Lithium Cobalt Oxide Market Outlook:

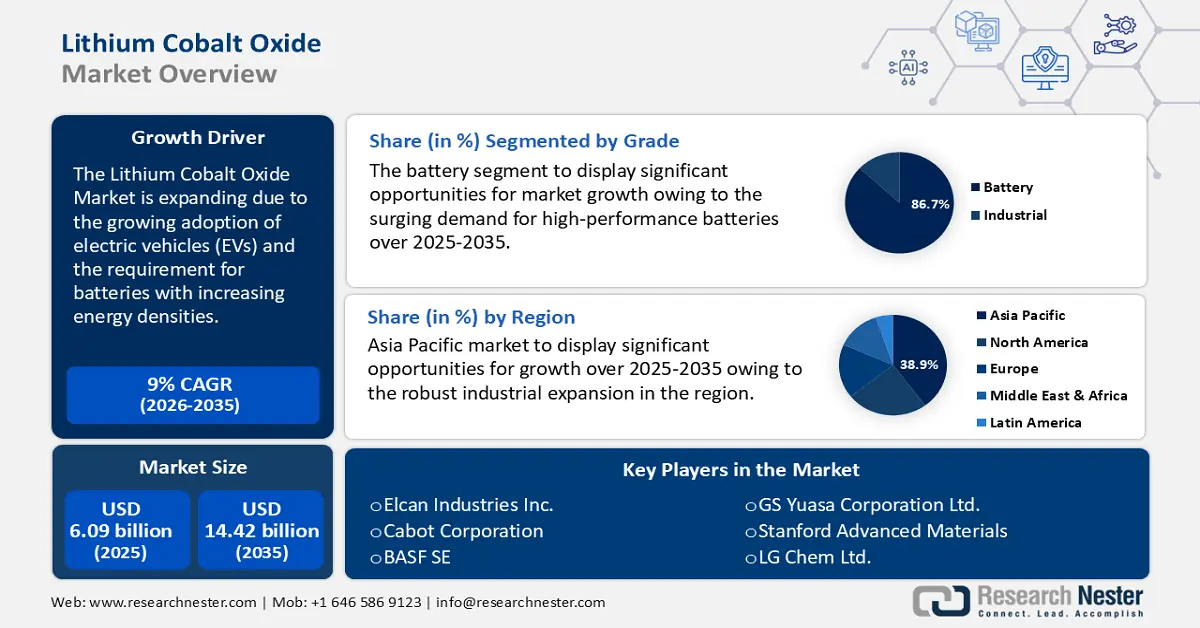

Lithium Cobalt Oxide Market size was over USD 6.09 billion in 2025 and is poised to exceed USD 14.42 billion by 2035, witnessing over 9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of lithium cobalt oxide is estimated at USD 6.58 billion.

The market is skyrocketing due to the growing adoption of electric vehicles (EVs) and the requirement for batteries with increasing energy densities. The International Energy Agency (IEA) reported that 14 million electric cars were sold in 2023. In terms of overall sales, the proportion of electric vehicles has grown from 4% in 2020 to 18% in 2023.

Also, its range of uses, from laptops and smartphones to grid-scale energy storage solutions, attests to its significance and versatility in driving contemporary technologies. The need for lithium cobalt oxide is increasing due to the rapid rise of electric mobility, integration of renewable energy, and portable devices. This is propelling advancements in battery technology and sustainable energy solutions.

Key Lithium Cobalt Oxide Market Insights Summary:

Regional Highlights:

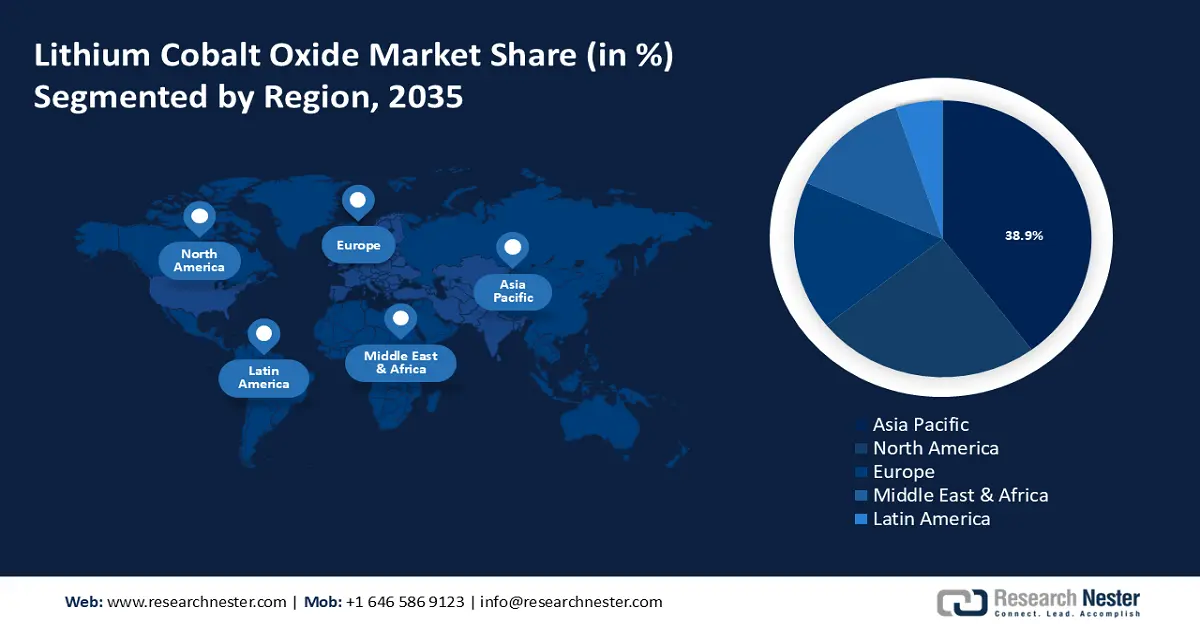

- Asia Pacific commands a 38.9% share of the Lithium Cobalt Oxide Market, driven by technological advancements and lithium-ion battery demand, positioning it as a global leader in battery manufacturing through 2026–2035.

- North America’s lithium cobalt oxide market is poised for significant expansion by 2035, driven by growing demand in automotive and defense sectors.

Segment Insights:

- The Consumer Electronics segment of the Lithium Cobalt Oxide Market is expected to experience substantial growth by 2035, fueled by technological innovations and the introduction of new electronic gadgets.

- The Battery segment is expected to capture 86.7% market share by 2035, propelled by surging demand for high-performance batteries in consumer electronics, EVs, and energy storage systems.

Key Growth Trends:

- Increased focus on energy density and performance optimization

- Growing development of thin-film lithium battery

Major Challenges:

- Volatile prices of cobalt

- Environmental and ethical concerns

- Key Players: Cosmo Advanced Materials & Technology Co., Ltd., Elcan Industries Inc., Cabot Corporation, BASF SE, GS Yuasa Corporation Ltd., Stanford Advanced Materials, Beijing Easpring Material Technology Co., Ltd., LG Chem Ltd., BYD Company Limited, Samsung SDI Co., Ltd..

Global Lithium Cobalt Oxide Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.09 billion

- 2026 Market Size: USD 6.58 billion

- Projected Market Size: USD 14.42 billion by 2035

- Growth Forecasts: 9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.9% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, Japan, South Korea, United States, Germany

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 14 August, 2025

Lithium Cobalt Oxide Market Growth Drivers and Challenges:

Growth Drivers

- Increased focus on energy density and performance optimization: Higher energy density, faster charging times, and longer cycle lives are required in lithium cobalt oxide batteries due to the increased popularity of EVs, portable gadgets, and grid-scale energy storage systems. By utilizing advancements in materials science and battery engineering, battery makers are allocating resources toward research and development aimed at improving the safety and performance of lithium cobalt oxide batteries.

Also, compared to lead-acid batteries, which have an energy density of about 75 Wh/kg, lithium-ion batteries have some of the highest energy densities of any commercial battery technology, reaching as high as 330 Wh/kg. Furthermore, Li-ion cells are appropriate for high-power applications such as transportation since they can provide up to 3.6 volts, 1.5–3 times the voltage of alternatives. - Growing development of thin-film lithium battery: Micro-electromechanical systems (MEMS) and smart wearables have developed rapidly in recent years, necessitating the urgent need for suitable power sources with high energy density and long cycling lives. Integrated circuits, smart security cards, and other intelligent systems with micron or nanoscale structures require power supplies that are thin, light, long-lasting, safe, and have a high energy density. As a result, research on thin-film and tiny lithium-ion batteries (LIBs) have gained significant traction. Lithium cobalt oxide (LCO) is one of the modern cathode materials with a high volumetric capacity and working potential, and a volumetric change that is small enough to prevent film cracking during cycling. Furthermore, without the need for conductive additives, the LCO cathode's strong conductivity can meet the electron transport property.

- Increasing investments in research & development activities: Major players are investing highly in R&D to develop new lithium cobalt oxide batteries such as lithium-ion batteries that are more efficient and have a longer lifespan. For instance, in November 2023, more than USD 1 billion was invested by E-One Moli to grow its British Columbian battery production and research and development center. The E-One Moli plant will grow to be Canada's biggest producer of high-performance lithium-ion battery cells for use in environmentally friendly transportation. Once complete, the plant will provide the newest generation of high-performance lithium-ion battery cells for use in aircraft, consumer electronics, medical, and high-performance automobiles.

Challenges

- Volatile prices of cobalt: Trade laws, supply-demand imbalances, and geopolitical concerns all contribute to fluctuations in cobalt prices. Cobalt is a key component in lithium cobalt oxide batteries. Battery manufacturers and consumers face challenges as a result of this volatility, which has an impact on pricing stability and production costs.

- Environmental and ethical concerns: The cobalt supply chain must take into account environmental and ethical challenges, such as labor violations, violations of human rights, and environmental degradation in cobalt mining locations. To solve these issues, transparent supply chains, environmentally friendly sourcing practices, and advocacy efforts for moral cobalt mining practices are required. If cobalt price volatility and supply chain vulnerabilities are not addressed along with ethical and environmental concerns, the lithium cobalt oxide market's viability and growth may be at risk.

Lithium Cobalt Oxide Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9% |

|

Base Year Market Size (2025) |

USD 6.09 billion |

|

Forecast Year Market Size (2035) |

USD 14.42 billion |

|

Regional Scope |

|

Lithium Cobalt Oxide Market Segmentation:

Grade (Industrial, Battery)

Battery segment is set to dominate lithium cobalt oxide market share of around 86.7% by the end of 2035. The segment growth can be attributed to the surging demand for high-performance batteries in consumer electronics, EVs, and energy storage systems. According to the IEA, the demand for automotive lithium-ion (Li-ion) batteries grew by almost 65% to 550 GWh in 2022 from around 330 GWh in 2021, mostly due to a rise in the sales of electric passenger cars, with new registrations rising by 55% in 2022 compared to 2021.

The battery-grade segment of the lithium cobalt oxide market takes on a dominant role due to its critical involvement in the production of lithium-ion batteries, holding a significant share. Lithium cobalt oxide designed specifically for batteries must adhere to strict quality criteria to provide the best possible electrochemical performance, stability, and safety. To satisfy the increasing demands of these quickly growing sectors, manufacturers prioritize producing battery-grade lithium cobalt oxide, which fuels its dominance and steady expansion in the market.

Application (Consumer Electronics, Electric Vehicles, Medical Devices, Energy Storage Systems, Telecommunication)

In lithium cobalt oxide market, consumer electronics segment is expected to account for revenue share of around 41.5% by 2035. The segment growth can be attributed to the growing technological innovations and the introduction of new electronic gadgets. Lithium cobalt oxide batteries continue to be essential due to the constant need for wearables, laptops, tablets, and smartphones, among other portable electronics. For instance, the first quarter of 2024 saw a growth spurt in the wearables sector, with global shipments of wearable devices growing 8.8% year over year to 113.1 million units.

These batteries satisfy the demanding specifications of contemporary consumer devices with their high energy density, steady performance, and extended cycle life. The market for lithium cobalt oxide is still growing as consumers look for gadgets with faster charging times and longer battery lives.

Our in-depth analysis of the global market includes the following segments:

|

Grade |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Lithium Cobalt Oxide Market Regional Analysis:

APAC Market Statistics

Asia Pacific industry is expected to account for largest revenue share of 38.9% by 2035. The market is growing in the region owing to significant technological advancements, robust industrial expansion, and rising lithium-ion battery demand. Also, Asia Pacific is a major player in the worldwide market due to its strategic location as a hub for manufacturing and its unwavering focus on technological improvement.

China has the highest lithium-ion battery production capacity in the world, and the nation is home to various battery suppliers and manufacturers. Exports of lithium-ion batteries increased by more than 33% to USD 65.18 billion in 2023 from the previous year. The need for lithium cobalt oxide is further fueled by nations' dominance in the world lithium cobalt oxide market for producing consumer electronics, including laptops, smartphones, and other portable gadgets.

The need for lithium cobalt oxide has been further stimulated by the Government of India, which has implemented encouraging laws and incentives to hasten the deployment of EVs and renewable energy storage technologies. Invest India stated that GST on electric vehicles has been reduced from 12% to 5%; GST on chargers/ charging stations for electric vehicles has been reduced from 18% to 5%.

South Korea is the industry leader in battery production due to its sophisticated manufacturing processes and wide-ranging supply networks. Korea is now second only to China in terms of volume in the worldwide battery market, with a 37% market share. Furthermore, the demand for lithium cobalt oxide in the nation is driven by the government's backing of renewable energy storage efforts, the growing consumer electronics industries, and the swift adoption of electric vehicles.

North America Market Analysis

North America is expected to witness huge growth in the lithium cobalt oxide market during the forecast period. The growth can be credited to the burgeoning demand for lithium-ion batteries in the automotive and defense industries.

In the U.S., there has been a surge in the demand for consumer electronics due to the increasing population. For instance, in 2024 retail sales of consumer electronics reached around USD 510 billion, a growth aided by the introduction of cutting-edge products like XR devices and AI smartphones.

Canada has advanced rapidly in the worldwide supply chain for EV batteries. Some of the biggest corporations in the world have made billion-dollar investments in Canada's EV battery supply chain since 2022. Also, Canada is accelerating the adoption of zero-emission vehicles (ZEVs) as part of its pledge to decarbonize the transportation sector. In Canada, the lithium cobalt oxide market share of ZEVs is steadily increasing. Canada has committed to achieving 100% ZEV sales for all light-duty cars by 2035 and has set ambitious EV sales targets.

Key Lithium Cobalt Oxide Market Players:

- Cosmo Advanced Materials & Technology Co., Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Elcan Industries Inc.

- Cabot Corporation

- BASF SE

- GS Yuasa Corporation Ltd.

- Stanford Advanced Materials

- Beijing Easpring Material Technology Co., Ltd.

- LG Chem Ltd.

- BYD Company Limited

- Samsung SDI Co., Ltd.

Lithium cobalt oxide market competition is defined by fierce competition between major competitors fighting for market dominance and technological supremacy. To satisfy changing customer and industry demands, the firms consistently allocate resources to research and development aimed at improving the performance, safety, and sustainability of lithium cobalt oxide batteries.

Recent Developments

- In September 2023, BASF, a global pioneer in battery materials, and Nanotech Energy, a leader in graphene-based energy storage technologies, will collaborate to drastically lower the CO footprint of Nanotech's lithium-ion batteries for the North American marketplace.

- In November 2022, Cabot Corporation announced the availability of its new LITX 93 series of conductive carbon additives (CCA) for use in lithium-ion batteries for electric vehicles (EV), energy storage applications, and consumer electronics.

- Report ID: 6511

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Lithium Cobalt Oxide Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.