Male Infertility Market Outlook:

Male Infertility Market size was valued at USD 4.59 billion in 2025 and is set to exceed USD 7.55 billion by 2035, expanding at over 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of male infertility is estimated at USD 4.8 billion.

The male infertility market is poised to witness significant growth owing to increased acceptance of male infertility as a medical condition. The shift in societal attitudes has led to a surge in demand for treatments, diagnostics tests, and support services. As the dissemination of information becomes easier due to rising digitization, more men and couples will become educated about male infertility, further boosting the male infertility market growth.

The World Health Organization (WHO) states low sperm count, abnormal morphology and motility of sperm, and issues in ejaculation are the most common issues for male infertility. Male infertility can be categorized into primary and secondary infertility i.e. primary infertility is when a male has never impregnated a fertile female and secondary infertility is when the male has impregnated a female prior but is unable to do so for the second term. As male infertility cases rise due to unhealthy diets, increasing stress levels, and sedentary lifestyles, the demand for specialized male fertility care is projected to boom.

An Oxford Academic paper estimated male infertility affects 7% of all men. The increased media coverage on news outlets and social media platforms has managed to dispel misconceptions about male infertility. Additionally, celebrity advocacy such as from Gordon Ramsay, Mark Zuckerberg, John Legend, etc., has led to greater penetration in dispelling stigmas associated with male infertility. The percentage of males undergoing fertility tests increases as fertility care improves globally which leads to the remarkable growth of the market revenue share.

Key Male Infertility Market Insights Summary:

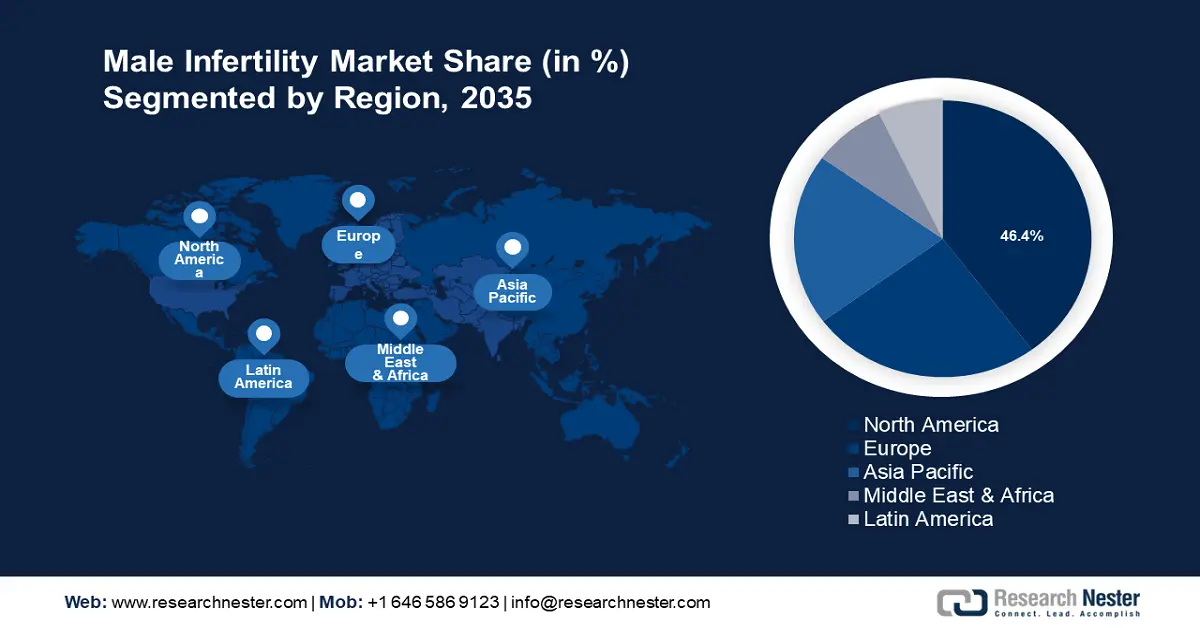

Regional Highlights:

- North America male infertility market will account for 46.40% share by 2035, driven by increasing awareness and innovations in ART for infertility care.

Segment Insights:

- The hospital pharmacies segment in the male infertility market is expected to see significant growth till 2035, driven by its significance as a primary distribution channel for essential medications and increased accessibility.

- The dna fragmentation test segment in the male infertility market is forecasted to achieve a substantially increased revenue share by 2035, propelled by rising awareness and demand for early diagnosis of male infertility.

Key Growth Trends:

- Aging paternity rates

- Technological innovations in ART

Major Challenges:

- High cost of treatment

- Social stigma and lack of awareness in emerging economies

Key Players: Andrology Solutions, Merck, Vitrolife Group, HalotechDNA, Bayer AG, SCSA Diagnostics, Inc., Examen, Carrot Fertility.

Global Male Infertility Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.59 billion

- 2026 Market Size: USD 4.8 billion

- Projected Market Size: USD 7.55 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 18 September, 2025

Male Infertility Market Growth Drivers and Challenges:

Growth Drivers

- Aging paternity rates: Globally, the age of men attaining fatherhood has increased leading to demand for infertility products. Delays in fatherhood can cause fertility issues owing to age-related decline in sperm quality and quantity. In 2022, Science Direct published a study stating that in the past 4 decades, the number of fathers conceiving a child for the first time in ages 30 to 34 increased by 15%, and in first-time fathers aged 35 to 49 increased by 63%. The increasing age in attaining fatherhood increases the infertility rate amongst men as sperm quality declines. This trend leads to greater demand for male fertility care leading to the growth that the market is experiencing currently.

- Technological innovations in ART: Innovations in assisted reproductive technologies (ART) such as intracytoplasmic sperm injection (ICSI), vasal aspiration, testicular sperm extraction, and epididymal aspiration are addressing male infertility. In 2023, a University of California Health (UCSF) study indicated that fertilization rates of 70 to 80% are successful with ICSI procedures and in the UCSF IVF laboratory, the fertilization rate with ICSI stands at 80 to 85%. Innovations in fertility care research lead to more couples and single males seeking fertility care, and as the accessibility to quality fertility care improves in emerging economies, the market will continue to register a significant profit share.

- Growing impact of environmental, occupational, and health-related factors: The rising cases of infertility in men is driven by a range of environmental, occupational, and health related factors. For instance, in November 2023, Healthy Male, reported that light and heavy smokers have reduced sperm quality due to DNA damage in sperm. Additionally, diet, lifestyle changes, obesity, stress, and environmental factors are also increasingly affecting men. A 2020 study published in the National Library of Medicine found, idiopathic infertility as the most recurrent diagnosis in male infertility representing almost 44% of cases. As awareness rises on health, lifestyle choices, and the treatment available, the demand for early testing and treatment is increasing manifolds.

Challenges

- High cost of treatment: A major constraint of the market is the high cost of ICSI, IVF, and other treatments. Advanced fertility care treatment for males requires multiple cycles that scale up the cost making it unaffordable for many patients. Many patients who do not have comprehensive insurance coverage struggle to finish the treatment cycle. Additionally, fertility clinics and services are concentrated in urban areas limiting accessibility to developing regions. The disparity in the availability of treatment along with the high cost can stymy the male infertility market growth.

- Social stigma and lack of awareness in emerging economies: Despite growing awareness and sponsored awareness drives, male infertility continues to remain a sensitive topic. Many men may be reluctant to seek fertility care due to cultural and social pressure. Prevailing tropes on masculinity can negatively affect men’s willingness to seek professional help. Additionally, the awareness drives in emerging economies is comparatively slower which can reduce the rate of market growth in certain developing regions.

Male Infertility Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 4.59 billion |

|

Forecast Year Market Size (2035) |

USD 7.55 billion |

|

Regional Scope |

|

Male Infertility Market Segmentation:

Distribution Channel Segment Analysis

Hospital pharmacies segment is anticipated to hold male infertility market share of over 31% by the end of 2035. The revenue growth of the segment is attributed to its significance as a primary distribution channel for essential medication and supplies. The number of pharmacies offering fertility care products has increased as the market sees growth leading to greater accessibility. In June 2024, NLM published a report on the rising demand for urologists and male fertility care. The report estimates around over 500000 men require reproductive urologist care annually leading to the rising demands for fertility care in men. Additionally, the product offerings to care for male infertility are expanding leading to greater footfall in hospital pharmacies for sell of medications such as supplements, antibiotics, hormonal therapies, and fertility drugs. The segment’s growth is projected to continue as an increasing number of males seek fertility care in hospitals leading to greater sales of male fertility care products in hospital pharmacies.

Retail pharmacies and drug stores are poised to have a considerable revenue growth during the forecast period. This segment is a vital distribution channel for male infertility products providing patients with convenient access to medications, supplements, and over the counter remedies. Retail pharmacies and drug stores offer a consumer-friendly approach to male fertility cater and are accessible to a broader demographic including men who are seeking supplemental or preventive products for early-stage infertility concerns. Due to ease of accessibility, the segment is poised for rapid growth as more males seek first line interventions such as vitamins, antioxidants, over the counter supplements. Additionally, availability of generic versions of fertility care drugs and supplements can be cost effective options for price conscious demographics boosting the segment’s growth.

Test Segment Analysis

DNA fragmentation in male infertility market segment is projected to increase its revenue share substantially during the forecast period due to rising awareness in males. It is an important biomarker for male infertility and healthcare professionals can tailor effective treatment plans by addressing underlying causes of DNA fragmentation. As early diagnosis demands for male fertility care grow, the demands for DNA fragmentation tests are poised to increase. Additionally, rising disposable income in emerging economies has made DNA fragmentation tests more accessible to males contributing to the segment’s growth. In July 2023, Medical Electronic Systems launched the QwikCheck DFI kit that is designed to make laboratory tests for DNA fragmentation quicker and easier.

Our in-depth analysis of the male infertility market includes the following segments

|

Distribution Channel |

|

|

Test |

|

|

Treatment |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Male Infertility Market Regional Analysis:

North America Market Insights

North America industry is expected to account for largest revenue share of 46.4% by 2035. Innovations of ART have assisted the rapid growth in the market share of the region. A recent meta-analysis found that male fertility had declined by more than 50% in North America which has led to greater demands for male infertility care. A key market driver is the increasing awareness drives such as the National Infertility Awareness Week (NIAW) conducted by the American Society for Reproductive Medicine that help dispel stigma around male infertility care. The growing awareness opens access to male fertility care to a wider set of demographics which in turn assists the robust growth of the market.

The U.S. is at the forefront of the revenue boom in North America. The Centers for Disease Control (CDC) estimates the male infertility rate in the United States to be around 11.4% of men aged between 15 to 49 years between 2015 to 2019. CDCs report found that infertility had increased from 7.8% in ages 15-24 to 14.3% between 2015 to 2019. The increase in male infertility in the U.S. is leading to greater demand for male fertility care which helps the market’s growth. CDC’s report also indicated that male infertility has increased in married men compared to single and cohabiting men and social factors indicate that married men are more likely to seek fertility care. Additionally, the U.S. general fertility rate fell by 3% from 2022 as per a CDC report released in April 2024, which is poised to increase the government investments in awareness drives to combat the falling fertility rates.

Canada is a leading male infertility market in North America and profits from the region’s overall growth. The market in Canada benefits from the robust regulatory ecosystem for healthcare and the growing demands for male fertility care. Canada is witnessing trends where paternal age is increasing which may increase infertility cases. For instance, in April 2024, Institut de la Statistique du Québec published a report stating paternal age had increased to 33.8 in 2022 from 30.3 in 1976. Additionally, the report stated that men in their twenties are facing a decrease in fertility over the past decade. Such trends are projected to increase the demand for quality male fertility care in Canada during the forecast period.

Europe Market Insights

Europe is poised to have profitable male infertility market growth during the forecast period owing to several factors such as the declining rate of birth, increasing cases of male infertility, awareness drives, and expansion of fertility preservation services. With the cases of cancer rising, the demand for male fertility preservation before treatment is increasing. In 2024, a study published in Oxford Academic stated that centers providing specialized crypto preservation of immature human testicular issues in Europe had increased in the last 20 years indicating a growing demand for male fertility care.

UK is poised to lead the male infertility market revenue share in Europe. UK is at the forefront of research on male infertility in Europe. For instance, in January 2022, Newcastle University published groundbreaking research showing new mutations during the reproduction process when the DNA of both parents is replicated can lead to infertility in men. Fertility awareness among the younger generations is increasing owing to a positive dissemination of information in social media channels regarding male infertility. The fertility index survey indicated that 11% of all men reported fertility issues with the highest concentration in the 18-24 age group in males. The rising cases and increasing awareness in younger demographics are poised to maintain the robust market growth in the UK.

Germany is expected to have a rapid increase in its revenue share during the forecast period. In December 2016, a researched published in Demographic Research indicated that fertility has decreased in German men compared to 1991 owing to various factors. The decline in sperm count of men in Europe in the past 50 years affects Germany and increases the demand for premium fertility care for men.

Male Infertility Market Players:

- Andrology Solutions

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Merck

- Vitrolife Group

- HalotechDNA

- Bayer AG

- SCSA Diagnostics, Inc.

- Examen

- Posterity Health

- ExSeed Health

- Carrot Fertility

- Reproductive Medicine Associates

The male infertility market is competitive with global, regional, and local players vying for market share. Key market players in national and global markets are focusing on acquisitions, research and development, and product launches for early fertility care to increase their market revenue shares.

Some of the key players in the male infertility market are:

Recent Developments

- In July 2024, LEGACY secured USD 7.5 million to make sperm testing and storage more accessible to all clients, especially military clients.

- In June 2024, Ferring Health and Posterity launched a new male fertility program on Ferring’s Fertility Out Loud platform enabling men to understand their fertility status.

- In June 2023, University of Alberta found unique protein biomarkers that can indicate whether surgery will work and offer non invasive diagnosis to couples.

- In June 2021, Nova IVF Fertility and Southend Fertility announced a strategic partnership to increase their presence in Delhi, India.

- Report ID: 6485

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Male Infertility Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.