Iodine Market Outlook:

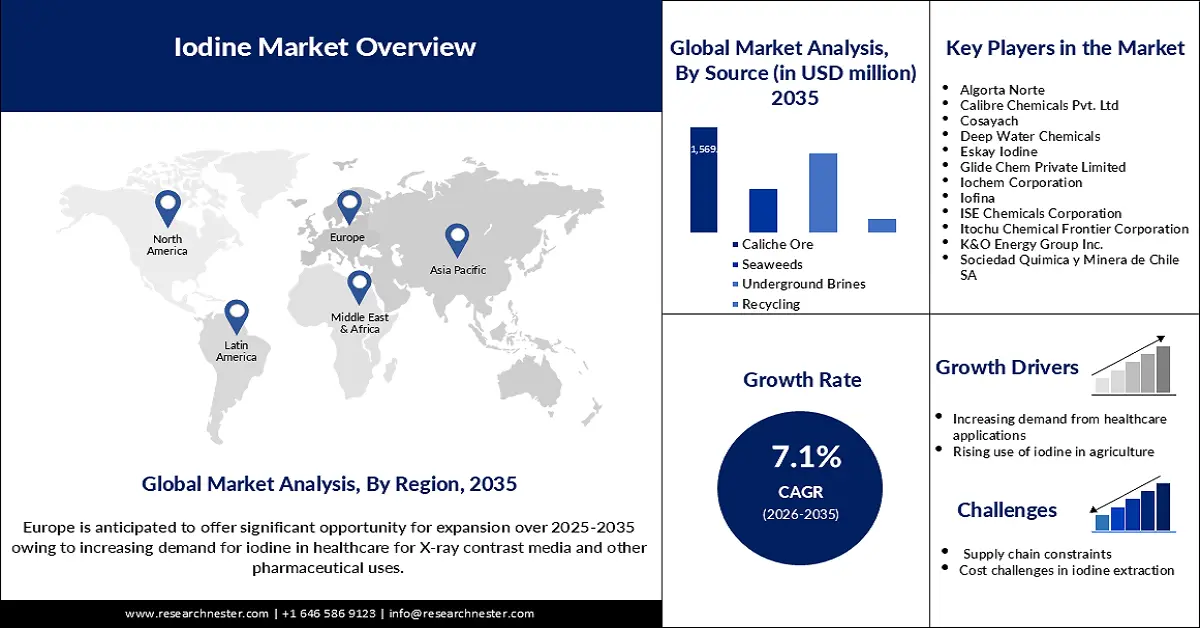

Iodine Market size was valued at USD 3.93 billion in 2025 and is likely to cross USD 7.8 billion by 2035, expanding at more than 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of iodine is assessed at USD 4.18 billion.

The iodine market is expanding due to the rising demand from major sectors, including health, agriculture, and chemical industries. The development of various medical diagnostic tools, especially X-ray contrast media with continuous advancements, also boosts the market growth. Another key factor driving demand higher is better infrastructure for healthcare in most emerging markets of Asia and Africa, supplemented by governmental initiatives to bridge nutritional gaps.

Governments worldwide have increased their regulations related to iodine deficiency and its supplementation. Recently, the European Food Safety Authority increased the regulatory pressure in relation to the supplementation of iodine in animal feed. Furthermore, the United Nations Food and Agriculture Organization (FAO) supported salt iodization legislation in the fight against iodine deficiency. Consequently, due to strict limits set by the Food and Drug Administration (FDA) to the levels of iodine in both foods and supplements, iodine intake among the population is considered to be within safe and controlled limits. As a result, these factors combined are anticipated to generate demand for iodine during the forecast period.

Key Iodine Market Insights Summary:

Regional Highlights:

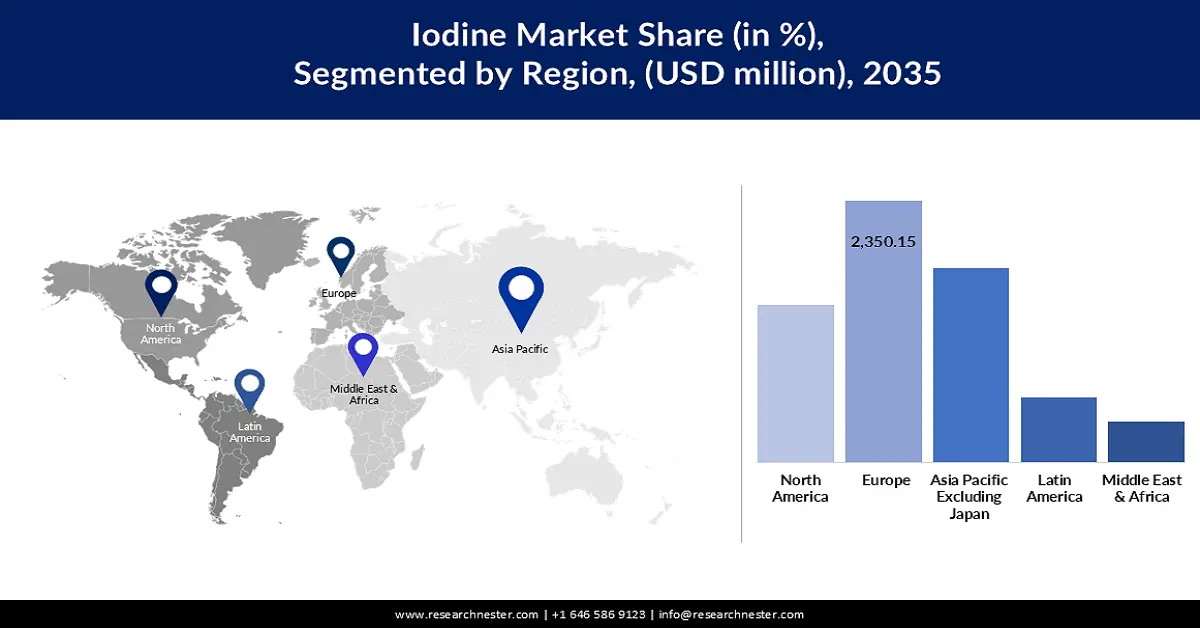

- Europe iodine market is anticipated to capture 34.20% share by 2035, driven by increasing demand for iodine in healthcare for X-ray contrast media.

- Asia Pacific market will exhibit moderate growth during the forecast timeline, driven by higher demands for iodine from healthcare and agriculture sectors.

Segment Insights:

- The caliche ore segment in the iodine market is expected to hold a significant share by 2035, driven by easy availability and high productivity of caliche ore, particularly in Chile.

- The x-ray contrast media segment in the iodine market is expected to secure a 23% share by 2035, driven by increasing use of diagnostic imaging and expansion of iodine-based contrast agent production.

Key Growth Trends:

- Healthcare Demand

- Agricultural Applications

Major Challenges:

- Environmental regulations

- Price volatility

Key Players: Axis Communications AB, Teledyne FLIR LLC, InfraTec GmbH, Leonardo DRS, Princeton Infrared Technologies, Inc., SATIR, Konica Minolta, Inc., Seek Thermal Inc., Sierra-Olympia Tech., Synectics plc., and InfiRay.

Global Iodine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.93 billion

- 2026 Market Size: USD 4.18 billion

- Projected Market Size: USD 7.8 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (34.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Japan, China, United States, Germany, Chile

- Emerging Countries: China, India, Japan, Chile, South Korea

Last updated on : 18 September, 2025

Iodine Market Growth Drivers and Challenges:

Growth Drivers:

- Healthcare Demand: Iodine has marked applications in medical imaging technologies, including X-ray contrast media and radiography. The increasing prevalence of chronic diseases, such as cancer and cardiovascular conditions, will spur the demand due to the need for diagnostic imaging. For example, in June 2022, GE Healthcare reached an agreement with Sociedad Química y Minera de Chile to create a secure supply of iodine necessary for contrast media so that supplies may be consistently available to healthcare providers. The growing adoption of telehealth and diagnosis from remote areas fosters the demand for iodine-based imaging solutions.

- Agricultural Applications: The use of iodine in agriculture has gained prominence, especially with biofortification. Research and studies have identified various beneficial effects of iodine on plant growth and nutritional enhancement. In 2022, a study showed that iodine-enriched fertilizers have advantages in generating better yields from iodine-deficient regions. Hence, this trend may accelerate iodine demand in the agricultural sector during the decade. Programs implemented by different organizations, including the Global Alliance for Improved Nutrition, point to iodine as an important factor in improving food security.

- Demand from chemical industries: Iodine is used as a catalyst in the manufacture of synthetic rubber and all kinds of polymers. Demand for iodine in the chemical field has been growing adequately due to the processing and production of polymers. One of the major developments in April 2024 was from Iofina, announcing a hike in iodine production capacity by 15% to ensure industrial demand keeps growing. The expansion is in line with the growing demand for value-added materials in the automotive and electronics industries.

Challenges:

- Environmental regulations: The main factor hindering market growth is strict environmental regulations over the extraction and handling of iodine, especially radioactive iodine. In 2023, the EPA in the United States laid down new regulations to impose much tighter controls on the emissions of iodine. These substantially raised operational costs for manufacturers. Complying with very strict environmental regulations requires considerable investments, which limits the adoption of new technologies and processes.

- Price volatility: Another factor that has impacted the growth of the iodine market is its price volatility. In 2023, prices for iodine went up by 30%, reaching USD 61 per kilogram, supported by the shortage in its supply from major producing countries such as Chile. Such unpredictability carries with it risks of long-term contracts and hampers manufacturing companies dependent on a predictable price.

Iodine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 3.93 billion |

|

Forecast Year Market Size (2035) |

USD 7.8 billion |

|

Regional Scope |

|

Iodine Market Segmentation:

Source Segment Analysis

The caliche ore segment will account for around 43% of the iodine market share by 2035 owing to its easy availability, especially from Chile. In April 2024, SQM declared the expansion of its mining operation related to the extraction of caliche ore, which would increase the annual production of iodine by 10%. This places the caliche ore as the most viable, economical, and productive elemental source of industrial iodine. The rich concentration of the element, in addition to the effective processes of extraction, makes ores a preferred among many producers.

Application Segment Analysis

The X-ray contrast media segment will dominate 23% market share by 2035. The primary factor driving the growth of the segment includes the higher usage of advanced diagnostic imaging technologies in healthcare. For instance, in December 2023, GE Healthcare announced plans to increase iodine-based contrast agent production owing to growing requirements within healthcare, further strengthening this segment's growth. Artificial intelligence in imaging systems also assists in improving the efficiency of iodine-based contrast agents. This further adds to the increase in the adoption of iodine for x-ray contrast media.

Our in-depth analysis of the market includes the following segments:

|

Source |

|

|

Form |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Iodine Market Regional Analysis:

Europe Market Insights

Europe industry is estimated to hold largest revenue share of 34.2% by 2035, owing to the increasing demand for iodine in healthcare for X-ray contrast media and other pharmaceutical uses. Some strict healthcare policies in the region favor innovation and increase the utilization rate of high-end medical technologies that rely massively on iodine-based products. Increasing awareness about iodine deficiency and subsequent government initiatives in many European countries are driving the market.

France as one of the major participants in the iodine market in Europe, concentrates on expanding its healthcare infrastructure and growing applications of iodinated products for radiology procedures. Demand for both iodized salt and iodine supplements has also picked up with different public health campaigns initiated by the government to fight against iodine deficiency. The demand for iodine in medical imaging is rising in the healthcare sector due to a government initiative to provide more diagnostic services to rural communities.

Germany iodine market is rising due to its strong pharmaceutical and chemical industries and demand for the manufacture of biocides and pharmaceutical products. The country is also focusing on improving diagnostic imaging techniques to cater to the rising demand for X-ray contrast media based on iodine compounds. In August 2023, BASF declared its plan to increase the capacity for iodine production to meet the growing demand of the Europe healthcare sector. Such developments are anticipated to propel the market growth during the forecast period.

APAC Market Insights

In iodine market, Asia Pacific region is set to witness moderate growth rate through 2035, driven by higher demands for iodine from the healthcare and agriculture sectors. China and India are leading in this respect, with growing awareness of iodine deficiency and developing healthcare infrastructure. Iodine demand has strongly increased in the China market for X-ray contrast media with government health reforms. Besides, regional collaboration and related trade agreements will facilitate easy access to iodine resources.

China is leading the growth in APAC due to the fast development of medical imaging technologies and government efforts to eradicate iodine deficiency. As per reports, China is the world's leading importer of iodine, having imported approximately 6.7 thousand metric tons valued at roughly USD 222 million in 2021. Government subsidies and incentives are also boosting local production and reducing dependence on imports.

India also holds a considerable share of the market, particularly following the time when the government implemented aggressive iodine supplementation programs. The Government of India launched the Nationwide Iodine Deficiency Campaign in March 2023 with a serious ambition to enhance the consumption of iodized salt by 15% within two years. This was one of the key drivers for iodine demand in India. The success of the campaign is reflected by improved public health metrics and increased market penetration by iodized salt products.

Iodine Market Players:

- Algorta Norte

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Calibre Chemicals Pvt. Ltd

- Cosayach

- Deep Water Chemicals

- Eskay Iodine

- Glide Chem Private Limited

- Iochem Corporation

- Iofina

- ISE Chemicals Corporation

- Itochu Chemical Frontier Corporation

- K&O Energy Group Inc.

- Sociedad Quimica y Minera de Chile SA

- Nippon Chemical Industrial Co.

- Tosoh Corporation

- Godos Chemicals

- Mitsubishi Gas Chemical Company

The global market is fiercely competitive, with key players such as Sociedad Química y Minera de Chile, Iofina, and Calibre Chemicals Pvt. Ltd. driving the market. These firms remain focused on strategic expansions, product innovations, and partnerships that will consolidate their positions within the market. The competitive landscape also saw mergers and acquisitions, basically for sustaining market share and strengthening technological capability.

In December 2023, it was announced that Iofina had opened yet another iodine extraction facility in the U.S. with an expanded production capacity of 12%. The motive behind this expansion was to deal with the rising demand for pharmaceuticals and agriculture. This reflects the competitive nature of the marketplace and the orientation of operations that thrive on economies of scale to meet rising global demand. Companies also invest in research and development to innovate new applications, improve extraction efficiencies, and maintain competitiveness.

Here are some leading companies in the iodine market:

Recent Developments

- In March 2043, Iofina revealed plans to construct its tenth iodine extraction plant, marking another milestone in its expansion strategy. The new facility will be located in Oklahoma, diversifying Iofina's production capabilities. This addition underscores the company's commitment to increasing iodine supply and operational efficiency.

- In June 2023, Iofina successfully commissioned its sixth iodine extraction plant in Oklahoma, employing its proprietary production technology. Following this launch, the company saw an increase in production and profitability, thanks to favorable iodine market prices throughout the year. The advancement reinforces Iofina's position in the iodine industry amid rising demand.

- In June 2023, REMONDIS SE & Co. KG inaugurated a new plant focused on recovering iodine from hazardous waste flue gas. This initiative aligns with the company’s sustainability goals and contributes to the circular economy. By turning waste byproducts into valuable resources, REMONDIS enhances its environmental impact and operational efficiency.

- In May 2023, Omron Healthcare announced a substantial investment in Tamil Nadu, India, planning to establish a medical equipment plant valued at INR 1.28 billion (approximately USD 15.7 million). This move aims to enhance healthcare provision in the region and expand Omron's operational presence in India. The initiative reflects the company's commitment to improving medical infrastructure and accessibility.

- Report ID: 6422

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Iodine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.