Marine Lubricants Market Outlook:

Marine Lubricants Market size was over USD 6.62 Billion in 2025 and is projected to reach USD 8.39 Billion by 2035, witnessing around 2.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of marine lubricants is evaluated at USD 6.76 Billion.

The major factor that can be attributed to the market growth is the rapid expansion of the chemical industry across the world. Chemicals are required for the production of virtually any product in mass manufacture in today’s age. From marine lubricants to all types of lubricants to oils and greases, they are the backbone of many important products. For instance, the Indian chemical industry accounted for nearly USD 170 billion in the year 2019 and is anticipated to reach around USD 300 billion by 2025.

Marine lubricants are considered to be specially manufactured lubricants that are produced to meet the rough performance required in marine vessels for optimized operations. High-quality marine lubricants are helpful for machinery components in marine systems that require lubricants for better functioning, protection, and prolonged life cycles. As a result, the adoption rate of marine lubricants is forecasted to increase in the shipping industry. Through recent reports published by United Nations Conference on Trade and Development (UNCTAD) in 2022, it was calculated that around 80% of the world’s trade is carried through maritime transport. As the world is highly dependent on seaborne trade, it is very imperative to enhance the performance and extend the life of machinery components and systems of marine vessels to ensure uninterrupted and cost-effective propagation of trade throughout the world. This trend is expected to increase the sales of marine lubricants in the marine industry in the upcoming years.

Key Marine Lubricants Market Insights Summary:

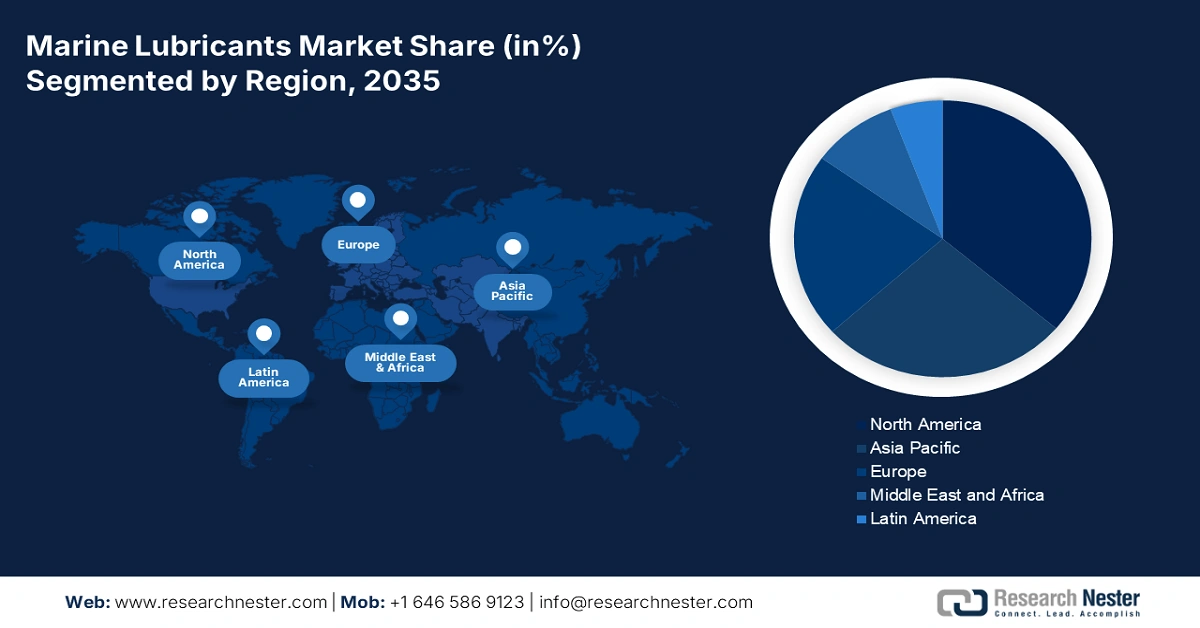

Regional Highlights:

- North America marine lubricants market, the largest share by 2035, is driven by increasing crude oil production and maritime trade dependency.

Segment Insights:

- The marine cylinder oil segment in the marine lubricants market is projected to exhibit the highest CAGR from 2026-2035, fueled by its engine-protective role and increased crude oil production.

- The bulk carrier segment in the marine lubricants market is anticipated to hold the largest share by 2035, driven by rising global trade and high lubricant usage in bulk carrier systems.

Key Growth Trends:

- High Dependence on Seaborne Trade

- Increasing Expansion Rate of Construction in the Marine Industry

Major Challenges:

- High Production Cost

- Restrictions Imposed by Government

Key Players: Royal Dutch Shell Plc, Exxon Mobil Corporation, BP p.l.c., Total SA, Chevron Corporation, The PJSC Lukoil Oil Company, Croda International Plc, Repsol S.A., Gazprom Neft PJSC, AvinOil S.A.

Global Marine Lubricants Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.62 Billion

- 2026 Market Size: USD 6.76 Billion

- Projected Market Size: USD 8.39 Billion by 2035

- Growth Forecasts: 2.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, Singapore

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 10 September, 2025

Marine Lubricants Market Growth Drivers and Challenges:

Growth Drivers

- High Dependence on Seaborne Trade – With industrialization taking its peak, the trading sector has swelled exponentially. As a result, the seaborne trade carries a major marine lubricants market share owing to its easiness and other advantages. Thus, the rising seaborne trade is expected to rise the need for ships and sea vessels which in turn is expected to increase the utilization of marine lubricants in the marine sector. The International Trade Administration showed the valuation of export through maritime in the U.S. to be USD 586 million and the valuation of imports to be USD 1,176 million in 2018.

- Increasing Expansion Rate of Construction in the Marine Industry – With the growing industrialization, the construction processes in the marine industry are also rising to generate the need for marine lubricants for varied purposes. According to estimates, by the end of 2025, the construction industry in India is expected to reach a total value of USD 1.3 trillion.

- High Number of Ships present in the World - As per the government of the UK, the total number of vessels in the world trading fleet rose from 62,100 vessels in 2020 to 63,000 vessels in 2021.

- Rising Government Support to Expand the Chemical Industry – Within the Union Budget 2022-23, the Indian government allocated approximately USD 27 million to the Department of Chemicals and Petrochemicals.

- Growing Marine Economy – The statistics of the U.S. Bureau of Economic Analysis show the marine economy of the United States accounted for 1.7 percent, or USD 361.4 billion of the total gross domestic product (GDP) in 2020.

Challenges

- High Production Cost - Base oils are essential for making lubricants and other fluids, therefore their scarcity has been a major problem. One of the main elements that affect base oil pricing is the price of crude oil, and lubricants have been particularly hard hit by rising crude oil and fuel prices.

- Restrictions Imposed by Government

- Lack of Expert Professionals

Marine Lubricants Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

2.4% |

|

Base Year Market Size (2025) |

USD 6.62 Billion |

|

Forecast Year Market Size (2035) |

USD 8.39 Billion |

|

Regional Scope |

|

Marine Lubricants Market Segmentation:

Product Segment Analysis

The global marine lubricants market is segmented and analyzed for demand and supply by product into marine cylinder oil, piston engine oil, system oil, and others. Out of these segments, the marine cylinder oil segment is expected to hold the highest growth by the end of the year 2035 owing to its crucial role in protecting the engine components and enhancing the performance of the engine, and increasing the production of crude oil. As of July 2022, the United States had generated 365,785 thousand barrels of crude oil. Further, the easy availability of marine cylinder oil and its low cost it is expected to boost the segment growth in the next few years. Also, the mixture of several mineral oils, marine cylinder oil has various properties and advantages that can be used in luxury and cruise ships.

Ship Type Segment Analysis

The global marine lubricants market is also segmented and analyzed for demand and supply by ship type into the bulk carrier, oil tankers, general cargo, container ships, and others. Out of these, the bulk carrier segment is attributed to holding the largest share during the assessment period. Bulk carrier vehicles are being heavily used for the transportation of bulk unpackaged cargo that includes steel, grains, cement, coal, and others. Furthermore, the high consumption of marine lubricants in bulk carrier vehicles owing to its demand in systems and components such as lifeboat launch systems, engine and davit, shaft bearing, mooring winch, main engine, and others is estimated to fuel the growth of the segment. Moreover, the rising global trade and the need to transport carriers from one place to another requires bulk carriers which subsequently expands the segment size.

Our in-depth analysis of the global market includes the following segments:

|

By Ship Type |

|

|

By Product |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Marine Lubricants Market Regional Analysis:

North American Market Insights

The North America marine lubricants market, amongst the market in all the other regions, is projected to hold the largest market share by the end of 2035, on the back of the increasing production of crude oil and increasing value of import and export of oil products in the region. It was observed that, as of July 2022, the import and export of crude oil accounted for 6352 thousand barrels per day of crude oil in the United States. Also, the high dependency on maritime trade in the region is expected to increase the utilization rate of ships and cargo, which in turn, is projected to bring positive sales in the market.

APAC Market Insights

On the other hand, the market in the Asia Pacific is also estimated to remain a major consumer of marine lubricants during the forecast period. The presence of major sheep fleet companies along with the high number of dry docks is the major factor estimated to fuel the market growth in the region. In addition, the increasing sea trade in emerging economies such as India, China, and Taiwan and their trade activities are anticipated to fuel market growth. Moreover, the high number of naval combat vessels in the region is also projected to support marine lubricants market growth in the region.

Marine Lubricants Market Players:

- Royal Dutch Shell Plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Exxon Mobil Corporation

- BP p.l.c.

- Total SA

- Chevron Corporation

- The PJSC Lukoil Oil Company

- Croda International Plc

- Repsol S.A.

- Gazprom Neft PJSC

- AvinOil S.A.

Recent Developments

-

Royal Dutch Shell Plc signed an agreement with China COSCO Shipping Company Limited (COSCO SHIPPING), for the supply of marine lubricants for five multi-purpose pulp carriers till the end of 2020.

-

Lukoil Marine Lubricants and a Dubai-based subsidiary of The PJSC Lukoil Company renewed its contract for the supply of marine lubricants to 24 ships of Kuwait Oil Tanker Company (KOTC).

- Report ID: 4561

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Marine Lubricants Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.