Life Science Tools Market Outlook:

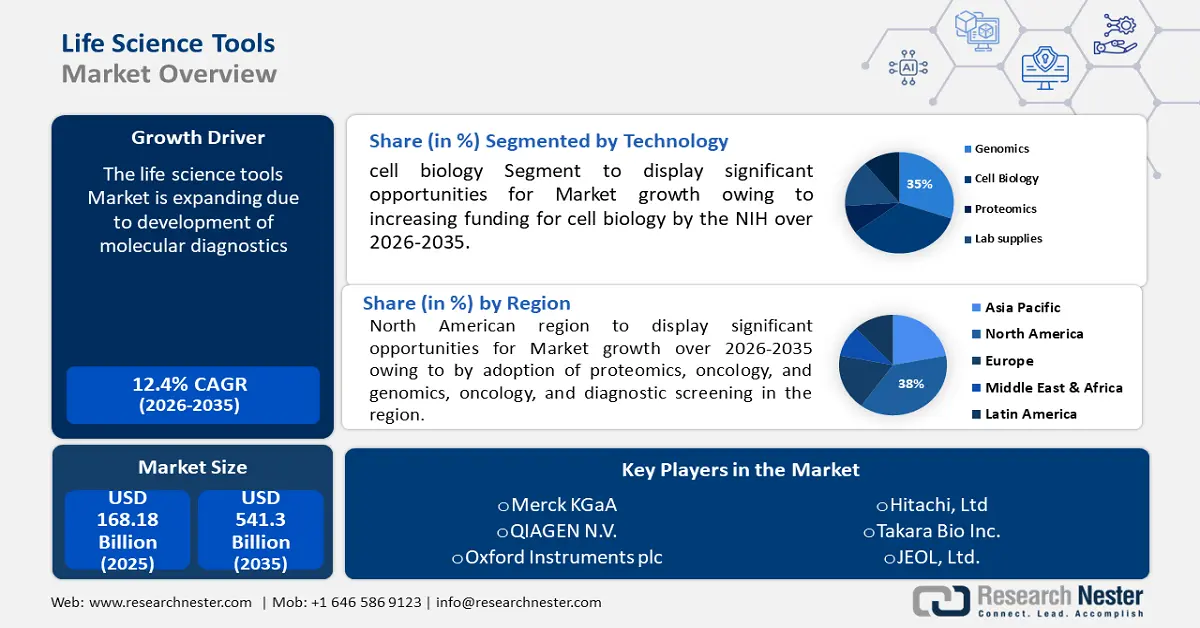

Life Science Tools Market size was over USD 168.18 billion in 2025 and is projected to reach USD 541.3 billion by 2035, witnessing around 12.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of life science tools is evaluated at USD 186.95 billion.

The development of molecular diagnostics, rising R&D expenditures on drug discovery, the necessity for cost control in drug research, and technology improvements are all anticipated to bring up the price of tools used in life science. Increased emphasis on companion diagnostics and precision medicine is also anticipated to fuel market expansion.

Furthermore, factors including longer life expectancies and a rise in pharmaceutical outsourcing are expected to offer market participants significant development prospects in the upcoming years. For instance, the spending of major pharmaceutical companies on research and development increased by 6 percent a year (2001–20200). Big Pharma has launched 251 new medicines, accounting for 46 % of all approvals from the FDA (2001–20200). The efficiency of Big Pharma's 20 years of research and development investment is $6.16 billion for new drugs 2001 to 2020.

Key Life Science Tools Market Insights Summary:

Regional Highlights:

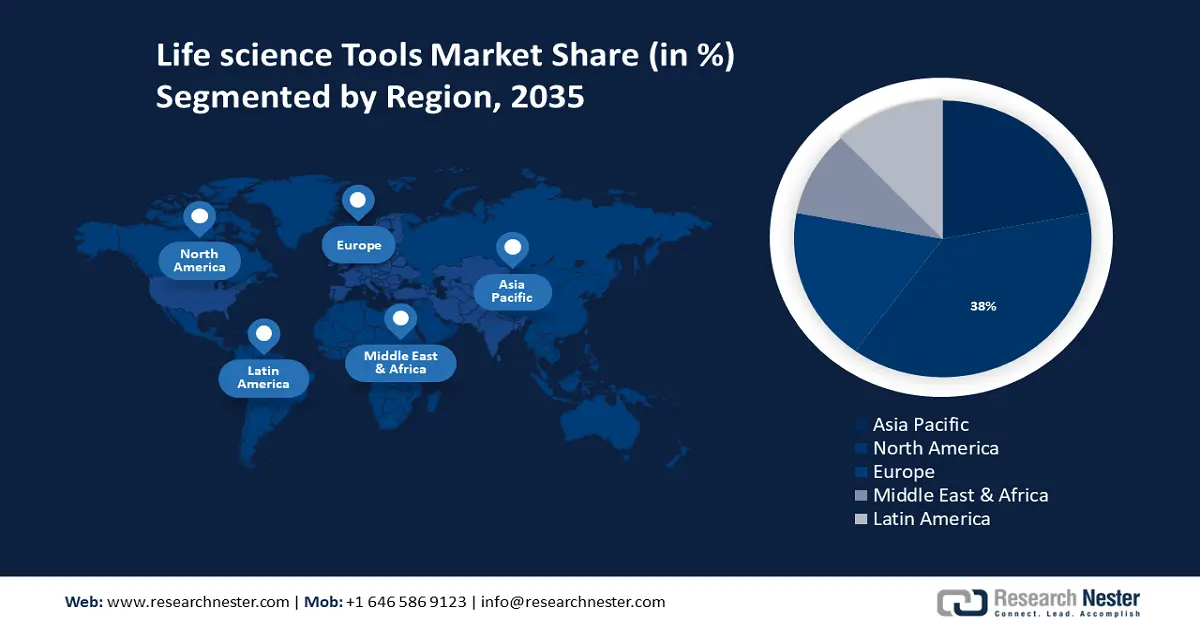

- North America life science tools market will hold more than 38% share by 2035, driven by adoption of proteomics, oncology, genomics, and diagnostic screening.

- Asia Pacific market will achieve huge CAGR during 2026-2035, driven by investments and efforts of global companies to exploit opportunities in the region.

Segment Insights:

- The cell biology segment in the life science tools market is projected to hold a 35% share by 2035, fueled by increased funding for cell biology in drug discovery.

- The healthcare segment in the life science tools market is projected to hold a 32% share by 2035, driven by the increased use of genomic and proteomic processes in hospitals.

Key Growth Trends:

- Rising adoption of nanotechnology-based life science tools

- Growing use of organic development

Major Challenges:

- High price of life science tools

- Complexity of Technologies

Key Players: F. Hoffmann-La Roche AG, Bio-Rad Laboratories, Inc., Danaher Corporation, Thermo Fisher Scientific Inc., Merck KGaA, QIAGEN N.V., Oxford Instruments plc, GE HealthCare Technologies, Inc., Becton, Dickinson and Company, Shimadzu Corporation.

Global Life Science Tools Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 168.18 billion

- 2026 Market Size: USD 186.95 billion

- Projected Market Size: USD 541.3 billion by 2035

- Growth Forecasts: 12.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 17 September, 2025

Life Science Tools Market Growth Drivers and Challenges:

Growth Drivers

-

Rising adoption of nanotechnology-based life science tools - Pathbreaking advances in nanotechnology are increasingly transforming the realm of biological sciences. Nanoscale matter manipulation and research is providing new avenues for improved research in fields such as molecular biology, proteomics, and genomics.

Tools for life science operating at the nanoscale technologies are making it possible for researchers and scientists to learn more about intricate biological systems and processes at the level of individual molecules and cells. Nanotechnology is being used by a number of life science tool firms to create incredibly complex and inventive lab apparatuses, tools, and devices. Nanoscale biosensors, which have never-before-seen levels of sensitivity in the detection and analysis of biomolecules, are one important field. -

Growing use of organic development - Over the course of the forecast period, the major players in the life science tools market are anticipated to use more organic growth methods, including product launches, which would propel the growth of the global life science tools market.

For example, the pharmaceutical corporation F. Hoffmann-La Roche Ltd. introduced the Digital A digital polymerase chain reaction (PCR) technology called the LightCycler technology (DLS) is intended to help in the diagnosis of infections, hereditary diseases, and cancer. It reliably identifies the illness and assesses traces of particular DNA and RNA targets that traditional PCR techniques usually miss. -

Increasing prevalence of chronic diseases - The high prevalence of chronic diseases creates a pressing need for advanced research to development new diagnostics and therapies. Life science tools are essential for studying disease mechanisms, identifying biomarkers, and testing potential treatments. Approximately one in three persons experience more than one chronic illness.

Challenges

-

High price of life science tools - One of the main things impeding the growth of the global life science tools market during the forecast period is the high cost of these tools. The instruments and apparatus used in life sciences research and development, including mass spectrometers, centrifuges, incubators, DNA sequencers, and centrifuges spectrometers, among other things, are quite sophisticated and sophisticated.

-

Complexity of Technologies - Advanced life science often involves complex technologies that require specialized training and expertise to operate effectively. This complexity can hinder widespread adoption and usage, particularly in settings with limited access to skilled personnel.

Life Science Tools Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.4% |

|

Base Year Market Size (2025) |

USD 168.18 billion |

|

Forecast Year Market Size (2035) |

USD 541.3 billion |

|

Regional Scope |

|

Life Science Tools Market Segmentation:

Technology Segment Analysis

Cell biology segment is set to capture over 35% life science tools market share by 2035, also the market held a market value of around USD 64 million. The expansion of this segment can be attributed to the increasing funding for cell biology by the NIH and the importance of cell biology technologies in drug discovery. Additionally, the use of cell-based assays for drug discovery has increased as a result of advancements in liquid handling and flow cytometry.

Additionally, major industry participants have joined forces to conduct cooperative research projects aimed at reprogramming fetal stem cells from blood and umbilical cord tissue into Induced Pluripotent Stem Cells (iPSCs). EdiGene and Haihe Laboratory, for instance, announced a strategic partnership in January 2022 to develop platform technologies and stem cell regenerative medicines. The partnership seeks to investigate new indicators to enhance quality assurance in the generation of stem cells. Over the course of the forecast period, these partnerships are anticipated to boost the life science tools market.

Product Type Segment Analysis

By 2035, cell culture & 3D cell culture segment is anticipated to dominate over 20% life science tools market share. Exploring the possibilities of cell biology & automated cell culture through research has produced significant breakthroughs that have increased profitability. A thorough understanding of cell biology has emerged as a valuable tool for laboratory workflows, creating new opportunities for market growth. It is anticipated that the segment will continue to grow as a result of scientists in the life science field being willing to adopt new and advanced instruments.

A number of important manufacturers have been inspired to diversify their instrument ranges by this industry trend. For example, a number of companies, including Cytiva, BioTek devices, Horizon Discovery, and Seahorse Bioscience, are working to introduce devices for imaging, cell biology, and analysis.

End-use (Government & Academic, Biopharmaceutical Company, Healthcare, Industrial Applications)

Healthcare segment share is anticipated to account for 32% life science tools market share by 2035. The expansion will continue to be fueled by an increase in the use of proteomic and genomic processes in hospitals for the diagnosis and treatment of various diseases.

Additionally, the life science tools market is anticipated to be driven by hospitals' increasing use of NGS and tissue diagnostic services. Presently, several clinics and hospitals offer sequencing services to their patients and are figuring out how to employ cutting-edge instruments and technology in day-to-day medical practice. One such hospital that offers sequencing services to patients with uncommon or undetected genetic conditions is Stanford Medicine.

One of the first hospital systems in the United States to provide public genetic sequencing, analysis, and interpretation services is Partners HealthCare. It is anticipated that genomic sequencing in a hospital or clinical context will reduce healthcare expenses and enhance patient care. As a result, the healthcare sector is expected to grow more rapidly over the coming years.

Our in-depth analysis of the market includes the following segments:

|

Technology |

|

|

Product Type |

|

|

End-use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Life Science Tools Market Regional Analysis:

North America Market Insight

North America industry is likely to hold largest revenue share of 38% by 2035. The market growth in the region is due to adoption of proteomics, oncology, and genomics, oncology, and diagnostic screening in the region.

In 2019, North America represented more than 40.0% of overall revenue in the proteomics market. The expansion of the market in the area may be attributed to the increasing use of genomic medicine, biopharmaceuticals, diagnostic techniques, and novel technologies for the diagnosis and treatment of clinical illnesses in the United States and Canada.

The area also benefits from the existence of numerous industry participants who are consistently working to produce cutting-edge instruments for life science research. Additionally, throughout the course of the forecast period, the market is anticipated to rise at a rapid pace due to the existence of a well-regulated environment for the approval and utilization of genomic and tissue diagnostic tests.

In 2023, the United States held a market share of more than 44.8% for life science tools worldwide. The market is driven by funds and investments intended for the development of advanced therapeutics as well as a steadfast need for cutting-edge medications and therapies. This demand is fuelled by the escalating prevalence of diseases like cancer, kidney and thyroid disorders, and diabetes. An estimated 1.9 million new instances of cancer will be identified in the US in 2021, and 608,570 people will die from cancer.

Moreover, there will probably be additional clinical trials for gene therapy as recombinant protein advances. For instance, as of 2020, the FDA expected to receive more than 200 applications annually for clinical trials of gene and cell therapies by 2029.

APAC Market Insight

The APAC region will also encounter huge growth for the life science tools market during the forecast period. Growth will be stimulated by investments and efforts of world companies in this region to exploit the opportunities which exist, as well as increasing their presence there. For instance, in January 2022, it was revealed that FUJIFILM Corporation would pay USD 100 million to acquire the Atara Biotherapeutics T-Cell Operations and Manufacturing (ATOM) facility in order to produce CAR-T and T-cell immunotherapies, among other commercial and clinical treatments. Furthermore, this area provides reasonably priced manufacturing and operating units for research. The growth of life science instruments and technology in this area is anticipated to be significantly influenced by these variables.

Leading companies in the life science tools sector typically see 10% to 20% of their revenues come from Chinese acquisitions, which have contributed to their disproportionate growth.

A number of new projects are scheduled to be introduced by Japan's Ministry of Economy, Trade, and Industry (METI; Tokyo) to aid in the development of biodevices and research equipment for the life sciences industry.

Additionally, as the population ages and chronic diseases become more common, medical research efforts have increased, which has increased the demand for life science tools in disease knowledge and diagnostics. Additionally, the market is growing due to the strong demand for high-throughput sequencing and gene editing technologies created by South Korea's ambitious genomics and genetic research projects. It was predicted that in 2020, the CRISPR genome editing market in South Korea would reach a valuation of USD 70 million.

Life Science Tools Market Players:

- Agilent Technologies, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- F. Hoffmann-La Roche AG

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- Thermo Fisher Scientific Inc.

- Merck KGaA

- QIAGEN N.V.

- Oxford Instruments plc

- GE HealthCare Technologies, Inc.

As life science tools are always developing and advancing technologically, there is intense competition in the global market for these tools. Furthermore, the industry participants employ cooperation, amalgamation, alliance, and additional inorganic expansion tactics to provide an extensive array of inventive and appealing resolutions to their clientele.

Recent Developments

- Hitachi Ltd. executed a stock purchase agreement with MAX Agilent Technologies, Inc. to improve customer access to genomic tools, teamed with Biosciences, Inc. to integrate the AVITI System with Sure Select target enrichment panels.

- QIAGEN established an exclusive strategic agreement with California-based population genomics company Helix, to enhance companion diagnostics for genetic disorders.

- Report ID: 6164

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Life Science Tools Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.