Antifreeze Market Outlook:

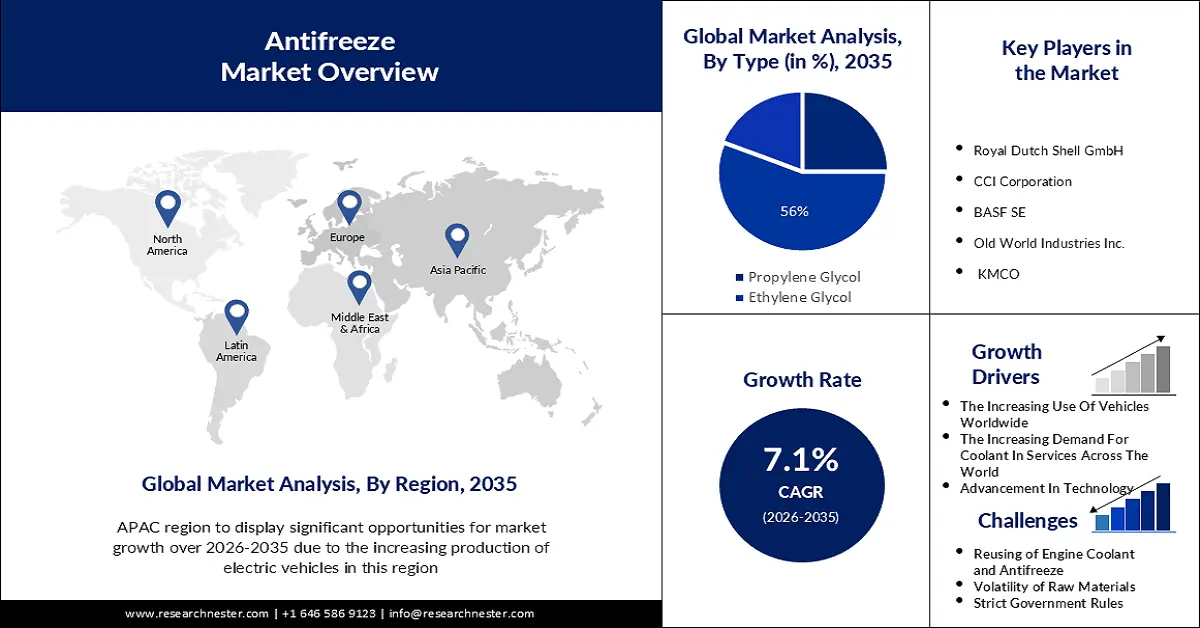

Antifreeze Market size was valued at USD 6.45 billion in 2025 and is likely to cross USD 12.81 billion by 2035, expanding at more than 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of antifreeze is assessed at USD 6.86 billion.

The primary reason behind the growth of the market is the increasing use of vehicles worldwide. To illustrate, rising fuel effectiveness standards are essential for cars and vans as even in the Net Zero Emissions by 2050 Outline, approximately 80% of cars and vans on the road in 2030 are still energized by inside combustion engines. Sales of weighty, less effective SUVs touched almost 46% of international sales in 2022, while electric vehicles were exactly 14% of sales. Continuously more countries are developing vehicle effectiveness standards and some are even placing zero-emission vehicle sales needs.

Another reason that will propel antifreeze market in the forecast period is the increasing demand for coolant in services worldwide. For instance, the percentage of yearly vehicle fuel consumption utilized by MAC differentiates by country, averaging between 3% in colder climates and 20% in hotter climates. Nevertheless, over smaller timescales, MAC can peak at more than 40% in warm climates and congested traffic. For electric vehicles, MAC can limit driving range by around 50% on hot and humid days. Automotive air conditioning systems function under unstable loads to give passengers comfort under extensive outside temperature situations. Under medium operating situations, the temperature stratum in the air stream at the exit of the vaporizer is noticed, which might lead to passengers’ distress. The cause of this issue is the uneven supply of the vaporizer’s parallel channels with the cooling liquid phase from the two-phase amalgamation stream in the header.

Key Antifreeze Market Insights Summary:

Regional Highlights:

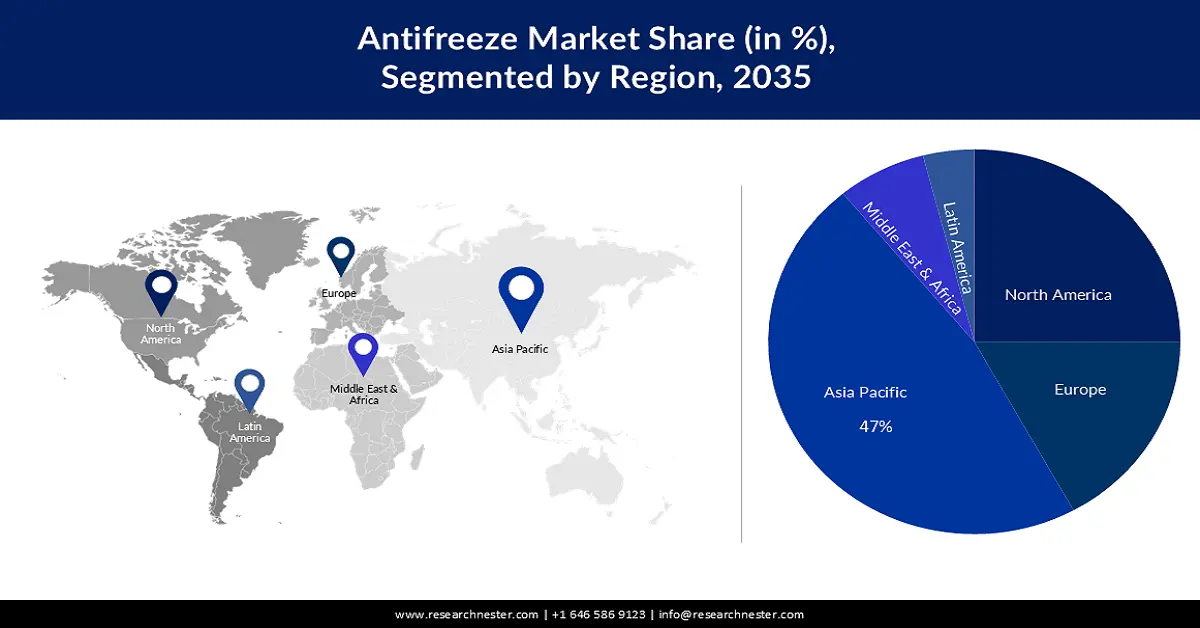

- Asia Pacific antifreeze market will dominate around 47% share, driven by increasing production of electric vehicles, particularly in China, which dominates global sales of electric buses and trucks, forecast period 2026–2035.

- North America market will hold the second largest share, fueled by the existence of a well-established automotive industry with significant vehicle production and employment, forecast period 2026–2035.

Segment Insights:

- The passenger cars segment in the antifreeze market is projected to achieve a 57% share by 2035, influenced by the growing production and adoption of electric vehicles.

- The ethylene glycol segment in the antifreeze market is projected to hold a 56% share by 2035, driven by the increasing use of ethylene glycol in deicing, radiator protection, and cooling.

Key Growth Trends:

- Advancement in Technology

- Growing Concern Worldwide About the Environment

Major Challenges:

- Reusing of Engine Coolant and Antifreeze

- Strict Government Rules

Key Players: Royal Dutch Shell GmbH, CCI Corporation, BASF SE, Old World Industries Inc., KMCO, SONAX GmbH, KOST USA, Inc., Recochem Inc., Amsoil, MITAN, SPDC Ltd., Japan Chemical Industries, Tanikawayuka Kogyo Co., Ltd., Mitsubishi Chemical Corporation.

Global Antifreeze Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.45 billion

- 2026 Market Size: USD 6.86 billion

- Projected Market Size: USD 12.81 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (47% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 16 September, 2025

Antifreeze Market Growth Drivers and Challenges:

Growth Driver

- Advancement in Technology - The commencement of high-executing cars and trucks makes constantly expanding requirements on each prospect of engine management. As current systems run much quicker and at higher temperatures, contemporary engines require highly efficient cooling systems that make sure they are functioning at their supreme level all year round. Contemporary engine structures have eventuated in the initiation of new groundbreaking components in engine cooling systems. The utilization of conventional antifreeze frequently has proven to give in many situations an adverse impact on the life of a contemporary engine cooling system. As electric vehicles (EVs) acquire a grip on the antifreeze market, security becomes a foremost thought. Among the crucial agents confirming protected EV operation are coolants with low electricity, weighing below 100 µS/cm. In reaction to this requirement, Q8Oils is initiating a range of BEV security coolants planned particularly for EVs.

- Growing Concern Worldwide About the Environment -In the last decade, ecological problems have become a big topic of public thought. People have started to create rising environmental consciousness and positive attitudes toward environmental factors. Specifically, young people have started to energetically take part in environmental challenges by arranging green movements and involving policymakers. To protect the ecology, people currently taking part in a large youth motion, a type of revolution as someone called it, named Fridays for Future (FFF), which has taken to multiple international climate strikes worldwide. Therefore, people recently are inclining more towards sustainable solutions to keep the world a safer place for everyone.

- Recent Increasing Trends in Trucks and Buses -The truck and bus industry is experiencing a deeper conversion, pushed by several trends that are remodeling business landscapes internally. Businesses functioning in this sector must adjust to these trends to stay competitive, increase operational effectiveness, and match evolving clientele prospects. For instance, the digitalization of business techniques includes the universal agreement with technologies like cloud calculating, software solutions, and Internet of Things (IoT) devices to maximize and modernize operations.

Challenges

- Reusing of Engine Coolant and Antifreeze - Generally, it’s feasible to recycle engine coolant if there are some preventive measures. However, when one relates the dangers of recycling your coolant and the level of exertion one must put in to confirm then it can done so securely, most people find it simpler and value the minor expenditure to utilize fresh antifreeze. The biggest problem with recycling coolant is that it can initiate particles into your cooling system. If one fails to perfectly wash the coolant catch pan before exhausting it, then one can simply initiate impurities. It can be very easy to miss small pieces of agent, and if one does, these can finish back in the engine when one reinitiates the antifreeze. To fight this, people who do recycle their coolant generally filter it to confirm nothing undesirable gets in the engine.

- Volatility of Raw Materials

- Strict Government Rules

Antifreeze Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 6.45 billion |

|

Forecast Year Market Size (2035) |

USD 12.81 billion |

|

Regional Scope |

|

Antifreeze Market Segmentation:

Type Segment Analysis

The ethylene glycol segment is predicted to account for 56% share of the global antifreeze market during the forecast period. This is attributed to the increasing implementation of ethylene glycol in deicing, prohibition of radiator overheating, security against radiator freezing, and hydraulic brakes are projected to push the market requirement. Additionally, rising implementation as a heat conductor in heating & cooling systems is possible to further fuel the market growth. The heat transfer capacity of graphene oxide/ deionized water-ethylene glycol nanofluids is tentatively examined in coolant applications for car radiators, in which the antifreeze flow rate is different from 180 to 420 (LPH) at a determined coolant temperature of 90 °C. The assessment of permanence is executed by implementing visual inspection and a zeta capacity test. The concentration of the nanofluid was decided by oscillating the U-Tube density meter. The maximized blend of 60% EG, 40% DW, and 0.1 wt% GO displayed higher heat conveyance of the radiator system utilized.

Vehicle Type Segment Analysis

The passenger cars segment in the antifreeze market is expected to hold 57% of the revenue share by 2035. This supremacy will be encountered due to the increasing production and use of passenger cars across the world. Electric vehicles are the main technology to decarbonize road transport, a sector that contributes to more than 15% of international energy-associated emissions. Current years have noticed a numerical expansion in the sale of electric vehicles along with improved range, broader model attainability, and enhanced execution. Passenger electric cars are increasing in reputation – it is calculated that 18% of the latest cars sold in 2023 will be electric. If the growth noticed in the past two years is kept, CO2 emissions from cars can by 2030 be put on a pathway incorporated into the Net Zero Emissions by 2050 (NZE) Scenario. However, electric vehicles are not yet an international sensation. Sales in growing and appearing economies have been slow because of the comparatively high buy price of an electric vehicle and a shortage of charging infrastructure accessibility.

Our in-depth analysis of the global antifreeze market includes the following segments:

|

Type |

|

|

Application |

|

|

Additive Technology OE & Aftermarket |

|

|

Distribution Channel |

|

|

Vehicle Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Antifreeze Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is expected to account for largest revenue share of 47% by 2035. This expansion will be noticed due to the increasing production of electric vehicles in this region. Furthermore, China goes on to control the generation and sales of electric (and fuel cell) trucks and buses. In 2022, 54 000 latest electric buses and a calculated 52 000 electric medium- and heavy-duty trucks were marketed in China, showcasing 18% and 4% of complete sales in China and around 80% and 85% of international sales, individually. Additionally, a lot of the buses and trucks being marketed in Latin America, North America, and Europe are Chinese brands.

North American Market Insights

The antifreeze market in the North America region will also encounter massive growth and will hold second position in the global revenue share. This dominance will be noticed due to the existence of a well-settled automotive industry. Over and above, North America's automotive industry recently produced more than USD 500 billion in yearly sales and employs more than 1.7 million people, in line with the National Automobile Dealers Association (NADA). In terms of generation, North America stays a major player, with more than 17 million vehicles generated yearly.

Antifreeze Market Players:

- Royal Dutch Shell GmbH

- Company Overview

- Business Planning

- Main Product Offerings

- Financial Execution

- Main Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- CCI Corporation

- BASF SE

- Old World Industries Inc

- KMCO

- SONAX GmbH

- KOST USA, Inc

- Recochem Inc

- Amsoil

- MITAN

Recent Developments

- 26 January 2024: Shell Deutschland GmbH has occupied a final investment decision (FID) to shift the hydrocracker of the Wesseling site at the Energy and Chemicals Park Rheinland into a generation unit for Group III base oils, utilized in making top-notch lubricants like engine and transmission oils. Crude oil handling will end at the Wesseling site by 2025 but will go on at the Godorf site.

- January 16, 2024: Shell Deutschland GmbH has come to an accord to bend its Nigerian onshore subordinate The Shell Petroleum Development Company of Nigeria Limited (SPDC) to Renaissance, an association of five organizations incorporating four exploration and generation organizations dependent in Nigeria and a global energy group.

- Report ID: 5741

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Antifreeze Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.