Huntington's Disease Treatment Market Outlook:

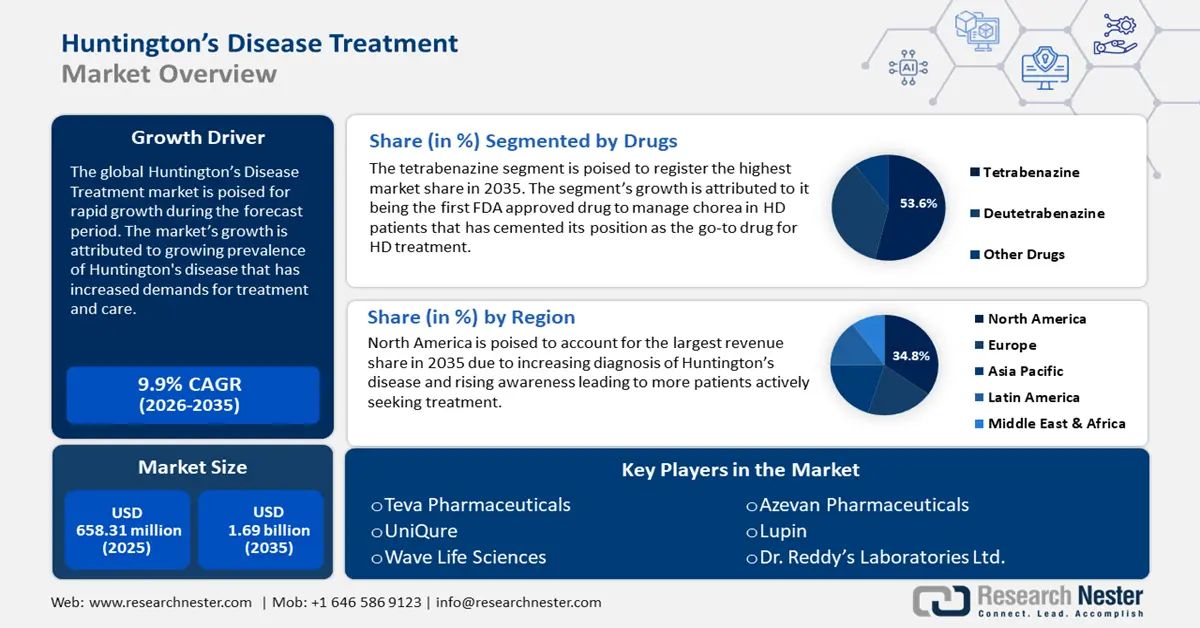

Huntington's Disease Treatment Market size was valued at USD 658.31 million in 2025 and is likely to cross USD 1.69 billion by 2035, registering more than 9.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of huntington's disease treatment is assessed at USD 716.97 million.

The huntington’s disease treatment market growth is owed to advancements in gene therapies and emerging treatments aimed at slowing the growth of the disease. The growing awareness surrounding Huntington’s disease has led to rise in demands for effective treatment contributing to the revenue growth.

In December 2022, a study published in National Library of Medicine (NLM) found a higher incidence of Huntington’s disease in Europe with 0.38 cases per 100,000 person-years followed by North America with 1.04 per 100,000 person-years. The increase in Huntington’s disease cases in the present times compared to previous decade can also be due to improvements in diagnosis, increase in the availability of molecular testing, and rapid advancements in supportive care. Advancements in comorbidities care allows patients affected by Huntington’s disease to have a longer lifespan, drastically increasing the demand for Huntington’s disease treatment. Additionally, a study published in NLM in April 2023 highlighted the improving trends in genetic testing with 6214 new genetic tests made available globally in 2022.

Advancements in genetic testing is poised to significantly improve HD care as direct genetic test remains the most accurate method of testing for HD. In the medical space, many countries in the world are pushing to develop precision medicine further and it opens up opportunities to administer treatment tailored to an individual’s genetic profile, thereby boosting the huntington’s disease treatment market demand. The rapid advent of social media has also helped in the positive dissemination of information regarding HD, helping dispel misconceptions and stigma and paving the path for patients to seek early medical care. With greater investments in research in HD care and growing global awareness, the market is poised to offer tremendous opportunities during the forecast period.

Key Huntington's Disease Treatment Market Insights Summary:

Regional Highlights:

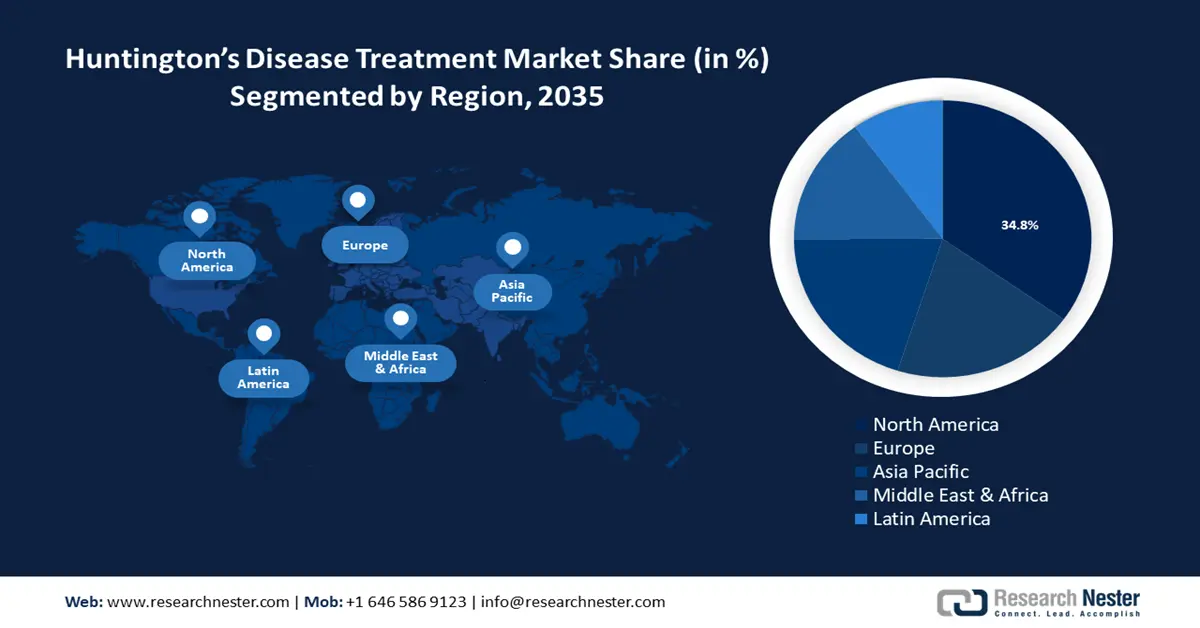

- North America leads the Huntington’s Disease Treatment Market with a 34.8% share, fueled by strong R&D investments and growing need for HD treatment, enhancing growth prospects through 2026–2035.

- Europe's Huntington's Disease Treatment Market is expected to experience the fastest growth by 2035, propelled by the higher HD prevalence among people of European descent and increasing demand for treatment.

Segment Insights:

- Tetrabenazine segment is anticipated to maintain a 53.6% share in the Huntington's Disease Treatment Market through 2035, propelled by its effectiveness in managing chorea symptoms.

Key Growth Trends:

- Rising government investments in research

- Advancement in gene therapies and antisense oligonucleotide treatments

Major Challenges:

- Lack of standardized treatment

- High cost of treatment

- Key Players: Teva Pharmaceuticals Industries Ltd., UniQure, Lupin, Wave Life Sciences, Azevan Pharmaceuticals, Dr. Reddy’s Laboratories Ltd., Neurocrine Biosciences Ltd..

Global Huntington's Disease Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 658.31 million

- 2026 Market Size: USD 716.97 million

- Projected Market Size: USD 1.69 billion by 2035

- Growth Forecasts: 9.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Japan, Germany, Brazil

Last updated on : 14 August, 2025

Huntington's Disease Treatment Market Growth Drivers and Challenges:

Growth Drivers

-

Rising government investments in research: Government and NGO’s are investing more in Huntington’s disease research pushing the growth of the market. The financial backing helps provide resources to accelerate drug development and clinical trials. Emergence of new treatments after research supports established pharmaceutical firms and emerging biotech companies, contributing significantly to the market’s growth. In December 2023, Harness Therapeutics raised USD 5 million to further the development of experimental treatment for HT. With increasing investment on research and support to patients during the treatment stage, the demand for HD treatment is poised to rise. Additionally, many patients remain deprived of HD care during treatment, and organizations like the HealthWell Foundation provides financial assistance to patients battling the disease which allows more people to seek HD treatment.

-

Advancement in gene therapies and antisense oligonucleotide treatments: Rapid advanced in gene therapies help identify the underlying genetic causes of HD. For instance, in July 2024, uniQure’s investigational gene therapy, i.e., AMT-130 highlighted treatment with high doses of agent leading to slowing of disease progression and lowering of neurofilament light (NL) in patients afflicated with Huntington’s disease.

Antisense oligonucleotide treatments are used for gene silencing to silence the mutant gene responsible for HT. In December 2023, the New England Journal of Medicine published research on the antisense oligonucleotide tominersen to slow the progression of HD by lowering the levels of huntingtin gene products including mutant huntingtin protein (HTT) and the phase 1-2a study of tominersen highlighted a positive dose-dependent reduction in cerebrospinal fluid levels of mutant HTT. Advancements in clinical studies is poised to lead a market boom as major companies race to patent new drugs and treatments. - Growing percentage of early diagnosis: A major market constraint in the previous decades was the lack of early diagnosis of HD which prevented from administrating appropriate HD care. A growing understanding of HD is leading to early diagnosis that enables patients to start treatments sooner and stymy disease progression, and improve the quality of life. Predictive gene testing can identify genetic conditions before symptoms develop.

Early diagnosis can help in HD care with family and caregivers reducing stress triggers for the patient and administer drugs such as haloperidol, tetrabenazine, and amantadine to manage the effects. The growing awareness and rising percentage of early diagnosis is fueling the demand for diagnostic tools and treatments, leading to a robust market growth.

Challenges

-

Lack of standardized treatment: The most significant challenge to HD treatment is the lack of cure. There are currently no cures to the disease but there are treatments to manage the conditions. Despite significant advancements in gene therapies, potential treatments are in early stages of trial with clinical efficacy still remaining uncertain. Additionally, the disease is complex involving multiple neurological pathways and genetic factors which is why there is a lack of standardized treatment. Variability in patient response creates further hurdles for companies trying to find a widely effective drug. This can cause decline in market growth as treatment focused on symptom management can be limiting.

-

High cost of treatment: The cost of HD treatment can be high owing to need for precision care. For instance, NLM published a report in January 2023 on the cost of HD treatment and care in the U.S. that Medicaid beneficiaries with HD have higher healthcare utilization that increases at later stages of the disease, causing greater financial burden. Additionally, long-term care is essential in HD treatment which also increases the financial burden. Higher costs of HD treatment limit the accessibility which in turn limits the rate of market growth.

Huntington's Disease Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.9% |

|

Base Year Market Size (2025) |

USD 658.31 million |

|

Forecast Year Market Size (2035) |

USD 1.69 billion |

|

Regional Scope |

|

Huntington's Disease Treatment Market Segmentation:

Drugs (Tetrabenazine, Deutetrabenazine, Other Drugs)

The tetrabenazine segment in huntington’s disease treatment market will register the highest market share of 53.6% by the end of 2035. The segment’s growth is attributed to its effectiveness in managing chorea, a common HD symptom. It is the first Food and Drug Administration (FDA) approved drug specifically designed to manage chorea and has solidified as a go-to drug for HD treatment by managing symptoms.

Tetrabenazine reduces excessive dopamine activity in the brain and manages involuntary movements of HD patients. Additionally, the rising awareness on HD treatment has led to a boost in the demand for symptom management medications. In the future, novel HD treatment solutions with tetrabenazine involving lesser side effects is poised to open new opportunities within the segment and continue increasing the revenue share.

Deutetrabenazine is a rapidly growing segment in the huntington’s disease treatment market that is estimated to significantly increase its revenue share by the end of 2035. In February 2023, Austedo XR or Deutetrabenazine was approved by the FDA to be administered as extended-release tablets. Deutetrabenazine is used to manage chorea in HD patients by suppressing dopamine activity in the brain. The segment’s growth is attributed to the longer half-life that allows stable symptom control with fewer doses and ability to reduce side effects such as fatigue and depression. Additionally, increased diagnosis of HD due to rising awareness has led to greater adoption of deutetrabenazine boosting the segment’s growth.

Type (Branded, Generic)

The branded segment in huntington’s disease treatment market is witnessing steady growth and is estimated to improve the revenue share by 2035. The segment’s growth is owed to Xenazine (Tetrabenazine) and Austedo (Deuterabenazine) that help manage symptoms of Huntington’s disease. The segment also benefits from growing awareness on the medications and increase in research & development activities by companies to develop therapies with greater efficacy. Branded drugs have the benefit of safety profiles and instill confidence in buyers compared to generic drugs. The segment is poised to grow further as new drug formulations are researched and pass clinical trial, and approval.

Our in-depth analysis of the huntington’s disease treatment market includes the following segments:

|

Drugs |

|

|

Type |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Huntington's Disease Treatment Market Regional Analysis:

North America Market Analysis

North America industry is predicted to account for largest revenue share of 34.8% by 2035. For instance, in September 2023, it was reported that between 2010 and 2012, North America had 1.21 per 100,000 person-years in HD cases. The data highlights a slight growth between 2012 to 2022 compared to the previous study in 2012 indicating a growing need for HD treatment in North America. Additionally, strong research and development investments in the region is poised to increase the market’s growth during the forecast period.

U.S. accounted for the largest share in the regional market in North America. The market in U.S. is growing due to the rising cases of HD diagnosis and the increasing demand for treatment. For instance, the Huntington’s Disease Society of America estimated in 2024, around 41,000 symptomatic patients in the U.S. that require treatment and more than 200,000 at risk of inheriting the disease. Additionally, U.S. has been proactive in spreading awareness on the disease and building a robust framework for HD treatment. For instance, the FDA has already approved two drugs, i.e., Austedo and Xenazine for management of HD symptoms and is pending stamp of approval on other drugs such as Pridopidine (Proof-HD), SOM3355, AMT-130, etc.

Canada is projected for a robust growth during the forecast period. The huntington’s disease treatment market growth is attributed to rising cases of HD in Canada and the growing demands for treatment and care. The Huntington’s Society of Canada estimates 1 in 7000 people in Canada to be diagnosed with HD and 1 in 5500 people to be at risk of the disease. Canada has been proactive in increasing diagnosis tests for HD. For instance, genetic testing for HD has been available in Canada since 1993 and has the efficacy has improved considerably in current times. Additionally, government support in the region for HD treatment boosts the market’s growth. For instance, in September 2021, the Huntington Society of Canada (HSC) introduced a long-term program to train neurologists in HD treatment. Such initiatives boost HD care and treatment

Europe Market Analysis

Europe is poised to register the fastest growth during the forecast period owing to growing cases of huntington’s disease and rising demands for treatment and care. HD prevalence is higher in people of European descent as per studies which increases the vulnerability in Europe, and positions the increase in demand for HD treatments. For instance, in August 2023, it was reported that HD prevalence ranged from 3 to 7 per 100,000 persons among European ancestry. Additionally, investments in HD research in Europe fuels the market’s rapid rise.

Germany is leading the huntington’s disease treatment market share in Europe due to a rising prevalence of HD cases and identification of people who may be at risk of inheriting the HD gene. For instance, German Center for Neurodegenerative Diseases (DZNE) estimates around 10,000 people to be affected by HD symptoms in Germany in 2024 and around 30,000 people to be at risk of carrying the gene. Demands for gene identification therapies to detect people at risk and effective treatment to manage chorea is driving the market in the country. New therapeutic cares are being researched to assist patients diagnosed with HD and support families caring for patients with HD.

France is estimated to increase its huntington’s disease treatment market share during the forecast period owing to rising diagnosis of HD. For instance, the Paris Brain Institute estimated around 18,000 people in France afflicted with Huntington’s disease and out of those, 6000 are exhibiting symptoms while 12000 carriers of the huntingtin gene remain asymptomatic. The market in France is boosted by the clinical trials and approvals of new drugs in Europe which positions market players to boost the revenue share by serving as distributors of new treatment methods. For instance, in September 2024, Prilenia’s Pridopidine for HD treatment was accepted for European marketing authorization review.

APAC Market Analysis

The Asia Pacific huntington’s disease treatment market is projected to register a rapid growth during the forecast period. The market in APAC is comparatively niche and is exhibiting signs of growth owing to rising awareness on Huntington’s disease leading to an increase in diagnosis. APAC also accounts for a significantly high number of population and administrating precision care for HD treatment opens opportunities for the key market players. Despite low prevalence of HD compared to North America and Europe, the increase rate of gene testing and awareness is expected to increase HD diagnosis percentage across APAC.

India accounts for a large share of the APAC market. The huntington’s disease treatment market growth in India is attributed to growing push for research on HD. In August 2024, it was reported that an estimated 7 in 1,00,000 people have Huntington’s disease. Additionally, every child of a parent diagnosed with HD has 50% chance of inheriting the affected gene which makes the population at risk higher.

India also accounts for the largest population in the world; hence, the cases of undiagnosed HD can be comparatively larger. In August 2024, HD patients, caregivers, and doctors submitted a referendum to the Union Health Ministry of India to include HD as a rare disease and make amendments to the National Policy of Rare Disease (NPRD). HD’s acceptance as a rare disease will open greater investments on research and improve HD care in the region.

China has a growing revenue share in the APAC huntington’s disease treatment market. The market in China is relatively niche compared to North America and Europe but the high population rate and growing investments in improving accessibility and quality of healthcare is poised to lead a stable market growth. In December 2023, the Economic Burden of Huntington’s Disease in China published a report that highlight 269 individuals with HD in China across various ages who are having financial troubles due to long-term HD care. China has a robust healthcare system with almost 95% of the population covered by 2020; assisting HD treatment costs.

Additionally, insurance coverage enables more people to actively seek HD treatment. Despite the low prevalence of HD in China, the pharmaceutical ecosystem in the country is robust and poised to offer HD treatment solutions globally that can boost the market’s growth. For instance, in March 2020, China approved the use of Austedo for managing HD related chorea and in February 2024, Jiangsu Nhwa and Teva announced a strategic partnership to improve patient access to Austedo in China.

South Korea is an emerging huntington’s disease treatment market with a rising prevalence of HD in the past decade. For instance, in January 2023, a paper published on NLM studied the number of cases in South Korea between 2010 and 2019. As per the findings, new HD cases in South Korea increased by almost a 1000 in 2019 and the number of people seeking HD treatment each year also increased, i.e., 144 in 2010 and 453 in 2019. The rising cases of HD and the increasing number of people seeking HD treatment is boosting the market in South Korea and by the end of 2035, the revenue share is estimated to increase.

Key Huntington's Disease Treatment Market Players:

- Teva Pharmaceuticals Industries Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- UniQure

- Lupin

- Dr. Reddy’s Laboratories Ltd.

- Neurocrine Biosciences Ltd.

- Sun Pharmaceutical Industries Ltd.

- Pfizer, Inc.

- Lundbeck A/S

- Bausch Health Companies Inc.

- Hikma Pharmaceuticals PLC

- Ionis Pharmaceuticals

- Sage Therapeutics

- WaVe Life Sciences

- Azevan Pharmaceuticals

Huntington’s disease treatment market is projected to have a steady growth during the forecast period. Key market players are investing in research and development to reduce side effects of HD treatment drugs, and provide better palliative care for patients.

Some of the key market players are:

Recent Developments

- In July 2024, UniQure’s stocks saw a surge of 60% as the company updated on the clinical trials for its gene therapy AMT-130 for Huntington’s disease. The company updates that higher dose of AMT-130 is decelerating the progression of Huntington’s.

- In May 2024, Teva announced Austedo extended-release tablets approved by the U.S. FDA as a one pill, daily treatment for clinically therapeutic doses.

- In May 2024, Evotec and CHDI Foundation extended their 20-year collaboration that is dedicated to developing therapeutics to improve lives of people afflicted with Huntington’s disease.

- In March 2023, Aitia and UCB announced a strategic collaboration for drug discovery in Huntington’s disease. The collaboration is aimed at early drug discovery and validation of novel drug targets.

- Report ID: 6517

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.