Insulation Market Outlook:

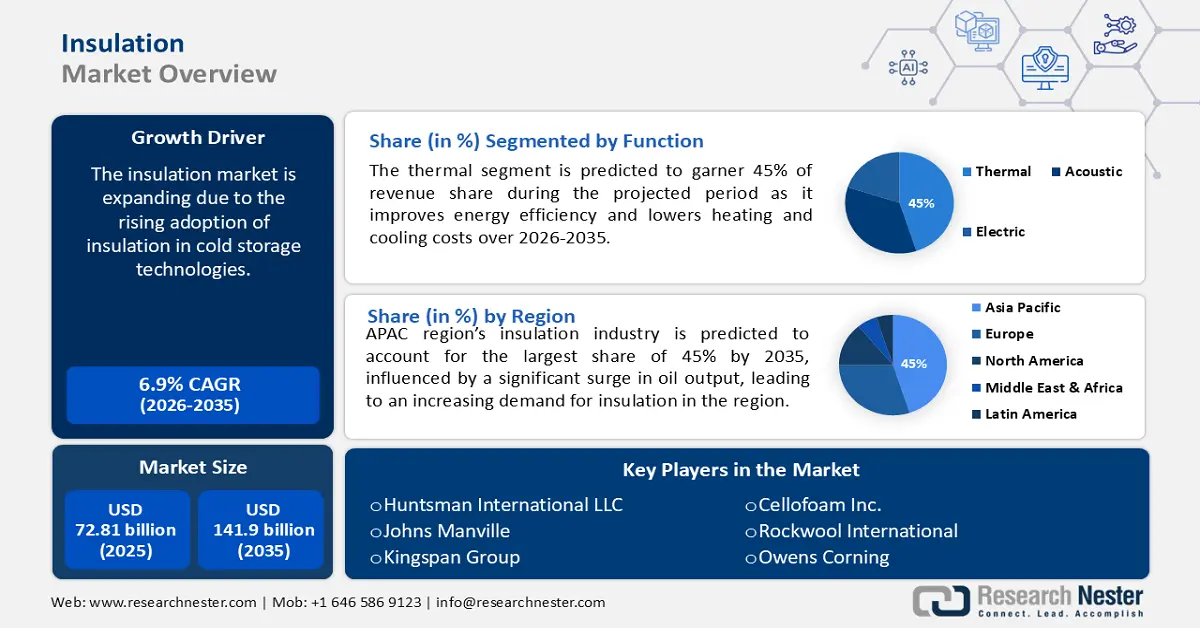

Insulation Market size was over USD 72.81 billion in 2025 and is projected to reach USD 141.9 billion by 2035, growing at around 6.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of insulation is evaluated at USD 77.33 billion.

Insulation market has a key application in cold storage and transportation. In the design phase of a cold storage facility, several factors are considered to ensure optimal temperature control and energy efficiency. These include the use of vapor barriers for the building enclosures and advanced insulation materials, with typical R-values of up to R-40+ for walls, R-60 for the roof, and R-30+ for internal walls. Appropriate insulation is necessary to prevent structural damage from moisture ingress and frost heave and incorporating HVAC systems for cold storage environments is vital for safety and compliance. Continuous development of cold chain logistics and the demand for insulation materials are fostering insulation market growth.

Key Insulation Market Insights Summary:

Regional Highlights:

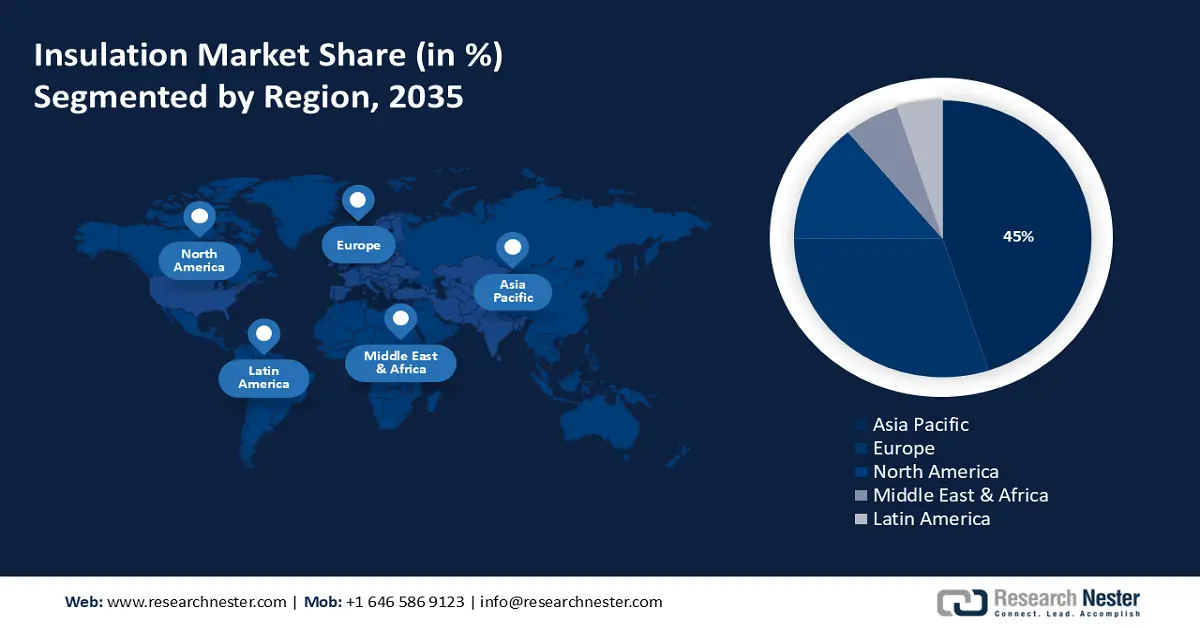

- The Asia Pacific insulation market will secure over 45% share by 2035, driven by the increasing oil output and demand for insulation materials in refurbishment and restoration.

- The Europe market will capture a 30% share by 2035, driven by industrialization and government initiatives for reducing carbon emissions.

Segment Insights:

- The thermal segment in the insulation market is projected to hold a 45% share by 2035, fueled by improved energy efficiency and lower heating/cooling costs.

- The building & construction segment in the insulation market is set for steady growth till 2035, influenced by the rising demand for urban insulation and energy efficiency.

Key Growth Trends:

- Role of biocomposite insulating materials in the future of green construction

- Rampant technological innovations

Major Challenges:

- Rising health concerns

- Lack of awareness

Key Players: BASF, GAF Materials Corporation, Knauf Insulation, Huntsman International LLC, Johns Manville, Kingspan Group, Saint-Gobain, Cellofoam North America, Inc., Rockwool International.

Global Insulation Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 72.81 billion

- 2026 Market Size: USD 77.33 billion

- Projected Market Size: USD 141.9 billion by 2035

- Growth Forecasts: 6.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 17 September, 2025

Insulation Market Growth Drivers and Challenges:

Growth Drivers

-

Role of biocomposite insulating materials in the future of green construction- Mycelium biocomposites (MCB) have gained huge traction for the production of MCB insulation foams. It exhibits high moisture resistance, dimensional stability, hydrophobicity, and fire resistance. MCB is a circular, biodegradable insulation material widely used in the construction industry. These mycelium biocomposites are manufactured using mushroom mycelium, rapeseed straw, Ganoderma resinaceum mycelium, and other agricultural byproducts and are a sustainable alternative to conventional insulation materials.

Biohm is a prominent manufacturer of mycelium-based fiber-reinforced composites and monolithic materials for construction, interior or architecture development, and retail packaging end users. Mycelium composites are an emerging type of affordable and sustainable materials, experiencing rising research interest and commercialization, particularly in the U.S. and EU for construction applications. Since these materials utilize natural fungal growth for low-energy bio-fabrication, they offer the opportunity to upcycle abundant agricultural waste and by-products. MCB has customizable properties and showcases the potential to replace synthetic foams, plastics, and timber. - Rampant technological innovations- Technological developments and a focus on addressing the changing demands of different industries have led to substantial progress and innovation in the insulation market. These improvements are anticipated to result in significant revenue growth and a wider range of opportunities for the electrical insulation materials market.

In June 2022, DuPont Performance Building Solutions announced the reformulation of Thermax polyisocyanurate insulation to eliminate the use of halogenated flame retardants. This updated product formulation represents another advancement in DuPont's ongoing efforts to develop technologies that prioritize safety through design further driving the Insulation market growth. - Rapid urbanization and increasing industrial development- The market is growing due to rapid urbanization and increasing industrial activity, and this rise is expected to continue during the projected period. Prominent participants in the global insulation sector are collaborating with small- and medium-sized manufacturers to expand their geographical footprint. Fiberglass and plastic foam are widely employed insulating materials in the global industry.

The insulation market is expanding as a result of increasing infrastructure development initiatives in emerging economies and the continuously growing global population. In April 2021, Installed Building Products, Inc., acquired Alert Insulation to diversify its product offerings. Their primary products and services cater to business customers and include the installation of fiberglass insulation, fireproofing, and acoustical ceiling systems.

Challenges

-

Rising health concerns - A major growth hurdle is the health risks of using insulating products. During laying, glass wool could damage the eyes and lungs. Due to styrene emissions, expanded and extruded polystyrenes are restricted. These insulation products' health risks limit their use and may slow insulation market growth in the projected term.

- Lack of awareness - The insulation materials industry may not reach its maximum growth potential if consumers remain unaware of the benefits of insulation. This could hinder the development of innovative and more efficient insulating techniques. Moreover, buildings lacking sufficient insulation consume a greater amount of energy, leading to an increase in their carbon footprint and the emission of greenhouse gases into the atmosphere.

Insulation Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.9% |

|

Base Year Market Size (2025) |

USD 72.81 billion |

|

Forecast Year Market Size (2035) |

USD 141.9 billion |

|

Regional Scope |

|

Insulation Market Segmentation:

Product Segment Analysis

Expanded polystyrene segment is expected to capture over 20% insulation market share by 2035. Polystyrene is expanded using rigid polystyrene. This lightweight plastic foam is high-tensile. These properties of expanded polystyrene driving the market during the forecast period. Polystyrene foam is often the most sustainable choice for its intended use when expanded using a blowing agent.

The expanded polystyrene foam cups are 95% air by volume, they take 35% less energy, 40% less water, and emit 40% less CO2 compared to materials such as paper cups. Polystyrene foam is utilized as a sub-layer in veneers and geo-forms for foundations, highways, and bridges because it insulates well. These insulating qualities are also seen in personal coolers and commercial refrigerated trucks. Polystyrene has been recycled over 25 million pounds by AmSty. AmSty almost reached five million pounds per year in 2022, surpassing the previous record by 55%.

Function Segment Analysis

By the end of 2035, thermal segment is poised to dominate around 45% insulation market share, as it improves energy efficiency and lowers heating and cooling costs. Energy-saving measures become more crucial as energy costs rise and environmental concerns grow. Thermal insulation effectively prevents heat transmission, maintaining indoor temperatures and relieving HVAC systems.

Furthermore, the segment is growing owing to an ongoing influx of investments. In July 2024, VARM, the pioneering insulation business, received USD 6.1 million in seed funding from Emerge, Pale Blue Dot, noa (previously A/O), Fundamental, and angel investors. This investment will transform the insulation business, helping VARM decarbonize Europe.

End user Segment Analysis

In insulation market, building & construction segment is likely to dominate around 35% revenue share by the end of 2035, due to the rising demand for Urban insulation. Substantial lifestyle changes have driven up the insulation need for cold storage and transportation. Insulation materials are also in demand across refineries and petrochemical sectors. It reduces loss and gain of heat in such industries thus it is very energy-efficient.

In May 2024, TopBuild Corp., a leading installer and specialty distributor of insulation and building materials to the construction industry in the U.S. and Canada, acquired Wickes, Ark.-based Insulation Works. Insulation Works serves Arkansas and nearby states' residential and light business markets and agricultural structures nationally. Insulation Works brings in USD 28 million annually from three Arkansas facilities which may end by the month of May. Therefore, such initiatives propel the Insulation market at a faster pace.

Our in-depth analysis of the global market includes the following segments:

|

Material |

|

|

Function |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Insulation Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is predicted to hold largest revenue share of 45% by 2035. In this region, there has been a significant surge in oil output, leading to an increasing demand for insulation. The oil production business requires insulation solutions to prevent energy wastage. The reason for this is the increasing oil output in the economies of China and India, as well as growing worries about major energy waste and the demand for materials in refurbishment and restoration.

The insulation market in India is projected to have rapid growth, driven by the strong expansion of building construction. This growth is particularly attributed to the increasing emphasis on energy efficiency, which would result in higher installation of insulation materials in each building. In addition, the reasons contributing to the recovery in industrial equipment production include strong recoveries in HVAC systems, transportation equipment, and appliance manufacturing. Furthermore, manufacturers are using more insulation per product to enhance their quality and improve their competitiveness in the worldwide market.

The China insulation market has been seeing substantial growth and is projected to sustain its expansion in the foreseeable future. The transportation sector in China has witnessed substantial growth and demand, hence driving the expansion of the insulating materials market. In addition, the government has enforced a set of mandatory energy conservation standards and procedures to meet energy-saving goals. This has also stimulated market growth for refurbishment and remodeling projects.

The insulation market in Japan is currently experiencing transformations, with a rising focus on the significance of insulation in terms of energy efficiency, health, and sustainability. Despite the presence of obstacles including differing insulation requirements and market fluctuations, the business nevertheless presents prospects for expansion and advancement. Nippon aqua, specializes in spray polyurethane foam (SPF) insulation. It operates in more than 30 locations around Japan and is a subsidiary of Hinokiya Holdings, a prominent residential home builder. Thus, such firms propel the market expansion.

Europe Market Insights

By the end of 2035, Europe insulation market is set to hold over 30% share. Due to the fast industrialization and the existence of important insulation product manufacturers, this region is expected to be an early user of developing insulation materials. The market expansion is also ascribed to the rising number of residential and commercial structures, together with governmental programs aimed at mitigating carbon emissions.

The UK insulation market consists of a range of different insulating materials and is influenced by factors including market size, predictions, construction activity, and industry developments. Knauf Insulation is delighted to declare a significant investment of around USD 200 million in a cutting-edge rock mineral wool production, specifically designed to cater to the UK market on May 14, 2024. This shows a strong dedication to meeting the increasing need for sustainable insulating solutions that do not produce combustion.

The insulation market in France is now growing due to numerous factors, including rapid economic expansion, increased investment in building, and a strong demand for acoustic and thermal insulation. Moreover, In December 6, 2023, Soprema Group has entered into an agreement with SaintGobain to acquire a controlling interest in the Polyisocyanurate insulation (PIR) business assets in france, namely under the Celotex brand.

The Germany insulation industry is marked by notable advancements and breakthroughs in insulation technologies, propelled by the need for energy-efficient solutions and environmentally friendly construction methods. The Ziegler Group now has a fully operational wood fiber insulation board (WFIB) factory, which was supplied by DIEFFENBACHER, a company situated in Eppingen. Production of the rigid WFIB line commenced on August 30, 2022. Ziegler Group submitted its order to DIEFFENBACHER on April 1, 2021.

Insulation Market Players:

- DuPont

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF

- GAF Materials Corporation

- Knauf Insulation

- Huntsman International LLC

- Johns Manville

- Kingspan Group

- Saint-Gobain

- Cellofoam North America, Inc.

- Rockwool International A/S

- Owens Corning

- Atlas Roofing Corporation

Insulation companies that dominate deliver new materials with increased thermal performance, sustainability, and installation convenience. They aim to develop insulation materials that strictly adhere to energy efficiency and green building standards. These players are increasing their product portfolios by supplying diverse insulating materials for specific applications and performance needs. Major corporations that dominate market demand include:

Recent Developments

- In January 2024, BASF and Carlisle Construction Materials formed a partnership to utilize Lupranate ZERO, the first isocyanate in the world that has no carbon footprint. Lupranate ZERO, which stands for Zero Emissions Renewable Origins, is utilized for the manufacturing of MDI polyisocyanurate boards (PIR or polyiso) and rigid polyurethane foam. These materials are specifically designed for thermal insulation in buildings. The construction industry has a specific interest in this, and Carlisle, as the top manufacturer of polyiso, is the ideal partner to investigate this technology.

- In March 2024, GAF announced its intention to construct a new facility for manufacturing shingles in Newton, Kansas. Approximately 25% of homes in the U.S. have a GAF roof, which allows GAF to expand its residential roofing manufacturing capabilities near its target markets and improve its top-notch customer service across the country.

- Report ID: 6310

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Insulation Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.