Interspinous Spacers Market Outlook:

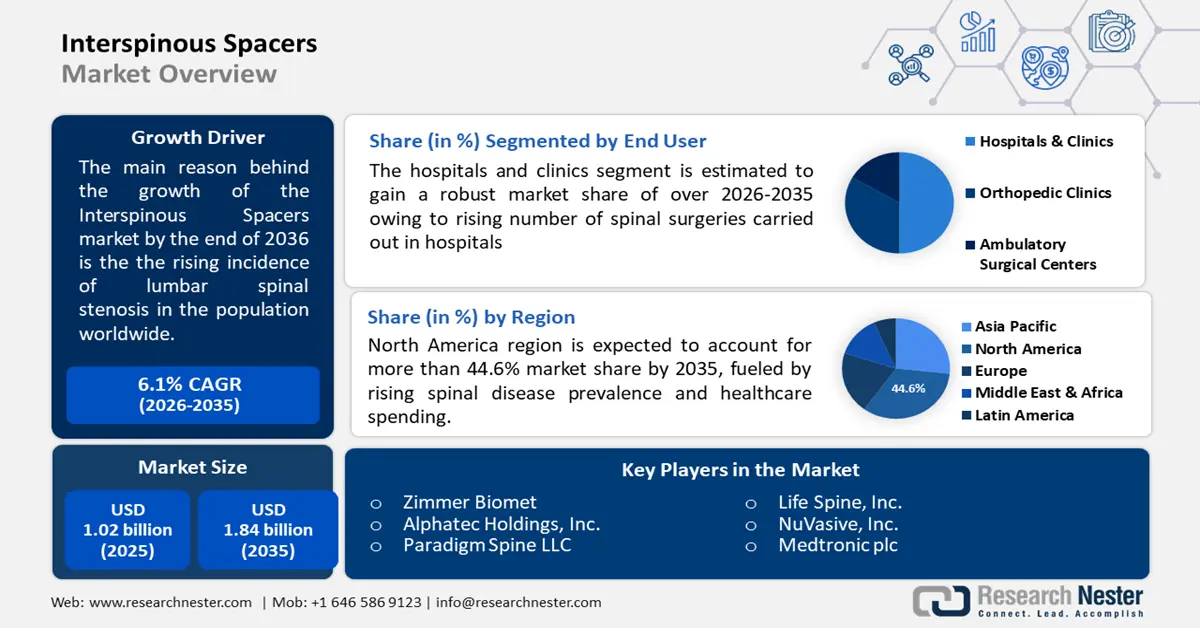

Interspinous Spacers Market size was valued at USD 1.02 billion in 2025 and is set to exceed USD 1.84 billion by 2035, registering over 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of interspinous spacers is estimated at USD 1.08 billion.

The growth of the market can be attributed primarily to the rising incidence of lumbar spinal stenosis in the population worldwide, owing to unhealthy lifestyles, illnesses, and accidents. For instance, a report of 2022 calculated that about 12% of American adults suffer from lumbar spinal stenosis, and nearly 19% of the population older than 60 years suffer from spinal stenosis.

Apart from the aforementioned factors, there are several other factors that are responsible for market growth. These factors are the increasing cases of degenerative disc disorders along with lumbar spinal stenosis, and other spinal disorders. Furthermore, with the rising cases of chronic and acute disorders, the demand for minimally invasive surgeries has soared which in turn is anticipated to bring lucrative growth opportunities for market expansion. Also, the high number of product approvals from government regulatory agencies, growth in technological advancement, and favorable compensation policies for patients is expected to generate significant revenue during the analysis period. In addition, the surge in awareness level about interspinous spacers and the advantages offered by them is also considered to fuel market growth.

Key Interspinous Spacers Market Insights Summary:

Regional Highlights:

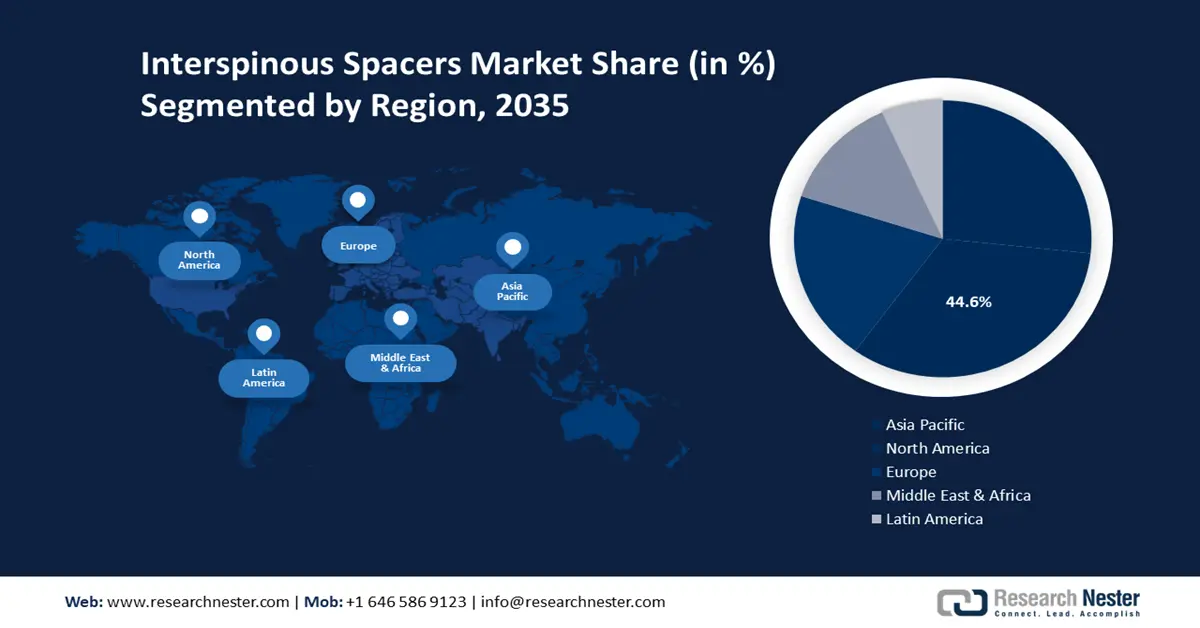

- The North America interspinous spacers market will hold around 44.6% share by 2035, fueled by rising spinal disease prevalence and healthcare spending.

Segment Insights:

- The hospitals & clinics segment in the interspinous spacers market is expected to hold the largest share by 2035, influenced by increasing spinal surgeries and expanding hospital infrastructure.

- The lumbar spinal stenosis segment in the interspinous spacers market is expected to hold the largest share by the forecast year 2035, driven by rising cases of lumbar stenosis and demand for less invasive procedures.

Key Growth Trends:

- Rising Incidence ofDegenerative Disk Disease Worldwide

- High Expenditure on Research and Development Activities

Major Challenges:

- High Cost of Implant Surgery

- Complications Associated with The Surgery

Key Players: Spine Wave, Inc., Boston Scientific Corporation, Globus Medical, Inc., Spinal Simplicity, Life Spine, Inc., NuVasive, Inc., Medtronic plc, Zimmer Biomet, Alphatec Holdings, Inc., Paradigm Spine LLC.

Global Interspinous Spacers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.02 billion

- 2026 Market Size: USD 1.08 billion

- Projected Market Size: USD 1.84 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, China

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 9 September, 2025

Interspinous Spacers Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing Base of Geriatric Population - Older adults over 60 suffer from low back pain and spinal disorders more frequently than other health conditions. Most spine surgeries are performed for lumbar spinal stenosis (LSS) among patients over 65 years old. Thus, the growing elderly people population is anticipated to drive global interspinous spacers market growth over the forecast period. The World Health Organization (WHO) forecasts that 2.1 billion people will be over 60 years old by 2050 in the world, an increase of 900 million from 2015.

- Rising Incidence of Degenerative Disk Disease Worldwide –Owing to the adoption of unhealthy lifestyles and a surge in cases of incidents, traumas, and accidents, the cases of degenerative disk diseases have also soared. As a result, the demand for interspinous spacers is expected to rise as it is widely used in the treatment process of these diseases. It was observed from a recent report of 2020 that around 40% of adults in the world age 40 or above are diagnosed with at least one degenerated vertebral disc. This percentage increases to 90% with people of age 60 and above.

- Growing Success Rate of Disk Replacement Surgery - The results of a recent study have shown that artificial disc replacement surgery has a success rate of 87% globally.

- High Expenditure on Research and Development Activities – The recent focus of the government to develop novel interspinous spacers to treat spinal disorders and disk diseases is expected to create a positive outlook for market expansion in the future. As of 2020, the World Bank calculated the global research and development expenditure to represent 2.63% of GDP, up from 2.2% in 2018.

- Innovative Product Development by Manufacturers - Major key players working in the market is an investment in the R&D sector to develop technologically advanced interspinous spacers which in turn is expected to rise the sales of interspinous spacers in the healthcare sector. In April 2022, Spinal Simplicity launched the Minuteman G5 implant, long-awaited by the medical device community. In the thoracic, lumbar, and sacral spines, the Minuteman device is designed to fixate and stabilize the spine with minimally invasive surgery.

Challenges

-

High Cost of Implant Surgery – In developing nations, the cost of implant surgery is too much high. As a result, the population with middle income is expected to be reluctant to adopt interspinous spacers owing to the unavailability of funds. This trend is expected to lower the growth rate of the market.

-

Complications Associated with The Surgery

-

Increased Risk of Reoperation After Interspinous Spacer Placement

Interspinous Spacers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 1.02 billion |

|

Forecast Year Market Size (2035) |

USD 1.84 billion |

|

Regional Scope |

|

Interspinous Spacers Market Segmentation:

End-user

The global interspinous spacers market is segmented and analyzed for demand and supply by end-user into hospitals & clinics, orthopedic clinics, and ambulatory surgical centers. Among these segments, the hospitals and clinics segment are attributed to holding the largest market share by the end of 2035 in the global interspinous spacers market owing to the rising number of spinal surgeries carried out in hospitals. Moreover, the growing number of hospitals across the world is expected to augment segment growth over the forecast period. The Organization for Economic Cooperation and Development (OECD) stated that the number of hospitals present in the United States grew from 5,564 in 2015 to 6,090 in 2019. Furthermore, the presence of proper facilities to carry out surgical producers to fit interspinous spacers along with favorable reimbursement policies offered by various hospitals across the globe is another factor expected to impetus a significant revenue generation.

Indication

The global interspinous spacers market is also segmented and analyzed for demand and supply by indication into lumbar spinal stenosis, degenerative disc disease, and others. Out of these, the lumbar spinal stenosis segment is projected to hold the largest share, backed by rising cases of lumbar spinal stenosis across the world. A recent report suggested that in the United States around 200,000 adults are affected by lumbar spinal stenosis, resulting in considerable pain and disability. Furthermore, the increased requirement of minimally invasive procedures by patients is expected to bring profitable opportunities for segment growth. Also, the rising number of spinal disorders is leading to increased spinal surgeries which again rises the demand for interspinous spacers during treatment procedures.

Our in-depth analysis of the global market includes the following segments:

|

By Product |

|

|

By Indication |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Interspinous Spacers Market Regional Analysis:

North American Market Insights

North America region is expected to account for more than 44.6% market share by 2035, fueled by rising spinal disease prevalence and healthcare spending. The healthcare spending of the United States reached USD 4.1 trillion in 2020, representing 19.7% of the country's GDP, according to the Centers for Medicare & Medicaid Services. Further, the presence of a strong healthcare network in the region, along with the availability of supportive policies by the regulatory bodies that promote the development of novel and technologically advanced interspinous spacers are also anticipated to contribute to the market growth in the region. In addition, the region's expanding healthcare industry and the presence of a high number of hospitals and clinics in the region are also anticipated to boost market growth during the forecast period. Moreover, the burgeoning geriatric population with lumbar spinal stenosis and degenerative disc disease along with rising accidents and incidents leading to disorders is also projected to fuel the market growth in the region.

Interspinous Spacers Market Players:

- Spine Wave, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Boston Scientific Corporation

- Globus Medical, Inc.

- Spinal Simplicity

- Life Spine, Inc.

- NuVasive, Inc.

- Medtronic plc

- Zimmer Biomet

- Alphatec Holdings, Inc.

- Paradigm Spine LLC

Recent Developments

-

Spine Wave, Inc. launched its Salvo 5.5/6.0mm spine system featuring the company's innovative modular screw design.

-

Boston Scientific Corporation announced a definitive agreement to purchase Vertiflex, Inc., a privately held company that has developed a minimally-invasive device to treat patients with lumbar spinal stenosis (LSS).

- Report ID: 4445

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Interspinous Spacers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.