Insect Cell Lines Market Outlook:

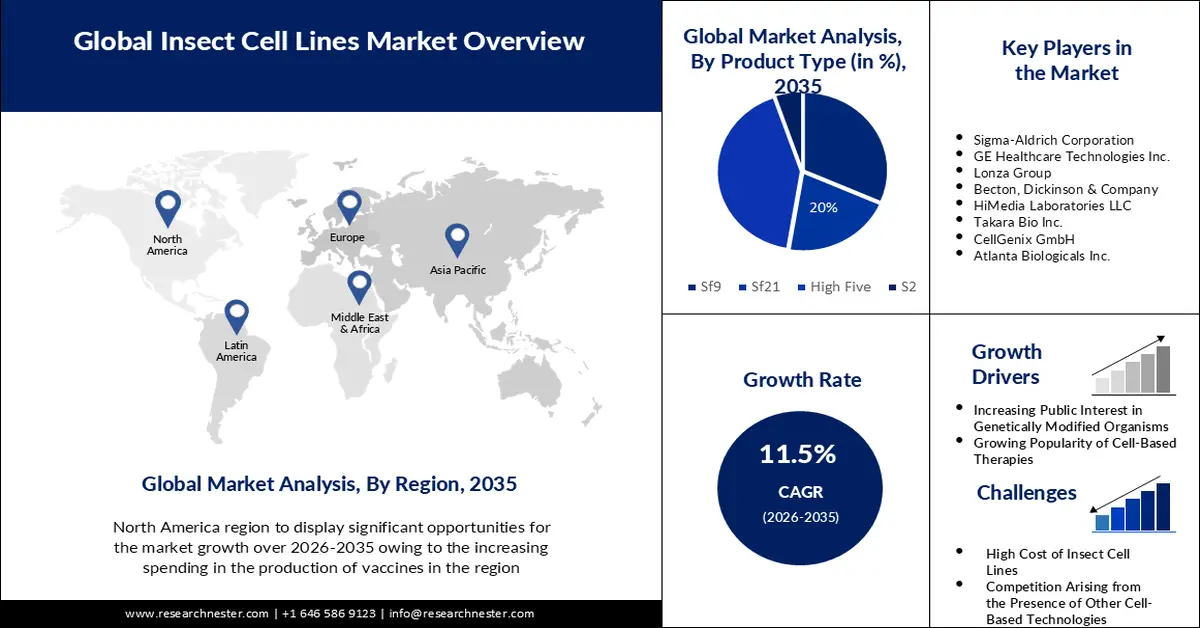

Insect Cell Lines Market size was over USD 1.23 billion in 2025 and is projected to reach USD 3.65 billion by 2035, witnessing around 11.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of insect cell lines is evaluated at USD 1.36 billion.

The reason behind the growth is due to the increasing production of vaccines. Several veterinary and human vaccines are commercially produced using the baculovirus-insect cell expression method that are desirable for high-level eukaryotic protein synthesis. There are already around 1 billion doses of vaccine produced each month by producers globally, and this number will increase to over 10 billion by the end of 2021, and, overall vaccine production reach over 22 billion by June 2022.

The rising need for insect-derived products is believed to fuel the insect cell lines market. Insects have recently been suggested as one of the most viable alternatives to animal protein which has led to the production of health-related products by insect cell lines using vectors created from insect viruses in insect cells, which give high levels of protein expression.

Key Insect Cell Lines Market Insights Summary:

Regional Highlights:

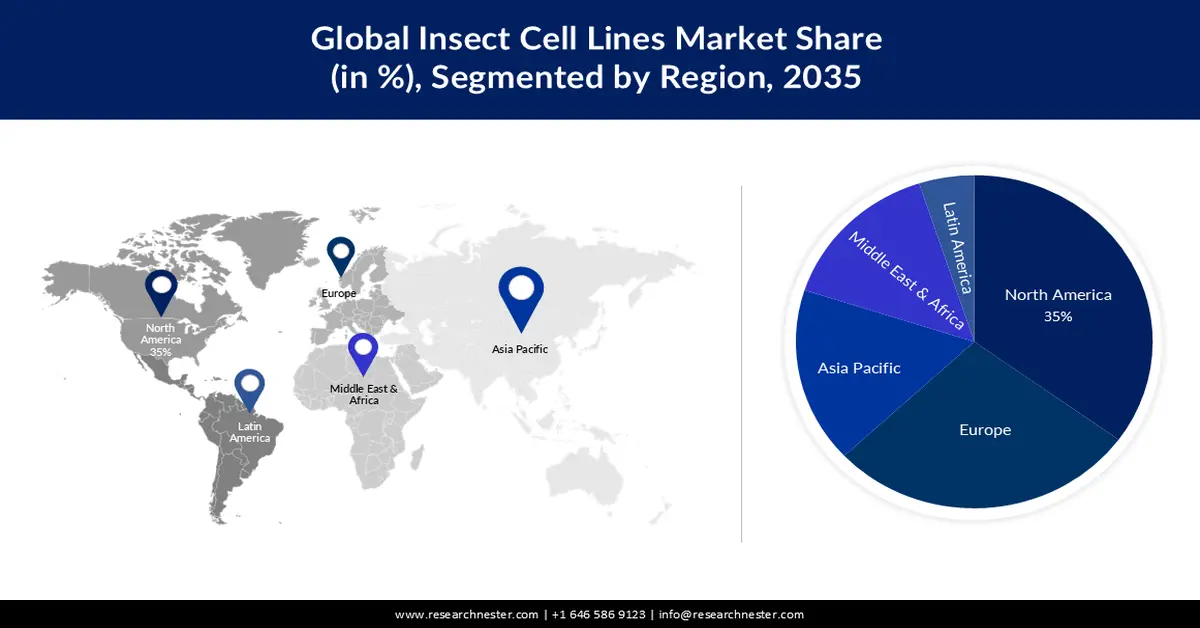

- By 2035, the North America insect cell lines market is set to command a 35% share, impelled by increasing spending in vaccine production.

- Europe is projected to hold the second-largest share, underpinned by escalating healthcare R&D investments.

Segment Insights:

- High-Five segment in the insect cell lines market is expected to achieve a 40% share, propelled by the rising prevalence of autoimmune disorders.

- The Biopharmaceutical Manufacturing segment is poised to secure a notable share by 2035, owing to the broadened adoption of recombinant DNA technology for therapeutic protein synthesis.

Key Growth Trends:

- Increasing Public Interest in Genetically Modified Organisms

- Growing Popularity of Cell Based Therapies

Major Challenges:

- High Cost of Insect Cell Lines

- Competition Arising from the Presence of Other Cell Based Technologies

Key Players: Sigma-Aldrich Corporation, GE Healthcare Technologies Inc., Lonza Group, Becton, Dickinson & Company, HiMedia Laboratories LLC, Takara Bio Inc., CellGenix GmbH, Atlanta Biologicals Inc., PromoCell GmbH.

Global Insect Cell Lines Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.23 billion

- 2026 Market Size: USD 1.36 billion

- Projected Market Size: USD 3.65 billion by 2035

- Growth Forecasts: 11.5%

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Singapore, Australia

Last updated on : 26 November, 2025

Insect Cell Lines Market - Growth Drivers and Challenges

Growth Drivers

- Increasing Public Interest in Genetically Modified Organisms– The genetic modification of insects has emerged as a significant topic of study as genetically modified organisms, or GMOs, are organisms that have had their genomes altered via the use of recombinant DNA technology.

- Growing Popularity of Cell-Based Therapies- Cell and gene therapies hold the potential to provide patients with life-altering medications therefore, the use of cell-based therapeutics is expanding quickly, and insect cell lines are being utilized to manufacture these therapies as they can be used as cutting-edge models with special benefits like higher efficiency and lower cost.

- Spiking Prevalence of Chronic Diseases- Insect cell lines are extensively used in the pharmaceutical sector as they aid in producing drugs and vaccines for the treatment of several chronic conditions. According to the World Health Organization (WHO), Noncommunicable diseases (NCDs) account for 41 million annual fatalities, or around 74% of all fatalities worldwide.

- Surge in Drug Development- In the early stages of drug screening, insect cell expression is common, as they provide several industrial benefits over mammalian cells, including less need for CO2, lower energy needs, and fewer biosafety requirements.

- Increasing Usage in Toxicity Screening- Insect cell cultures are used to compare the toxicities of various substances in both target organisms and non-target organisms as they are capable of mimicking certain aspects of mammalian cell responses.

- Rising Trend of Personalized Medicine- Insect cell lines are used in the production of viral vectors that have been developed to offer personalized medications that can be used for a variety of applications in medical biotechnology and biological sciences.

- Expanding Usage in Virus Research- Insect-derived cell lines offer useful resources for the controlled research of insect viruses that are spread between insects and plants.

Challenges

- High Cost of Insect Cell Lines – The cost of maintaining controlled environments is usually high as insect cell lines must be kept at 37°C and are grown at 27°C for optimum growth in a carbon dioxide-rich environment. Besides this, eliminating microbial contamination is a difficult but necessary first step in the development of an insect cell line to clean insect tissues, whereby researchers employ a variety of techniques that consume a lot of time, energy, and money.

- Competition Arising from the Presence of Other Cell-Based Technologies

- Limited Funding can Impede the Overall Efficiency of Insect Cell Lines

Insect Cell Lines Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

11.5% |

|

Base Year Market Size (2025) |

USD 1.23 billion |

|

Forecast Year Market Size (2035) |

USD 3.65 billion |

|

Regional Scope |

|

Insect Cell Lines Market Segmentation:

Product Type Segment Analysis

The high-five segment in the insect cell lines market is estimated to gain a robust revenue share of 40% in the coming years impelled by the rising prevalence of autoimmune disorders. For instance, more than 3% of the world's population suffers from at least one autoimmune illness. It is expected that air pollution, infections, personal lifestyles, stress, and climate change are likely contributing factors to the sharp rise in autoimmune illnesses that are occurring in many regions of the world. The examination of autoimmune-mediated responses has benefited greatly from the use of recombinant proteins that are employed in the creation of biotherapeutic medications. These factors are expected to drive the demand for high-five insect cell lines.

An insect cell line called High Five (BTI-Tn-5B1-4) was developed from the ovarian cells of the cabbage looper which have been extensively studied for the synthesis of heterologous proteins. Moreover, the High Five cell line, the BTI-Tn5B1-4 insect cell line encourages the production of larger concentrations of recombinant proteins that are proteins encoded by recombinant DNA that are created through the introduction of particular genes into hosts, such as bacteria or yeast. According to current estimates, the global prevalence of autoimmune illnesses is increasing by over 7% yearly.

Besides this, the Sf9 segment in the insect cell lines market is poised to gain a significant revenue share. Sf9 insect cell lines is a clonal strain obtained from the parental Spodoptera frugiperda cell line IPLB-Sf-21-AE, and it is frequently employed in insect cell culture for the manufacture of recombinant proteins.

Application (Biopharmaceutical Manufacturing, Tissue Culture & Engineering, Gene Therapy, Cytogenetic)

Insect cell lines market from biopharmaceutical manufacturing segment is set to garner a notable share shortly. Biopharmaceuticals, or medications derived from live organisms or their cells, are highly effective in treating a variety of ailments and are manufactured by biosynthesis generally that produce proteins and nucleic acids. Moreover, recombinant DNA technology is used to create biopharmaceuticals, which use a host cell to express and secrete therapeutic proteins that can be utilized as medicines, vaccines, and diagnostic tools.

Insect cells can effectively express recombinant proteins and are typically employed for the creation of virus-like particles and vaccines have been widely employed in recent years to produce many kinds of physiologically active recombinant proteins as a cell line retains favorable growth and productivity characteristics.

End-User Segment Analysis

The pharmaceuticals manufacturing segment in the insect cell lines market is anticipated to garner a notable share during the forecast timeframe. Pharmaceutical manufacturing is the process of creating pharmaceutical medications on an industrial scale and includes physical procedures such as blending, compression, filtration, heating, encapsulating, shearing, coating, and drying.

The most often utilized insect cell lines are High Five, Sf9, and S2 are often used for the production of vaccines and other biologicals and provide several technological benefits over mammalian cells. Moreover, it has previously been suggested that the preferred biosecurity technique for vaccine manufacture, especially for upcoming influenza pandemic vaccines, is the insect cell expression system as they are capable of carrying out many of the post-translational modifications that viral antigens frequently need.

Our in-depth analysis of the global insect cell lines market includes the following segments:

|

Product Type |

|

|

Application |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Insect Cell Lines Market - Regional Analysis

North American Market Insights

The insect cell lines market in North America industry is expected to account for largest revenue share of 35% by 2035, impelled by increasing spending in the production of vaccines. This, as a result, may lead to increasing development of vaccines in the region which is expected to drive the demand for insect cell lines. For instance, as of 2020, American biopharmaceutical companies worked on over 250 vaccines to prevent and treat diseases including cancer, and other autoimmune disorders.

The US government spent over USD 31 billion on the research, development, and acquisition of mRNA COVID-19 vaccines, with significant sums spent in the three decades before the pandemic and through March 2022.

European Market Insights

The Europe insect cell lines market is estimated to be the second largest, during the forecast period led by rising spending in research & development in the healthcare industry. This has led to an increase in focus on research and development in the area of creative medicines by the pharmaceutical industry in the region which is essential if diseases and disorders are to be treated efficiently. In Europe, the research-based pharmaceutical business alone spent around €37 billion on R&D in 2019 and over €35 billion in 2020.

Insect Cell Lines Market Players:

- Thermo Fisher Scientific Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sigma-Aldrich Corporation

- GE Healthcare Technologies Inc.

- Lonza Group

- Becton, Dickinson & Company

- HiMedia Laboratories LLC

- CellGenix GmbH

- Atlanta Biologicals Inc.

- PromoCell GmbH

- Merck

Recent Developments

- Thermo Fisher Scientific Inc. teamed up with Moderna, Inc. for the production of Spikevax, COVID-19 vaccine, and other investigational mRNA therapies in its pipeline and provide devoted capacity for lyophilized and liquid filling, among other aseptic fill-finish services.

- Merck acquired AmpTec, to enhance its capacity to create and manufacture mRNA for its clients for use in many other diseases-related vaccines, therapies, and diagnostics and to hasten the creation of new treatments for numerous more ailments.

- Report ID: 5339

- Published Date: Nov 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Insect Cell Lines Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.