Hair Wigs and Extensions Market Outlook:

Hair Wigs and Extensions Market size was over USD 7.95 billion in 2025 and is anticipated to cross USD 16.39 billion by 2035, growing at more than 7.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hair wigs and extensions is assessed at USD 8.49 billion.

These days, wigs play a significant role in boosting self-esteem and improving appearance, allowing for amazing changes. A wave of wig-related material has been sparked by the rise of social media platforms like Instagram and TikTok, where famous hairstylists are sharing their styling secrets. As per the data quoted in “Social Media Use and Mental Health: A Global Analysis’ by National Library of Medicine; Facebook reported 2.5 billion monthly active users as of December 2019, Twitter reported 330 million monthly active users as of January 2020, while Instagram reported over 1 billion monthly active users globally as of January 2020.

Key Hair Wigs and Extensions Market Insights Summary:

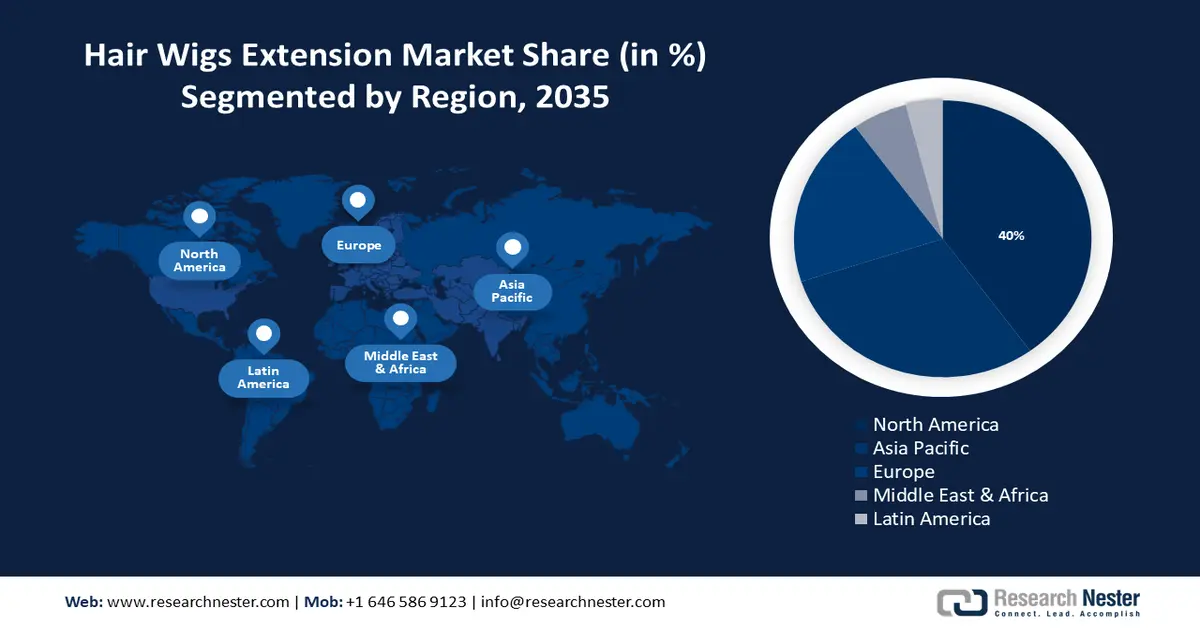

Regional Highlights:

- North America hair wigs and extensions market will hold more than 40% share by 2035, attributed to rising disposable incomes fueling demand for beauty and personal care products including wigs and extensions.

- Asia Pacific market will achieve the fastest CAGR during 2026-2035, driven by e-commerce expansion, human hair exports, and increasing social media influence across the region.

Segment Insights:

- The online stores segment in the hair wigs and extensions market is set for significant growth over 2026-2035, fueled by consumer preference for variety and competitive pricing.

- The wigs segment in the hair wigs and extensions market is projected to achieve a 60% share by 2035, influenced by increasing consumer preference for stylish and easy-to-wear human hair wigs.

Key Growth Trends:

- Growing frequency of problems with hair thinning and loss

- Growing need for non-invasive hair improvement products

Major Challenges:

- Expensive price for superior products

- Issues with synthetic product quality

Key Players: HairOriginals, Aleriana Wigs, Diva Divine Hair Extensions and Wigs, FNLOnglocks Hair Extensions, Shake-N-Go Inc, Locks & Bonds, KLIX HAIR, INC, Godrej Consumer Products Limited, Indique Hair.

Global Hair Wigs and Extensions Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.95 billion

- 2026 Market Size: USD 8.49 billion

- Projected Market Size: USD 16.39 billion by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, India, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 17 September, 2025

Hair Wigs and Extensions Market Growth Drivers and Challenges:

Growth Drivers

-

Growing frequency of problems with hair thinning and loss - Thinned hair and hair loss are common issues that a large percentage of people deal with. Stress, pollution, bad lifestyle choices, and genetic predispositions are some of the factors that cause these issues, which is why wigs and hair extensions are becoming more and more popular as remedies.

A non-invasive and transient solution to hair loss and thinning, wigs and extensions provide people the chance to improve the volume and appearance of their hair without having to have surgery. This has increased the hair wigs and extensions market, making them well-liked options for people trying to feel more confident and improve the way their hair looks.

The majority of people on the planet will experience hair loss greater than they could have ever imagined by the age of 80, with males seeing a 70% loss rate. To assist them regrow their hair, these individuals will require professional treatments, which start at age 35 and increase to 40% for men. All this is eventually resulting in rising the demand. -

Growing need for non-invasive hair improvement products - Demand for non-invasive hair enhancement procedures is rising, supporting the hair wigs and extensions market expansion. This is indicative of a trend away from surgical procedures and toward safer, less dangerous options. Customers are looking for safer solutions as a result of growing concerns about the possible risks and negative effects of surgical operations.

People can improve their hair volume and appearance without having surgery by using wigs and extensions, which provide a temporary, non-invasive solution to hair loss and thinning. At any given time, around 50% of women have worn wigs. -

Emphasize ethical sourcing and sustainability - The hair wigs and extensions market is driven by consumer awareness of social and environmental issues to emphasize sustainability and ethical sources. Customers are looking for products that are sourced and made responsibly as they become more conscious of the effects their purchases have on the environment and society.

By embracing sustainable sourcing and production methods, such as ethically sourced real hair wigs and extensions or sustainable synthetic fibers, manufacturers can set themselves apart from competitors with their products. Manufacturers can create chances in the market by promoting these practices, which appeal to consumers who are seeking hair products that align with their beliefs and are also ecologically conscientious.

Seventy-eight percent of consumers think sustainability matters. 55% of buyers are prepared to pay extra for environmentally conscious products. 84% of consumers claim that a company's unsatisfactory environmental policies will make them dislike the brand.

Challenges

-

Expensive price for superior products - The higher price point of high-quality products can be attributed to various factors such as labor-intensive production procedures, expensive raw material costs, and the craftsmanship needed to manufacture them. This may make these products less accessible to a larger market and lead to customers choosing cheaper or artificial substitutes. For many customers, the high price of premium wigs and extensions is a major deterrent, especially in underdeveloped nations where affordability is a crucial factor.

-

Issues with synthetic product quality - Synthetic wigs and extensions may be less expensive than their real hair counterparts, but they frequently fall short of giving customers the desired natural look and feel. Synthetic hair may not blend in well with natural hair and can look shiny and fake. Furthermore, compared to human hair products, synthetic products might have a shorter lifespan and fewer styling possibilities, which would hinder the hair wigs and extensions market expansion.

Hair Wigs and Extensions Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 7.95 billion |

|

Forecast Year Market Size (2035) |

USD 16.39 billion |

|

Regional Scope |

|

Hair Wigs and Extensions Market Segmentation:

Product Segment Analysis

Wigs segment is estimated to hold over 60% hair wigs and extensions market share by the end of 2035. The market is expanding because wigs are easy to dress and are regarded as stylish. As a result, people are starting to favor human hair wigs. Many men and women are influenced to pick between these options instead of hair transplants and surgery by the availability of high-quality wigs.

Technology advancements and digitalization have increased as a result of the rising demand for hair wigs and the variety of issues consumers face when selecting the best solution. For example, in April 2021, the distributor of wigs and extensions Evergreen Products Group Limited said that it will use non-fungible tokens (NFTs) to create and invest in digital wigs. The business collaborated with Hong Kong-based XR content and software provider Shadow Factory Limited to develop an augmented reality-driven e-commerce platform that allows users to try on wigs prior to purchase.

Hair Type Segment Analysis

The human hair segment share in the hair wigs and extensions market is poised to surpass 37% by 2035, which may be attributed to the natural appearance they offer to customers. The human hair industry consists of several types, most prominently Remy hair, which has cuticles oriented in the same direction to provide the appearance of natural hair. Conversely, non-Remy hair provides an alternative because its strands have cuticles pointing in opposite directions.

Genuine people are drawn to virgin hair because it is highly valued for being unprocessed and in its original state. Processed hair comes in colored, bleached, or curled varieties, offering a variety of customizable styles. Furthermore, the International Society of Hair Restoration Surgery (ISHRS) reports that, in 2021, 396 individuals on average per member had non-surgical hair restoration treatments performed by ISHRS doctors. This statistic indicates the surging demand for market, especially in this segment.

Distribution Channel Segment Analysis

By 2035, online stores segment is set to capture over 70% hair wigs and extensions market share due to increase more quickly in the upcoming years due to consumers' propensity to physically try on and compare products. A greater variety of products, competitive price, ease of online retail, and rising internet usage are some of the factors driving this increase.

At 5.3 billion, about two thirds of the world's population were online as of 2023. This represents the total number of internet users globally. The rise in popularity of direct-to-consumer companies and online marketplaces is also contributing to the online segment's increase in market.

Our in-depth analysis of the market includes the following segments:

|

Product |

|

|

Hair Type |

|

|

Fitting Type |

|

|

Cap Type |

|

|

End-User |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hair Wigs and Extensions Market Regional Analysis:

North America Market Insights

North America industry is expected to account for largest revenue share of 40% by 2035. This dominance is a result of customers' growing disposable income in North America, which leads to higher expenditure on beauty products and personal care products including hair wigs and extensions. The average annual expenditure of American women on cosmetic goods and services is USD 3,756.

In response to the expanding market for a wide variety of wigs and extensions, new supply outlets are opening up across the United States. An example of this will be the May 2023 opening of Charlene's Beauty Supply in Elk Grove, California. With its emphasis on providing a selection of hair care products together with premium medical-grade wigs and extensions, this new business hopes to further enhance the area's standing as a major player in the sector.

APAC Market Insights

Asia Pacific hair wigs and extensions market is expected to observe fastest growth till 2035. The abundance of small and large competitors in this industry have made it a profitable place to buy hair goods and accessories, such as wigs and extensions, to meet the varied needs of consumers.

Furthermore, a 2023 article published by Scandinavian Biolabs states that India (14.3%) and Hong Kong (44.4%) are two of the top exporters of human hair to other countries, underscoring the Asia Pacific region's importance in the world's hair market.

The use of e-commerce sites and China's explosive growth have both contributed significantly to the rise in demand. According to information provided by UN Trade & Development, Chinese business-to-consumer e-commerce sales in 2018 were valued at USD 163 billion and USD 1,361 billion, respectively.

The popularity of social media and influencers in Japan has led to an increase in demand for hair extensions. Japan is expected to have 101.9 million active social media users by 2022. This represents about 81.1% of the addressable demographic.

In Korea, the demand for toupees and other hairpieces may grow as more people learn about the options available for hiding thinning or hair loss. A survey on men's beauty trends in South Korea in 2022 found that almost 36% of participants said they had experienced hair thinning.

Hair Wigs and Extensions Market Players:

- Donna Bella Hair

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- HairOriginals

- Aleriana Wigs

- Diva Divine Hair Extensions and Wigs

- FNLOnglocks Hair Extensions

- Shake-N-Go Inc

- Locks & Bonds

- KLIX HAIR, INC

- Godrej Consumer Products Limited

- Indique Hair

The hair wig and extension market is a mash-up of established firms, creative upstarts, developing technologies, and shifting customer preferences. These businesses have made enhancing operations, partnerships, product launches, and acquisitions a top priority.

Recent Developments

- HairOriginals announced the release of a new hair app intended for stylists, salons, and end customers. The program, which is compatible with both iOS and Android platforms, aims to foster a community centered around hair extension products and services. This highlights HairOriginals' dedication to improving connectivity and participation within the haircare sector.

- Diva Divine Hair has introduced a line of reasonably priced goods. The brand unveiled high-quality, reasonably priced clip-in wigs, hair toppers, and accessories. These products instantly lengthen or add volume to hair because they are made entirely of natural human hair.

- Report ID: 6116

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hair Wigs and Extensions Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.