Implantable Medical Devices Market Outlook:

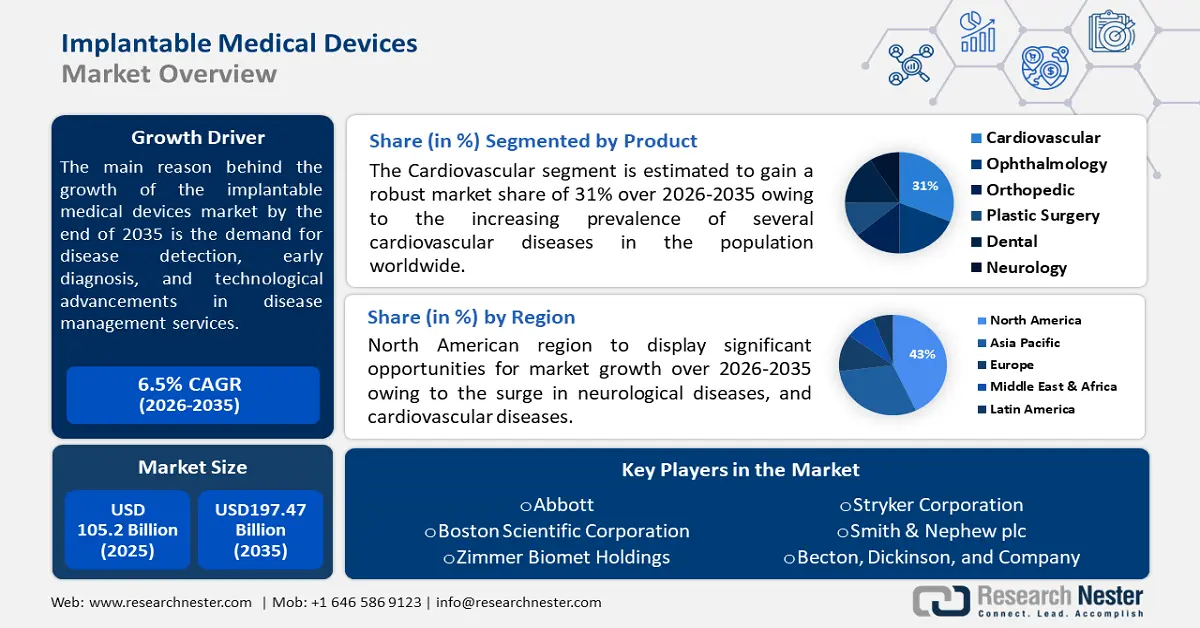

Implantable Medical Devices Market size was valued at USD 105.2 billion in 2025 and is set to exceed USD 197.47 billion by 2035, registering over 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of implantable medical devices is estimated at USD 111.35 billion.

This boost is anticipated by the slated demand for disease detection, early diagnosis, and technological advancements in disease management services, which can not only help cure it but prevent any mishap as well. According to the American Cancer Society, in 2022 more than 20 million cases of cancer were diagnosed newly, and about 9.7 million people have died globally due to this disease.

Key Implantable Medical Devices Market Insights Summary:

Regional Highlights:

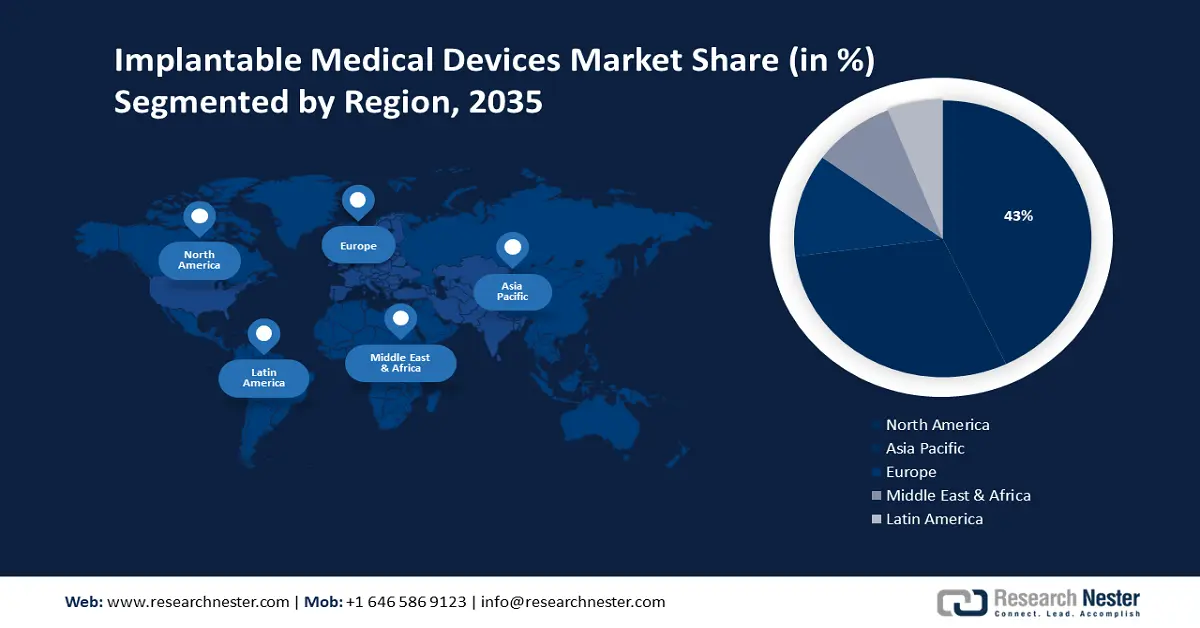

- North America implantable medical devices market will secure over 43% share by 2035, driven by rising cases of neurological and cardiovascular diseases alongside an aging population.

- Asia Pacific market will attain the second largest share by 2035, attributed to increasing cases of spinal cord injury and demand for better medical devices.

Segment Insights:

- The cardiovascular segment in the implantable medical devices market is expected to hold a 31% share by 2035, driven by the increasing prevalence of cardiovascular diseases worldwide.

- The active segment in the implantable medical devices market is forecasted to achieve lucrative growth till 2035, attributed to the rising use of devices like defibrillators, pacemakers, and infusion pumps.

Key Growth Trends:

- Rising scarcity of donors

- Rising technological advancements in healthcare

Major Challenges:

- Rising scarcity of donors

- Rising technological advancements in healthcare

Key Players: Abbott, Boston Scientific Corporation, Zimmer Biomet Holdings, Stryker Corporation, Smith & Nephew plc, Becton, Dickinson, and Company, LivaNova, Edwards Lifesciences, Globus Medical, Inc.

Global Implantable Medical Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 105.2 billion

- 2026 Market Size: USD 111.35 billion

- Projected Market Size: USD 197.47 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, France

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 17 September, 2025

Implantable Medical Devices Market Growth Drivers and Challenges:

Growth Drivers

-

Rising scarcity of donors - With the lucrative global population along with the boosting economies, there is also a significant increase in demand for organ donors, as according to the Health Ministry, the data of donors only crossed to 16,041 in 2022 from about 6,916 in 2014. Owing to this, other innovative options are in demand, such as implantable medical devices.

- Rising technological advancements in healthcare - As the innovations in the healthcare and pharmaceutical sector are at a surge, owing to the increasing artificial intelligence (AI) penetration and the demand for more accurate, quick, and conventional diagnoses, this would surpass the demand for implantable medical devices such as miniaturized electronics, biocompatible materials, wireless communication protocols, advanced sensor technology, and many more.

Moreover, in breast cancer, AI enables mammograms to be reviewed more than 30 times faster coupled with 100% accuracy, this reduces the requirement for biopsies.

- Increasing chronic diseases - The increasing chronic disease conditions are estimated to increase as about 1 out of 3 adults suffer worldwide from multiple chronic conditions. According to the National Institutes of Health, there has been an increase of about 7% from 67% of deaths in 2010 to 74% of deaths in 2019, globally which are caused by chronic conditions.

Challenges

-

Lack of trained and qualified crane operators - There is a lack of skilled crane operators in the renting industry due to which several rental firms are being turned down. Many implantable medical device providers have started training programs for upskilling their work but this would take an ample amount of time to take a lead.

- For implantable medical devices as they are often considered as medical devices because they are subjected to a strict regulatory requirement and approval before they can be used and adopted in hospitals, clinics, and several other medical facilities as well, which involves a lengthy process of evaluation and approval by the higher authorities, which can take time, high costs, and can hinder the adoption and expansion of implantable medical devices market.

Implantable Medical Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 105.2 billion |

|

Forecast Year Market Size (2035) |

USD 197.47 billion |

|

Regional Scope |

|

Implantable Medical Devices Market Segmentation:

Product Segment Analysis

Cardiovascular segment is poised to account for more than 31% implantable medical devices market share by the end of 2035 driven by the increasing prevalence of several cardiovascular diseases in the population worldwide. According to a report by the World Health Organization in 2021, it was estimated that more than 17.9 million people died in 2019 attributed to cardiovascular diseases; this data registers a share of about 32% of global deaths.

Additionally, there is also an increase in technological advancements; increasing investments, coupled with the surge in the geriatric population, would help the cardiovascular segment dominate this implantable medical devices market expansion. The increase in such technological advancements has fueled the revenue share while improving the safety features, which makes them a better option for consumers.

Material Segment Analysis

The stainless-steel segment is estimated to gain a robust implantable medical devices market share owing to the highly durable, resilient, and stable material, which makes it one of the most commonly, used materials for implantable medical devices. Stainless steel is a very resistant material, with a high strength and ability to withstand pressure, making it ideal for use in the human body.

According to a report, stainless steel 304 is regarded globally as the most suited material for the manufacturing of medical devices. Furthermore, stainless steel has a high resistance to corrosion and oxidization, which is a crucial factor in maintaining the long-term stability and reliability of implantable medical devices.

Nature of Device Segment Analysis

The Active segment in the implantable medical devices market is estimated to exhibit lucrative CAGR till 2035. The reason behind this impact is projected by the increase in several devices such as defibrillators, ventricular assist systems, infusion pumps, pacemakers, and many more.

According to a report by the National Institutes of Health in 2021, from 2012 to 2018 there was an increase in public awareness regarding the knowledge of how to use Automated External Defibrillators (AED) grew from 4.7% to 20.8%.

Our in-depth analysis of the implantable medical devices market includes the following segments:

|

Product |

|

|

Type |

|

|

Nature of Device |

|

|

Material |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Implantable Medical Devices Market Regional Analysis:

North American Market Insights

North America industry is predicted to hold largest revenue share of 43% by 2035. The landscape's substantial growth in the region is expected to be credited to the surge in neurological diseases, neurology devices, and cardiovascular diseases, coupled with the geriatric population in this region. According to the World Health Organization, more than 3 billion people globally suffer with neurological conditions in 2021.

According to the Centers for Disease Control and Prevention, it was projected that more than 695,000 people in the United States died from heart disease in 2021, which was about 1 in every 5 deaths.

More than 10% of Canadians suffer from neurological disorders, according to a report by the National Institutes of Health based on Canada’s National Population Health Study about neurological conditions.

APAC Market Insights

The Asia Pacific region will also encounter a huge influence on the implantable medical devices market value during the forecast period and will account for the second position attributed to the increasing cases of spinal cord injury. According to the World Health Organization, there are about 15 million people who suffer from spinal cord injuries (SCI).

The growing demand for better medical devices in this region is slated to increase. According to a report, China’s medical device industry is expected to set a share of about USD 36 billion in 2024.

There has been an increase in healthcare expenditures, which will increase the market share of the implantable medical devices market. According to the Organization for Economic Cooperation and Development (OECD), there was an increase of about 5.8% of Japan’s GDP used for health expenditure.

Implantable Medical Devices Market Players:

- Johnson & Johnson

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Abbott

- Boston Scientific Corporation

- Zimmer Biomet Holdings

- Stryker Corporation

- Smith & Nephew plc

- Becton, Dickinson, and Company

- LivaNova

- Edwards Lifesciences

- Globus Medical, Inc

The Implantable medical devices market is predicted that the top five companies would occupy about 20%. Most of these companies are continuously collaborating, expanding, making agreements, and joining ventures for the growth of this revenue share and are estimated to be the major key players in this landscape.

Recent Developments

- Johnson & Johnson Medical Devices Companies- announced that they would collaborate with Microsoft to enable the expansion of their company and for create a surge for digital surgery ecosystem.

- Abbott- announced that the U.S. Food and Drug Administration (FDA) has approved the expansion of the indication for the company's CardioMEMS HF System for supporting the care of several people suffering from heart failure.

- Report ID: 6094

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Implantable Medical Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.