Host Cell Protein Testing Market Outlook:

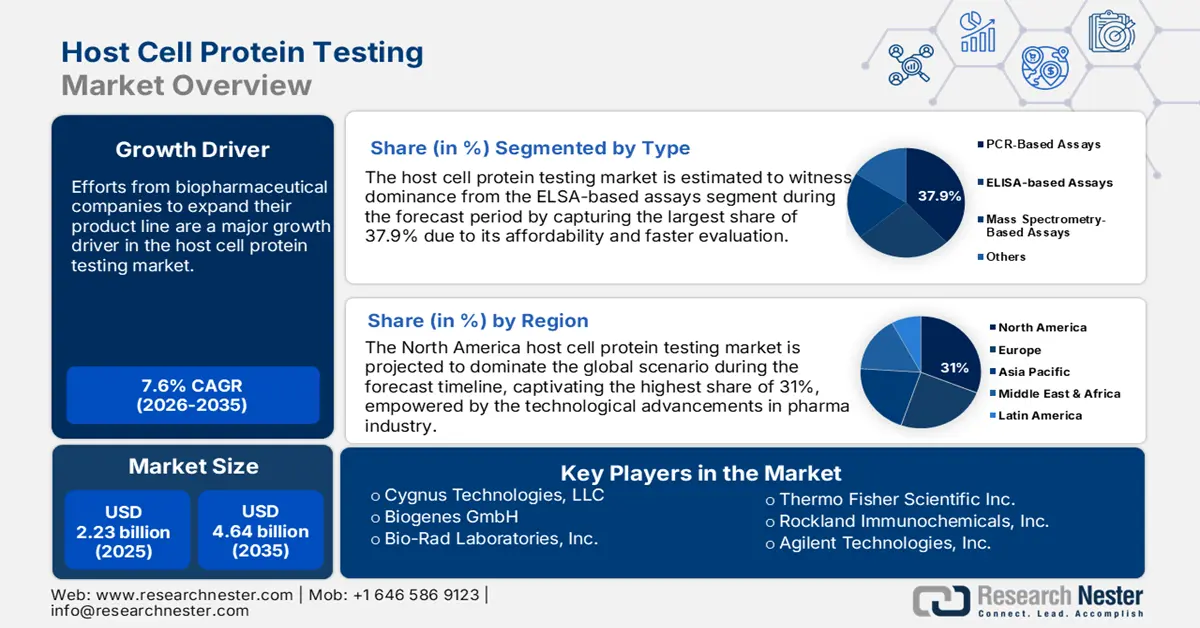

Host Cell Protein Testing Market size was over USD 2.23 billion in 2025 and is anticipated to cross USD 4.64 billion by 2035, witnessing more than 7.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of host cell protein testing is assessed at USD 2.38 billion.

Efforts from biopharmaceutical companies to expand their product line are a major growth driver in the market. As the industry of this specified category emphasizes, the demand for more innovative and targeted therapeutics increases. According to a survey conducted by ThermoFisher, in 2024, the biopharma industry is expected to be valued at USD 856.1 billion by 2030. It further predicted the industry to obtain USD 22 billion by the end of 2025, exhibiting a notable CAGR of 11%. Thus, these pharma leaders are continuously working on producing new bio-components, where testing such as cell culture and host cell protein (HCP) detection is a crucial part.

The strict regulatory framework pushes these pharma manufacturers to invest in the market to ensure product purity and safety before launching. Governing authorities such as the FDA, EMA, MHLW, and ICH in emerging landscapes such as the U.S. and Japan promote HCP testing by mandating enrollment for every biologic product. This is further inspiring biotech companies to leverage the performance of their laboratory offerings to provide faster and more cost-effective clinical trials. For instance, in June 2021, Bio-Rad Laboratories collaborated with Seegene Inc. to commercialize its CFX96 Dx Real-Time PCR System, accelerating clinical development and approval from the FDA in the U.S. market. It was the same year when the company earned a gross profit of USD 1.6 billion.

Key Host Cell Protein Testing Market Insights Summary:

Regional Highlights:

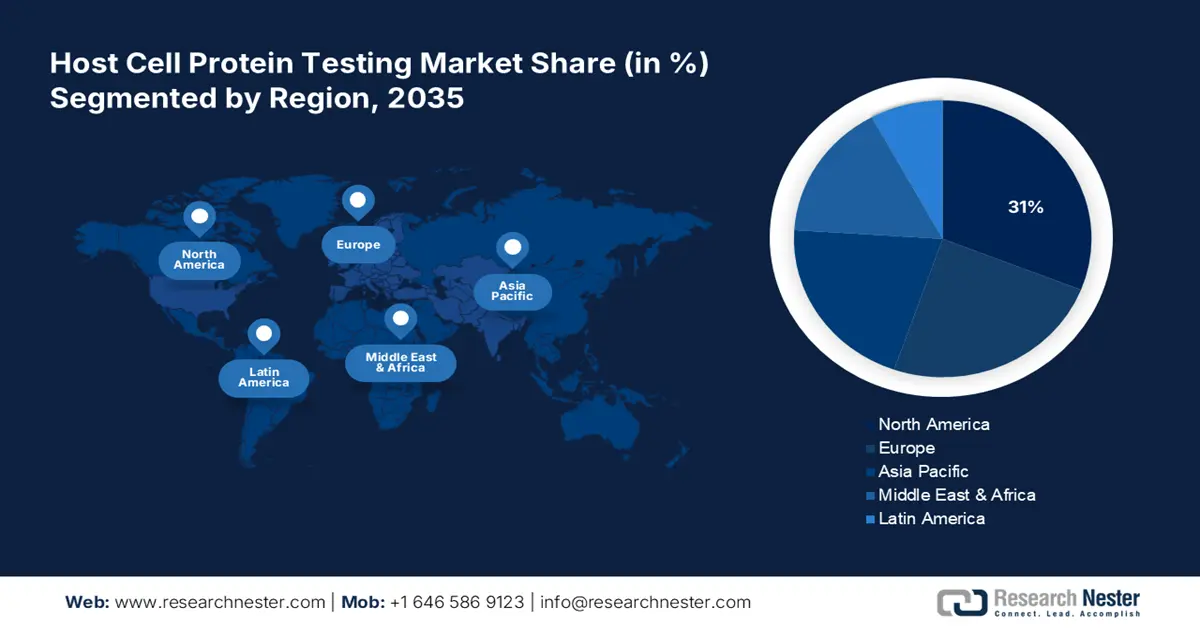

- North America leads the Host Cell Protein Testing Market with a 31% share, fueled by robust pharmaceutical R&D culture and regulatory frameworks, driving growth through 2026–2035.

- The Asia Pacific Host Cell Protein Testing Market is projected to achieve the fastest CAGR by 2035, attributed to rising pharmaceutical production in China and India and improved regulatory frameworks.

Segment Insights:

- ELISA-based Assays segment are projected to capture over 37.9% market share by 2035, fueled by their affordability, faster evaluation, and compliance with FDA and EMA regulations.

- The biopharmaceutical companies segment of the Host Cell Protein Testing Market is anticipated to achieve a remarkable share by 2035, fueled by advanced HCP assessments that reduce test-to-result time and comply with regulations.

Key Growth Trends:

- Increased earnings from lab-tech solutions

- Rising R&D activities for drug discoveries

Major Challenges:

- High time and capital consumption

- Limitation in adaptation

- Key Players: Cygnus Technologies, LLC, Biogenes GmbH, Agilent Technologies, Inc., Cytiva, Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc..

Global Host Cell Protein Testing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.23 billion

- 2026 Market Size: USD 2.38 billion

- Projected Market Size: USD 4.64 billion by 2035

- Growth Forecasts: 7.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (31% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, Brazil, Mexico

Last updated on : 13 August, 2025

Host Cell Protein Testing Market Growth Drivers and Challenges:

Growth Drivers

-

Increased earnings from lab-tech solutions: Expansion of the biotechnology industry is the most prominent evidence of growth in the market. A significant increment in revenue of global leaders in this sector is also an indicator of a promising future in participation. For instance, in the 2023 annual report, ThermoFisher revealed the value of generated revenue to be USD 42.8 billion, where the pharma and biotech products & services held the highest share of 57%. The company further expressed its plans to invest USD 1.3 billion in developing new technologies for more enhanced laboratory operations.

- Rising R&D activities for drug discoveries: To bring advancement in the highly competitive biopharmaceutical industry, extensive R&D initiatives are inflating demand in the market. Continuous efforts from both government bodies and pharma companies to produce effective biologics and vaccines are also propelling cash flow in this sector. For instance, in November 2024, AstraZeneca made a capital investment of USD 3.5 billion in biologics R&D and manufacturing facility for the U.S. market. These findings act as a financial cushion for this sector and inspire others to get involved as well.

Challenges

-

High time and capital consumption: Some of the offerings from the host cell protein testing market such as mass spectrometry are expensive and time-consuming. The significant resources required for such qualifying tests may become an economic hurdle for consumers, limiting adoption. In addition to the elongated development timeline, it requires skilled laboratory technicians to perform these complex detection methods, which adds to the production budget, preventing pharma companies from acquiring.

- Limitation in adaptation: Penetrating innovations of the market into the legacy lab infrastructure is a challenge for inadequate facilities. New testing methodologies of unique HCPs, specifically developed for personalized medicines are limited to the associated boundaries. Thus, they do not perform well in other categories, restricting diverse applications and wide adaptation. Moreover, the fragmented landscape of this sector is fed by continuous drug discoveries, which may become an issue for manufacturers to cope with.

Host Cell Protein Testing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.6% |

|

Base Year Market Size (2025) |

USD 2.23 billion |

|

Forecast Year Market Size (2035) |

USD 4.64 billion |

|

Regional Scope |

|

Host Cell Protein Testing Market Segmentation:

Type (PCR-Based Assays, ELISA-based Assays, Mass Spectrometry-Based Assays)

ELSA-based assays segment is likely to capture host cell protein testing market share of over 37.9% by 2035. This segment is gaining traction due to its affordability and faster evaluation. For instance, in October 2023, Lonza launched PyroCell MAT Rapid System and PyroCell MAT Human Serum (HS) Rapid System. This new MAT pipeline consists of PeliKine Human IL-6 Rapid ELISA Kit, which offers a faster, easier, and simpler testing experience to pharma manufacturers. In addition, this method is widely adopted for its compliance with major validating authorities such as the FDA and EMA, making it preferable for pharma companies who seek globalization.

End user (Contract Research Organizations, Biopharmaceutical Companies)

In terms of end users, the biopharmaceutical companies segment is estimated to secure a remarkable share of the host cell protein testing market by 2035. Advanced testing methods such as HCP assessments are the key weapons for them, as they help in reducing test-to-result time conveniently while complying with mandatory regulations. These tools are also the power engines behind the accelerated production of biologics, making them the perfect option for biopharma companies. For instance, in a study, published in January 2025, a novel combined approach to HCP testing was introduced to support mass detection in biopharmaceutical products. The method combined TMT-labeling and signal boosting with conventional mass spectrometry to enhance sensitivity and detection capacity.

Our in-depth analysis of the global host cell protein testing market includes the following segments:

|

Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Host Cell Protein Testing Market Regional Analysis:

North America Market Analysis

North America host cell protein testing market is expected to dominate revenue share of over 31% by 2035. The pharma industry of this region is empowered by technological revolutions. Being home to a wide spectrum of new drug discoveries, North America, particularly the U.S. is considered to be the foundation of global expansion. This has created a proactive environment for pharmaceutical R&D culture, raising investments in this sector. According to a report published by the Congressional Budget Office of the U.S., in April 2021, the accumulated R&D expenditure of the national pharma industry reached USD 83 billion in 2019. It further classified the costs per drug development to range from less than USD 1 billion to more than USD 2 billion.

Due to the dependence on R&D to survive in the competitive and continuously evolving pharma industry of the U.S., both domestic and foreign leaders are forced to invest in the market. In addition, being a crucial part of the FDA-approval process, HCP has made the country’s proprietary on the regional landscape more evident. According to an NLM article, published in October 2022, the number of registered trials in the U.S. increased from 1873 in 2000 to 22,131 in 2020. The numbers testify to the increased drug discovery activities, confirming a profitable atmosphere for this sector in the country.

Canada is one of the biggest investors among regional participants in the market. The investments in healthcare research including drug development are well-proportionately distributed across the country, which establishes a good business condition for this sector. A report from the government of Canada, published in December 2024 estimated the total investment in biomanufacturing, vaccines, and therapeutics to value at USD 2.3 billion. This amount is funded to 41 R&D projects in the country, situated in British Columbia, Alberta, Saskatchewan, Atlantic, Quebec, and Ontario strengthening the life science innovation of Canada.

APAC Market Statistics

Asia Pacific is predicted to register the fastest CAGR in the global host cell protein testing market during the forecast period, 2025-2035. The enlarged pharmaceutical industry in this region has opened new pathways to generating profitable revenues from this sector. In addition, manufacturing powerhouses such as China and India are marking a predominant territory in this industry, inflating demand for such quality control tests.

India is propagating the market with recent developments in the pharmaceutical industry. It presents a lucrative opportunity for both global and domestic pharma companies to gain profit in this sector by utilizing its growing emphasis on biotechnology. According to an IBEF datasheet, the biotechnology industry of India doubled to USD 70.2 billion in 2020 from 2021. It is further poised to be evaluated at USD 150 billion in 2025, showing its potential to achieve approximately USD 300.0 billion by the end of 2030. The report further predicted its biologics industry to hold USD 12 billion in 2025.

China is among the largest suppliers of pharmaceutical products including drugs in the world, making it a strong competitor in the host cell protein testing market. Considering the increasing number of applications for clinical trials from this country, it is cultivating resources and making heavy investments to levitate innovation and production in this industry. According to the report from the International Trade Administration, published in April 2023, the pharma industry in China was expected to be valued at USD 161.8 billion in 2023. The report further stated that it captured 30% share of the total global industry size.

Key Host Cell Protein Testing Market Players:

- Enzo Life Sciences, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Abcam plc

- Thermo Fisher Scientific Inc.

- Cytiva

- Bio-Rad Laboratories, Inc.

- Biogenes GmbH

- Cisbio Bioassays

- Cygnus Technologies, LLC

- Rockland Immunochemicals, Inc.

- Agilent Technologies, Inc.

- Applied Biomics, Inc.

The strings of the host cell protein testing market are outstretching toward new possibilities by exploring the potential of the HCP method in molecular diagnosis and DNA sampling & analysis. Global leaders are increasingly engaging in strategic partnerships and collaborations to introduce new applications and improve the efficiency of HCP components. For instance, in August 2024, Cygnus Technologies collaborated with TriLink BioTechnologies to commercialize AccuRes Host Cell DNA Quantification Kits in the global market. Both companies utilized each other’s capabilities in technologies and reagents in developing an assay, enabling safer and more stable biotherapeutics production. Such key players include:

Recent Developments

- In February 2024, Applied Biomics launched a new product line of Anti-Host Cell Protein (HCP) Antibodies, offering more than 95% coverage. The pipeline provides diverse applications and a wide range of reactivity with host species strains such as CHO-S, CHO-K1, CHO-GS, CHO-DG44, HEK293, CAP, Hela, Per.C6, A549, MRC-5, and others.

- In September 2023, Thermo Fisher Scientific introduced ground-breaking laboratorty components, Orbitrap Astral Mass Spectrometer, and monoclonal antibodies. These instruments are designed to enable accurate host cell protein detection and mab analysis in biopharmaceuticals.

- Report ID: 7018

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Host Cell Protein Testing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.