Green Hydrogen Market Outlook:

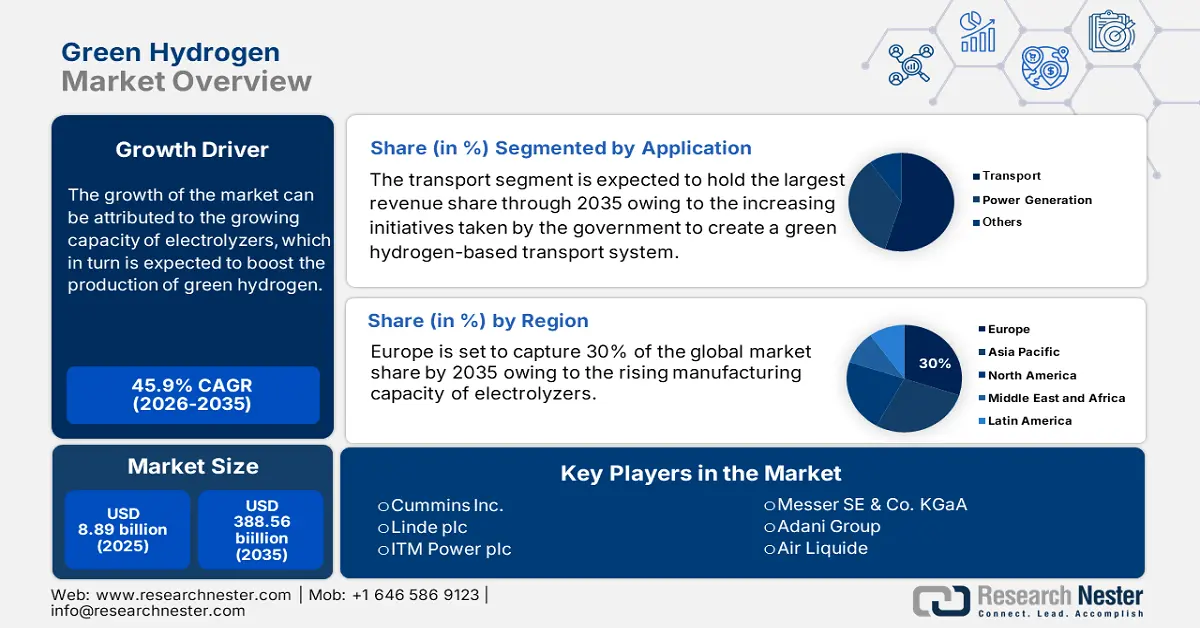

Green Hydrogen Market size was over USD 8.89 billion in 2025 and is poised to exceed USD 388.56 billion by 2035, witnessing over 45.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of green hydrogen is estimated at USD 12.56 billion.

The growth of the market can be attributed to the growing capacity of electrolyzers which in turn is expected to boost the production of green hydrogen. Installed electrolyzer capacity could reach 134–240 GW by 2030, exceeding forecasts from the previous year by two times. Electrolyser manufacturing capacity has nearly doubled since last year, reaching nearly 8 GW annually. Moreover, by 2030, home consumption is likely to have the largest electrolysis (green hydrogen generation) capacity in the world, at about 60 GW/5 million tons.

In addition to these, factors that are believed to fuel the green hydrogen market growth of green hydrogen include the rising efforts put by the entire world to reduce the emission of greenhouse gases. Around 131 nations representing nearly 88% of global greenhouse gas emissions had made net zero commitments by April 2022. In comparison to pre-industrial levels, anthropogenic emissions have already resulted in an increase in global temperature of 1.1°C. furthermore, the rising need for fuel cell electric vehicle is also expected to boost the demand for green hydrogen. Over 40 000 fuel cell electric vehicles were in use worldwide by June 2021, with nearly 90% of those being found in Korea, the United States, the People's Republic of China, and Japan.

Key Green Hydrogen Market Insights Summary:

Regional Highlights:

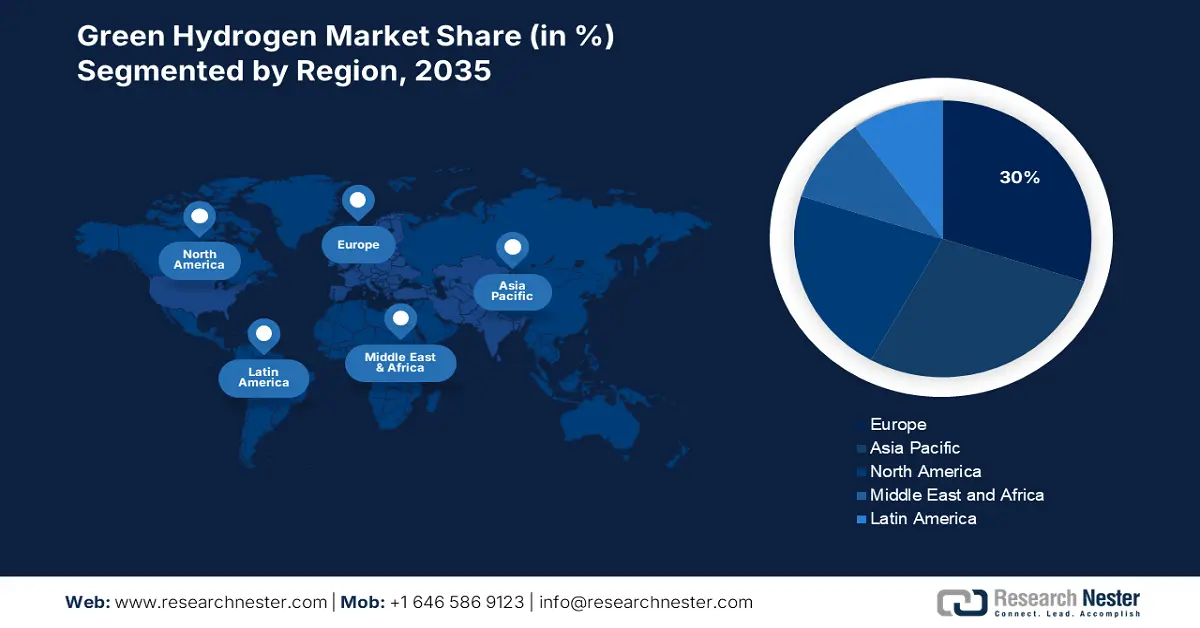

- Europe green hydrogen market is predicted to capture 30% share by 2035, driven by rising manufacturing capacity of electrolyzers and favorable regulatory environment.

- Asia Pacific market will account for 28% share by 2035, driven by increasing efforts to reduce carbon emissions and rising demand for hydrogen vehicles.

Segment Insights:

- The proton exchange membrane segment in the green hydrogen market is anticipated to hold a significant share by 2035, driven by the high efficiency of PEM to produce pure green hydrogen.

- The transport segment in the green hydrogen market is poised for substantial growth during 2026-2035, fueled by increasing government initiatives to create green hydrogen-based transport systems.

Key Growth Trends:

- Growing Levels of Global Warming

- Increasing Demand for Hydrogen

Major Challenges:

- High Cost of Manufacturing

- It Requires a High Initial Investment

Key Players: Siemens Energy, Cummins Inc., Linde plc, ITM Power plc, Nel ASA, Air Products and Chemicals Inc., Iwatani Corporation Ltd., Messer SE & Co. KGaA, Adani Group, Air Liquide.

Global Green Hydrogen Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.89 billion

- 2026 Market Size: USD 12.56 billion

- Projected Market Size: USD 388.56 billion by 2035

- Growth Forecasts: 45.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (30% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: Germany, France, United Kingdom, Netherlands, Spain

Last updated on : 10 September, 2025

Green Hydrogen Market Growth Drivers and Challenges:

Growth Drivers

- Growing Levels of Global Warming– Green hydrogen emits no greenhouse gases but can provide high-temperature heat to drive sizable industrial activities. Therefore, it can be a great alternative to other energy sources for reducing the levels of global warming. The average world temperature is expected to rise by about 1.15 degrees Celsius in the eight warmest years which are anticipated to be those from 2015 to 2022. Moreover, in 2022, the atmospheric concentrations of the three primary greenhouse gases—carbon dioxide, methane, and nitrous oxide have grown.

- Increasing Demand for Hydrogen– Green hydrogen is hydrogen created by using renewable electricity to separate water into hydrogen and oxygen. Therefore, higher production of hydrogen is likely to boost the production of green hydrogen In 2021, the world's demand for hydrogen increased by 5% to 94 Mt, primarily due to increased activity in the chemical and refining industries. The historical peak of 91 Mt was surpassed by the demand for hydrogen in 2019.

- Growing Investment in Hydrogen Energy – Higher spending on the development of hydrogen energy is likely to create more opportunities for the green hydrogen market. With a 35% increase over 2020, public financing for hydrogen R&D experienced its biggest yearly growth in 2021. Around 5% of the entire R&D expenditure for sustainable energy technologies was allocated to hydrogen technologies.

- Rising Capacity of Electrolyzer– High capacity of electrolyzers is expected to boost the manufacturing of green hydrogen. Electrolysers, which are required to manufacture low-emission hydrogen from renewable power, are predicted to see a six-fold rise in worldwide manufacturing capacity by 2025.

- Rising Need for Clean Energy – The only byproduct of using green hydrogen as fuel in a fuel cell is water which makes it green energy. According to the International Energy Agency the capacity of new renewable energy sources is expanded to 290 gigawatts (GW) in 2021, breaking the previous record set in the previous years.

Challenges

- High Cost of Manufacturing -Hydrogen is more expensive to obtain, as it costs more to produce the energy from renewable sources that is necessary to produce green hydrogen through electrolysis.

- It Requires a High Initial Investment

- Lack of Storage and Moving Facilities for Green Hydrogen

Green Hydrogen Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

45.9% |

|

Base Year Market Size (2025) |

USD 8.89 billion |

|

Forecast Year Market Size (2035) |

USD 388.56 billion |

|

Regional Scope |

|

Green Hydrogen Market Segmentation:

Application Segment Analysis

The transport segment is estimated to gain the largest green hydrogen market share in the year 2035. The growth of the segment can be attributed to the increasing initiatives taken by the government to create a green hydrogen-based transport system. The world's most cutting-edge technology-developed Green Hydrogen Fuel Cell Electric Vehicle (FCEV) Toyota Mirai is made available in India as part of a pioneering project by the Ministry of Road Transport and Highways that intends to establish a Green Hydrogen-based ecosystem there. On the other hand, the rising adoption of fuel-cell electric vehicles is also expected to boost the segment growth. Green hydrogen is being used in transportation as an alternative to fossil fuels because of technology like the fuel cell.

Technology Segment Analysis

The proton exchange membrane electrolyzer segment is expected to garner a significant share in the year 2035. The growth of the segment is attributed to the high efficiency of PEM to produce a pure form of green hydrogen. This method has many advantages over traditional alkaline electrolysis that will make it easier to connect to the solar electricity grid in the future. Proton exchange membrane (PEM) electrolyzers are regarded as an innovative method for manufacturing hydrogen fuel utilizing renewable electricity. Moreover, with polymer serving as the electrolyte, PEM water electrolysis technology has a working current density that can reach 1-3 A/cm2, high electrolysis efficiency, the compact volume under the same power, and hydrogen purity that can approach around 99.999%. On the other hand, the alkaline electrolytic cell has poor efficiency and a working current density that is typically no higher than 0.6 A/cm2.

Our in-depth analysis of the global market includes the following segments:

|

By Technology |

|

|

By Application |

|

|

By End User Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Green Hydrogen Market Regional Analysis:

Europe Market Insights

The green hydrogen market in Europe is projected to be the largest with a share of about 30% by the end of 2035. The growth of the market can be attributed majorly to the rising manufacturing capacity of electrolyzers. In a Joint Declaration signed by the Commissioner of the European Commission and 20 CEOs from related industries, the business agreed to tenfold its capacity to reach 17.5 GW per year for producing electrolyzers by 2025. By 2030, the EU is expected to be able to produce the 10 million tons of renewable hydrogen that were set as a goal in March 2022. Moreover, the commission also pledged to implement a favorable regulatory environment, easier access to financing, and the promotion of effective supply chains for green hydrogen.

APAC Market Insights

The Asia Pacific green hydrogen market is estimated to be the second largest, registering a share of about 28% by the end of 2035. The growth of the market can be attributed majorly to the increasing efforts to reduce carbon emissions. The 2021 Glasgow climate conference saw the introduction of five emission commitments from the Indian government. By the year 2070, net emissions are likely to be zero. Moreover, to reach a 500 GW non-fossil fuel capacity by 2030. Furthermore, the rising demand for hydrogen fuel cell vehicle is also expected to augment the market growth in the region. China wants 1 million hydrogen fuel cell electric vehicles (EVs) on the road by 2030, along with at least 1,000 hydrogen recharging stations, according to the Ministry of Industry and Information Technology.

North American Market Insights

North America region is anticipated to register substantial growth through 2035. The growth of the market can be attributed majorly to the growing need for clean energy across various sectors which is likely to boost the need for green hydrogen. In response to ongoing economic and environmental concerns, as well as regional demands for clean renewable energy sources, fuels, and other goods, the U.S. economy is growing more flexible and inventive. Moreover, a hydrogen programme plan has been prepared by the U.S. Department of Energy (DOE). In order to advance the production, transportation, storage, and use of hydrogen across various economic sectors. This plan offers a structure that includes the research, development, and demonstration efforts of all the combined offices of energy.

Green Hydrogen Market Players:

- Siemens Energy

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cummins Inc.

- Linde plc

- ITM Power plc

- Nel ASA

- Air Products and Chemicals Inc.

- Iwatani Corporation Ltd.

- Messer SE & Co. KGaA

- Adani Group

- Air Liquide

Recent Developments

-

Siemens Energy collaborated with Air Liquide to increase the production of renewable hydrogen electrolyzers in Europe for industrial purposes. A sustainable hydrogen economy would be able to take off in Europe owing to this Franco-German alliance. Production is anticipated to start in the second half of 2023 and build up to a three gigawatt annual production capacity by 2025.

-

Adani Group announced their plan to invest USD 20 billion for the generation of renewable energy. This is likely to involve investments with possible partners for the production of electrolyzers.

- Report ID: 4778

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Green Hydrogen Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.