Low Foam Surfactants Market Outlook:

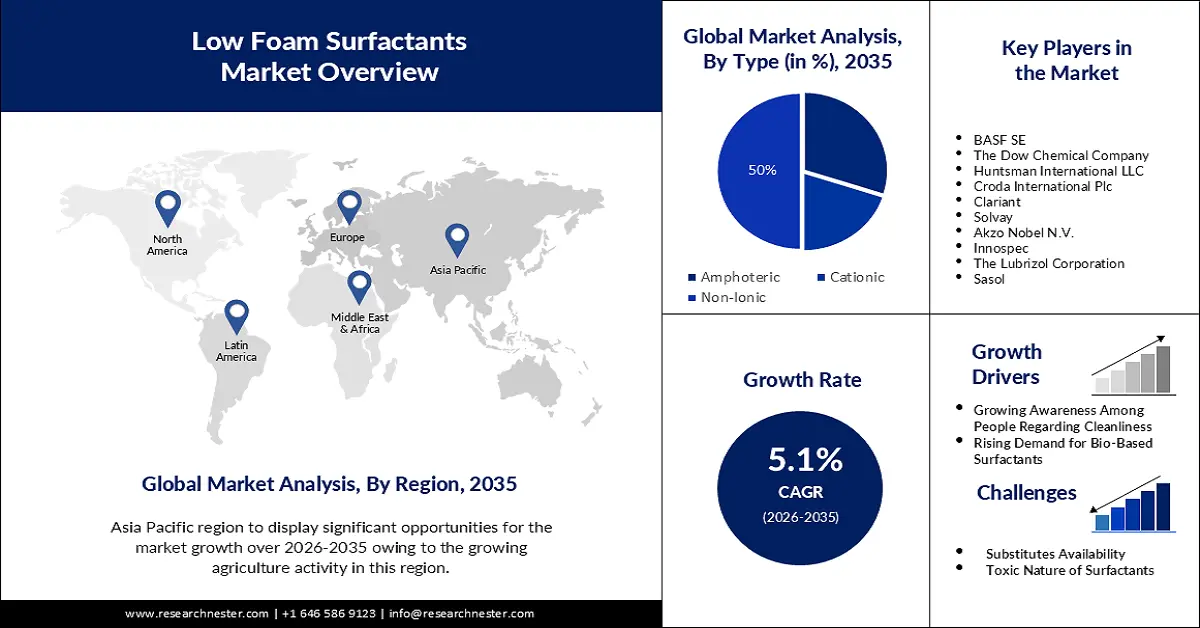

Low Foam Surfactants Market size was over USD 17.17 billion in 2025 and is projected to reach USD 28.24 billion by 2035, growing at around 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of low foam surfactants is evaluated at USD 17.96 billion.

This growth is set to be encouraged by the growing production of paper & pulp. Roughly 95 million metric tons of graphic paper were manufactured around the world in 2021. Manufacturing of packaging paper and board was about 263 million metric tons in the meantime. In total, nearly 416 million metric tons of paper and paperboard were generated worldwide in 2021. Hence, with this increase in production the market for low foam surfactants is also expected to expand.

The paper which is under production has to go through different stages. Defoamers must be used throughout the whole paper-producing process. All varieties of paper goods are produced with the aid of defoaming agents. They lessen paper breakage, thereby increasing the efficiency of the paper machine and increasing output at the paper mill. Moreover, defoamers substantially decrease the amount of steam used by the dryers, resulting in energy-efficient operation that lowers expenses. As a result, the utilization of low-foam surfactants is growing.

Key Low Foam Surfactants Market Insights Summary:

Regional Highlights:

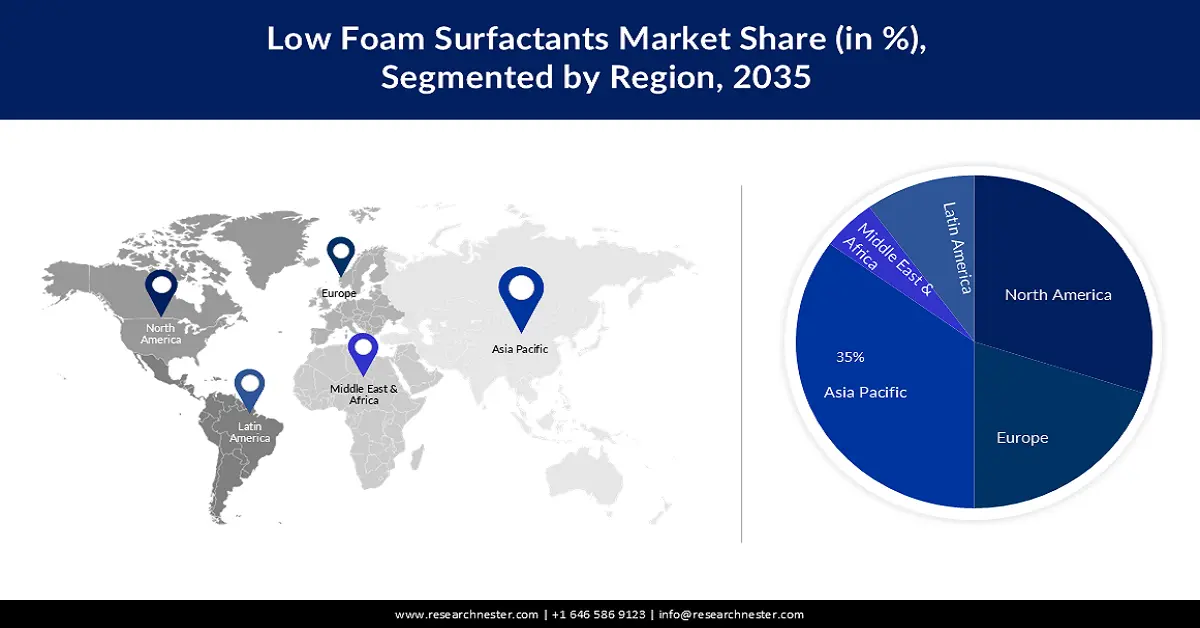

- The Asia Pacific low foam surfactants market is expected to capture 35% share by 2035, attributed to increasing agricultural activity and agrochemical demand.

- The North America market will achieve substantial CAGR during 2026-2035, fueled by rising demand for food and dairy processing efficiency.

Segment Insights:

- The non-ionic segment in the low foam surfactants market is expected to attain a 50% share by 2035, attributed to the widespread use of non-ionic surfactants in household and personal care products due to their superior cleaning properties.

- The detergents & cleaning agents segment in the low foam surfactants market is forecasted to achieve a 40% share by 2035, fueled by rising demand for low-foam detergents with appealing fragrances and increased urban consumption.

Key Growth Trends:

- Growing Awareness Among People Regarding Cleanliness

- Rising Demand for Bio-Based Surfactants

Major Challenges:

- Substitutes Availability

- Toxic Nature of Surfactants

Key Players: BASF SE, The Dow Chemical Company, Clariant AG, Croda International Plc, Evonik Industries AG, Huntsman Corporation, Stepan Company, Kao Corporation, Solvay S.A., Akzo Nobel N.V.

Global Low Foam Surfactants Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 17.17 billion

- 2026 Market Size: USD 17.96 billion

- Projected Market Size: USD 28.24 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Thailand, Indonesia, Brazil

Last updated on : 11 September, 2025

Low Foam Surfactants Market Growth Drivers and Challenges:

Growth Drivers

- Growing Awareness Among People Regarding Cleanliness: ore and more people are becoming aware of cleanliness not only in developed countries but also in developing nations. Low-foaming surfactants have less foam volume, which is particularly advantageous in cleaning operations requiring a lot of mechanical energy. Hence, the utilization of low-foam surfactants is growing in detergents and household rinse aids. Therefore, with the growing people's preference for cleanliness, they would demand these detergents further boosting the market growth.

- Rising Demand for Bio-Based Surfactants: Biosurfactants are amphiphilic substances that are either released extracellularly or synthesized on the surfaces of living things. They have the capacity to lower the tension on the surface between a fluid and a solidifying agent as well as between two liquid surfaces since they contain both hydrophilic and hydrophobic components. The governments of numerous nations throughout the world are working to encourage the consumption of eco-friendly or green surfactants due to the negative consequences and non-biodegradable nature of chemically synthesized surfactants. As a result of their high biodegradability and low toxicity, bio-based low-foam surfactants are becoming more popular among end users. For instance, in 2022, by assisting in the removal of fossil carbon from the value chain, Clariant introduced its new Vita 100% bio-based surfactants and polyethylene glycols (PEGs) to directly combat climate change.

- Surge in Demand for Cosmetics: In many cosmetics formulas, surfactants play an essential role. Various cosmetics application such as body cleansing, and wetting is possible with the utilization of surfactants. However, in the past, the use of foam in order to create bubbles was also high and was greatly liked by people. But in spite of that, the use of low-foam surfactants was encouraged. Low foam detergents utilize fewer resources such as energy and water compared to high foam detergents, making them more environmentally friendly. Moreover, low-foam detergents are more economical since people may use less of them per load since they are more concentrated. As a result, their use in cosmetics is growing.

Challenges

- Substitutes Availability - Low-foam surfactants have the potential to be replaced by anionic surfactants with comparable properties. Anionic surfactants are commonly employed as emulsifiers, wetting agents, spreading agents, and foaming agents. They are utilized in agrochemicals, oilfield chemicals, personal care products, laundry detergent, cosmetics, industrial and institutional cleaning, and personal care goods. Hence, this factor is projected to restrain the market expansion.

- Toxic Nature of Surfactants

- Surge in Price of Raw Materials Required for Low Foam Surfactants

Low Foam Surfactants Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 17.17 billion |

|

Forecast Year Market Size (2035) |

USD 28.24 billion |

|

Regional Scope |

|

Low Foam Surfactants Market Segmentation:

End-User Industry Segment Analysis

The detergents & cleaning agents segment in the low foam surfactants market is set to garner a share of about 40% during the projected period. The need for low-foam surfactants has grown significantly as a consequence of the increase in laundry detergents and cleaners for domestic and commercial use. Additionally, consumers are purchasing detergents with various smells since fresh perfumes are currently fashionable, thereby rendering them popular in urban areas and fueling the market's expansion. Moreover, increasing fast-paced lifestyles have already pushed major market participants to develop innovative customer-drawing techniques. Hence, this element is also driving demand for detergents & cleaning agents further influencing market growth.

Type Segment Analysis

The non-ionic segment in the low foam surfactants market is expected to grow at the highest share of approximately 50% over the coming years. The non-ionic surfactants provide enhanced emulsification, reduced foam, and reduced water solubility. The nonionic alkoxylates containing ethylene and propylene oxide function work exceptionally well when cleaning. Non-ionic low-foam surfactants are in great demand as a result of their widespread use in household and personal care cleansers and detergents.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

End-User Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Low Foam Surfactants Market Regional Analysis:

APAC Market Insights

The Asia Pacific low foam surfactants market is projected to grow at the largest share of about 35% over the projected period. This could be owing to growing agricultural activity in this region. For instance, China is estimated to experience a surge in food supplies and various different agricultural products by about 650 million tons. Hence, the need for low-form surfactants will also rise since it is used in agrochemicals for rapid and healthy production of crops.

North American Market Insights

The low foam surfactants market in North America is also poised to experience substantial growth by the end of 2035. The major factor for its growth in this region is the rising demand for food & dairy products. For many companies involved in food processing, foaming is a crucial unit action. Hence, the use of low-foam surfactants is growing in this region.

Low Foam Surfactants Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- The Dow Chemical Company

- Huntsman International LLC

- Croda International Plc

- Clariant

- Solvay

- Akzo Nobel N.V.

- Innospec

- The Lubrizol Corporation

- Sasol

Recent Developments

- With RSPO (Roundtable on Sustainable Palm Oil) certifications, the BASF SE Home Care, I&I, and Industrial Formulators Europe division has greatly increased the range of palm-based surfactants in its offering.

- In order to commercialize its portfolio of high-performance sophorolipid biosurfactants in the international personal care and home care industries, The Dow Chemical Company established an exclusive agreement with Locus Performance Ingredients (Locus PI). Compared to traditional surfactants, the chemicals offer a significant reduction in carbon impact. Through this collaboration, Dow will be better able to meet the growing demand from consumers for ingredients that are sustainable, biobased, and biodegradable.

- Report ID: 5236

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Low Foam Surfactants Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.