Medical Imaging Market Outlook:

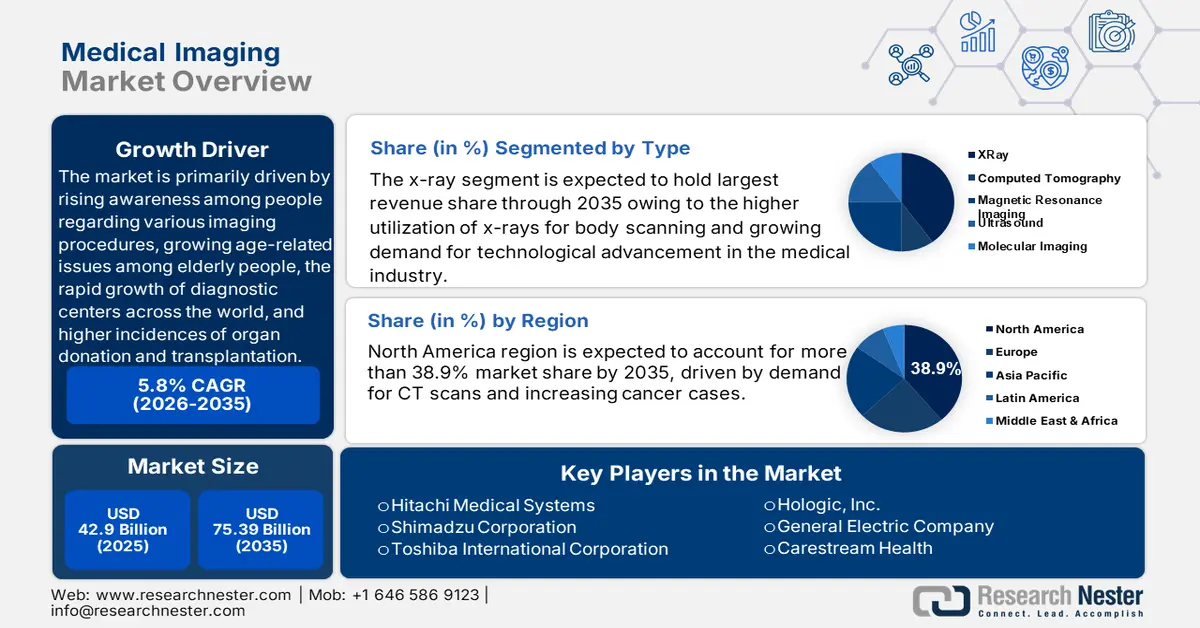

Medical Imaging Market size was valued at USD 42.9 Billion in 2025 and is expected to reach USD 75.39 Billion by 2035, expanding at around 5.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of medical imaging is evaluated at USD 45.14 Billion.

The market is primarily driven by rising awareness among people regarding various imaging procedures, growing age-related issues among elderly people, the rapid growth of diagnostic centers across the world, and higher incidences of organ donation and transplantation. In 2020, there were about 130,000 organ transplants performed worldwide. The most often transplanted organ overall was the kidney, followed by heart transplants.

The rising incidences of chronic diseases such as cancer, diabetes, and kidney disorders, increasing neurological disorders associated with brain damage, and the rising number of orthopedic issues in adults and geriatric people are expected to fuel the growth of the medical imaging market. In 2022, there were about 25,000 brand-new cases of brain and nervous system cancer. It was in 2019, about 178 million new fractures were testified around the world’s population. Furthermore, the market growth is followed by a higher number of performing CT scans, a growing number of inpatients in emergencies, and an increased need for gradual monitoring equipment during the pandemic. Globally, the number of CT scan examinations is rising by 4% annually, totaling over 300 million scans annually.

Key Medical Imaging Market Insights Summary:

Regional Highlights:

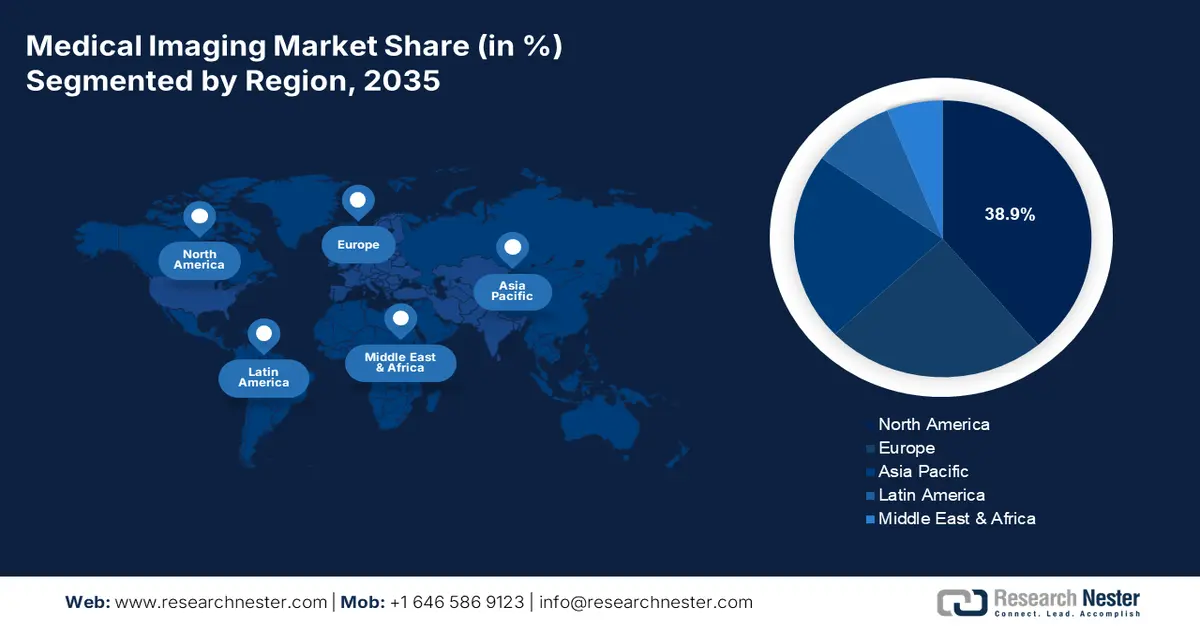

- North America medical imaging market is predicted to capture 38.9% share by 2035, driven by demand for CT scans and increasing cancer cases.

Segment Insights:

- The x-ray segment in the medical imaging market is anticipated to achieve a 40% share by 2035, driven by higher utilization of x-rays for body scanning and technological advancements in the medical industry.

Key Growth Trends:

- Growing Prevalence of Chronic Diseases in Senior Citizens Owing to Reduced Immunity

- Rise in Surgical Procedures with the Growing Adoption of Surgical Procedures such as C-Sections

Major Challenges:

- Risk of Getting Exposed to Harmful Penetrating Radiation

- Higher Cost of the Medical Imaging Machine

Key Players: Koninklijke Philips N.V., Fujifilm India Private Limited, Siemens Healthcare Private Limited, Samsung Medison Co., Ltd., Hitachi Medical Systems, Shimadzu Corporation, Toshiba International Corporation, Hologic, Inc., General Electric Company, Carestream Health.

Global Medical Imaging Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 42.9 Billion

- 2026 Market Size: USD 45.14 Billion

- Projected Market Size: USD 75.39 Billion by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 10 September, 2025

Medical Imaging Market Growth Drivers and Challenges:

Growth Drivers

- Growing Prevalence of Chronic Diseases in Senior Citizens Owing to Reduced Immunity-Around 18 million individuals every year die of cardiovascular disease (CVD) as per the statistics of the World Health Organization. CVD is one of the primary causes of global fatalities.

- Rise in Surgical Procedures with the Growing Adoption of Surgical Procedures such as C-Sections-Over 2 million surgeries were performed by surgeons in 2018 as reported by the World Health Organization and out of 100%, about 11% of all diseases and injuries require surgical treatment.

- Higher Requirement for Organ Donation owing to Rise in End-Stage Organ Failures-Every 9 minutes a new name is added to the list of organ transplantation occupied by around 100,000 people worldwide. In 2021, more than 40,000 organs are transplanted.

- Increased Expenditure on the Healthcare Sector with a Lack of Awareness or No Insurance Coverage-The health needs of people attributed to the rise in health charges universally to by approximately 4% and can hold around USD 10 trillion by the last of 2024.

- Increasing Preliminary Diagnosis Examinations During Pregnancy to Prevent Birth Complications -At least one birth defect was discovered out of 33 babies diagnosed in the U.S as of 2022 which can occur at any stage of pregnancy through ultrasound imaging technology.

- Rapidly Growing Technological Advancement Owing to FDA Approval -‘Computed tomography’ received U.S Food and Administration (FDA) approval after ten years of its arrival on the medical imaging market. That was the first major progression of imaging devices to reach the effort of the FDA to promote innovation in the field of scientific and diagnostic evolution.

Challenges

- Risk of Getting Exposed to Harmful Penetrating Radiation

- The radiation from X-rays, nuclear imaging, and CT scans are of high energy wavelength rays; it quickly enters our tissues and, if exposed for an extended period of time, can even disrupt our organs and protein structures. Radiation has the potential to harm DNA and cells. As a result, the risk of radiation exposure is anticipated to impede market expansion.

- Higher Cost of the Medical Imaging Machine

- Unavailability of Equipment in Underdeveloped Regions

Medical Imaging Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 42.9 Billion |

|

Forecast Year Market Size (2035) |

USD 75.39 Billion |

|

Regional Scope |

|

Medical Imaging Market Segmentation:

Type Segment Analysis

The global medical imaging market is segmented and analyzed for demand and supply by type into computed tomography, magnetic resonance imaging, x-ray, ultrasound, and molecular imaging. Out of all, the x-ray segment is anticipated to hold the largest market size by the end of 2035. The growth of the segment is attributed to the higher utilization of x-rays for body scanning, growing demand for technological advancement in the medical industry, rising inclination towards digitalization and automation, and increasing spending capacity of individuals in developing countries. According to the World Health Organization, nearly 3.6 billion diagnostics such as X-rays are being carried out. Out of this 3.6 billion, x-ray accounts for 40% of the total medical imaging.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Application |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Medical Imaging Market Regional Analysis:

Regionally, the global medical imaging market is studied into five major regions including North America, Europe, Asia Pacific, Latin America, and Middle East & Africa region. Amongst these markets, the market in North America is projected to hold the largest market share by the end of 2035. The market growth in North America is expected on the account of the increasing need for CT scans, a higher number of cancer patients, rising injury cases in inpatient and outpatient groups, and elevating traumatic cases in the old people such as Alzheimer’s disease. The number of new instances of cancer reported in 2021 was roughly 2 million in the United States, and the disease claimed the lives of about 600,000 people. Moreover, a higher number of CT scans performed in the region is to push the market growth in North America. Furthermore, each year, around 80 million CT scans are taken place in the United States.

Medical Imaging Market Players:

- Koninklijke Philips N.V.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Fujifilm India Private Limited

- Siemens Healthcare Private Limited

- Samsung Medison Co., Ltd.

- Hitachi Medical Systems

- Shimadzu Corporation

- Toshiba International Corporation

- Hologic, Inc.

- General Electric Company

- Carestream Health

Recent Developments

-

Siemens Healthineers announce its latest launch MAGNETOM Free. Star and NAEOTOM Alpha. It is a unique solution to both MRI and CT. The machine is built on latest dry cool technology and easier to install.

-

Hitachi Medical Systems launched two new permanent open MRI system. It has SynergyDrive workflow solution and it gives faster and automated scanning pictures.

- Report ID: 4564

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Medical Imaging Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.