GPON Market Outlook:

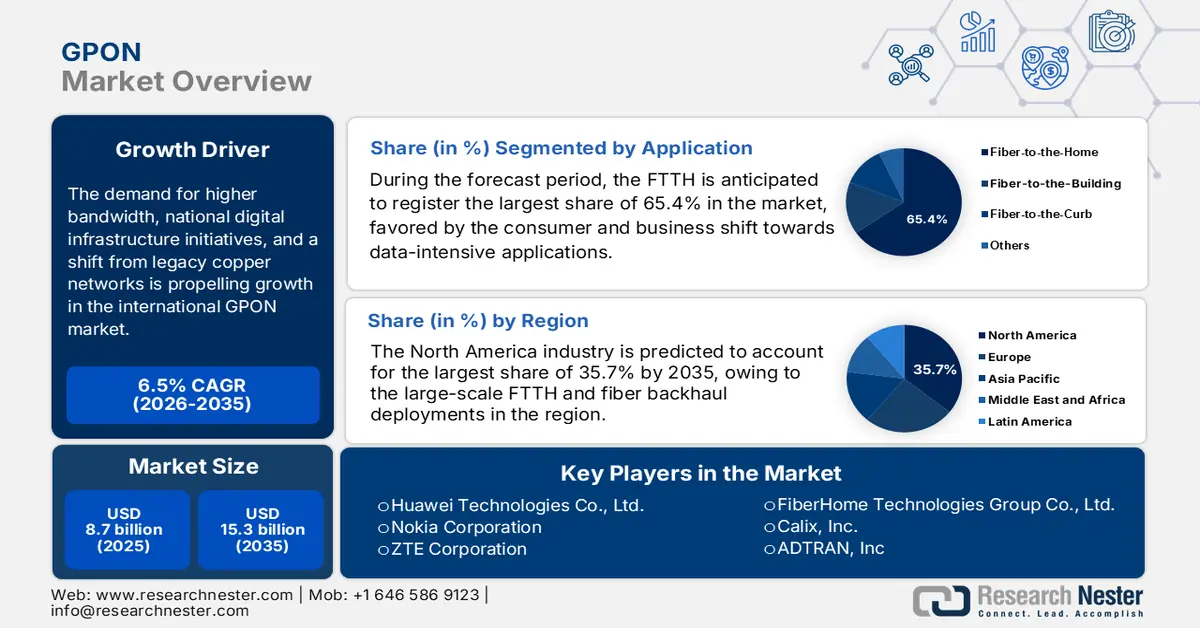

GPON Market size was valued at USD 8.7 billion in 2025 and is projected to reach USD 15.3 billion by the end of 2035, rising at a CAGR of 6.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of GPON is assessed at USD 9.2 billion.

The heightened demand for higher bandwidth and a shift from legacy copper networks are the key factors behind the robust growth of the GPON market. Also, the continued investments in fiber-to-the-home deployments, supported by government broadband initiatives, also drive business in this sector. The article by TRAI in March 2023 stated that the telecom regulatory authority of India has recommended certain measures to support domestic manufacturing in the television broadcasting sector, which focuses on reducing import dependency. Besides, the key proposals, which have been highlighted, include establishing centers of excellence for R&D in broadcasting technologies, extending the production-linked incentive scheme to enable coverage to set-top boxes, and creating a technology development fund to support more innovations. In addition, TRAI highlighted the need to clarify harmonized system codes for hybrid set-top boxes, strengthen export promotion councils, and thereby address challenges associated with components, tariffs, as well as grey market activities.

Furthermore, the GPON market also benefits from continued investments from both public and private entities, which are ensuring that GPON remains the foundational access network for residential, enterprise, and 5G backhaul applications. In this regard, Tejas Networks in February 2024 reported that it is receiving ₹27.78 crore (≈ USD 3.4 million) in design-linked PLI incentives for FY23, representing 85% of its approved claim, wherein the remaining amount is to follow under the scheme guidelines. The company also noted that the incentives, which are a part of a committed ₹750 crore (≈ USD 92 million) multi-year investment plan, are accelerating domestic R&D and manufacturing capacity for its telecom and broadband product lines. Hence, this funding strengthens the company’s ability to scale across all nations and deepen its product portfolio as it is pursuing growth within the optical-access and PON ecosystem.

Key GPON Market Insights Summary:

Regional Insights:

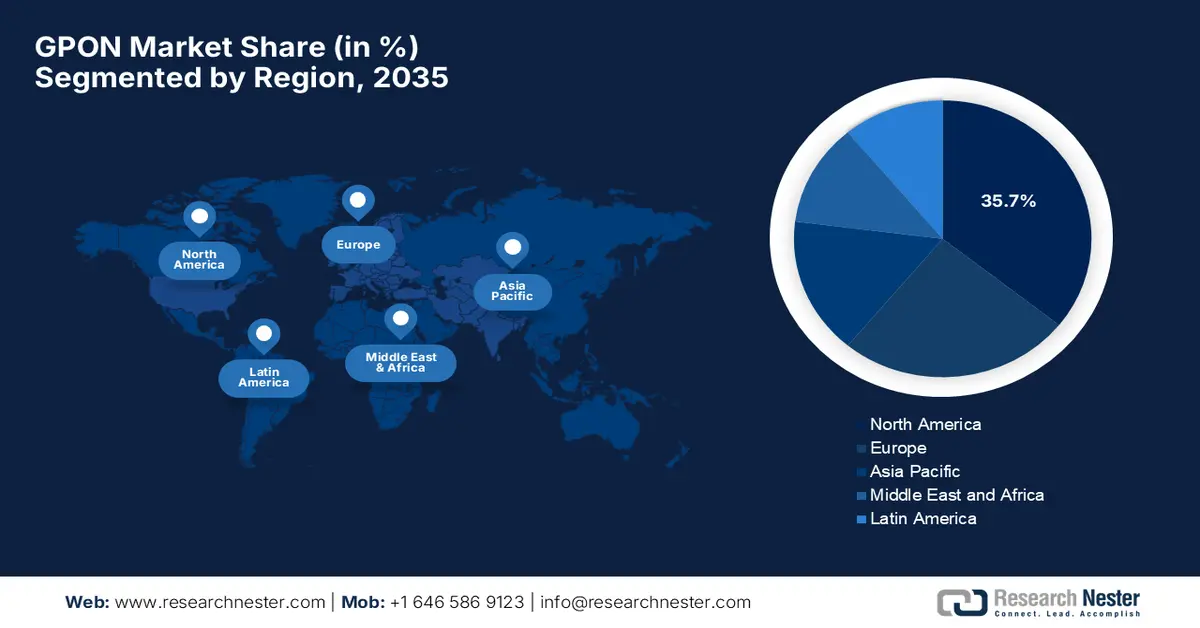

- By 2035, North America is poised to secure a 35.7% share in the gpon market, strengthened by extensive FTTH and fiber-backhaul deployments alongside rural broadband initiatives.

- Asia Pacific is projected to expand robustly through 2026–2035, supported by massive urbanization and government-led broadband infrastructure programs.

Segment Insights:

- By 2035, the FTTH segment is projected to command a 65.4% share in the gpon market during 2026–2035, supported by expanding adoption of data-intensive applications such as 4K/8K streaming, cloud gaming, and remote work.

- The residential sub-segment is set to secure a notable revenue share by 2035, upheld by extensive government-backed national broadband initiatives.

Key Growth Trends:

- Surging demand for high-speed broadband

- National digital infrastructure initiatives

Major Challenges:

- Higher expenses for network deployment

- Technological obsolescence

Key Players: Huawei Technologies Co., Ltd. (China), Nokia Corporation (Finland), ZTE Corporation (China), FiberHome Technologies Group Co., Ltd. (China), Calix, Inc. (U.S.), ADTRAN, Inc. (U.S.), DASAN Zhone Solutions, Inc. (South Korea), Cisco Systems, Inc. (U.S.), NEC Corporation (Japan), Allied Telesis Holdings K.K. (Japan), Iskratel d.o.o. (Slovenia), Fujitsu Limited (Japan), Mitsubishi Electric Corporation (Japan), Sumitomo Electric Industries, Ltd. (Japan), Tellabs, Inc. (U.S.)

Global GPON Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.7 billion

- 2026 Market Size: USD 15.3 billion

- Projected Market Size: USD 9.2 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, India, Japan, Germany

- Emerging Countries: Brazil, Indonesia, Vietnam, Saudi Arabia, South Africa

Last updated on : 3 December, 2025

GPON Market - Growth Drivers and Challenges

Growth Drivers

- Surging demand for high-speed broadband: This is the primary growth driver for the GPON market, influenced by remote work, streaming, IoT & 5G backhaul. GPON and PON are among the most cost-effective ways for ISPs to deliver high-speed, gigabit-tier fixed broadband at scale, attracting more investments. In this regard, the article published by OECD in July 2024 reported that fibre connections accounted for 42% of all fixed broadband subscriptions by the conclusion of 2023 across OECD countries, which marks a up from 38% in 2022, whereas 5G mobile subscriptions reached 28%, which reflects the increased adoption of future-proof broadband technologies to support high-speed connectivity. During the same time, countries such as Chile, Colombia, and Mexico are experiencing a 258% increase in fibre, and Nordic countries are seeing a 36% growth, highlighting the rising demand for GPON as it serves as a key infrastructure for delivering scalable networks.

- National digital infrastructure initiatives: This, coupled with initiatives and public funding for fiber installations, is readily driving growth in the GPON market. In most of the emerging nations, governments and operators are expanding their fiber networks with a collective goal to connect thousands of villages with fiber. The Ministry of Communications in April 2025 reported that the BharatNet project is an initiative implemented by the Government of India to provide broadband connectivity to all Gram Panchayats, with a goal to bridge the digital divide in rural areas. The report underscores that more than 2.18 lakh GPs are service-ready, 42.13 lakh route km of optical fiber is laid, and more than 12 lakh FTTH connections are commissioned. Through this, BharatNet enables e-governance, digital education, telemedicine, and economic opportunities. Hence, this extensive deployment directly drives GPON demand by creating a highly scalable backbone for high-capacity broadband delivery to rural communities.

- Fiber migration: The increasing replacement of legacy copper, cables, and DSL infrastructure with fiber is providing encouraging opportunities for pioneers in the GPON market. This migration wave ensures sustained demand for GPON as a replacement technology. In April 2023, Telefónica announced that it is closing all of 3,329 remaining copper central offices in Spain, completing a nationwide transition from legacy copper networks to full fibre-to-the-home infrastructure. This move is a part of a switch-off program, which was initiated a decade ago, and enhances network performance, increases broadband speeds, and reduces the operator’s energy consumption and carbon footprint. On the other hand, the company is also leveraging AI for next-generation network management and is driving decarbonization initiatives. Therefore, the complete migration to fibre infrastructure directly increases demand for GPON equipment and deployments as service providers replace copper with passive optical networks.

Global GPON Market Opportunities and Next-Generation PON Deployments (2024-2025)

|

Year |

Company |

Brief Description |

GPON Market Opportunity |

|

2025 |

CommScope & Altice Labs |

PON Evo suite enables service providers to upgrade existing GPON networks to XGS-PON and 50G PON on the same infrastructure, expanding the addressable market. |

Multi-billion USD FTTH upgrade opportunity globally; supports migration from GPON → XGS-PON → 50G PON. |

|

2024 |

Broadcom |

First merchant silicon 50G PON OLT-ONU with AI/ML, interoperable with GPON/XGS-PON; cost-efficient and power-efficient upgrade path. |

~USD 10 billion+ market opportunity for 50G PON merchant silicon and GPON/XGS-PON upgrades |

|

2024 |

ZTE (ANGA COM) |

Combo PON solution facilitates GPON/XGS-PON/50G PON migration; Light ODN reduces OPEX and simplifies deployment for operators. |

Europe FTTH market expansion opportunity: several billion USD over the next 5 ye |

Source: Company Official Press Releases

Challenges

- Higher expenses for network deployment: Installing GPON infrastructure necessitates significant capital investments, which is an inclusion of fiber-optic cables, optical line terminals, network termination units, and supporting passive components. In this regard, service providers in the emerging economies find it challenging, which can delay or limit network emergence. Meanwhile, in terms of developed regions, the cost of trenching, civil works, and right-of-way permissions can also increase overall expenditure. Hence, the presence of these high initial costs can affect return on investment timelines, making operators concerned about large-scale GPON adoption. Furthermore, integrating GPON with legacy networks requires additional investment in management systems, adding complexity, hence hampering widespread adoption in the GPON market.

- Technological obsolescence: This, coupled with rapid evolution, has been yet another challenge for the GPON market to capture its estimated success. The emergence of higher-capacity PON variants such as XGS-PON and 50G-PON is restricting most of the small-scale firms from operating in this field. Operators who are deploying GPON risk potential obsolescence within a decade as bandwidth demands grow due to AI, cloud, and 5G services. Simultaneously upgrading these legacy GPON networks involves additional CAPEX for new OLTs, ONUs, and optical splitters, as well as potential service disruption during the process of migration. Therefore, the need to future-proof networks adds both operational and financial complexities, especially for operators who are serving enterprise clients with stringent SLAs.

GPON Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 8.7 billion |

|

Forecast Year Market Size (2035) |

USD 15.3 billion |

|

Regional Scope |

|

GPON Market Segmentation:

Application Segment Analysis

During the forecast period, the FTTH segment based on application is anticipated to register the largest share of 65.4% and dominate the GPON market. The dominance of the subtype is increasingly favored by the consumer and business shift towards data-intensive applications such as 4K or 8K video streaming, cloud gaming, and remote work. In March 2025, Adtran announced that it achieved two FTTH innovation awards at the 2025 FTTH Conference for its SDX 6405 OLT and ALM fiber monitoring platform, which marks major advancements in scalable fiber networks. It also mentioned that the SDX 6405 supports GPON, XGS-PON, and 50G PON on every port, enabling multigigabit services without infrastructure overhaul, whereas ALM provides real-time, in-service fiber monitoring for improved reliability. Hence, these innovations enhance network scalability and efficiency for broadband service providers.

End user Segment Analysis

In the GPON market residential sub-segment based on end user is expected to retain a significant revenue share by the end of 2035. The growth in the segment is readily propelled by government-backed national broadband plans across almost all nations. This can be evidenced by the broadband equity access and deployment program, which is funded by the IIJA with USD 42.45 billion, and it aims to provide high-speed internet access by supporting infrastructure partnerships. It also notes that funds can be used for planning, deploying, or upgrading internet infrastructure in unserved and underserved areas, installing Wi-Fi in multi-unit residences, and supporting adoption, workforce readiness, and community programs. As of June 2023, NTIA allocated funds to all 56 states and territories, with 18 final proposals approved, enabling states to advance broadband connectivity and digital inclusion across the U.S.

Component Segment Analysis

The OLT sector is poised for significant expansion and is expected to secure a high-value share of the GPON market. This is the core central office equipment in a GPON network, wherein its growth is associated with the initial capital expenditure of network build-outs. In June 2024, Radisys announced the launch of its combo PON optical line terminal, which supports both G-PON and XGS-PON on a single platform as part of its Connect Open Broadband portfolio. Besides, the white box OLT offers flexible, high-density, and cost-efficient deployments for residential, enterprise, and cloud services. Furthermore, it is compatible with VOLTHA or SEBA architectures, thereby enabling service providers to scale and upgrade networks without hardware replacement. Hence, the presence of all of these factors together positions at the forefront to generate revenue in this field.

Our in-depth analysis of the GPON market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

End user |

|

|

Component |

|

|

Technology |

|

|

Services |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

GPON Market - Regional Analysis

North America Market Insights

The GPON market in North America is leading the entire global dynamics, commanding the largest revenue share of 35.7% by the end of 2035. The region continues to expand strongly, driven by large-scale FTTH and fiber‑backhaul deployments coupled with rural broadband initiatives. Most of the ISPs and alternative‑network operators U.S. and Canada are leaning on GPON-based FTTH to meet growing demand for high-speed home broadband. In August 2025, Calix announced the launch of enhanced capabilities for its ASM5001 broadband system by uniting subscriber management, OLT control, and remote line card support in a single platform. In this regard, this solution allows U.S. broadband service providers to simplify network design and scale multi-gig services efficiently. Simultaneously, by consolidating hardware and offering flexible PON architecture options, the firm allows providers to accelerate deployments and improve service reliability.

The U.S. is considered to be the key contributor to growth in the GPON market, wherein the operators complete network upgrades and legacy copper networks are replaced. Simultaneously, this fiber migration is driving new GPON deployments into both urban and rural markets. The rapid pace of home passes and FTTH activations is efficiently boosting demand for passive optical network infrastructure. In November 2025, IonQ announced the acquisition of an optical communications leader, Skyloom Global, to enhance high-speed, secure optical networking infrastructure. Besides, Skyloom’s satellite-to-ground and satellite-to-satellite laser communication terminals will support scalable, high-bandwidth links, accelerating next-generation network deployments. Hence, this move strengthens the company’s capabilities in distributed optical networks, thereby highlighting advancements relevant to high-performance fiber and broadband systems.

Canada has gained enhanced exposure in the GPON market, supported by federal broadband‑coverage goals and funding programs that encourage fiber-based solutions over legacy cable or DSL. In addition, the regulatory and funding environment favors fiber, making the country a stable growth market for GPON suppliers. In February 2024, TELUS announced that it had accelerated its transition from copper to pure fiber by migrating over half a million customers and making 14 regions in BC and AB completely copper-free. This upgrade has reduced over 7,400 tonnes of greenhouse gas emissions, improved energy efficiency by up to 85%, and enhanced network resilience against extreme weather, benefiting the country’s market growth. Furthermore, the company’s sustainable fibre rollout demonstrates the environmental and operational benefits of modernizing broadband infrastructure.

APAC Market Insights

Asia Pacific in the GPON market is growing at an extensive pace over the forecasted years since there has been a massive urbanization, large populations, and government broadband infrastructure initiatives across countries such as China and India drive very high FTTH adoption. In February 2023, Nokia announced that it had expanded the manufacturing of GPON optical line terminals at its Chennai factory in response to the heightened demand for high-speed broadband. Besides, the move supports both fiber-to-the-home deployments and 5G transport networks, helping operators manage surging data traffic. Moreover, its participation in India’s production-linked incentive scheme further strengthens the company’s capacity to meet regional and international requirements. Hence, this expansion allows the region to advance next-generation PON solutions and enhance fiber connectivity across diverse markets.

China is augmenting its leadership in the GPON market on account of a huge base of fiber-optic broadband subscribers. The country’s continued infrastructure investments and high FTTH adoption rates are sustaining strong demand for both GPON OLT/ONU hardware and passive fiber components. In June 2025, China Mobile and ZTE together announced the launch of a 50G PON-based fixed mobile convergence residential community in Jiangsu to deliver ultra-fast symmetric 50-gigabit services. Also, this deployment supports advanced applications such as cloud gaming, smart homes, and Fiber to the Room, thereby demonstrating the commercialization of 50G PON technology. Furthermore, with the integration of 5G small cells and high-speed broadband, the community offers strong connectivity indoors and outdoors, hence denoting a positive GPON market opportunity.

The government-backed rural and urban broadband programs are accelerating fiber installations, increasing demand in the GPON market as the preferred access technology in India. Since there has been an expansion of population centers simultaneously the internet penetration is also deepening, wherein many fiber broadband subscribers are being connected through GPON networks. For instance, in April 2022, HFCL announced that it had completed broadband connectivity for all 1,789 gram panchayats in Jharkhand through a GPON network, laying 7,765 km of optical fiber cable, making it the first state in the country to achieve full connectivity under the state-led BharatNet program. The company also reported that it will operate and maintain the network for eight years to ensure continuous, high-quality broadband services. Furthermore, the company has also expanded GPON deployments in Punjab and is supplying fiber optic cables in Maharashtra, Telangana, and Chhattisgarh under BharatNet, strengthening rural digital infrastructure.

Europe Market Insights

Europe has acquired the most prominent position in the global GPON market, which is coordinated by national as well as increasing fiber coverage, and is achieving gigabit connectivity for households and businesses. Operators across the region continue upgrading older networks toward fiber-based GPON or next-gen PON infrastructure. In October 2023, DZS announced that it had partnered with Orange to deploy its velocity fiber access portfolio across Europe, which was followed by a successful pilot in Orange Polska, supporting GPON, XGS-PON, and point-to-point technologies. Thus, this deployment enhances Orange’s FTTH network by providing multi-gigabit services, flexible system options, and future-ready upgrades to 50/100 Gbps capacity. Furthermore, this collaboration strengthens network automation and multi-vendor interoperability, advancing the region’s next-generation broadband infrastructure.

Germany has gained a prominent position in the regional GPON market, in which a significant portion of broadband expansion is focused on fiber deployment, driven by federal broadband funding programs and increasing demand for high-speed broadband among both urban and suburban households. In September 2024, EIP reported that the European Investment Bank provided a €350 million (USD 411 million) loan under the EU’s Invest EU programme to Deutsche Glasfaser to expand fibre-optic broadband access to around 460,000 rural homes and businesses in Germany. It also mentioned that the project will deliver high-speed fibre connections (up to 10 Gbps) to underserved and rural areas, addressing the digital‑infrastructure gap inherently creates demand for passive and active optical‑network components, hence making it suitable for overall market growth.

The government programs, such as Project Gigabit, are catalyzing nationwide fiber deployment, propelling continued growth in the U.K. GPON market. The country is witnessing an increased demand for high-speed connectivity, due to which GPON-based FTTH deployments are also expanding, creating sustained opportunities for both network operators and equipment suppliers. In October 2024, Adtran and Netomnia announced that they had entered into a partnership to launch the country’s first-ever 50G PON services, providing high-capacity broadband to meet growing residential and enterprise demands. Besides, the technology integrates with existing GPON and XGS-PON networks, enabling non-disruptive upgrades. Furthermore, backed by over £1.3 billion (≈ US$1.6 billion) in funding, Netomnia aims to serve 3 million premises by the end of 2025 and scale 50G PON.

Key GPON Market Players:

- Huawei Technologies Co., Ltd. (China)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Nokia Corporation (Finland)

- ZTE Corporation (China)

- FiberHome Technologies Group Co., Ltd. (China)

- Calix, Inc. (U.S.)

- ADTRAN, Inc. (U.S.)

- DASAN Zhone Solutions, Inc. (South Korea)

- Cisco Systems, Inc. (U.S.)

- NEC Corporation (Japan)

- Allied Telesis Holdings K.K. (Japan)

- Iskratel d.o.o. (Slovenia)

- Fujitsu Limited (Japan)

- Mitsubishi Electric Corporation (Japan)

- Sumitomo Electric Industries, Ltd. (Japan)

- Tellabs, Inc. (U.S.)

- Huawei Technologies Co., Ltd. remains the global GPON market leader in GPON equipment, supported by a broad portfolio of OLTs, ONUs, and combo‑PON systems that support GPON as well as newer PON standards. Its scale and global reach span around Asia‑Pacific, Latin America, and parts of Europe, which allows it to exploit economies of scale and maintain competitive pricing. Further, the firm also makes investments in R&D and network automation, making it a go-to vendor for FTTH.

- ZTE Corporation ranks among the top players in the worldwide GPON sector, which is offering a flexible and cost-effective suite of GPON and next-gen PON, such as 10G‑PON / XGS‑PON/combo solutions that draw the interest of operators, especially in fast-growing regions. Besides, the company leverages modular designs and adherence to open standards to support multi-vendor interoperability, thereby helping smaller ISPs adopt fiber infrastructure more rapidly.

- Nokia Corporation is considered the central player in this field and is extremely competitive, particularly in North America and Europe. The firm is offering end-to-end GPON and next-generation PON platforms under globally recognized standards. Nokia’s strengths include robust interoperability, software-defined networking integration, and well-established partnerships with major telecom operators. Furthermore, with a great emphasis on standards compliance and network resilience, Nokia positions itself as a reliable enterprise-grade vendor.

- Calix, Inc. is best known for its strong focus on broadband access and managed services, serving many small to medium-sized ISPs, especially in North America. The company is providing GPON, 10G-PON, and even NG-PON2 capable hardware, often with cloud-based management and support services that reduce deployment complexity for operators. Calix emphasizes upgrade-friendly architectures and support for rural and suburban broadband expansion.

- ADTRAN, Inc. is considered to be a significant player in the GPON and PON market, especially in regions where there is a heightened demand for open‑standards and multi-gigabit broadband solutions. Its total access GPON and PON platforms are designed for scalability and performance, appealing to telecom operators, enterprises, and wholesale service providers as well. In addition, the firm’s strategic focus on open networking standards and flexible deployment helps it compete in markets.

Below is the list of some prominent players operating in the global GPON market:

The companies involved in the GPON market are extremely fragmented, which leverages both multinational vendors along regional suppliers. Leading firms such as Huawei, Nokia, and ZTE lead based on broad product portfolios and global reach, whereas the U.S.-based players such as Calix and ADTRAN hold strong regional positions in North America and Asia. In addition, these organizations are pursuing distinct strategies to secure their global market positions. In February 2025, Nokia announced that it had completed the acquisition of Infinera, creating a combined optical networks powerhouse which are aimed at accelerating innovation and scaling product roadmaps to meet the demands of the AI era. Besides, the merger expands Nokia’s presence in the fast-growing webscale segment and strengthens its capabilities across service providers, data centers, and enterprise networks across the globe.

Corporate Landscape of the GPON Market:

Recent Developments

- In October 2025, Nokia introduced the world’s first-ever 50G PON solution, delivering ultra-fast, post-quantum-ready broadband for enterprise connectivity on its existing Lightspan MF platform, fully compatible with 10G and 25G PON for seamless upgrades.

- In September 2025, Huawei announced the launch of its F5G-A FTTO solution, which highlights fiber as the backbone of AI-driven smart campuses and the solution delivers symmetric 50G PON, simplified 2-layer architecture, and AI-enhanced connectivity with integrated sensing for smarter operations.

- Report ID: 5345

- Published Date: Dec 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

GPON Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.