Industrial Microbiology Testing Services Market Outlook:

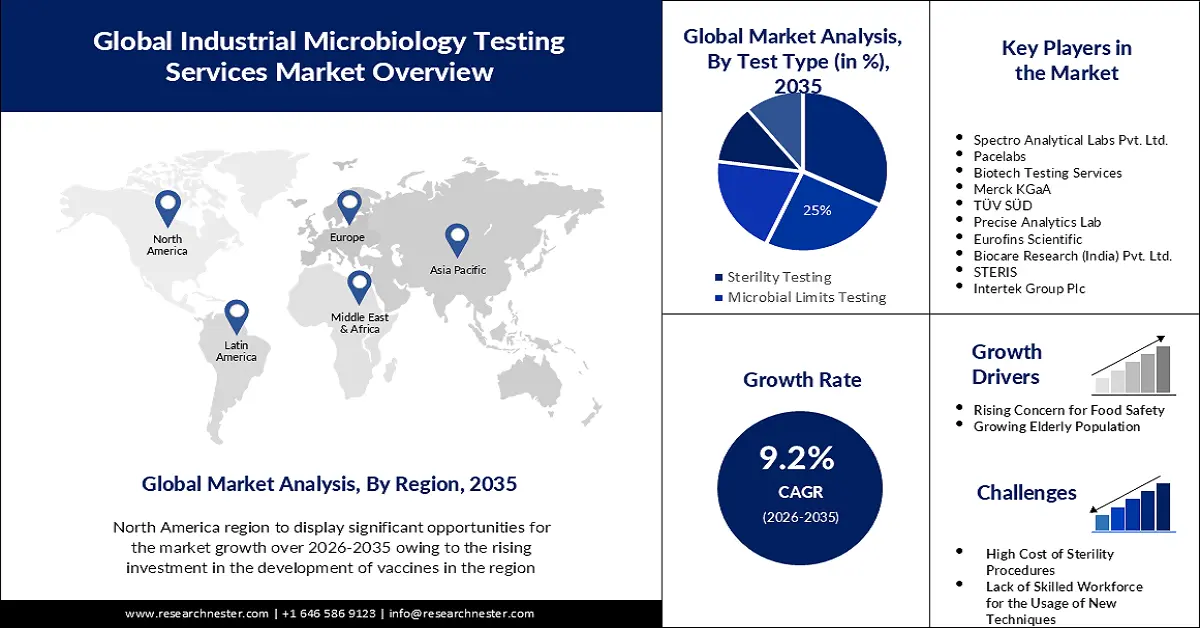

Industrial Microbiology Testing Services Market size was valued at USD 3.82 billion in 2025 and is likely to cross USD 9.21 billion by 2035, registering more than 9.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of industrial microbiology testing services is assessed at USD 4.14 billion.

The reason behind the growth is impelled by the increasing cases of infectious diseases. Clinical microbiology's goal is to definitively diagnose infectious diseases when a clinical infection is suspected and enables the identification of infectious agents based on their unique DNA or RNA sequences by using a variety of testing methodologies including microbiology testing. According to estimates, there were more than 38 million HIV-positive individuals worldwide.

The growing government initiatives to maintain products quality in pharmaceutical and food industry are believed to fuel the market growth. The regulatory system mandates that products meet safety, efficacy, and quality requirements as it maintains a zero-tolerance approach against individuals who undermine the quality of the medications and food. Therefore, the administration reviews the microbiological standards and guidelines for food and makes any necessary amendments to improve food safety.

Key Industrial Microbiology Testing Services Market Insights Summary:

Regional Insights:

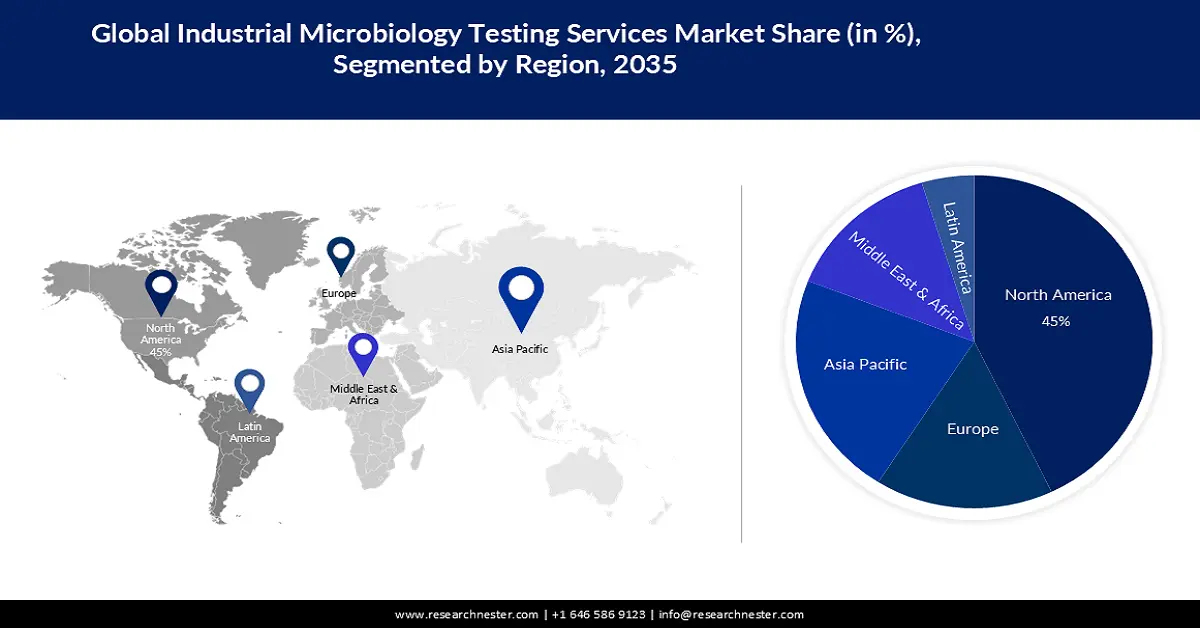

- North America is projected to hold a 45% share by 2035 (impelled by rising investment in vaccine development).

- The APAC industrial microbiology testing services market is expected to secure the second-largest share by 2035 (owing to increased healthcare R&D spending).

Segment Insights:

- The sterility testing segment in the industrial microbiology testing services market is projected to account for a 32% share by 2035 (driven by increasing launch of drugs).

- The pharmaceutical & biotechnology segment is expected to hold a 30% share by 2035 (propelled by rising adoption of microbial testing solutions).

Key Growth Trends:

- Rising Concern for Food Safety

- Growing Elderly Population

Major Challenges:

- High Cost of Sterility Procedures

- Lack of Skilled Workforce for the Usage of New Techniques

Key Players: Charles River Laboratories, Spectro Analytical Labs Pvt. Ltd., Pace® Analytical Services, Biotech Testing Services, Merck KGaA, TÜV SÜD, Precise Analytics Lab, Eurofins Scientific, Biocare Research (India) Pvt. Ltd., STERIS, Intertek Group Plc.

Global Industrial Microbiology Testing Services Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.82 billion

- 2026 Market Size: USD 4.14 billion

- Projected Market Size: USD 9.21 billion by 2035

- Growth Forecasts: 9.2%

Key Regional Dynamics:

- Largest Region: North America (45% Share by 2035)

- Fastest Growing Region: APAC

- Dominating Countries: United States, China, India, Canada, United Kingdom

- Emerging Countries: Brazil, Indonesia, Australia, Saudi Arabia, UAE

Last updated on : 26 November, 2025

Industrial Microbiology Testing Services Market - Growth Drivers and Challenges

Growth Drivers

- Rising Concern for Food Safety – Microbiological testing services can assess the food to see if any potentially dangerous pathogens are present to ensure the safety of the food products, avoid food contamination, deterioration, and possible health problems, help food sector operators comply with legal obligations, and maximize operational effectiveness.

- Growing Elderly Population- The elderly population tend to have weaker immune systems which increases the need for strict quality control in healthcare facilities.

- Surging Popularity of Molecular Biology and Genetic Technologies- Recombinant DNA technology and conventional industrial microbiology have given rise to a brand-new branch of study known as molecular biology which is often used to detect pathogens and spoilage organisms in food and beverages, including wine and beer, and helps in studying industrial microbiology for sustainable advancement of human society.

- Expanding Usage of Fermentation Technology- Technological advancements in fermentation and microbiology have been steady in the subject of fermentation technology, microbes and enzymes are used to create molecules that are used in several end-use industries including pharmaceutical and food & beverage.

- Increasing Production of Generic Drugs- In terms of identification, strength, quality, purity, and potency, generic medications must also adhere to strict requirements set by the FDA therefore, the tight guidelines of good manufacturing practice (GMP) must be followed by manufacturers at every stage of production, especially the final one before release, that calls for the use of microbiology, which is essential to pharmaceutical quality control.

- Growing Demand for Cosmetics- The microbiology testing measures the overall microbiological efficacy of cosmetic and personal care products and is used to detect the amount of yeast and mold and total aerobic microbial count (TAMC) and evaluate the antibacterial effectiveness of preservatives in non-sterile items.

Challenges

- High Cost of Sterility Procedures – This procedure is complex and requires the use of advanced equipment and highly skilled professionals which adds to the overall cost of the sterility procedure. These factors increase the expenses of industrial microbiology testing services which can limit their adoption as companies with limited financial resources may not choose these services.

- Lack of Skilled Workforce for the Usage of New Techniques

- Compliance Issues with Stringent Regulatory Requirement across Different Regions

Industrial Microbiology Testing Services Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 3.82 billion |

|

Forecast Year Market Size (2035) |

USD 9.21 billion |

|

Regional Scope |

|

Industrial Microbiology Testing Services Market Segmentation:

Test Type Segment Analysis

The sterility testing segment in the industrial microbiology testing services market is estimated to gain a robust revenue share of 32% in the coming years owing to the increasing launch of drugs. Successful drug launches have traditionally been a growth driver for pharmaceutical businesses as drug development is being automated using AI and creating opportunities for quicker, less expensive medications.

Sterility testing is a GMP microbiology requirement of pharmaceutical items to guarantee that there are no detectable viable contaminating microorganisms in a product, and verifies that the supplied product is suitably sterile It is necessary for both ordinary release testing and the sterilization validation process so that it can be transmitted for additional use. These tests are essential for maintaining product sterility and ensuring quality control which entails putting a certain amount of a therapeutic product through two filters that are intended to hold microorganisms after that, the filter is rinsed to make sure no medicinal product is left on it as that could stop the growth of microorganisms.

Furthermore, the rules for sterility tests for biological products are being changed by the Food and Drug Administration (FDA) to encourage the use of the most suitable and advanced test procedures for biological product safety assurance. For instance, in 2021, the FDA continued a decade-long trend of increasing medicine approvals by approving more than 45 new medications, and over 53 were authorized by the European Medicines Agency.

Additionally, the microbial limits testing segment is poised to gain a notable share during the forecast timeframe. The microbial limit test (MLT) is used to determine the quantity and type of specific live microorganisms present in non-sterile industrial samples from pharmaceutical goods to evaluate whether or not a product contains particular undesirable organisms and to determine whether a pharmaceutical product conforms with a set standard for microbiological quality.

End-User Segment Analysis

The pharmaceutical & biotechnology segment is expected to account for 30% share of the global industrial microbiology testing services market by 2035. The second most popular test used by industrial microbiology to assess raw materials is microbial testing which is increasingly used by the pharmaceutical and biotechnology industries as they have specific needs, which are addressed by microbial solutions.

Besides this, the food & beverages segment is anticipated to gain significant share by the year 2035. The food sample's food additives, pollutants, and toxins are examples of food safety parameters to assure food quality and safety which are tested by microbial solutions.

Our in-depth analysis of the global industrial microbiology testing services market includes the following segments:

|

Test Type |

|

|

End-User |

|

|

Product Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Industrial Microbiology Testing Services Market - Regional Analysis

North American Market Insights

North America industry is estimated to dominate majority revenue share of 45% by 2035 impelled by the rising investment in the development of vaccines. This is expected to create a huge demand for industrial microbiology testing services in the region as it can be used to determine the quantity of microorganisms in a vaccination which often takes time since rigorous testing is necessary to make sure there are no unforeseen repercussions from them before distributing vaccines to the general public. For instance, for the development, manufacture, and acquisition of mRNA covid-19 vaccines, the US government spent more than USD 30 billion, before the pandemic until March 2022.

APAC Market Insights

The APAC industrial microbiology testing services market is estimated to be the second largest, during the forecast timeframe led by the rising spending in healthcare. This has resulted in increasing spending research & development of reliable and efficient testing services to meet the rising need for quality control measures in the region. India spent over 1% of its GDP on healthcare in the year 2021.

Industrial Microbiology Testing Services Market Players:

- Charles River Laboratories

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Spectro Analytical Labs Pvt. Ltd.

- Pace® Analytical Services

- Biotech Testing Services

- Merck KGaA

- TÜV SÜD

- Precise Analytics Lab

- Eurofins Scientific

- Biocare Research (India) Pvt. Ltd.

- STERIS

- Intertek Group Plc

Recent Developments

- Charles River Laboratories introduced Accugenix for bacterial identification and fungal identification, which gives important knowledge about microbial management to pharmaceutical and personal care producers and enables customers to take full control of environmental monitoring while reducing the danger of contamination.

- Pace® Analytical Services acquired Alpha Analytical to introduce additional capabilities that include increased sediment and tissue testing, and sophisticated hydrocarbon analytical support, to examine tissue, soil, and water samples contaminated by hydrocarbons and allow clients to analyze the findings and gather data to support the cause or extent of the release of hydrocarbons into the environment.

- Report ID: 5340

- Published Date: Nov 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Industrial Microbiology Testing Services Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.