advanced medical devices. According to the OECD data, unveiled in November 2022, public spending on health rose across all income groups from 2010 to 2019, In 2019, out-of-pocket expenses made up 49% of total health expenditures in lower-middle and low-income Asia-Pacific countries. Additionally, the growing number of surgeries has amplified the need for efficient fluid management systems, with medical manifolds playing a key role in ensuring precise fluid delivery and control.

The rapidly aging population and the rising prevalence of chronic illnesses in China, including diabetes, hypertension, and respiratory disorders, are driving the demand for advanced healthcare solutions. For instance, about 70% of overall disease burden in China is attributable to chronic illnesses, according to a November 2020 National Library of Medicine publication. Age-related conditions and lifestyle-induced diseases require sophisticated medical equipment, with medical manifolds playing a vital role in ensuring accurate fluid control during treatments and monitoring. This growing need for effective patient care solutions underscores the increasing adoption of medical manifolds in the evolving healthcare landscape in China.

Investment in India in modernizing hospitals, diagnostic centers, and healthcare facilities, particularly in tier 2 and 3 cities, is driving demand for advanced medical devices such as manifolds, essential for efficient fluid management. According to the International Trade Administration report, released in January 2024, the healthcare industry of India surpassed USD 370 billion in 2022. The increasing number of surgeries stemming from road accidents, trauma cases, and elective procedures has intensified the demand for reliable fluid control systems. In this context, medical manifolds are essential for ensuring precision and efficiency in modern surgical environments. Thus, propelling the medical manifolds market.

Key Medical Manifolds Market Players:

- Stryker

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cardinal Health

- Getinge AB

- Smiths Medical

- Parker Hannifin Corporation

- Cook Medical

- Teleflex Incorporated

- Festo SE & Co. KG

- Becton, Dickinson and Company

- Boston Scientific Corporation

- Baxter International Inc.

- Medtronic plc

- ICU Medical, Inc.

- Merit Medical Systems

- ConvaTec Group plc

Key players in the medical manifolds market are enhancing performance and cost-efficiency through innovations in materials like bonded multilayer plastics. They are creating customized solutions and integrating smart technologies for precise fluid management. Strategic partnerships and investments in research and development are leading to compact, reliable systems for minimally invasive procedures. For instance, in January 2025, Stryker acquired Imari Medical for USD 80 per share, strengthening its venous thromboembolism portfolio and advancing medical manifolds through improved vascular solutions. Some of the key players include:

Recent Developments

- In June 2024, Festo expanded into plastic multilayer manifolds by acquiring Carville’s production system, enabling compressive solutions for medical and laboratory equipment manufacturers.

- In July 2023, BeaconMedaes launched the MAT-5, a next-generation Automatic Manifold Changeover System, offering innovative features for superior performance, reliability, and reduced operational and maintenance costs.

- Report ID: 6970

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Medical Manifolds Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.