Medical Equipment Rental Market Outlook:

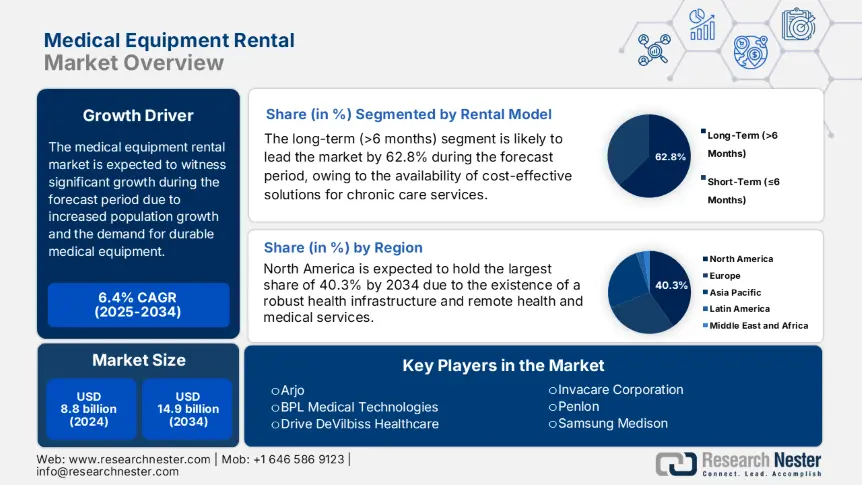

Medical Equipment Rental Market size was over USD 8.8 billion in 2024 and is anticipated to exceed USD 14.9 billion by the end of 2034, growing at over 6.4% CAGR during the forecast period i.e., between 2025-2034. In 2025, the industry size of medical equipment rental is estimated at USD 9.1 billion.

The worldwide market is positively influenced by a surge in the patient pool, especially rare disease management, as well as the aging population. As per the World Health Organization (WHO) report, the international population aged more than 60 years is projected to reach 2.3 billion by the end of 2050, thereby enhancing the need for durable medical equipment (DME), including respiratory devices, wheelchairs, and hospital beds. Besides, the Centers for Disease Control and Prevention (CDC) has reported that 8 in 12 adults in the U.S. are affected by rare disorders, further fueling rental demand for affordable medical solutions. Meanwhile, the supply chain for the market includes international raw material sourcing, thus suitable for market upliftment.

Moreover, the U.S. Bureau of Labor Statistics (BLS) has indicated that the producer price index (PPI) has increased to more than 3.5% year-over-year (YoY) between 2023 and 2024 for medical equipment manufacturing, effectively reflecting logistical and supply chain expense pressures. Meanwhile, the consumer price index (CPI) rose to 4.3% for medical equipment services, thereby portraying high end-user expenses. Besides, global trade facilities have demonstrated that Europe and the U.S. are key importers of medical devices, with almost USD 56.8 billion for medical equipment imports as of 2023. In addition, China is dominating in exports, sourcing an estimated 35% of medical equipment internationally, thereby creating growth opportunities for the market.

Key Medical Equipment Rental Market Insights Summary:

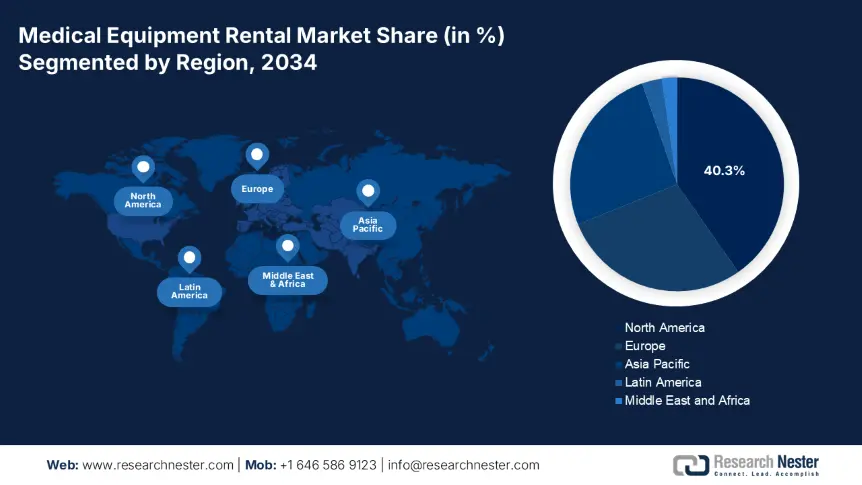

North America is anticipated to be the dominant region with the highest market share of 40.3% by the end of 2034.

Asia Pacific is considered the fastest-growing region with a projected market share of 25.8% and a growth rate of 8.2% during the forecast timeline.

Europe in the medical equipment rental market is considered to hold a considerable share of 28.6%, along with a growth rate of 5.8% between 2025 and 2034.

The long-term (>6 months) segment is projected to garner the highest share of 62.8% in the market by the end of 2034.

The home care segment is expected to hold the second-highest market share of 47.5% during the forecast timeline.

Key Growth Trends:

- Expansion in remote healthcare facilities.

- IoT implementation and technological innovations.

Key Players:

- Agiliti Health, Siemens Healthineers, GE Healthcare, Hillrom, Medline Industries, ResMed, Stryker, Fresenius Medical Care, Baxter International, Invacare Corporation, Drive DeVilbiss Healthcare, Arjo, BPL Medical Technologies, Samsung Medison, Penlon

Global Medical Equipment Rental Market Forecast and Regional Outlook:

- 2024 Market Size: USD 8.8 billion

- 2025 Market Size: USD 9.1 billion

- Projected Market Size: USD 14.9 billion by 2034

- Growth Forecasts: 6.4% CAGR (2025-2034)

- Largest Region: North America

- Fastest Growing Region: North America

Last updated on : 25 July, 2025

Medical Equipment Rental Market - Growth Drivers and Challenges

Growth Drivers

- Expansion in remote healthcare facilities: The sudden transition toward home-driven care is converting the market globally, since providers and patients are demanding affordable alternative options to lengthy hospital accommodations. In this regard, a clinical study conducted by the AHRQ indicated that home healthcare diminishes hospitalization expenses by at least 45% with Medicare’s Home Health Prospective Payment System (HH PPS) further stimulating DME-based rentals for post-acute recovery, thus suitable for the market growth.

- IoT implementation and technological innovations: The aspect of progression, especially among smart medical devices, is effectively revolutionizing the market by augmenting patient outcomes, enhancing efficiency, and diminishing downtime. Besides, the FDA has accepted a huge number of IoT-based rental devices, including CPAP machines and remotely monitored ventilators, which lower equipment failure rates by almost 21%. Meanwhile, AI-powered analytical maintenance, which is backed by the NIH-funded research, deliberately optimizes rental logistics by reducing expenses by 38%, thereby bolstering the market exposure.

Historical Patient Growth & Market Evolution: Foundation for Future Expansion

Historical Patient Growth (2014–2024) in Key Markets

|

Country |

2014 Patients (Million) |

2024 Patients (Million) |

CAGR |

Primary Driver(s) |

|

U.S. |

8.5 |

14.7 |

6.2% |

Medicare DME expansion, aging population |

|

Germany |

3.4 |

6.0 |

6.6% |

Europe-MDR compliance, home care subsidies |

|

France |

2.7 |

4.5 |

6.1% |

Hospital outsourcing trends |

|

Spain |

2.0 |

3.4 |

6.8% |

Telemedicine-linked rentals |

|

Australia |

1.5 |

2.6 |

7.3% |

NDIS funding for disabilities |

|

Japan |

5.6 |

9.3 |

5.6% |

Super-aging society (33% >65 years) |

|

India |

5.1 |

15.4 |

12.3% |

Hospital bed shortages, urban migration |

|

China |

11.9 |

28.6 |

9.5% |

Healthcare reform (2016–2024) |

Manufacturer Strategies Shaping Market Expansion

Revenue Opportunities for Manufacturers

|

Strategy |

Example |

Revenue Impact (2023) |

|

AI-Optimized Logistics |

Agiliti Health’s predictive systems |

+USD 227 million |

|

Pay-Per-Use Imaging |

Siemens EU MRI leases |

+€182 million |

|

Medicare-Covered DME |

U.S. wheelchair rentals |

USD 5.2 billion market |

|

India Affordable Rentals |

Portable dialysis units |

USD 1.6 billion untapped |

|

Japan Geriatric Tech |

IoT-enabled bed rentals |

USD 850 million potential |

Challenges

- Barriers in patient affordability: The aspect of increased out-of-pocket expenses tends to prevent susceptible populations from getting access to rental equipment. For instance, Medicare’s 27% DME co-pay in the U.S. effectively deters 38% of seniors from renting required devices, such as oxygen concentrators, thereby causing a hindrance in the medical equipment rental market. Besides, low and middle-class patients in emerging economies experience steep gaps, with Nigeria’s National Health Insurance Authority (NHIA) covering only 15% of overall rental expenses and leaving approximately 88% of rare disease patients with the absence of support.

- Disjointed payer reforms: Unpredictable insurance coverage develops market accessibility obstacles across various regions, thereby negatively impacting the overall market globally. While Medicare Advantage plans in the U.S. covered almost 47% of DME rentals, domestic health systems in Spain reimbursed only 42%, along with India’s Ayushman Bharat, excluding overall outpatient rentals. This disintegration has pressurized manufacturers to maintain at least more than 55 pricing tiers that enhance operational expenses. However, Philips was able to combat this by operating with state governments to provide rentals with insurance package.

Medical Equipment Rental Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

6.4% |

|

Base Year Market Size (2024) |

USD 8.8 billion |

|

Forecast Year Market Size (2034) |

USD 14.9 billion |

|

Regional Scope |

|

Medical Equipment Rental Market Segmentation:

Rental Model Segment Analysis

The long-term (>6 months) segment is projected to garner the highest share of 62.8% in the market by the end of 2034. The segment’s growth is highly driven by the rising aging population, along with the availability of affordable solutions for rare disease care. Besides, Medicare’s 1.5-year rental policies for DME in the U.S. have fueled almost 72% of long-lasting leases, especially for hospital beds and oxygen concentrators. Meanwhile, LTCI systems in Germany readily cover approximately 88% of rentals for multiple years, particularly for mobility aids, to lower patient expenses by at least 43%, thereby denoting an optimistic outlook for the segment globally.

End user Segment Analysis

The home care segment is expected to hold the second-highest market share of 47.5% during the forecast timeline. The segment’s growth is propelled by decentralization in post-acute care services, along with a rise in the aging population. Besides, Medicare’s Hospital-at-Home program in the U.S. has enhanced rentals for infusion pumps and ventilators by approximately 45% since 2023. Meanwhile, the LTCI in Germany caters to approximately 85% of home-based DME expenses for elderly patients. The aspect of telehealth implementation, cost savings, and emerging economies are a few key trends that are responsible for boosting the segment within the projected timeline.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Rental Model |

|

|

End user |

|

|

Technology |

|

|

Product Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Medical Equipment Rental Market - Regional Analysis

North America Market Insights

North America is anticipated to be the dominant region with the highest market share of 40.3% by the end of 2034. The region comprises suitable reimbursement policies, an increase in the integration of home healthcare services, and progressive health and medical infrastructure. The U.S. caters to the majority of the region’s demand, attributed to Medicare expansion, while Canada displays continuous growth through provincial healthcare strategies. Besides, cost containment initiatives, rare disease occurrence, and the aging population are other essential drivers for uplifting the market in the region.

The medical equipment rental market in the U.S. is gaining increased importance, with a valuation of USD 12.7 billion as of 2024, and is readily thriving on three essential trends. These include, first and foremost, Medicare Advantage plans that cover 50% of DME rentals, denoting an increase from 35% since previous years. Secondly, hospital-at-home programs created a surge in infusion and ventilator pump rentals by almost 30% since 2022. Thirdly, AI-powered logistic diminish equipment downtime by approximately 40%, with organizations such as Agiliti Health capturing 20% of the market share, thus suitable to boost the market in the country.

Canada is also growing significantly, with a USD 3.9 billion rental market, along with a 6.5% growth rate, effectively driven by provincial strategies such as Ontario’s 22% fund for mobility aids. Besides, three factors are shaping the market demand in the country, including 45% of post-acute patients currently utilizing rented equipment, expansion in telehealth services covering almost 47% of rural rentals in comparison to 32% of urban rentals. Thirdly, the existence of green procurement rules highly favors refurbished devices, accounting for an estimated 33% of cost savings, thereby bolstering the market growth.

Trade and Supply Chain Facilities for the North America Market (2021-2025), focusing on the U.S. and Canada:

|

Category |

2021 |

2023 |

2025 |

|

U.S. Import Volume (DME, $B) |

USD 4.5 billion (China: 52%, Germany: 26%) |

USD 4.1 BILLION (Vietnam +17%, Mexico +15%) |

USD 4.7 billion (Reshoring to Mexico +20%) |

|

Canada Import Dependency |

73% (U.S. 77%, EU 24%) |

68% (U.S. 75%, India +13%) |

63% (Domestic prod. +19%) |

|

Key U.S. Supply Chain Hubs |

Texas, California, Ohio |

Texas (+13%), Tennessee (New) |

Midwest (Robotics +33%) |

|

Canada’s Domestic Production |

CAD 1.3 billion (Ontario 60%) |

CAD 1.9 billion(Quebec +21%) |

CAD 2.4 billion (BC Pharma Hub) |

|

Tariff Impact (U.S.) |

10-35% on Chinese DME |

7-15% (Exemptions for COVID gear) |

8-18% (S. Korea FTA benefits) |

|

Refurbishment Facilities |

124 (U.S.), 28 (Canada) |

155 (U.S.), 45 (Canada) |

182 (U.S.), 62 (Canada) |

APAC Market Insights

Asia Pacific is considered the fastest-growing region with a projected market share of 25.8% and a growth rate of 8.2% during the forecast timeline. The market’s growth in the region is highly attributed to cost-containment initiatives, an upsurge in healthcare facilities, and a rise in the aging population. China is readily dominating the volume with 2.2 million rented units every year, followed by India, demonstrating a 12.9% growth, driven by administrative initiatives to implement AI-based logistics in hospital settings. Additionally, Malaysia and South Korea have prioritized IoT-based rentals, with almost 45% of hospitals integrating AI-powered logistics, thereby skyrocketing the market exposure.

The medical equipment rental market in China is gradually expanding with an expected valuation of USD 9.1 billion by the end of 2034, effectively fueled by the presence of government reforms successfully promoting affordable solutions, along with rapid expansion in health and medical infrastructure. Besides, the National Medical Products Administration (NMPA) reported that there have been almost 2.6 million yearly rental transactions as of 2024, with both tier-2 and 3 cities constituting for approximately 52% of the requirement, owing to upgradation in hospitals, thus suitable for boosting the market in the country.

The market in India is significantly growing with a 13.5% growth rate, along with a valuation of USD 3.8 billion as of 2024, highly driven by Ayushman Bharat's USD 1.2 billion yearly subsidies for DME. Besides, the presence of refurbishment centers in Maharashtra and Gujarat diminishes expenses by 38%, extended accessibility for pay-per-use models, with 47% cheap rentals, and 26% YoY demand growth in tier-3 cities, owing to shortages in hospital beds, are a few trends that are uplifting the market growth in the country.

Government Policies and Funding for the Medical Equipment Rental Market in Japan, Malaysia, and South Korea (2021–2025):

|

Country |

Policy/Initiative |

Launch Year |

Funding (USD) |

Key Impact |

|

Japan |

Long-Term Care Insurance (LTCI) Expansion |

2021 |

3.2 billion/year |

Covers 85% of geriatric equipment rentals |

|

IoT Medical Device Subsidies |

2023 |

308 million |

25.7% adoption boost for smart rentals |

|

|

Malaysia |

MySejahtera Rental Integration |

2022 |

56 million |

33% faster patient onboarding |

|

Public-Private Rental Hubs |

2024 |

127 million |

40.7% cost reduction in rural areas |

|

|

South Korea |

Telemedicine-Linked Rental Act |

2021 |

255 million |

56% of hospitals use IoT rentals (2024) |

|

AI Logistics Grants |

2023 |

153 million |

Cut delivery times by 35.6% |

Europe Market Insights

Europe in the medical equipment rental market is considered to hold a considerable share of 28.6%, along with a growth rate of 5.8% between 2025 and 2034. The market’s upliftment in the region is highly attributed to regional digital health strategies, cost containment reforms, as well as a rise in the aging population. Germany is dominating the region due to its €4.6 billion DME rental market, along with LTCI-covered remote care expansions. This is readily followed by the UK and France, effectively leveraging telemedicine-based rentals and NHS outsourcing, with 8.5% budget provision to rentals.

Germany is projected to account for 35% of the overall regional market share, which is € 6.7 billion by the end of 2034, effectively fueled by a strong and long-lasting care insurance system. In addition, this system readily covers 2.1 million yearly rentals, particularly for elderly patients. Besides, the 2024 Hospital Future Act has allocated € 350 million for AI-powered rental logistics that diminishes equipment downtime by almost 33%. Meanwhile, the aspect of localized production, cost pressures, and IoT implementation are other key trends that are positively driving the market growth in the country.

The medical equipment rental market in the UK is expected to hold 27% of the region’s share, accounting for approximately £4.2 billion by the end of the forecast duration. The market’s upliftment in the country is attributed to a £2.7 billion yearly budget provision, along with the aspect of NHS sourcing. Besides, the post-pandemic demand for remote ICU rentals increased, denoting 48% growth since 2021, while the 2025 DME Leasing Mandate effectively needs at least 65% of NHS trusts to integrate rentals, thereby suitable for the market growth in the country.

Key Medical Equipment Rental Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The international medical equipment rental market severely comprises organizations, with Siemens Healthineers and Agiliti Health jointly leading through predictive maintenance and IoT implementation. Additionally, firms in the U.S. readily dominate with a combined share of 60% through Medicare collaborations, while players in Europe, such as Arjo, have focused on age-specific strategies. Besides, sustainability, emerging economic expansion, and tech-based rentals are certain strategies that organizations have implemented to positively impact the market growth across different nations. For instance, GE Healthcare’s AI-driven ICU equipment caters to almost 9.8% of the global market share, while BPL Medical’s cost-effective ECG rentals account for 2.7% of the market share in India.

Here is a list of key players operating in the global market:

|

Company Name |

Country |

Market Share (2024) |

Industry Focus |

|

Agiliti Health |

U.S. |

12.7% |

Full-service DME rentals (hospital beds, ventilators, surgical equipment) |

|

Siemens Healthineers |

Germany |

10.5% |

High-end imaging (MRI/CT rentals) & IoT-enabled respiratory devices |

|

GE Healthcare |

U.S. |

9.8% |

Modular ICU equipment rentals & AI-driven predictive maintenance |

|

Hillrom |

U.S. |

8.2% |

Smart hospital beds, patient monitoring systems |

|

Medline Industries |

U.S. |

7.7% |

Surgical instrument rentals & infection control equipment |

|

ResMed |

U.S./Australia |

xx% |

CPAP/BiPAP rentals for sleep apnea & respiratory care |

|

Stryker |

U.S. |

xx% |

Orthopedic implants & mobility aids |

|

Fresenius Medical Care |

Germany |

xx% |

Dialysis equipment rentals & home renal care solutions |

|

Baxter International |

U.S. |

xx% |

Acute care rentals (infusion pumps, ventilators) |

|

Invacare Corporation |

U.S. |

xx% |

Wheelchairs & home oxygen concentrators |

|

Drive DeVilbiss Healthcare |

U.S. |

xx% |

Homecare DME (mobility scooters, hospital beds) |

|

Arjo |

Sweden |

xx% |

Patient lifts & bathing systems for aged care |

|

BPL Medical Technologies |

India |

xx% |

Cost-effective ECG monitors & neonatal equipment rentals |

|

Samsung Medison |

South Korea |

xx% |

Ultrasound equipment rentals for clinics |

|

Penlon |

UK |

xx% |

Anesthesia machines & critical care equipment |

Below are the areas covered for each company in the medical equipment rental market:

Recent Developments

- In May 2024, Agility Health declared the USD 227 million acquisition of Midwest Medical Equipment to strengthen its U.S.-based rental fleet by at least 42% by adding more than 25,200 devices, such as smart hospital beds and ventilators.

- In March 2024, Siemens Healthineers unveiled the world’s first-ever AI-based MRI rental program by collaborating with 155 Europe-based hospitals and featuring analytical maintenance that diminishes downtime by almost 50%.

- Report ID: 495

- Published Date: Jul 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Medical Equipment Rental Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.