Hydraulic Fluids Market Outlook:

Hydraulic Fluids Market size was valued at USD 9.5 billion in 2025 and is set to exceed USD 14.2 billion by 2035, registering over 4.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hydraulic fluids is estimated at USD 9.85 billion.

The reason behind the growth is impelled by growing automobile manufacturing. The automotive industry is a key driver of the hydraulic fluid market. Hydraulic fluids are used in many different applications in the automotive industry, such as braking systems, power steering systems, and suspension systems.

According to the International Automobile Manufacturers (OICA), global production of automobiles has increased steadily in recent years. In 2020, 74.7 million vehicles were produced worldwide, a year-on-year increase of 4.8%.

The rising demand for heavy equipment is believed to fuel the market growth. Heavy equipment demand is one of the main drivers of the hydraulic fluid market. Hydraulic fluid is used as a power transmission medium in hydraulic systems commonly used in heavy machinery such as construction machinery, mining machinery, agricultural machinery, and ships.

Key Hydraulic Fluids Market Insights Summary:

Regional Highlights:

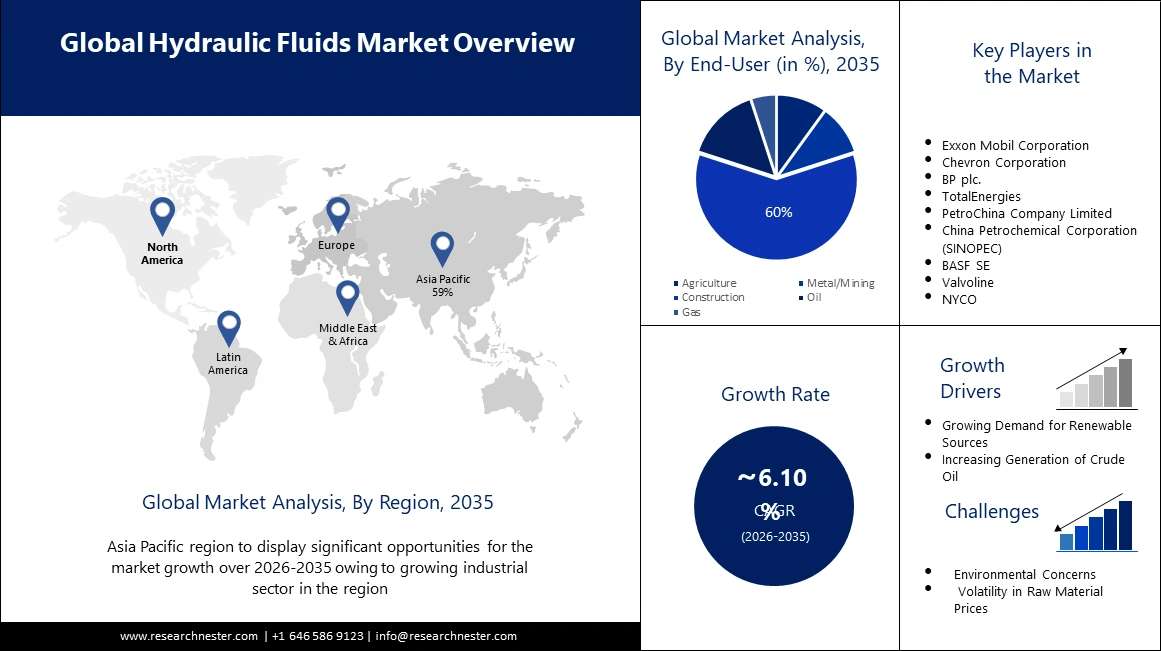

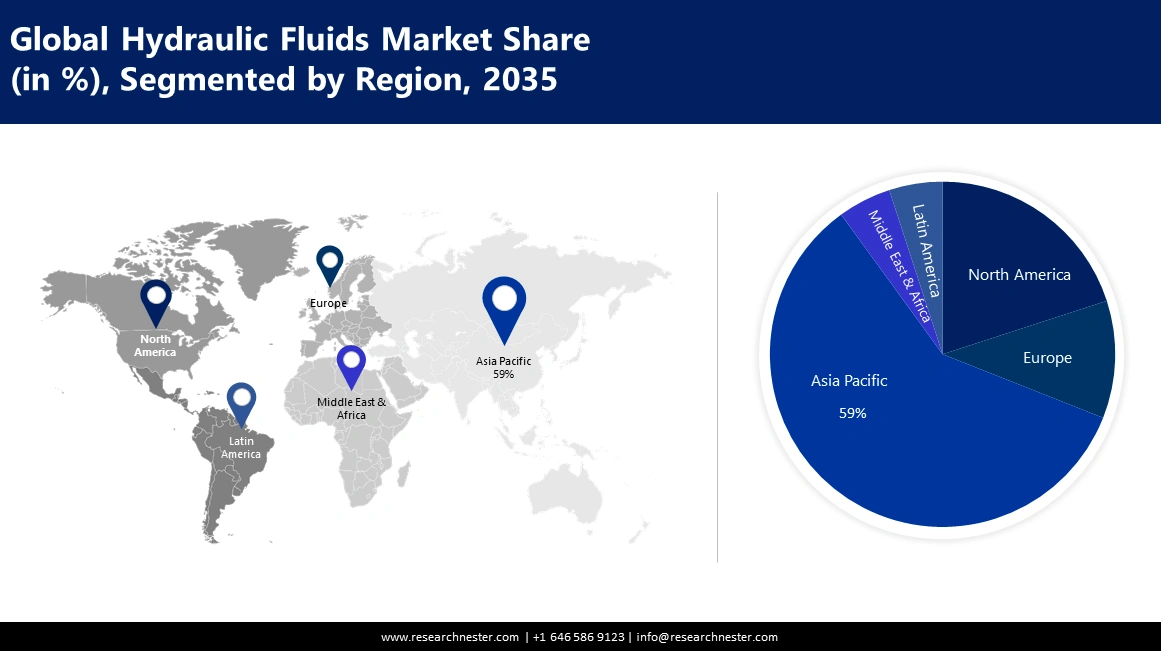

- The Asia Pacific hydraulic fluids market is projected to command a substantial 59% revenue share by 2035, impelled by the rapidly expanding industrial sector and increasing machinery utilization across developing economies.

- North America is expected to emerge as the second-largest region by 2035, fueled by the growing agricultural sector and the extensive adoption of hydraulic systems in advanced farming machinery.

Segment Insights:

- The construction segment in the hydraulic fluids market is projected to hold a commanding 60% share by 2035, propelled by the increasing use of hydraulic machinery such as excavators, backhoes, and bulldozers across large-scale infrastructure projects.

- The bio-based oil segment is anticipated to capture a 40% share by 2035, driven by the expanding marine sector and the rising preference for biodegradable and low-toxicity fluids.

Key Growth Trends:

- Growing Demand for Renewable Sources

- Increasing Generation of Crude Oil

Major Challenges:

- Environmental Concerns

- Volatility in Raw Material Prices

Key Players: Shell plc, Exxon Mobil Corporation, Chevron Corporation, BP plc., TotalEnergies, PetroChina Company Limited, China Petrochemical Corporation (SINOPEC), BASF SE, Valvoline, NYCO, Idemitsu Kosan Co., Ltd., JX Nippon Oil & Energy Corporation (ENEOS Holdings, Inc.), Showa Shell Sekiyu K.K, Nippon Oil Corporation, Mitsui Chemicals, Inc.

Global Hydraulic Fluids Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.5 billion

- 2026 Market Size: USD 9.85 billion

- Projected Market Size: USD 14.2 billion by 2035

- Growth Forecasts: 4.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (59% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, India, Germany

- Emerging Countries: Brazil, Indonesia, Mexico, South Korea, Vietnam

Last updated on : 10 September, 2025

Hydraulic Fluids Market Growth Drivers and Challenges:

Growth Drivers

- Growing Demand for Renewable Sources – Rising demand for renewable energy sources such as wind and solar power is driving the hydraulic oil market. Hydraulic systems are also used to generate solar energy. They are used in the installation of solar panels and to control the movement of mirrors in concentrator photovoltaic plants.

According to a report from the International Energy Agency, solar power is expected to be the largest source of electricity by 2035, with solar power capacity increasing by 7% annually. - Increasing Generation of Crude Oil - As hydraulic systems are widely used in oil and gas exploration and production, thus increasing crude oil production has increased the demand for hydraulic fluids. This increase in production will be driven by increased drilling activity and the use of advanced drilling technology that relies heavily on hydraulic systems and hydraulic fluids.

According to the reported data, global oil production reached a total of more than 93 million barrels per day in the year 2021.

Challenges

- Environmental Concerns - Hydraulic fluids, especially those based on mineral oils, are known to harm the environment. Hydraulic oil leaks and spills can cause soil and water contamination and have serious impacts on ecosystems. Governments and regulators are increasingly focused on environmental issues, increasing pressure on manufacturers to develop more sustainable hydraulic fluids with minimal environmental impact.

- Volatility in Raw Material Prices

- Competition from Substitutes

Hydraulic Fluids Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.1% |

|

Base Year Market Size (2025) |

USD 9.5 billion |

|

Forecast Year Market Size (2035) |

USD 14.2 billion |

|

Regional Scope |

|

Hydraulic Fluids Market Segmentation:

End-User Segment Analysis

The construction segment in the hydraulic fluids market is estimated to gain a robust market share of 60% in the coming years. Common hydraulic construction equipment that utilizes hydraulic fluids are excavators, backhoes, bulldozers, trenchers, loaders, dump trucks, and graders. In an often out-of-control construction situation, it can be difficult to keep operations flowing and things under control. To meet tight deadlines without compromising revenue and profitability, one needs to maintain the reliability and availability of your construction equipment.

Lubrication is an important part of the maintenance process. Lubricants account for 1% to 3% of construction equipment maintenance budgets, according to Valvoline. Although a small fraction of the budget, lubrication can have a big impact on your performance goals and project success, and it increases the demand for hydraulic fluids in the construction sector. Therefore, it is predicted to boost the growth of the segment in the hydraulic fluids market.

Base Oil Segment Analysis

The bio-based oil segment is set to garner a notable share of 40% shortly on the account of growing marine sector. As compared to conventional petroleum-based hydraulic fluids bio-based oils are biodegradable and less toxic, and help in reducing the danger of environmental harm to marine life and protect the overall marine ecosystem.

According to recent data, the marine sector in the US contributed over USD 430 billion, to the country's GDP in 2021.

Our in-depth analysis of the global market includes the following segments:

|

Base Oil |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hydraulic Fluids Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is estimated to account for largest revenue share of 59% by 2035 impelled by the growing industrial sector. In developing countries such as Japan, India, and China, the industrial sector is growing owing to rapid urbanization. The need for hydraulic fluid is expected to rise in the region as the industrial sector depends on a variety of machinery that uses hydraulic systems. The hydraulic system's many components receive power from the pump through the hydraulic fluid for the system's performance, and to provide many other functions.

In May 2023, India's industrial production increased by over 5% annually.

North American Market Insights

The North America hydraulic fluids market is estimated to be the second largest, during the forecast timeframe led by increasing agricultural sector. In the US, agriculture is a significant industry and a key part of the American economy. This has led to an increase in demand for hydraulic fluids in the region as the agriculture industry uses a wide range of sophisticated machinery that utilizes hydraulic systems.

In 2021, the U.S. gross domestic product (GDP) was over USD 1.260 trillion, with contributions from agriculture, food, and associated industries.

Hydraulic Fluids Market Players:

- Shell plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Exxon Mobil Corporation

- Chevron Corporation

- BP plc.

- TotalEnergies

- PetroChina Company Limited

- China Petrochemical Corporation (SINOPEC)

- BASF SE

- Valvoline

- NYCO

- Idemitsu Kosan Co., Ltd.

- JX Nippon Oil & Energy Corporation (ENEOS Holdings, Inc.)

- Showa Shell Sekiyu K.K

- Nippon Oil Corporation

- Mitsui Chemicals, Inc.

Recent Developments

- TotalEnergies launched a range of recycled hydraulic fluids for industrial use. They are suitable for all types of industrial hydraulic systems.

- BASF SE announced the opening of a new production plant for fuel performance additives in Shanghai, China. The plant aims to address the surging demand for fuel performance additives for customers in Asia.

- Report ID: 4889

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hydraulic Fluids Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.