Intrinsically Safe Equipment Market Outlook:

Intrinsically Safe Equipment Market size was valued at USD 3.8 billion in 2025 and is likely to cross USD 7.48 billion by 2035, expanding at more than 7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of intrinsically safe equipment is assessed at USD 4.04 billion.

The intrinsically safe equipment market is witnessing lucrative growth opportunities in industries such as oil, gas, mining, and manufacturing chemical operations, where hazardous atmospheres are common. The crucial mover for intrinsically safe equipment includes growing demands on automation and remote monitoring for dangerous locations, and development in technology, thereby making the product of higher functionality and reliability and greater awareness of environmental impact related to industrial processes. For instance, in March 2022, Monnit announced that its intrinsically safe ALTA-ISX long-range wireless sensors are available to protect workers and facilities in industrial environments with explosive atmospheres. This range includes the ALTA-ISX temperature and dry contact sensors and the 300 PSIG pressure meter.

In addition, continued investments in infrastructure development are further fostering the need for reliable safety solutions. According to the International Energy Agency, Investment in electricity grids would have to be around USD 600 billion a year till 2030 to align with the NZE Scenario path. It would be about twice the current investment, at a round of USD 300 billion annually. With industries seeking to constantly balance operational efficiency with onerous safety requirements, intrinsically safe equipment stands out as an essential feature in safeguarding personnel and assets alongside ensuring uninterrupted productivity.

In addition, the safety regulations and relentless moves in approach to maintain safety as a prime concern for employees push the intrinsically safe equipment market growth. Moreover, industrial growth has also led to an emerging trend of ensuring strict rules which compel the government agencies and organizations to revolutionise the lawa and implement the. For instance, according to United Nations Industrial Organizations, industrial economies grew from as low as 2.5% Y-o-Y in the second quarter of 2022 to 3.6% growth in the third quarter. Other industrializing economies experienced a Y-o-Y increase in output at 4.9% in the third quarter of 2022.

Key Intrinsically Safe Equipment Market Insights Summary:

Regional Highlights:

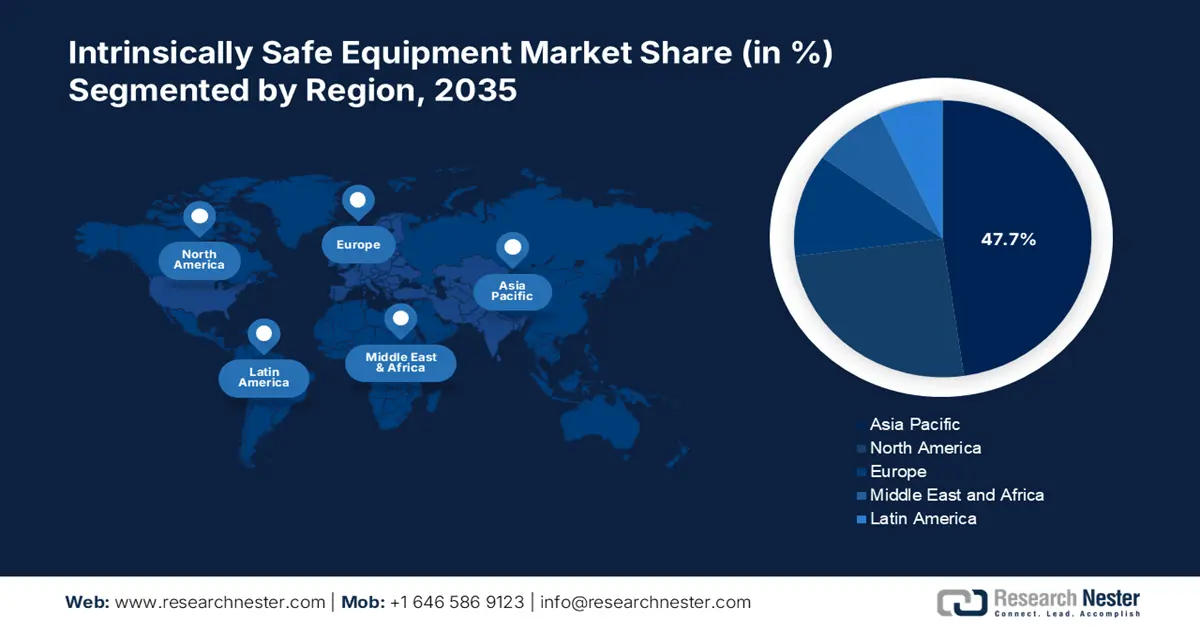

- Asia Pacific holds a 47.70% share in the Intrinsically Safe Equipment Market, driven by increasing workplace safety concerns, growing industrial accidents, and investments in intrinsically safe equipment, ensuring robust growth by 2035.

Segment Insights:

- The Oil & Gas segment is forecasted to hold a major share by 2035, driven by the enforcement of stringent safety regulations.

- The Class 1 Segment is anticipated to achieve a 59.2% share by 2035, driven by strict safety regulations in critical applicative environments.

Key Growth Trends:

- Rising industrial automation

- Growing awareness of safety practices

Major Challenges:

- Complex certification process

- Evolving industry standards

- Key Players: OMEGA Engineering (Spectris PLC), Stahl AG, RAE Systems (Honeywell), Eaton Corporation, CorDEX Instruments Ltd., Bayco Products, Inc., and more.

Global Intrinsically Safe Equipment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.8 billion

- 2026 Market Size: USD 4.04 billion

- Projected Market Size: USD 7.48 billion by 2035

- Growth Forecasts: 7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (47.7% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 13 August, 2025

Intrinsically Safe Equipment Market Growth Drivers and Challenges:

Growth Drivers

- Rising industrial automation: The increasing automation within diverse industries drives up growth in the intrinsically safe equipment market. It requires automated systems, such as robots, and remote monitoring devices that operate under intrinsically safe conditions without generating the risks of ignition in the presence of explosive atmospheres. For instance, in December 2021, Omron Automation, introduced heater conditioning monitor K7TM. This monitor system provides support from preventive maintenance to prevent the failure of the heater. As companies try to harness the power of automation for better productivity, intrinsically safe equipment becomes necessary so that operational integrity and worker safety are maintained in hazardous work environments.

- Growing awareness of safety practices: Increased awareness related to safety practices has led to intrinsically safe equipment becoming an essential growth driver. As hazard-related risks are increasing, several organizations want to mitigate them by protecting their employees in such environments. For instance, in July 2021, Fluke Process Instruments, the world leader in infrared imaging and thermal profiling solutions for industrial applications, introduced the latest Thermalert 4.0 Series Pyrometers, including intrinsically safe ATEX- and IECEx-certified models. In addition, the cultural aspect is strongly biased toward proactive risk management and corporate social responsibility the ever-growing demand for reliable safety solutions fuels the growth.

Challenges

- Complex certification process: This process of certification is the major challenge in the intrinsically safe equipment market as manufacturers need to deal with a complex regulatory requirement process, thereby meeting the requirements of the ATEX and IECEx safety standards. This process, though complex, often consists of a lot of testing, documentation, and validation, which may be long-drawn and expensive. One of the supporting reasons for this challenge is that different standards of regulations from one region to another pose difficulty in entering a global market by manufacturers and prolong delays before the availability of a product. As such, it might discourage investment and retard innovation in the intrinsically safe equipment sector.

- Evolving industry standards: It presents an increased difficulty to the manufacturers of intrinsically safe equipment as such, due to the incessant evolution in the standards of industrial processes. The landscape will also involve some costs and extend the production development time. In addition, the rapid evolution of technology often outweighs the existing regulations thereby creating a gap that always requires constant updates and modification of safety measures. This makes the manufacturers face the pressure of balancing compliance with innovation to deliver according to market demands complicating their operational strategies.

Intrinsically Safe Equipment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7% |

|

Base Year Market Size (2025) |

USD 3.8 billion |

|

Forecast Year Market Size (2035) |

USD 7.48 billion |

|

Regional Scope |

|

Intrinsically Safe Equipment Market Segmentation:

Class (Class 1, Class 2, Class 3)

In intrinsically safe equipment market, Class 1 segment is set to dominate revenue share of over 59.2% by 2035, attributable to the critical applicative environment, further complemented by strict regulations on safety in industry applications. For instance, in June 2024, Siemens Smart Infrastructure and BASF announced their first electrical safety product featuring components from biomass-balanced plastics. Siemens SIRIUS 3RV2 circuit breaker is produced using Ultramid BMBcertTM and Ultradur BMBcertTM from BASF, which replaces fossil feedstock. Companies in such industries prioritize safety compliance and risk management, which boosts the demand for Class 1 intrinsically safe devices and keeps driving the market to new growth heights.

End user (Oil & Gas, Mining, Power, Chemical & Petrochemical, Processing, Others)

Based on end users, the oil & gas segment is expected to garner the major share in the intrinsically safe equipment market by the end of 2035. This segment boasts stringent safety regulations that require intrinsically safe devices for protecting the worker and assets from possible sources of ignition. For instance, in October 2022, Nokia announced to strengthen its industry-leading portfolio of ruggedized user equipment for hazardous, flammable, explosive, and dusty environments. It is launching the improved variants of industrial 5G field routers and the Nokia XR20 smartphone designed by HMD Global for 4.9G and 5G networks to help oil and gas companies. As companies increasingly focus on operational integrity, the need for intrinsically safe equipment will continue unabated, securing its strategic position in such a high-risk environment.

Our in-depth analysis of the global intrinsically safe equipment market includes the following segments:

|

Zone |

|

|

Class |

|

|

End user |

|

|

Product |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Intrinsically Safe Equipment Market Regional Analysis:

Asia Pacific Market Statistics

Asia Pacific intrinsically safe equipment market is expected to account for revenue share of around 47.7% by 2035. Companies in the region, view workplace safety as an essential factor in ensuring the continued operation of their businesses and protecting human lives. In addition, industrial accidents are growing and it is against this backdrop of legal and financial consequences It has thus pushed the market to focus on installing intrinsically safe equipment as the nucleus of their safety measures.

India intrinsically safe equipment market is witnessing a robust growth owing to the expansion and investments in the oil and gas industry. In addition, the continuous evolution lifestyle changes and adaptations towards safety concerns is propelling the market growth. For instance, in April 2021, Havells launched an Anti-Viral Anti-Bacterial switch range to promote the safe lifestyle. Crabtree unveils novel virus-safe switches -within 1 minute of exposure to the virus that assures92.5% anti-viral efficacy and within 2 hours it ensures 99.89% anti-viral efficacy.

China in the intrinsically safe equipment market is expanding owing to modern designs in electrical equipment to meet the rigors of the different processes involved in the industry. As the use of electrical equipment increases throughout the industry, there is a greater need for intrinsically safe equipment to reduce the possibility of explosions. For instance, in November 2023, Hytera Communications announced the release of its latest IS radio series, including the HP79XEx DMR Portable Two-way Radio and PT890Ex TETRA Portable Radio. Engineered to meet stringent IECEX and ATEX requirements for explosion-proof equipment, these leading-edge devices give personnel confidence in workplace safety.

North America Market Analysis

The intrinsically safe equipment market is gaining traction and is expected to witness lucrative growth during the forecast timeline. The rising focus of the region on safety standards to strengthen industrial safety and operational efficiency is further aiding the market growth. addition, the presence of key market players, ongoing technological advancements, and a strong focus on innovation and research and development activities are strengthening the market growth.

The U.S. intrinsically safe equipment market is unfolding expansion owing to the strong key players that focus on research and development activities to meet the dynamic demand of market. In addition, they incorporate their expertise in product redesigning and redeveloping. For instance, In August 2023, Rockwell Automation designed an ArcShield Technology that can be easily integrated with the CENTERLINE. This central motor control manages the motor and prevents arcing faults.

The intrinsically safe equipment market in Canada growing exponentially driven by the legislations that demand for installing safe and reliable solutions to refrain from accidents in industry operations. For instance, in September 2024, the Canadian Electric Code reflected an addition stating that installing electrical equipment in hazardous locations as classified by section 0, or those where there exists a potential to ignite explosive gases or combustible dust, fibers, or flyings from the designs, installing or even the use of electrical equipment is discussed under Section 18.

Key Intrinsically Safe Equipment Market Players:

- Bayco Products, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Pepperl + Fuchs

- Fluke Corporation

- OMEGA Engineering (Spectris PLC)

- Stahl AG

- RAE Systems (Honeywell)

- Eaton Corporation

- CorDEX Instruments Ltd.

- Kyland Technology Co., Ltd.

- Banner Engineering Corp.

- Georgin

The intrinsically safe equipment market is highly competitive with strong key players within its ecosystem. Companies are focusing on developing advanced materials and technologies to enhance product offerings and sustain market competition and align with customer goals. For instance, in October 2023, Vedanta Aluminium launched a new range of advanced wire rods, namely T4, AL59, and the 8xxx series, that set a new benchmark for excellence in product offerings for the global power and transmission sector.

Here's the list of some key players in intrinsically safe equipment market:

Recent Developments

- In November 2024, GE Vernova Inc. announced that it has signed a contract with Powerlink to provide crucial electrical equipment in support of its Capital Work program. Under this contract, GE Vernova will deliver 69 Dead Tank Circuit Breakers (DTCBs) rated 245 kV and above to support renewable energy objectives and enhance the resilience of power infrastructure.

- In September 2023, BlackBerry Limited, announced the launch of a new series of BlackBerry Radar devices for hazardous materials carriers, H2M IS. It is certified as intrinsically safe, and through this certification, BlackBerry Radar, an asset-tracking solution, is now targeting transportation and logistics companies.

- Report ID: 6929

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Intrinsically Safe Equipment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.