- An Outline of the Global Injection Molded Plastics Market

- Market definition

- Market segmentation

- Product overview

- Assumptions and Abbreviations

- Research Methodology & Approach

- Research process

- Primary research

- Manufacturers

- Suppliers & Distributors

- End-users

- Secondary research

- Market size estimation

- Summary of the Report for Key Decision Makers

- Forces of the Market Constituents

- Factors/drivers impacting the growth of the market

- Market trends for better business practices

- Key Market Opportunities for Business Growth

- Decarbonization Strategy and Carbon Credit Benefit for Market Players

- Global government decarbonization plans/goals by each country under 2015 agreement agreed by 200 countries

- Measures taken by countries to reduce carbon footprints

- Carbon credits and subsidy plans/benefits rolled out by the government for market players

- Effective ways to harness carbon-credits and impact on profit margins

- Demand impact on the companies opting for carbon credits

- Major Roadblocks for the Market Growth

- Government Regulation

- Technology Transition and Adoption Analysis

- Industry Risk Analysis

- Global Economic Outlook: Challenges for Global Recovery and its Impact on Global Injection Molded Plastics Market

- Ukraine-Russia crisis

- Potential US economic slowdown

- Industry Pricing Benchmarking & Analysis

- Analysis on Latest Trends in Injection Molded Plastics Market

- Increase in Contract Manufacturing

- Increased Focus on Sustainability

- Others

- Industry Supply Chain Analysis

- Product Feature Analysis

- Analysis on Ongoing Technological Advancements in Injection Molded Plastics Market

- Competitive Positioning: Strategies to differentiate a company from its competitors

- Competitive Model: A Detailed Inside View for Investors

- Market share of major companies profiled, 2022

- Business profiles of key enterprises

- Exxon Mobil Corporation.

- BASF SE

- Celanese Corporation

- The Dow Inc.

- Huntsman International LLC.

- Eastman Chemical Company

- INEOS Group

- LyondellBasell Industries N.V.

- SABIC

- Chevron Phillips Chemical Company LLC.

- Daicel Corporation

- Global Injection Molded Plastics Market Outlook & Projections, Opportunity Assessment, 2022 to 2035

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Global Injection Molded Plastics Market Outlook & Projections, Opportunity Assessment by Segment

- By Raw Material

- Polypropylene (PP), Market Value (USD Million), CAGR, 2022-2035F

- Acrylonitrile Butadiene Styrene (ABS), Market Value (USD Million), CAGR, 2022-2035F

- High Density Polyethylene (HDPE), Market Value (USD Million), CAGR, 2022-2035F

- Polystyrene (PS), Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- By Application

- Packaging, Market Value (USD Million), CAGR, 2022-2035F

- Consumables & Electronics, Market Value (USD Million), CAGR, 2022-2035F

- Automotive, Market Value (USD Million), CAGR, 2022-2035F

- Motor Cycle Industry, Market Value (USD Million), CAGR, 2022-2035F

- Building & Construction, Market Value (USD Million), CAGR, 2022-2035F

- Aerospace, Market Value (USD Million), CAGR, 2022-2035F

- Healthcare, Market Value (USD Million), CAGR, 2022-2035F

- Railway Application, Market Value (USD Million), CAGR, 2022-2035F

- Computer Industry, Market Value (USD Million), CAGR, 2022-2035F

- Industrial Equipment (Materials), Market Value (USD Million), CAGR, 2022-2035F

- Manufacturing Market Value (USD Million), CAGR, 2022-2035F

- Office supplies, Market Value (USD Million), CAGR, 2022-2035F

- Households, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- By Automotive Application

- Exterior components, Market Value (USD Million), CAGR, 2022-2035F

- Splash Guards, Market Value (USD Million), CAGR, 2022-2035F

- Grilles, Market Value (USD Million), CAGR, 2022-2035F

- Floor Rails, Market Value (USD Million), CAGR, 2022-2035F

- Fenders, Market Value (USD Million), CAGR, 2022-2035F

- Bumpers, Market Value (USD Million), CAGR, 2022-2035F

- Doors, Market Value (USD Million), CAGR, 2022-2035F

- Tail Lights, Market Value (USD Million), CAGR, 2022-2035F

- A/C Condensers, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- Interior components, Market Value (USD Million), CAGR, 2022-2035F

- Interior Surfaces, Market Value (USD Million), CAGR, 2022-2035F

- Glove Compartments, Market Value (USD Million), CAGR, 2022-2035F

- Interior Door Handles, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- Exterior components, Market Value (USD Million), CAGR, 2022-2035F

- By Healthcare Application

- Medical Labware, Market Value (USD Million), CAGR, 2022-2035F

- Medical Equipment, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- By Railway Application

- Exterior, Market Value (USD Million), CAGR, 2022-2035F

- Interior and Flooring, Market Value (USD Million), CAGR, 2022-2035F

- Infrastructure, Market Value (USD Million), CAGR, 2022-2035F

- Technical Parts, Market Value (USD Million), CAGR, 2022-2035F

- By Office Supplies Application

- Office Automation Equipment, Market Value (USD Million), CAGR, 2022-2035F

- Office Machinery, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- By Household Application

- Exterior, Market Value (USD Million), CAGR, 2022-2035F

- Outdoor Furniture, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- Interior, Market Value (USD Million), CAGR, 2022-2035F

- Plastic Kitchenware, Market Value (USD Million), CAGR, 2022-2035F

- Toilet Seats, Market Value (USD Million), CAGR, 2022-2035F

- Organizers, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- By Industrial Equipment (Materials) Application

- Industrial Safety Helmets, Market Value (USD Million), CAGR, 2022-2035F

- Industrial Parts, Market Value (USD Million), CAGR, 2022-2035F

- By Region

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- North America, Market Value (USD Million) CAGR, 2022-2035F

- Europe, Market Value (USD Million) CAGR, 2022-2035F

- Asia Pacific, Market Value (USD Million) CAGR, 2022-2035F

- Latin America, Market Value (USD Million) CAGR, 2022-2035F

- Middle East & Africa, Market Value (USD Million) CAGR, 2022-2035F

- By Raw Material

- North America Injection Molded Plastics Market Outlook & Projections, Opportunity Assessment, 2022 to 2035

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- North America Injection Molded Plastics Market Outlook & Projections, Opportunity Assessment by Segment

- By Raw Material

- Polypropylene (PP), Market Value (USD Million), CAGR, 2022-2035F

- Acrylonitrile Butadiene Styrene (ABS), Market Value (USD Million), CAGR, 2022-2035F

- High Density Polyethylene (HDPE), Market Value (USD Million), CAGR, 2022-2035F

- Polystyrene (PS), Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- By Application

- Packaging, Market Value (USD Million), CAGR, 2022-2035F

- Consumables & Electronics, Market Value (USD Million), CAGR, 2022-2035F

- Automotive, Market Value (USD Million), CAGR, 2022-2035F

- Motor Cycle Industry, Market Value (USD Million), CAGR, 2022-2035F

- Building & Construction, Market Value (USD Million), CAGR, 2022-2035F

- Aerospace, Market Value (USD Million), CAGR, 2022-2035F

- Healthcare, Market Value (USD Million), CAGR, 2022-2035F

- Railway Application, Market Value (USD Million), CAGR, 2022-2035F

- Computer Industry, Market Value (USD Million), CAGR, 2022-2035F

- Industrial Equipment (Materials), Market Value (USD Million), CAGR, 2022-2035F

- Manufacturing Market Value (USD Million), CAGR, 2022-2035F

- Office supplies, Market Value (USD Million), CAGR, 2022-2035F

- Households, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- By Automotive Application

- Exterior components, Market Value (USD Million), CAGR, 2022-2035F

- Splash Guards, Market Value (USD Million), CAGR, 2022-2035F

- Grilles, Market Value (USD Million), CAGR, 2022-2035F

- Floor Rails, Market Value (USD Million), CAGR, 2022-2035F

- Fenders, Market Value (USD Million), CAGR, 2022-2035F

- Bumpers, Market Value (USD Million), CAGR, 2022-2035F

- Doors, Market Value (USD Million), CAGR, 2022-2035F

- Tail Lights, Market Value (USD Million), CAGR, 2022-2035F

- A/C Condensers, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- Interior components, Market Value (USD Million), CAGR, 2022-2035F

- Interior Surfaces, Market Value (USD Million), CAGR, 2022-2035F

- Glove Compartments, Market Value (USD Million), CAGR, 2022-2035F

- Interior Door Handles, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- Exterior components, Market Value (USD Million), CAGR, 2022-2035F

- By Healthcare Application

- Medical Labware, Market Value (USD Million), CAGR, 2022-2035F

- Medical Equipment, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- By Railway Application

- Exterior, Market Value (USD Million), CAGR, 2022-2035F

- Interior and Flooring, Market Value (USD Million), CAGR, 2022-2035F

- Infrastructure, Market Value (USD Million), CAGR, 2022-2035F

- Technical Parts, Market Value (USD Million), CAGR, 2022-2035F

- By Office Supplies Application

- Office Automation Equipment, Market Value (USD Million), CAGR, 2022-2035F

- Office Machinery, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- By Household Application

- Exterior, Market Value (USD Million), CAGR, 2022-2035F

- Outdoor Furniture, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- Interior, Market Value (USD Million), CAGR, 2022-2035F

- Plastic Kitchenware, Market Value (USD Million), CAGR, 2022-2035F

- Toilet Seats, Market Value (USD Million), CAGR, 2022-2035F

- Organizers, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- By Industrial Equipment (Materials) Application

- Industrial Safety Helmets, Market Value (USD Million), CAGR, 2022-2035F

- Industrial Parts, Market Value (USD Million), CAGR, 2022-2035F

- By Country

- US, Market Value (USD Million) CAGR, 2022-2035F

- Canada, Market Value (USD Million) CAGR, 2022-2035F

- By Raw Material

- Europe Injection Molded Plastics Market Outlook & Projections, Opportunity Assessment, 2022 to 2035

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Europe Injection Molded Plastics Market Outlook & Projections, Opportunity Assessment by Segment

- By Raw Material

- Polypropylene (PP), Market Value (USD Million), CAGR, 2022-2035F

- Acrylonitrile Butadiene Styrene (ABS), Market Value (USD Million), CAGR, 2022-2035F

- High Density Polyethylene (HDPE), Market Value (USD Million), CAGR, 2022-2035F

- Polystyrene (PS), Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- By Application

- Packaging, Market Value (USD Million), CAGR, 2022-2035F

- Consumables & Electronics, Market Value (USD Million), CAGR, 2022-2035F

- Automotive, Market Value (USD Million), CAGR, 2022-2035F

- Motor Cycle Industry, Market Value (USD Million), CAGR, 2022-2035F

- Building & Construction, Market Value (USD Million), CAGR, 2022-2035F

- Aerospace, Market Value (USD Million), CAGR, 2022-2035F

- Healthcare, Market Value (USD Million), CAGR, 2022-2035F

- Railway Application, Market Value (USD Million), CAGR, 2022-2035F

- Computer Industry, Market Value (USD Million), CAGR, 2022-2035F

- Industrial Equipment (Materials), Market Value (USD Million), CAGR, 2022-2035F

- Manufacturing Market Value (USD Million), CAGR, 2022-2035F

- Office supplies, Market Value (USD Million), CAGR, 2022-2035F

- Households, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- By Automotive Application

- Exterior components, Market Value (USD Million), CAGR, 2022-2035F

- Splash Guards, Market Value (USD Million), CAGR, 2022-2035F

- Grilles, Market Value (USD Million), CAGR, 2022-2035F

- Floor Rails, Market Value (USD Million), CAGR, 2022-2035F

- Fenders, Market Value (USD Million), CAGR, 2022-2035F

- Bumpers, Market Value (USD Million), CAGR, 2022-2035F

- Doors, Market Value (USD Million), CAGR, 2022-2035F

- Tail Lights, Market Value (USD Million), CAGR, 2022-2035F

- A/C Condensers, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- Interior components, Market Value (USD Million), CAGR, 2022-2035F

- Interior Surfaces, Market Value (USD Million), CAGR, 2022-2035F

- Glove Compartments, Market Value (USD Million), CAGR, 2022-2035F

- Interior Door Handles, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- Exterior components, Market Value (USD Million), CAGR, 2022-2035F

- By Healthcare Application

- Medical Labware, Market Value (USD Million), CAGR, 2022-2035F

- Medical Equipment, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- By Railway Application

- Exterior, Market Value (USD Million), CAGR, 2022-2035F

- Interior and Flooring, Market Value (USD Million), CAGR, 2022-2035F

- Infrastructure, Market Value (USD Million), CAGR, 2022-2035F

- Technical Parts, Market Value (USD Million), CAGR, 2022-2035F

- By industrial Equipment (Materials) Application

- Industrial Safety Helmets, Market Value (USD Million), CAGR, 2022-2035F

- Industrial Parts, Market Value (USD Million), CAGR, 2022-2035F

- By Office Supplies Application

- Office Automation Equipment, Market Value (USD Million), CAGR, 2022-2035F

- Office Machinery, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- By Household Application

- Exterior, Market Value (USD Million), CAGR, 2022-2035F

- Outdoor Furniture, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- Interior, Market Value (USD Million), CAGR, 2022-2035F

- Plastic Kitchenware, Market Value (USD Million), CAGR, 2022-2035F

- Toilet Seats, Market Value (USD Million), CAGR, 2022-2035F

- Organizers, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- By Country

- U.K., Market Value (USD Million), CAGR, 2022-2035F

- Spain, Market Value (USD Million), CAGR, 2022-2035F

- France, Market Value (USD Million), CAGR, 2022-2035F

- Italy, Market Value (USD Million), CAGR, 2022-2035F

- Germany, Market Value (USD Million), CAGR, 2022-2035F

- Russia, Market Value (USD Million), CAGR, 2022-2035F

- Netherlands, Market Value (USD Million), CAGR, 2022-2035F

- Rest of Europe, Market Value (USD Million), CAGR, 2022-2035F

- By Raw Material

- Asia Pacific Injection Molded Plastics Market Outlook & Projections, Opportunity Assessment, 2022 to 2035

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Asia Pacific Injection Molded Plastics Market Outlook & Projections, Opportunity Assessment by Segment

- By Raw Material

- Polypropylene (PP), Market Value (USD Million), CAGR, 2022-2035F

- Acrylonitrile Butadiene Styrene (ABS), Market Value (USD Million), CAGR, 2022-2035F

- High Density Polyethylene (HDPE), Market Value (USD Million), CAGR, 2022-2035F

- Polystyrene (PS), Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- By Application

- Packaging, Market Value (USD Million), CAGR, 2022-2035F

- Consumables & Electronics, Market Value (USD Million), CAGR, 2022-2035F

- Automotive, Market Value (USD Million), CAGR, 2022-2035F

- Motor Cycle Industry, Market Value (USD Million), CAGR, 2022-2035F

- Building & Construction, Market Value (USD Million), CAGR, 2022-2035F

- Aerospace, Market Value (USD Million), CAGR, 2022-2035F

- Healthcare, Market Value (USD Million), CAGR, 2022-2035F

- Railway Application, Market Value (USD Million), CAGR, 2022-2035F

- Computer Industry, Market Value (USD Million), CAGR, 2022-2035F

- Industrial Equipment (Materials), Market Value (USD Million), CAGR, 2022-2035F

- Manufacturing Market Value (USD Million), CAGR, 2022-2035F

- Office supplies, Market Value (USD Million), CAGR, 2022-2035F

- Households, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- By Automotive Application

- Exterior components, Market Value (USD Million), CAGR, 2022-2035F

- Splash Guards, Market Value (USD Million), CAGR, 2022-2035F

- Grilles, Market Value (USD Million), CAGR, 2022-2035F

- Floor Rails, Market Value (USD Million), CAGR, 2022-2035F

- Fenders, Market Value (USD Million), CAGR, 2022-2035F

- Bumpers, Market Value (USD Million), CAGR, 2022-2035F

- Doors, Market Value (USD Million), CAGR, 2022-2035F

- Tail Lights, Market Value (USD Million), CAGR, 2022-2035F

- A/C Condensers, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- Interior components, Market Value (USD Million), CAGR, 2022-2035F

- Interior Surfaces, Market Value (USD Million), CAGR, 2022-2035F

- Glove Compartments, Market Value (USD Million), CAGR, 2022-2035F

- Interior Door Handles, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- Exterior components, Market Value (USD Million), CAGR, 2022-2035F

- By Healthcare Application

- Medical Labware, Market Value (USD Million), CAGR, 2022-2035F

- Medical Equipment, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- By Railway Application

- Exterior, Market Value (USD Million), CAGR, 2022-2035F

- Interior and Flooring, Market Value (USD Million), CAGR, 2022-2035F

- Infrastructure, Market Value (USD Million), CAGR, 2022-2035F

- Technical Parts, Market Value (USD Million), CAGR, 2022-2035F

- By Office Supplies Application

- Office Automation Equipment, Market Value (USD Million), CAGR, 2022-2035F

- Office Machinery, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- By Household Application

- Exterior, Market Value (USD Million), CAGR, 2022-2035F

- Outdoor Furniture, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- Interior, Market Value (USD Million), CAGR, 2022-2035F

- Plastic Kitchenware, Market Value (USD Million), CAGR, 2022-2035F

- Toilet Seats, Market Value (USD Million), CAGR, 2022-2035F

- Organizers, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- By Industrial Equipment (Materials) Application

- Industrial Safety Helmets, Market Value (USD Million), CAGR, 2022-2035F

- Industrial Parts, Market Value (USD Million), CAGR, 2022-2035F

- By Country

- China, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- India, Market Value (USD Million), CAGR, 2022-2035F

- Singapore, Market Value (USD Million), CAGR, 2022-2035F

- Japan, Market Value (USD Million), CAGR, 2022-2035F

- Vietnam, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Thailand, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Indonesia, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Australia, Market Value (USD Million), CAGR, 2022-2035F

- South Korea, Market Value (USD Million), CAGR, 2022-2035F

- Rest of Asia Pacific, Market Value (USD Million), CAGR, 2022-2035F

- By Raw Material

- China Injection Molded Plastics Market Outlook & Projections, Opportunity Assessment, 2022 to 2035

- Market Overview

- Market Revenue by Value (USD Million), Volume (Kilotons)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- China Injection Molded Plastics Market Outlook & Projections, Opportunity Assessment by Segment

- By Raw Material

- Polypropylene (PP), Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Acrylonitrile Butadiene Styrene (ABS), Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- High Density Polyethylene (HDPE), Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Polystyrene (PS), Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Others, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- By Application

- Packaging, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Consumables & Electronics, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Automotive, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Motor Cycle Industry, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Building & Construction, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Aerospace, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Healthcare, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Railway Application, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Computer Industry, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Industrial Equipment (Materials), Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Manufacturing Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Office supplies, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Households, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Others, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- By Automotive Application

- Exterior components, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Splash Guards, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Grilles, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Floor Rails, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Fenders, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Bumpers, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Doors, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Tail Lights, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- A/C Condensers, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Others, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Interior components, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Interior Surfaces, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Glove Compartments, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Interior Door Handles, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Others, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Exterior components, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- By Healthcare Application

- Medical Labware, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Medical Equipment, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Others, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- By Railway Application

- Exterior, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Interior and Flooring, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Infrastructure, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Technical Parts, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- By Office Supplies Application

- Office Automation Equipment, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Office Machinery, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Others, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- By Household Application

- Exterior, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Outdoor Furniture, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Others, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Interior, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Plastic Kitchenware, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Toilet Seats, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Organizers, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Others, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- By Industrial Equipment (Materials) Application

- Industrial Safety Helmets, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Industrial Parts, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- By Raw Material

- Vietnam Injection Molded Plastics Market Outlook & Projections, Opportunity Assessment, 2022 to 2035

- Market Overview

- Market Revenue by Value (USD Million), Volume (Kilotons)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Vietnam Injection Molded Plastics Market Outlook & Projections, Opportunity Assessment by Segment

- By Raw Material

- Polypropylene (PP), Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Acrylonitrile Butadiene Styrene (ABS), Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- High Density Polyethylene (HDPE), Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Polystyrene (PS), Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Others, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- By Application

- Packaging, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Consumables & Electronics, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Automotive, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Motor Cycle Industry, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Building & Construction, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Aerospace, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Healthcare, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Railway Application, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Computer Industry, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Industrial Equipment (Materials), Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Manufacturing Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Office supplies, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Households, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Others, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- By Automotive Application

- Exterior components, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Splash Guards, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Grilles, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Floor Rails, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Fenders, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Bumpers, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Doors, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Tail Lights, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- A/C Condensers, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Others, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Interior components, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Interior Surfaces, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Glove Compartments, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Interior Door Handles, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Others, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Exterior components, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- By Healthcare Application

- Medical Labware, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Medical Equipment, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Others, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- By Railway Application

- Exterior, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Interior and Flooring, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Infrastructure, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Technical Parts, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- By Office Supplies Application

- Office Automation Equipment, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Office Machinery, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Others, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- By Household Application

- Exterior, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Outdoor Furniture, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Others, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Interior, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Plastic Kitchenware, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Toilet Seats, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Organizers, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Others, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- By Industrial Equipment (Materials) Application

- Industrial Safety Helmets, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Industrial Parts, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- By Raw Material

- Thailand Injection Molded Plastics Market Outlook & Projections, Opportunity Assessment, 2022 to 2035

- Market Overview

- Market Revenue by Value (USD Million), Volume (Kilotons)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Thailand Injection Molded Plastics Market Outlook & Projections, Opportunity Assessment by Segment

- By Raw Material

- Polypropylene (PP), Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Acrylonitrile Butadiene Styrene (ABS), Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- High Density Polyethylene (HDPE), Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Polystyrene (PS), Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Others, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- By Application

- Packaging, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Consumables & Electronics, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Automotive, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Motor Cycle Industry, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Building & Construction, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Aerospace, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Healthcare, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Railway Application, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Computer Industry, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Industrial Equipment (Materials), Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Manufacturing Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Office supplies, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Households, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Others, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- By Automotive Application

- Exterior components, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Splash Guards, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Grilles, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Floor Rails, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Fenders, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Bumpers, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Doors, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Tail Lights, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- A/C Condensers, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Others, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Interior components, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Interior Surfaces, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Glove Compartments, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Interior Door Handles, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Others, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Exterior components, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- By Healthcare Application

- Medical Labware, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Medical Equipment, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Others, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- By Railway Application

- Exterior, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Interior and Flooring, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Infrastructure, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Technical Parts, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- By Office Supplies Application

- Office Automation Equipment, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Office Machinery, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Others, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- By Household Application

- Exterior, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Outdoor Furniture, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Others, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Interior, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Plastic Kitchenware, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Toilet Seats, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Organizers, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Others, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- By Industrial Equipment (Materials) Application

- Industrial Safety Helmets, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Industrial Parts, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- By Raw Material

- Indonesia Injection Molded Plastics Market Outlook & Projections, Opportunity Assessment, 2022 to 2035

- Market Overview

- Market Revenue by Value (USD Million), Volume (Kilotons)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Indonesia Injection Molded Plastics Market Outlook & Projections, Opportunity Assessment by Segment

- By Raw Material

- Polypropylene (PP), Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Acrylonitrile Butadiene Styrene (ABS), Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- High Density Polyethylene (HDPE), Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Polystyrene (PS), Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Others, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- By Application

- Packaging, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Consumables & Electronics, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Automotive, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Motor Cycle Industry, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Building & Construction, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Aerospace, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Healthcare, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Railway Application, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Computer Industry, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Industrial Equipment (Materials), Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Manufacturing Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Office supplies, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Households, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Others, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- By Automotive Application

- Exterior components, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Splash Guards, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Grilles, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Floor Rails, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Fenders, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Bumpers, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Doors, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Tail Lights, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- A/C Condensers, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Others, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Interior components, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Interior Surfaces, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Glove Compartments, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Interior Door Handles, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Others, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Exterior components, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- By Healthcare Application

- Medical Labware, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Medical Equipment, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Others, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- By Railway Application

- Exterior, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Interior and Flooring, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Infrastructure, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Technical Parts, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- By Office Supplies Application

- Office Automation Equipment, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Office Machinery, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Others, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- By Household Application

- Exterior, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Outdoor Furniture, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Others, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Interior, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Plastic Kitchenware, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Toilet Seats, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Organizers, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Others, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- By Industrial Equipment (Materials) Application

- Industrial Safety Helmets, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Industrial Parts, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- By Raw Material

- Latin America Injection Molded Plastics Market Outlook & Projections, Opportunity Assessment, 2022 to 2035

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Latin America Injection Molded Plastics Market Outlook & Projections, Opportunity Assessment by Segment

- By Raw Material

- Polypropylene (PP), Market Value (USD Million), CAGR, 2022-2035F

- Acrylonitrile Butadiene Styrene (ABS), Market Value (USD Million), CAGR, 2022-2035F

- High Density Polyethylene (HDPE), Market Value (USD Million), CAGR, 2022-2035F

- Polystyrene (PS), Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- By Application

- Packaging, Market Value (USD Million), CAGR, 2022-2035F

- Consumables & Electronics, Market Value (USD Million), CAGR, 2022-2035F

- Automotive, Market Value (USD Million), CAGR, 2022-2035F

- Motor Cycle Industry, Market Value (USD Million), CAGR, 2022-2035F

- Building & Construction, Market Value (USD Million), CAGR, 2022-2035F

- Aerospace, Market Value (USD Million), CAGR, 2022-2035F

- Healthcare, Market Value (USD Million), CAGR, 2022-2035F

- Railway Application, Market Value (USD Million), CAGR, 2022-2035F

- Computer Industry, Market Value (USD Million), CAGR, 2022-2035F

- Industrial Equipment (Materials), Market Value (USD Million), CAGR, 2022-2035F

- Manufacturing Market Value (USD Million), CAGR, 2022-2035F

- Office supplies, Market Value (USD Million), CAGR, 2022-2035F

- Households, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- By Automotive Application

- Exterior components, Market Value (USD Million), CAGR, 2022-2035F

- Splash Guards, Market Value (USD Million), CAGR, 2022-2035F

- Grilles, Market Value (USD Million), CAGR, 2022-2035F

- Floor Rails, Market Value (USD Million), CAGR, 2022-2035F

- Fenders, Market Value (USD Million), CAGR, 2022-2035F

- Bumpers, Market Value (USD Million), CAGR, 2022-2035F

- Doors, Market Value (USD Million), CAGR, 2022-2035F

- Tail Lights, Market Value (USD Million), CAGR, 2022-2035F

- A/C Condensers, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- Interior components, Market Value (USD Million), CAGR, 2022-2035F

- Interior Surfaces, Market Value (USD Million), CAGR, 2022-2035F

- Glove Compartments, Market Value (USD Million), CAGR, 2022-2035F

- Interior Door Handles, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- Exterior components, Market Value (USD Million), CAGR, 2022-2035F

- By Healthcare Application

- Medical Labware, Market Value (USD Million), CAGR, 2022-2035F

- Medical Equipment, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- By Railway Application

- Exterior, Market Value (USD Million), CAGR, 2022-2035F

- Interior and Flooring, Market Value (USD Million), CAGR, 2022-2035F

- Infrastructure, Market Value (USD Million), CAGR, 2022-2035F

- Technical Parts, Market Value (USD Million), CAGR, 2022-2035F

- By Office Supplies Application

- Office Automation Equipment, Market Value (USD Million), CAGR, 2022-2035F

- Office Machinery, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- By Household Application

- Exterior, Market Value (USD Million), CAGR, 2022-2035F

- Outdoor Furniture, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- Interior, Market Value (USD Million), CAGR, 2022-2035F

- Plastic Kitchenware, Market Value (USD Million), CAGR, 2022-2035F

- Toilet Seats, Market Value (USD Million), CAGR, 2022-2035F

- Organizers, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- By industrial Equipment (Materials) Application

- Industrial Safety Helmets, Market Value (USD Million), CAGR, 2022-2035F

- Industrial Parts, Market Value (USD Million), CAGR, 2022-2035F

- By Country

- Brazil, Market Value (USD Million), CAGR, 2022-2035F

- Mexico, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Argentina, Market Value (USD Million), CAGR, 2022-2035F

- Rest of Latin America, Market Value (USD Million), CAGR, 2022-2035F

- By Raw Material

- Mexico Injection Molded Plastics Market Outlook & Projections, Opportunity Assessment, 2022 to 2035

- Market Overview

- Market Revenue by Value (USD Million), Volume (Kilotons)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Mexico Injection Molded Plastics Market Outlook & Projections, Opportunity Assessment by Segment

- By Raw Material

- Polypropylene (PP), Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Acrylonitrile Butadiene Styrene (ABS), Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- High Density Polyethylene (HDPE), Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Polystyrene (PS), Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Others, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- By Application

- Packaging, Market Value (USD Million), CAGR, 2022-2035F

- Consumables & Electronics, Market Value (USD Million), CAGR, 2022-2035F

- Automotive, Market Value (USD Million), CAGR, 2022-2035F

- Motor Cycle Industry, Market Value (USD Million), CAGR, 2022-2035F

- Building & Construction, Market Value (USD Million), CAGR, 2022-2035F

- Aerospace, Market Value (USD Million), CAGR, 2022-2035F

- Healthcare, Market Value (USD Million), CAGR, 2022-2035F

- Railway Application, Market Value (USD Million), CAGR, 2022-2035F

- Computer Industry, Market Value (USD Million), CAGR, 2022-2035F

- Industrial Equipment (Materials), Market Value (USD Million), CAGR, 2022-2035F

- Manufacturing Market Value (USD Million), CAGR, 2022-2035F

- Office supplies, Market Value (USD Million), CAGR, 2022-2035F

- Households, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- By Automotive Application

- Exterior components, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Splash Guards, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Grilles, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Floor Rails, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Fenders, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Bumpers, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Doors, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Tail Lights, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- A/C Condensers, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Others, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Interior components, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Interior Surfaces, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Glove Compartments, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Interior Door Handles, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Others, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Exterior components, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- By Healthcare Application

- Medical Labware, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Medical Equipment, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Others, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- By Railway Application

- Exterior, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Interior and Flooring, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Infrastructure, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Technical Parts, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- By Office Supplies Application

- Office Automation Equipment, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Office Machinery, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Others, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- By Household Application

- Exterior, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Outdoor Furniture, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Others, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Interior, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Plastic Kitchenware, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Toilet Seats, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Organizers, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Others, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- By Industrial Equipment (Materials) Application

- Industrial Safety Helmets, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- Industrial Parts, Market Value (USD Million), Volume (Kilotons), CAGR, 2022-2035F

- By Raw Material

- Middle East & Africa Injection Molded Plastics Market Outlook & Projections, Opportunity Assessment, 2022 to 2035

- Market Overview

- Market Revenue by Value (USD Million) and Compound Annual Growth Rate (CAGR)

- Year-on-Year (Y-o-Y) Growth Trend Analysis

- Middle East & Africa Injection Molded Plastics Market Outlook & Projections, Opportunity Assessment by Segment

- By Raw Material

- Polypropylene (PP), Market Value (USD Million), CAGR, 2022-2035F

- Acrylonitrile Butadiene Styrene (ABS), Market Value (USD Million), CAGR, 2022-2035F

- High Density Polyethylene (HDPE), Market Value (USD Million), CAGR, 2022-2035F

- Polystyrene (PS), Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- By Application

- Packaging, Market Value (USD Million), CAGR, 2022-2035F

- Consumables & Electronics, Market Value (USD Million), CAGR, 2022-2035F

- Automotive, Market Value (USD Million), CAGR, 2022-2035F

- Motor Cycle Industry, Market Value (USD Million), CAGR, 2022-2035F

- Building & Construction, Market Value (USD Million), CAGR, 2022-2035F

- Aerospace, Market Value (USD Million), CAGR, 2022-2035F

- Healthcare, Market Value (USD Million), CAGR, 2022-2035F

- Railway Application, Market Value (USD Million), CAGR, 2022-2035F

- Computer Industry, Market Value (USD Million), CAGR, 2022-2035F

- Industrial Equipment (Materials), Market Value (USD Million), CAGR, 2022-2035F

- Manufacturing Market Value (USD Million), CAGR, 2022-2035F

- Office supplies, Market Value (USD Million), CAGR, 2022-2035F

- Households, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- By Automotive Application

- Exterior components, Market Value (USD Million), CAGR, 2022-2035F

- Splash Guards, Market Value (USD Million), CAGR, 2022-2035F

- Grilles, Market Value (USD Million), CAGR, 2022-2035F

- Floor Rails, Market Value (USD Million), CAGR, 2022-2035F

- Fenders, Market Value (USD Million), CAGR, 2022-2035F

- Bumpers, Market Value (USD Million), CAGR, 2022-2035F

- Doors, Market Value (USD Million), CAGR, 2022-2035F

- Tail Lights, Market Value (USD Million), CAGR, 2022-2035F

- A/C Condensers, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- Interior components, Market Value (USD Million), CAGR, 2022-2035F

- Interior Surfaces, Market Value (USD Million), CAGR, 2022-2035F

- Glove Compartments, Market Value (USD Million), CAGR, 2022-2035F

- Interior Door Handles, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- Exterior components, Market Value (USD Million), CAGR, 2022-2035F

- By Healthcare Application

- Medical Labware, Market Value (USD Million), CAGR, 2022-2035F

- Medical Equipment, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- By Railway Application

- Exterior, Market Value (USD Million), CAGR, 2022-2035F

- Interior and Flooring, Market Value (USD Million), CAGR, 2022-2035F

- Infrastructure, Market Value (USD Million), CAGR, 2022-2035F

- Technical Parts, Market Value (USD Million), CAGR, 2022-2035F

- By Office Supplies Application

- Office Automation Equipment, Market Value (USD Million), CAGR, 2022-2035F

- Office Machinery, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- By Household Application

- Exterior, Market Value (USD Million), CAGR, 2022-2035F

- Outdoor Furniture, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- Interior, Market Value (USD Million), CAGR, 2022-2035F

- Plastic Kitchenware, Market Value (USD Million), CAGR, 2022-2035F

- Toilet Seats, Market Value (USD Million), CAGR, 2022-2035F

- Organizers, Market Value (USD Million), CAGR, 2022-2035F

- Others, Market Value (USD Million), CAGR, 2022-2035F

- By industrial Equipment (Materials) Application

- Industrial Safety Helmets, Market Value (USD Million), CAGR, 2022-2035F

- Industrial Parts, Market Value (USD Million), CAGR, 2022-2035F

- By Country

- Israel, Market Value (USD Million), CAGR, 2022-2035F

- GCC, Market Value (USD Million), CAGR, 2022-2035F

- South Africa, Market Value (USD Million), CAGR, 2022-2035F

- Rest of Middle East and Africa, Market Value (USD Million), CAGR, 2022-2035F

- By Raw Material

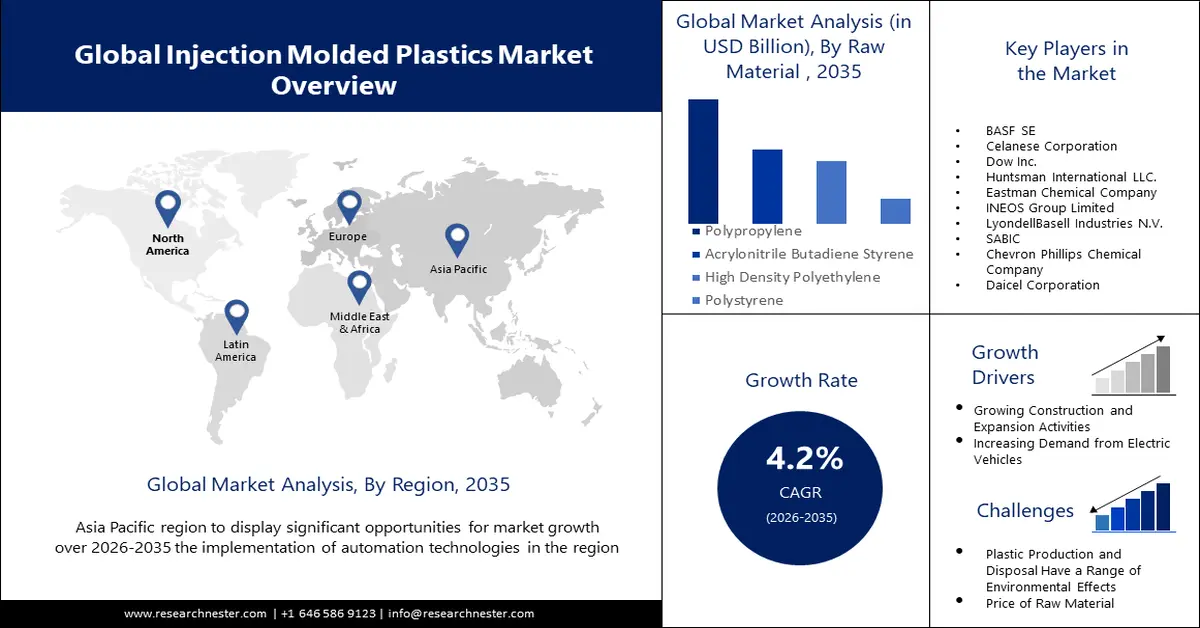

Injection Molded Plastics Market Outlook:

Injection Molded Plastics Market size was valued at USD 382.43 billion in 2025 and is likely to cross USD 577.07 billion by 2035, expanding at more than 4.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of injection molded plastics is assessed at USD 396.89 billion.

The market has expanded globally due to factors such as cost-effectiveness, design flexibility, innovative materials, technological improvements, and increased awareness of sustainability. Additionally, the growing need from a variety of end-use industries, including consumer goods, automotive, packaging, electronics, and medical devices, is driving up the need for injection molded plastics. For instance, Canada is home to one of the top 12 manufacturers of light vehicles worldwide. Five major OEMs, Stellantis, Ford, GM, Honda, and Toyota, build almost 1.4 million cars annually at their Canadian operations. Nearly 700 vendors, including domestic Tier 1 companies like Magna, Linamar, and Martinrea, provide parts to these operations. Furthermore, one of the five machine-tool-die-and-mould (MTDM) manufacturing clusters in located in Canada.

In addition to these, the Canadian government's overarching plan to tackle pollution, reach its target of having no plastic waste by 2030 and reduce greenhouse gas emissions includes the Single-use Plastics Prohibition Rules (SUPPR). Producing, importing, and selling single-use plastic checkout bags, flatware, and food service equipment made with problematic plastics, stir sticks, rings, and straws are all prohibited by the Rules. Manufacturers of injection-molded plastic may find new markets if single-use plastics are banned. There may be a rise in demand for biodegradable and compostable materials that can be made using injection molding as organizations and governments search for substitutes for single-use plastics.

Key Injection Molded Plastics Market Insights Summary:

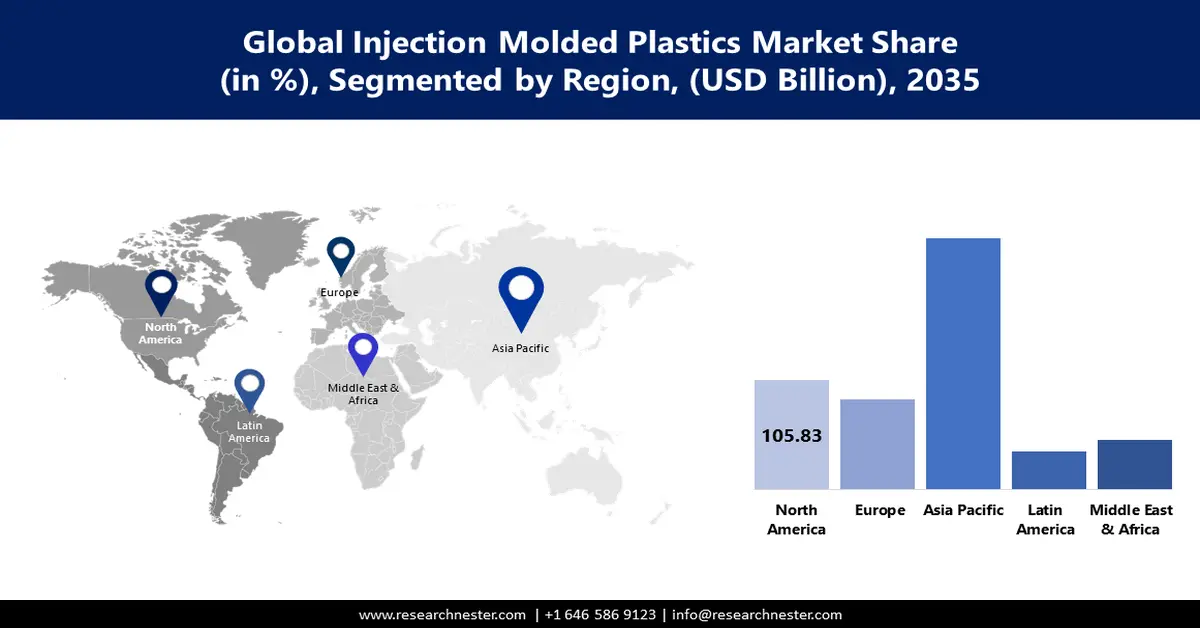

Regional Highlights:

- The Asia Pacific injection molded plastics market is projected to attain a 47% share by 2035, fueled by automation technologies and government support for plastic recycling and waste reduction.

Segment Insights:

- The packaging segment in the injection molded plastics market is projected to capture a 35% share by 2035, attributed to the versatility and profitability of plastics in food packaging.

- The polypropylene segment in the injection molded plastics market is forecasted to hold the highest market share by 2035, driven by polypropylene’s versatility and favorable molding and recycling properties.

Key Growth Trends:

- Increasing Demand from Electric Vehicles

- Growing Construction and Expansion Activities ; One of the largest industrial consumers of plastic injection molded goods and components is the building sector. The building industry is looking for plastic goods with three qualities

Major Challenges:

- Plastic Production and Disposal Have a Range of Environmental Effects

Key Players: Exxon Mobil Corporation, BASF SE, Celanese Corporation, Dow Inc., Huntsman International LLC., Eastman Chemical Company, INEOS Group Limited, LyondellBasell Industries N.V., SABIC, Chevron Phillips Chemical Company, Daicel Corporation.

Global Injection Molded Plastics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 382.43 billion

- 2026 Market Size: USD 396.89 billion

- Projected Market Size: USD 577.07 billion by 2035

- Growth Forecasts: 4.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (47% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, India, Japan, Germany

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 11 September, 2025

Injection Molded Plastics Market Growth Drivers and Challenges:

Growth Drivers

- Need for Injection-Molded Plastics Is Driven by the Food and Beverage Industries- Among the various industries driving the need for injection-molded plastics are food and beverage facilities. The food and beverage business uses injection molded plastics for a range of purposes, such as containers, processing machinery, and packaging. Plastic packaging is durable, lightweight, and has good barrier properties that can reduce food waste, increase food shelf life, and prevent contamination. It is also reasonably priced and easy to develop and store. Food and drink items are frequently stored, transported, and displayed in injection-molded plastic containers. Injection molded plastics are utilized not only in containers but also in food processing machinery, including food trays, conveyor belts, and machine parts. Because these components must be strong, resilient to heat and chemicals, and long-lasting, injection-molded plastics are a common option in food and beverage facilities.

- Increasing Demand from Electric Vehicles- Injection molded plastic is in high demand due in large part to the growing popularity of electric vehicles (EVs). For instance, the US Bureau of Labor Statistics reports that the country's sales of electric vehicles increased from 0.2% in 2011 to 4.6% in 2021. Furthermore, injection molded plastic can be created from recycled or biodegradable plastics, which lessens the environmental impact of EV production in light of the growing emphasis on sustainability.

- Growing Construction and Expansion Activities- One of the largest industrial consumers of plastic injection molded goods and components is the building sector. The building industry is looking for plastic goods with three qualities: resilience, durability, and weather and chemical resistance. The construction industry finds injection molded plastic parts to be an appealing option due to their numerous advantages over conventional building materials like metal, concrete, and wood. Furthermore, plastic components are lightweight and portable, which can drastically save transportation expenses and improve the productivity of building projects. The need for injection-molded plastics might rise as a result of expansion and construction projects in several ways. In the construction sector, injection-molded plastics find extensive use in wall panels, insulation, roofing materials, and structural components. For instance, the U.S. Census Bureau reports that in January 2023, building expenditures totaled USD 1,825.7 billion. The January amount is 5.7% more than the USD 1726.6 forecast for January 2022.

Challenges

- Plastic Production and Disposal Have a Range of Environmental Effects- The injection molded plastics market may be impacted by the substantial environmental effects of plastic production and disposal. As more people become aware of the environmental problems linked to plastic garbage, these effects are taking on greater significance. The use of non-renewable resources, or the substantial amounts of fossil fuels needed to produce plastic, is one of the main effects of plastic manufacture on the environment. Fossil fuels also contribute to greenhouse gas emissions and climate change. Furthermore, the decomposition of plastic trash can take hundreds of years, which causes a build-up of plastic garbage in landfills and oceans.

- The market for injection-molded plastics is not growing as quickly as it should due to issues like manufacturing complexity, quality control, and competition from alternative manufacturing techniques.

- For companies that make injection-molded plastics, the price of raw materials might provide serious difficulties.

Injection Molded Plastics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.2% |

|

Base Year Market Size (2025) |

USD 382.43 billion |

|

Forecast Year Market Size (2035) |

USD 577.07 billion |

|

Regional Scope |

|

Injection Molded Plastics Market Segmentation:

Raw Material Segment Analysis

The polypropylene segment in the injection molded plastics market is predicted to gather the highest revenue share by the end of 2035. Because of its many uses, polypropylene is a major player in the worldwide injection molded plastic industry, which encourages segment expansion. Despite being semi-crystalline, polypropylene flows remarkably well and is easy to mold because of its low melt viscosity. They can be used for non-load-bearing purposes such as car batteries, kiddie pools, toys, cutlery, Tupperware, and the caps on ketchup and shampoo bottles. In order to facilitate injection molding and subsequent recycling, polypropylene liquefies rather than burns, which contributes to the market's expansion. In 2022, the total amount of polypropylene produced worldwide was roughly 79.01 million metric tons. With a 97.86-million-ton global production capacity, the demand for polypropylene in 2022 was 86.74 million tons. By 2030, it is anticipated to reach around 104.99 million metric tons.

Application Segment Analysis

The packaging segment share in the injection molded plastics market is expected to hold 35% revenue share by 2035. Due to the versatility of plastic materials and the profitability of plastics in food packaging, the packaging segment is expected to hold the biggest market share. It is possible to create plastic packaging for a variety of uses and shapes thanks to injection molding. Food containers, distinctive packaging for cosmetics and body care products, and even packaging for household chemicals can all be produced using the injection molding technique. The industry is growing because there are several plastic injection molding choices available for high-volume packaging, such as PET bottle preforms molds and thin-walled containers for ice cream, margarine, milk products, and closures.

Our in-depth analysis of the global injection molded plastics market includes the following segments:

|

Raw Material |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Injection Molded Plastics Market Regional Analysis:

APAC Market Insights

The injection molded plastics market in Asia Pacific is poised to dominate 47% revenue share by 2035. The injection molded plastic industry's implementation of automation technologies is anticipated to fuel the market's expansion in the Asia Pacific region. Furthermore, by enacting laws and providing financing for the facilities, the Australian government is promoting the development of cutting-edge technology targeted at boosting plastic recycling and decreasing plastic waste. The utilization of recycled plastic waste in construction materials, transportable recycling facilities, and chemical processing of contaminated plastic waste are some of these advancements. For instance, Integrated Green Energy Solutions (IGES) has received USD 1.9 million from the Australian government under the CRC-P for the development of technology that turns waste plastic that is contaminated into useful raw materials through chemical recycling. Australia will lead the world in the management of plastic waste thanks to this technology.

North American Market Insights

The North America injection molded plastics market is expected to hold the largest revenue share by 2035. Injection-molded plastic products are widely used as packaging materials in the food industry in the region. This includes trays, containers, and other packaging supplies that help keep food safe and fresh throughout storage and transit. Plastic packaging is becoming more and more common because of its cost, strength, and lightweight. For example, the food and beverage industry are the third-largest contributor to the gross domestic product of American manufacturing, according to the National Institute of Standards and Technology (NIST). The industry employs about 1.8 million people overall, and more than 75% of the 27,000 food firms in the US have fewer than 100 employees.

Injection Molded Plastics Market Players:

- Exxon Mobil Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF SE

- Celanese Corporation

- Dow Inc.

- Huntsman International LLC.

- Eastman Chemical Company

- INEOS Group Limited

- LyondellBasell Industries N.V.

- SABIC

- Chevron Phillips Chemical Company

- Daicel Corporation

Recent Developments

- SABIC introduced a specialized SABIC PP compound product line for foam injection molding (FIM). The new mineral-reinforced SABIC PPc F9005, F9007, and F9015 grades can assist in achieving excellent aesthetics for visible automotive interior parts with complex geometries, such as door panels and trim, seat and trunk cladding and more.

- Daicel changed to Polyplastics, Co. Ltd., a well-known engineering plastics business that had been founded in conjunction with a U.S. S. company, into a fully owned subsidiary. Due to the relatively low performance volatility and synergy opportunities, the acquisition represents an investment in a company that, on a consolidated basis, has higher profitability and capital efficiency than their own company. This investment will be advantageous in terms of strengthening their business portfolio.

- Report ID: 5220

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Injection Molded Plastics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.