Healthcare Staffing Market Outlook:

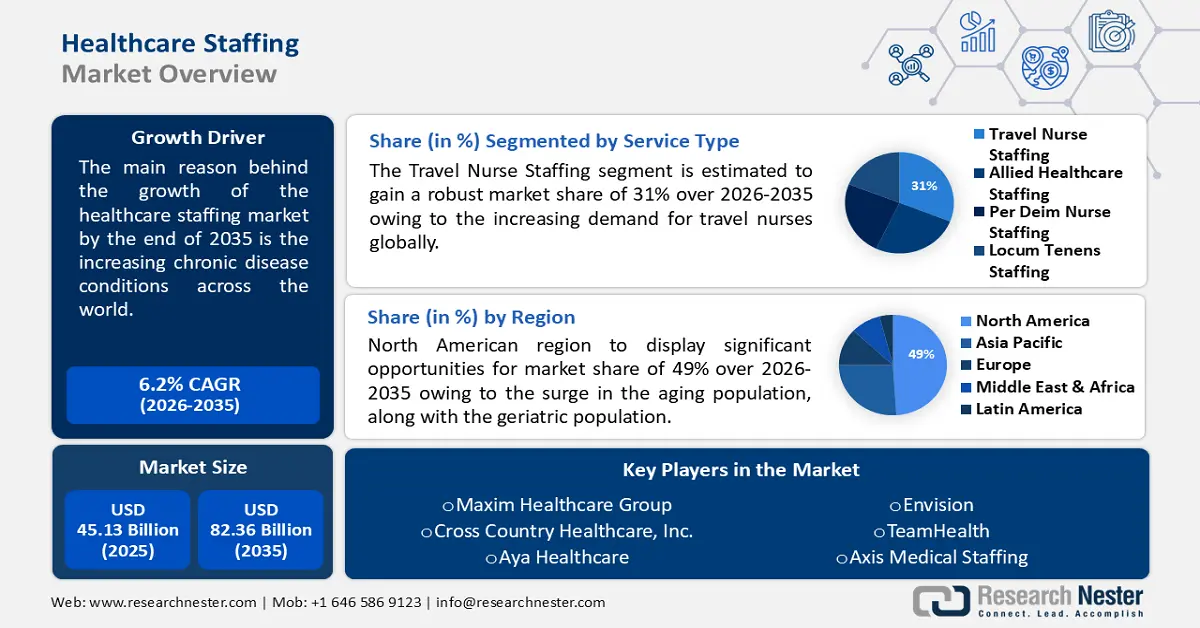

Healthcare Staffing Market size was over USD 45.13 billion in 2025 and is projected to reach USD 82.36 billion by 2035, witnessing around 6.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of healthcare staffing is evaluated at USD 47.65 billion.

This boost is anticipated by the slated growth in chronic disease conditions are estimated to increase as about 1 out of 3 adults suffer worldwide from multiple chronic conditions. According to the National Institutes of Health Report 2023, there has been an increase of about 7% from 67% of deaths in 2010 to 74% of deaths in 2019, globally which are caused by chronic conditions.

Key Healthcare Staffing Market Insights Summary:

Regional Highlights:

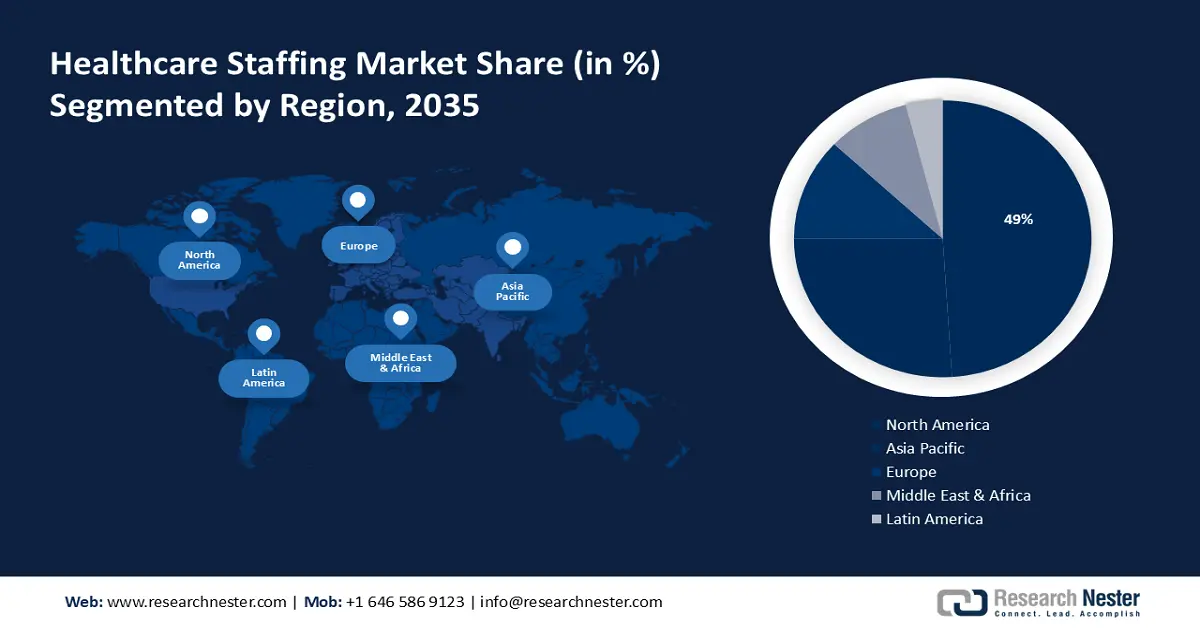

- North America healthcare staffing market will hold more than 49% share by 2035, driven by an aging population and increasing demand for healthcare services.

- Asia Pacific market will secure the second largest share by 2035, driven by a rising population and increasing demand for medical professionals.

Segment Insights:

- The travel nurse staffing segment in the healthcare staffing market is expected to hold a 31% share by 2035, driven by the increasing demand for travel nurses globally and flexible work hours.

Key Growth Trends:

- Shortage of healthcare workers

- Slated technological advancements in healthcare

Major Challenges:

- Lack of skilled health workers

- Lack of wages

Key Players: Vibra Healthcare, AMN Healthcare, CHG Management, Inc., Maxim Healthcare Group, Cross Country Healthcare, Inc., Aya Healthcare, Envision, TeamHealth, Axis Medical Staffing, Acara Solutions India.

Global Healthcare Staffing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 45.13 billion

- 2026 Market Size: USD 47.65 billion

- Projected Market Size: USD 82.36 billion by 2035

- Growth Forecasts: 6.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (49% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, United Kingdom, Germany, Japan

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 17 September, 2025

Healthcare Staffing Market Growth Drivers and Challenges:

Growth Drivers

-

Shortage of healthcare workers - There is a surge in the population of patients across the globe credited to which the demand for healthcare staffing is also increasing. According to a report by the Bureau of Health Workforce in 2024, it is predicted that there will be a shortage of about 37% of primary care physicians in nonmetro areas. It is predicted that about 100 countries have skilled professionals below the threshold level which is a shortage of about 7.2 million health professionals with proper skills.

-

Slated technological advancements in healthcare - Owing to the healthcare and pharmaceutical sectors are increasing, credited to the surge in AI penetration along with the demand for more accurate diagnoses, this would surpass the demand for healthcare staffing such as miniaturized electronics, biocompatible materials, wireless communication protocols, advanced sensor technology, and many more. According to a report in 2022, more than 80% of medical practices and hospitals, already have or are planning to have some kind of AI technology in place.

- Increase in the geriatric population - Accredited to the healthcare support for health issues and needs, there is an increasing demand for healthcare, there is also a greater focus on providing more personalized and better care to elderly patients. According to a report by the Census in 2020, the U.S. population above the age of 65 years increased by more than 38% from 2010 to 2010 in 10 years.

Challenges

-

Lack of skilled health workers - There is a lack of skilled workers in the healthcare staffing industry impelled by which several healthcare staffing firms are being turned down. Many healthcare staffing providers have started training programs for upskilling their work, but it would take ample time to take the lead.

-

Lack of wages - There is a shortage in wages for several healthcare workers and medical assistants. According to the Bureau of Labor, nurses earn up to USD 43 per hour, while many medical assistants earn below USD 21, which according to the expected professional requirement does not equal fair compensation.

Healthcare Staffing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 45.13 billion |

|

Forecast Year Market Size (2035) |

USD 82.36 billion |

|

Regional Scope |

|

Healthcare Staffing Market Segmentation:

Service Type Segment Analysis

The travel nursing staffing segment is poised to hold over 31% healthcare staffing market share by the end of 2035 driven by the increasing demand for travel nurses globally. According to a report by AMN Healthcare survey in 2024, the usage of travel nurses increased by 35% in 2020, attributed to the gain in clinical experience in several settings, short-term assignments, travel opportunities, and flexible work hours.

In addition, there is a growth in healthcare costs and hospitals are expected to reduce their working staff, credited to which travel nurses are required whenever the workload is increased.

End-users Segment Analysis

The hospital segment is estimated to gain a robust revenue globally in the end-user segment, owing to the increasing demand for the healthcare industry, the all-time availability of trauma centers, and the lucrative handling of traumatic injuries and several serious cases. Hospitals are well-equipped with advanced diagnostic facilities, including high-resolution computed tomography (CT) scanners and ultrasound machines. According to a report in 2022, more than 3.5 billion people which is almost half of the world’s population lacks the access to proper healthcare.

Additionally, hospitals will dominate this industry as they offer a multidisciplinary approach to healthcare staffing management. This collaborative environment allows for consultations with various specialists, including urologists, nephrologists, radiologists, and dietitians, ensuring a well-rounded and individualized approach to patient care.

Our in-depth analysis of the healthcare staffing market includes the following segments:

|

Service Type |

|

|

End-users |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Healthcare Staffing Market Regional Analysis:

North American Market Insights

North America industry is estimated to hold largest revenue share of 49% by 2035. The landscape's substantial growth in the region is expected credited to the surge in the aging population.

Attributed to the growth in the geriatric population the demand for healthcare services in the United States is increasing. According to a report by the Census in 2023, the elder population has grown by 50.9 million, from 4.9 million (or 4.7% of the total U.S. population) in 1920 to 55.8 million (16.8%) in 2020.

In Canada there is an increasing demand for medical professionals, especially in temporary staffing. According to a report in 2022, the personal and temporary healthcare staffing would grow by about 15% with a size of more than USD 4 billion.

APAC Market Insights

The Asia Pacific region will also encounter a huge influence on the healthcare staffing market demand during the forecast period with a size and will account for the second position attributed to the increasing population of this region. According to the UN-Habitat, it is predicted that the urban population in APAC is projected to increase by 50%.

The increase in demand for nurses and doctors for better medical services in China is expected to boost the demand for healthcare staffing. According to a report by the National Institutes of Health in 2021, there were about 2.62 physicians for per 1000 population in China.

There has been an increase in healthcare expenditures in Japan which will increase the market size expansion of the healthcare staffing sector. According to a report in 2023, there was about 2.2 times growth over the last 30 years in Japan from 1990 to 2015 in the healthcare expenditure in Japan.

Healthcare Staffing Market Players:

- Vibra Healthcare

- AMN Healthcare

- CHG Management, Inc.

- Maxim Healthcare Group

- Cross Country Healthcare, Inc.

- Aya Healthcare

- Envision

- TeamHealth

- Axis Medical Staffing

- Acara Solutions India

The healthcare staffing market value is predicted that the top five companies would occupy about 21%. Most of these companies are continuously collaborating, expanding, making agreements, and joining ventures for the growth of this revenue share and are estimated to be the major key players in this landscape.

Recent Developments

- Vibra Healthcare- announced their new business for helping with the healthcare staffing called Vibra Travels which is considered as a healthcare staffing business and travel nursing.

- AMN Healthcare- the acquired Connetics USA, which is a global allied staffing and nurse company, by this acquisition AMN would expand the allied staffing, and nursing, and would recruit several the business of AMN Healthcare.

- Report ID: 6133

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Healthcare Staffing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.