Healthcare ERP Market Outlook:

Healthcare ERP Market size was valued at USD 8.65 Billion in 2025 and is expected to reach USD 16.7 Billion by 2035, expanding at around 6.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of healthcare ERP is evaluated at USD 9.18 Billion.

The primary factor for the market growth is attributed to the rising cases of cardiovascular diseases such as heart attack, strokes and others along with the increment in deaths owing to them. As per the World Health Organization, cardiovascular diseases are considered to be the leading cause of deaths globally, taking almost 17.9 million lives in 2019, which is equivalent to 63% of the total deaths that occurred.

The world is projected to see a huge pool of patients in the upcoming years. As a result, the pressure on the healthcare system is rising, which increases the demand for a smooth process of supply chain and logistics, as well as patient care and treatment. Thus, the increase in the number of deaths due to non-communicable diseases is anticipated to increase the adoption rate of healthcare ERP in hospitals, ambulances, and clinics. As per a report published by the World Health Organization in 2021, it is stated that non-communicable diseases kill almost 41 million people each year, an equivalent of 71% of global deaths.

Key Healthcare ERP Market Insights Summary:

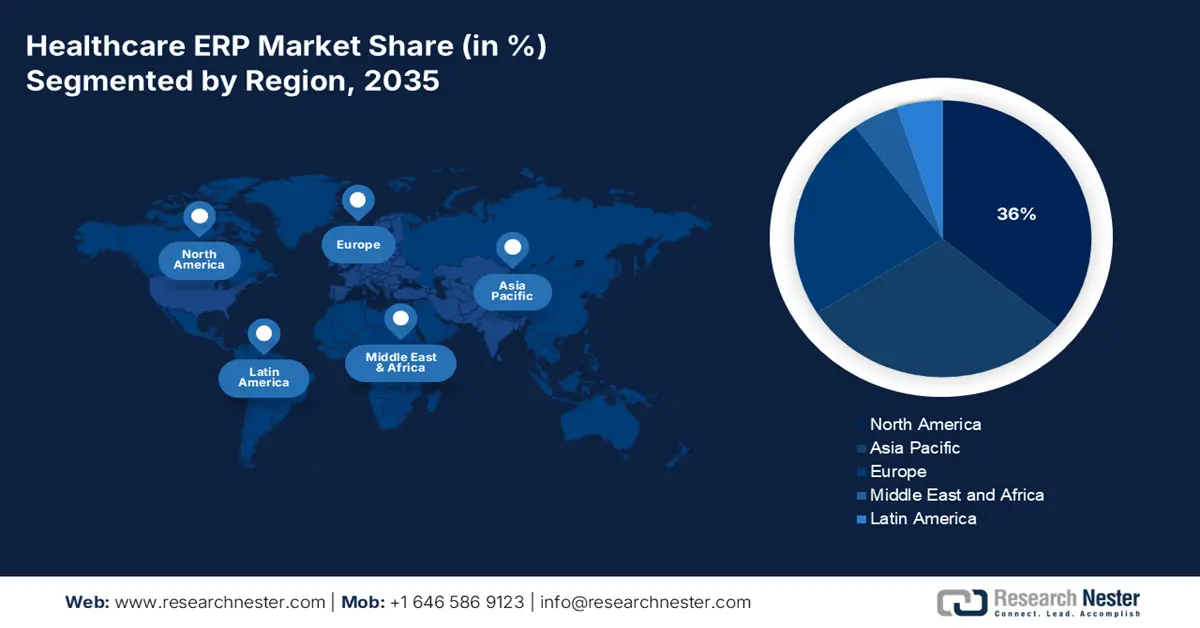

Regional Highlights:

- North America’s healthcare ERP market is predicted to capture 36% share by 2035, attributed to high healthcare costs, high disposable income, and a large number of healthcare facilities.

Segment Insights:

- The on-premise segment in the healthcare erp market is anticipated to hold a 69% share by 2035, driven by the popularity of on-premise solutions for their accessibility and control.

- The hospital segment in the healthcare erp market will command the highest market share, fueled by increasing hospital count and growing patient visits, 2026-2035.

Key Growth Trends:

- Prevalence of Heart Diseases

- Escalation in Health Expenditure

Major Challenges:

- Lack Awareness About Healthcare ERP

- Low Adoption Rate in Developing Countries

Key Players: McKesson Corporation, Infor, Odoo SA, SAP SE, Oracle, Epicor Software Corporation, QAD Inc., Aptean Group, The Sage Group plc, Microsoft.

Global Healthcare ERP Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.65 Billion

- 2026 Market Size: USD 9.18 Billion

- Projected Market Size: USD 16.7 Billion by 2035

- Growth Forecasts: 6.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, France, China

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 9 September, 2025

Healthcare ERP Market Growth Drivers and Challenges:

Growth Drivers

- Growing Prevalence of Unhealthy Lifestyle Diseases - Several diseases such as diabetes, hypertension, obesity and high blood pressure are occurring among the population owing to the shift towards an unhealthy lifestyle, which is further expected to bring lucrative opportunities in the healthcare ERP market in the assessment period. Diabetes prevalence was estimated to be nearly 10%, or 460 million people, in 2019 and is expected to rise steadily in the future, reaching 11%, or 700 million people, by 2030.

- Prevalence of Heart Diseases – There is an alarming rise in the number of heart disease patients across the world. This has brought the need for the deployment of healthcare ERP systems across the healthcare sector. The majority of cardiovascular diseases are accounted for by heart attacks and strokes. Around 85% of the cardiovascular disease deaths were due to heart attacks and strokes in 2019.

- Increase in Patient Visits — According to recent reports, approximately 770 million outpatient visits were reported in hospitals in the United States in 2020.

- Boom in the Healthcare Sector - The revenue generated by the global healthcare sector in 2022 stood at USD 60 billion.

- Escalation in Health Expenditure – The World Bank released the health expenditure of the world in the year 2019, which accounted for 9.83% of the total GDP. This is a rise from 2017, when global health expenditure was 9.77% of total GDP.

Challenges

- Lack Awareness About Healthcare ERP – In many of the developing areas, the latest technology has not peeked in yet, resulting a less awareness about healthcare ERP. This has also prompted the low adoption rate in several nations which is projected to hamper the market growth.

- Low Adoption Rate in Developing Countries

- Stringent Rules by Government

Healthcare ERP Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 8.65 Billion |

|

Forecast Year Market Size (2035) |

USD 16.7 Billion |

|

Regional Scope |

|

Healthcare ERP Market Segmentation:

End-user Segment Analysis

The global healthcare ERP market is segmented and analyzed for demand and supply by end users into hospitals, clinics, long & short-term facilities, and others. Out of these, the hospitals segment is expected to garner the highest market share by 2035, owing to the rising number of hospitals across the world, owing to high number of patient visits and rising diseases. As per the Organization for Economic Co-operation and Development, the number of hospitals in the United States rose from 5,564 in 2015 to 6,090 in 2019.

Deployment Segment Analysis

On the other hand, in the deployment segment, the on premise segment will hold the major market share of 69%. The rising popularity of on premise owing to its easy accessibility and other associated benefits is expected to significantly drive the demand for on premise based healthcare ERP systems across the globe.

Our in-depth analysis of the global market includes the following segments:

|

By Deployment |

|

|

By Application |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Healthcare ERP Market Regional Analysis:

The healthcare ERP market, amongst the market in all the other regions, is projected to hold the largest market share by the end of 2035, with a market share of 36%. The market in the region is primarily driven by the high cost of healthcare made by the population owing to high disposable income and presence of high number of healthcare facilities. The Centers for Medicare & Medicaid Services stated that the national health expenditure increased by 9.7% in 2020 to USD 4.1 trillion, or USD 12,530 per person. This accounted for 19.7% of Gross Domestic Product (GDP). Further, the burden of chronic diseases and the deaths caused by them is another factor driving the expansion of market size. The recent study of 2022 stated that 6 in 10 adults in the U.S. have a chronic disease, and chronic disease is the leading driver of the nation’s USD 4.1 trillion.

Healthcare ERP Market Players:

- McKesson Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Infor

- Odoo SA

- SAP SE

- Oracle

- Epicor Software Corporation

- QAD Inc.

- Aptean Group

- The Sage Group plc

- Microsoft

Recent Developments

-

Infor acquired Intelligent InSites, Inc., a North Dakota-based provider of healthcare software and services. Intelligent InSites, Inc. offers dynamic, scalable, and user-friendly location platforms to businesses in order to optimize operations, streamline patient journeys, and improve clinical outcomes.

-

McKesson Corporation has entered into a partnership with HCA Healthcare, Inc. to form a joint venture to advance cancer care by combining McKesson’s US Oncology Research (USOR) and HCA Healthcare’s Sarah Cannon Research Institute (SCRI).

- Report ID: 4392

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Healthcare ERP Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.