Large Volume Wearable Injectors Market Outlook:

Large Volume Wearable Injectors Market size was over USD 3.22 billion in 2025 and is anticipated to cross USD 7.76 billion by 2035, witnessing more than 9.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of large volume wearable injectors is assessed at USD 3.49 billion.

The growth of the market can be attributed to the rising cases of chronic diseases becoming the major cause of death across the globe. Large-volume wearable injectors are useful to provide drugs over a prolonged time via a subcutaneous route to cure chronic diseases such as cancer and diabetes. As per a recent study in 2020, it was estimated that around 40 million people are killed globally by chronic diseases. Further, it was estimated by the Centers for Disease Control and Prevention that 6 out of 10 adults in the United States are living with one chronic disease, whereas 4 out of 10 adults have been diagnosed with more than two chronic diseases in the year 2022.

Large-volume wearable injectors are drug delivery devices used for the single-step administration of drugs to a lengthier extent. These devices are designed to stick to the patient’s body. A large reservoir is used for storing and delivering a sufficient amount of medications via subcutaneous tissues more quickly and safely. The increasing prevalence of non-communicable diseases among the global population is anticipated to bolster the demand for large-volume wearable injectors over the forecast period. According to a recent World Health Organization (WHO) study published in 2021, non-communicable diseases (NCDs) kill approximately 41 million people worldwide each year. This is equivalent to around 71% of the total global deaths.

Key Large Volume Wearable Injectors Market Insights Summary:

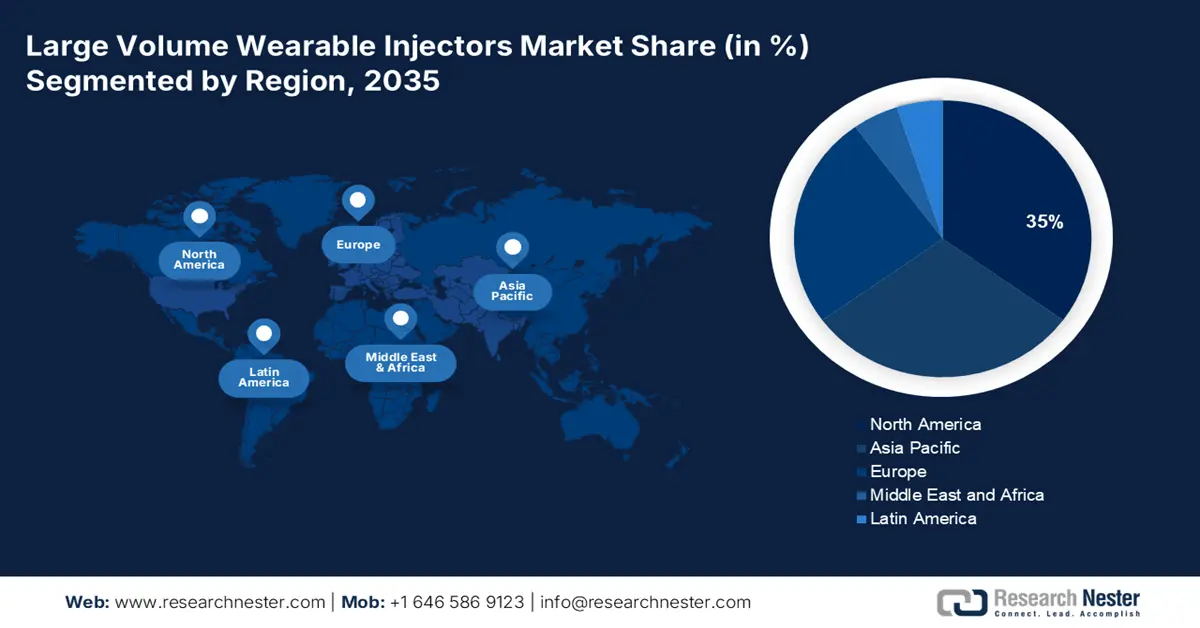

Regional Highlights:

- North America’s large volume wearable injectors market will hold around 35% share by 2035, fueled by the rising cases of chronic diseases and the booming healthcare industry in the region.

- Asia Pacific market will secure the second largest share by 2035, attributed to the higher prevalence of cancer and autoimmune diseases, coupled with increased healthcare spending in the region.

Segment Insights:

- The on-body injectors segment in the large volume wearable injectors market is projected to hold the largest share by 2035, attributed to advancements in wearable AI technology and real-time health monitoring.

- The oncological disorders segment in the large volume wearable injectors market is expected to capture a significant share by 2035, fueled by rising cancer prevalence and the need for efficient drug delivery systems.

Key Growth Trends:

- Burgeoning Geriatric Population

- Increase in Deaths by Cardiovascular Diseases Around the World

Major Challenges:

- Extra Expenses with the Equipment

- Lack of Proper Knowledge

Key Players: Insulet CorporationBecton, Dickinson, and CompanyYpsomed AGAmgen USA Inc.United Therapeutics CorporationWest Pharmaceutical Services, Inc.Frederick Furness Publishing LimitedCrunchbase, Inc.Eitan Medical Ltd.

Global Large Volume Wearable Injectors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.22 billion

- 2026 Market Size: USD 3.49 billion

- Projected Market Size: USD 7.76 billion by 2035

- Growth Forecasts: 9.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 9 September, 2025

Large Volume Wearable Injectors Market Growth Drivers and Challenges:

Growth Drivers

-

Burgeoning Geriatric Population – The United States stated that there were 703 million people aged 65 years and above across the whole world in 2019. Further, this number is projected to rise significantly to 1.5 billion by 2050. Furthermore, it was also estimated that more than 90% of geriatrics have at least one chronic disease while 78% of them have more than one across the globe.

Growth in the geriatric has propelled the demand for large-volume wearable injectors since these devices are beneficial for drug delivery in the most convenient way. People age 65 and above are prone to have cardiovascular disease, chronic disease, or autoimmune diseases and require constant medical care. Some people aged above 70 are unable to visit the hospital more frequently but require routine check-ups or doses of drugs. In these circumstances, large-volume wearable injectors can deliver specific amounts of drugs for an extended period without any interruption. -

Increase in Deaths by Cardiovascular Diseases Around the World – As per the statistics shared by the World Health Organization (WHO) in 2021, around 17.9 million people globally died due to cardiovascular diseases in 2019. It was approximately 32% of all global deaths. Cardiovascular diseases are being more prevalent than before owing to rising air pollution and an increasing number of people adopting unhealthy lifestyles.

-

Rising Instances of Autoimmune Diseases – The report released by the National Institute of Environmental Health Sciences revealed that more than 24 million people are affected by autoimmune illnesses.

-

Rise in Healthcare Expenditure across the Globe – As per the World Bank, global health expenditure accounted for 9.83% of the total GDP in 2019. This was a significant rise from 9.37% of the total GDP in 2013.

-

Boom in Healthcare Sector – As per recent estimates, the revenue generated by India’s healthcare sector was approximately USD 300 billion in 2020, which is further anticipated to rise to USD 380 billion by 2022.

Challenges

- Extra Expenses with the Equipment - Large-volume wearable injectors are noticed to add extra expense since these injectors are expensive themselves and apart from that, they require an extra amount of required drugs for constant circulation in the body to provide better chronic disease management. Hence, this factor is projected to hamper the market growth over the forecast period.

- Lack of Proper Knowledge

- Rising Concerns About the Lack of Reimbursement

Large Volume Wearable Injectors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 3.22 billion |

|

Forecast Year Market Size (2035) |

USD 7.76 billion |

|

Regional Scope |

|

Large Volume Wearable Injectors Market Segmentation:

The global large-volume wearable injectors market is segmented and analyzed for demand and supply by product type into on-body, off-body, and handheld wearable injectors. Out of the three types of products, the on-body segment is estimated to gain the largest market share in the year 2035. The growth of the segment can be attributed to the rising adoption of technologically advanced products along with rising development in wearable AI technology. Wearable AI technology comprises real-time health monitoring sensors to provide health data and other health parameters to assist healthcare providers and patients in making quick and necessary decisions. AI in healthcare is being more prevalent owing to its accuracy and convenience. For instance, in 2021, approximately 9% of healthcare organizations were observed to be using AI models. The segment growth is also supported by rising initiatives and funding to develop medical technologies across the globe. Hence, all these factors are projected to propel the growth of the segment over the forecast period.

The global large-volume wearable injectors market is also segmented and analyzed for demand and supply by therapeutic areas into cardiovascular disorders, infectious diseases, neurological disorders, oncological disorders, and others. Amongst these segments, the oncological disorders segment is expected to garner a significant share in the year 2035. The growth of the segment can be attributed to the higher utilization of wearable injectors in collecting cancer cells from patients’ cells and spiking instances of cancer across the globe. During the treatment of cancer, several drugs need to be delivered intravenously for prolonged periods, it becomes quite convenient with the help of large-volume wearable injectors since they automatically deliver drug doses at optimal times. As of 2020, around 10 million people lost their lives owing to cancer according to the data released by World Health Organization (WHO). Therefore, such a higher prevalence of cancer is projected to drive the growth of the segment over the forecast period.

Our in-depth analysis of the global large-volume wearable injectors market includes the following segments:

|

By Product Type |

|

|

By Device Type |

|

|

By Usability |

|

|

By Therapeutic Area |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Large Volume Wearable Injectors Market Regional Analysis:

North America Market Insights

The North American large-volume wearable injectors market, amongst the market in all the other regions, is projected to hold the largest market share of 35% by the end of 2035. The growth of the market can be attributed majorly to the rising cases of chronic disease in the region. Chronic diseases such as heart disease, cancer, and diabetes are the leading causes of death and disability in the United States. They are also the leading drivers of the nation’s USD 4.1 trillion in annual healthcare costs. Further, the boom in the healthcare industry is another growth factor for the large volume of wearable injectors market growth. The revenue generated by the U.S. healthcare industry stood at USD 800 billion as of 2021. Additionally, the growing geriatric population in the region with severe autoimmune and chronic diseases is further anticipated to propel the market growth over the forecast period. It was projected that in the United States, every 6 people out of 10 suffer from at least 1 chronic disease.

Additionally, the global large-volume wearable injectors market is anticipated to hold the second-largest share in the Asia Pacific region over the forecast period. The growth of the market in the region can ascribe a higher prevalence of cancer in the region backed by the escalating spending capacity of the population coupled with an escalation in autoimmune diseases. For instance, in 2018, approximately 8 million new cases of cancer were diagnosed in Asia Pacific while more than 5 million death occurred owing to cancer in a similar year. Furthermore, the surge in the cases of diabetes, lung diseases, and others is further estimated to expand the market size over the forecast period.

Large Volume Wearable Injectors Market Players:

- Insulet Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Becton, Dickinson, and Company

- Ypsomed AG

- Amgen USA Inc.

- United Therapeutics Corporation

- West Pharmaceutical Services, Inc.

- Frederick Furness Publishing Limited

- Crunchbase, Inc.

- Eitan Medical Ltd.

Recent Developments

-

Becton, Dickinson, and Company have collaborated with LabCorp, a leading global life sciences company. This collaboration is expected to create a framework to develop, manufacture, and commercialize flow cytometry-based companion diagnostics (CDx) with life-changing treatments for cancer and other diseases.

-

Insulet Corporation announces full market releases of Omnipod 5 Automated Insulin Delivery (AID) System through U.S. retail pharmacy channels for individuals aged six years and older with type 1 diabetes.

- Report ID: 4235

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.