Gift Cards Market Outlook:

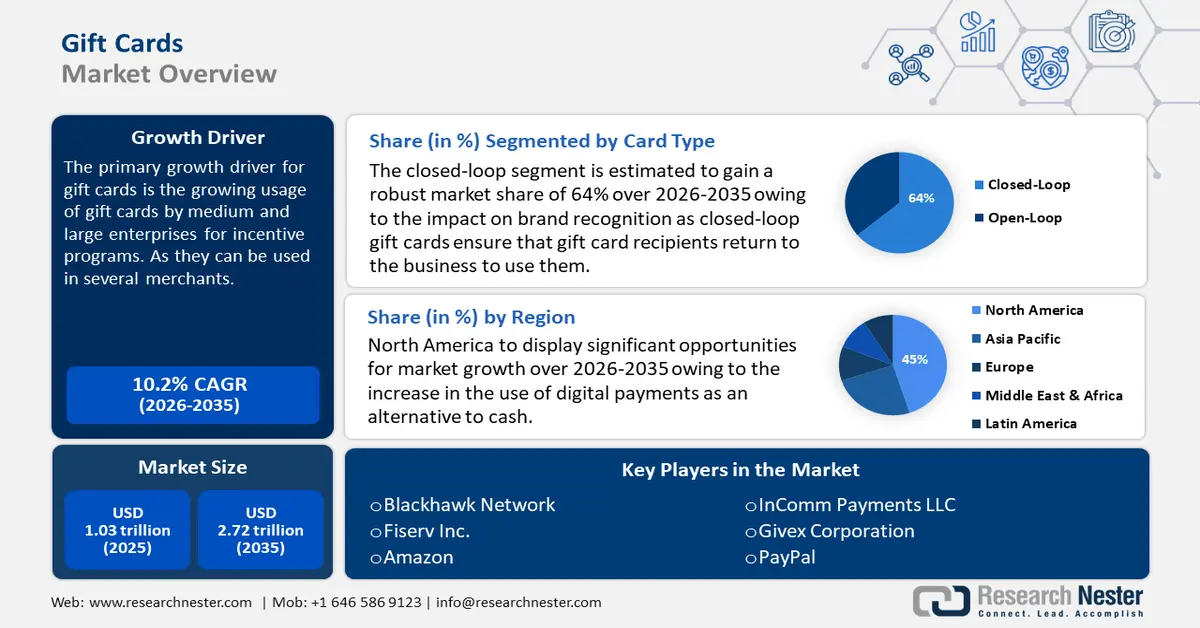

Gift Cards Market size was valued at USD 1.03 trillion in 2025 and is likely to cross USD 2.72 trillion by 2035, registering more than 10.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of gift cards is assessed at USD 1.12 trillion.

The growing usage of gift cards by medium and large enterprises has boosted the requirement for gift cards. According to a survey done by the Gift Card & Voucher Association in March 2023, around 54.1% of UK adults or approximately 28.8 million people received at least 1 gift card in 2022. These gift cards can be used in a variety of merchants such as dining, electronics, gas, clothing, and jewelry.

Key Gift Cards Market Insights Summary:

Regional Highlights:

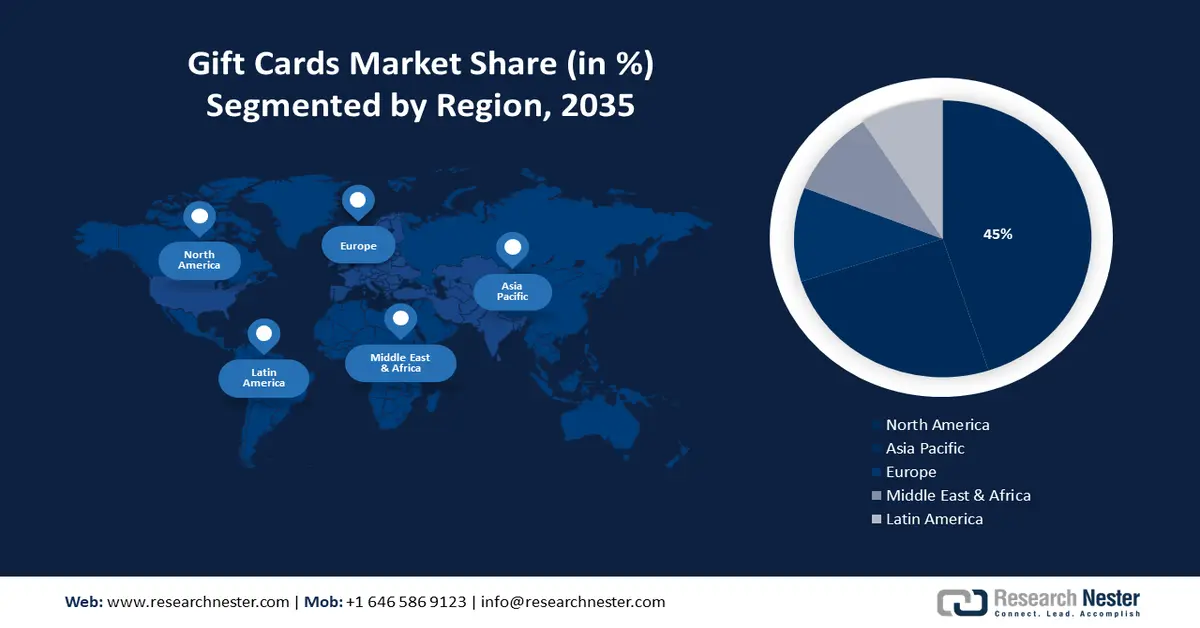

- North America’s gift cards market will account for 45% share by 2035, driven by surge in digital payments across various industries and growing digital inclusion initiatives.

- Asia Pacific market will exhibit huge growth during the forecast timeline, driven by surge in internet penetration and increasing internet literacy in the region.

Segment Insights:

- The closed-loop segment in the gift cards market is projected to capture a 64% share by 2035, driven by improved brand loyalty and anti-fraud features.

- The retail establishment segment in the gift cards market is expected to witness significant growth till 2035, attributed to a large customer base and demand for well-known brand gift cards.

Key Growth Trends:

- Increase in digital gifting options

- Demand for personalized gifting options

Major Challenges:

- Lack of reliability

- Limited acceptance of gift card

Key Players: Walmart, Paytronix Systems, Blackhawk Network, Fiserv Inc., Amazon, InComm Payments LLC, Givex Corporation, PayPal, American Express, Foodpanda.

Global Gift Cards Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.03 trillion

- 2026 Market Size: USD 1.12 trillion

- Projected Market Size: USD 2.72 trillion by 2035

- Growth Forecasts: 10.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, United Kingdom, Germany

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 18 September, 2025

Gift Cards Market Growth Drivers and Challenges:

Growth Drivers

- Increase in digital gifting options: The increasing number of social media users due to high internet penetration has boosted a variety of digital gifting options such as gift cards. This has promoted several gift card services and products including merchants and enterprises. According to a report in 2024, there are more than 5.15 billion users of social media globally, with an annual growth of about 5.6%. Moreover, gift cards are also used as marketing on social media as this is one of the most used promoting methods used by various industries and companies.

Moreover, the usage of digital gifting options is projected to be a simple and practical way for customers to buy presents as they can be purchased both, online and in-store. A report in 2022 estimated that the retail sales of digital gift cards surpassed the previous sales by 106%. In addition, the market for gift cards is being driven primarily by consumers' preference for experiences over material gifts and by the growing use of gift cards as incentives and rewards. - Demand for personalized gifting options: Personalized messages and unique designs are common features on gift cards, with this feature, givers can select themes, images, or graphics that go well with the occasion or the recipient's preference. A survey done by Research Nester in 2024 concluded that personalized and customized gifting is popular in more than 55% of companies. Furthermore, gift givers can further tailor the gift card with these design options to the recipient's style, which will improve the gift's overall presentation and impact. The 3D printing share has increased, augmented by the rising personalized technology in gifting.

Additionally, a survey conducted on about 200 Americans in 2020 projected that about 51% of the people wait till the last minute to purchase a gift. Gift givers can select a card from a merchant that holds special meaning for the recipient or select a design that is appropriate for the occasion to personalize the gift-giving experience. To make them even more attractive as personalized gift options, some gift cards now have customizable features like customized phrases or packaging. This is expected to boost the revenue share.

Challenges

- Lack of reliability: Gift cards are prone to fraud and theft, particularly if they lack security features or correct activation procedures. People may fall victim to fraud or theft as a result of insufficient consumer protection, losing the value displayed on their card and being unable to retrieve it again. Buyers and receivers of gift cards may be frustrated by technical faults or errors that arise during the activation, redemption, or balance-checking procedure.

- Limited acceptance of gift card: Customers may be less likely to purchase gift cards in the future or recommend them to others if they have difficulty using or redeeming them due to a lack of information about their activation in numerous regions.

Gift Cards Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.2% |

|

Base Year Market Size (2025) |

USD 1.03 trillion |

|

Forecast Year Market Size (2035) |

USD 2.72 trillion |

|

Regional Scope |

|

Gift Cards Market Segmentation:

Card Type Segment Analysis

Closed-loop segment is predicted to account for more than 64% gift cards market share by the end of 2035. Significant growth in the revenue share is anticipated as a result of the impact on brand recognition. Closed-loop gift cards ensure that gift card recipients return to the business to use them, which is profitable for businesses because they can only be used at one location or under one corporate brand. In addition, to help stop fraud and unauthorized use, advanced security features like magnetic stripes, PINs, or special activation codes are generally included.

Moreover, a lot of retailers allow customers to link or register their gift cards with online accounts, giving them the ability to monitor transactions, check their balance, and report issues right away. The World Bank published a report in 2022 estimating that about 2/3rd of global adults now receive and make digital payments which is an increase of 22% to cross 57% from 2014 to 2021. Growth in this sector will boost the digital experience platform value in the near future.

End use Segment Analysis

Retail establishment segment in the gift cards market is expected to register significant growth till 2035. This tremendous gain is credited to the large customer base coupled with the well-known brands that are common among retail enterprises. Gift cards from big retail chains, department stores, and specialty stores are set to be more valuable as they are well-known brands. The National Retail Federation shared their forecast about annual retail sales for 2024, it is estimated that retail sales will have a growth rate of more than 2.5% with a size of about USD 5.26 trillion as compared to USD 5.1 trillion in 2023.

Additionally, consumers who are familiar with these well-known brands and believe in their products & services and frequently prefer them to favor giving or receiving gift cards from these companies.

Our in-depth analysis of the global market includes the following segments:

|

Card Type |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Gift Cards Market Regional Analysis:

North America Market Insights

North America industry is poised to dominate majority revenue share of 45% by 2035. The surge in digital payments as an alternative to cash in several industries such as retail, banking, corporate, hospitality, institutes, and more. The gain in this sector will augment the real-time payments value in the near future. Moreover, the United States Agency for International Development (USAID) announced WiDEF (Women in the Digital Economy Fund) in the White House in 2023, this was a digital inclusion partnership to include women-led tools, solutions, and products. USAID provided about USD 50 million in GEEA (Gender Equity and Equality Action), while Inclusive Development Hub provided USD 500,000, especially for disability inclusion.

In the U.S., gift-giving is highly appreciated for occasions such as birthdays, weddings, graduation, holidays, and many more. A survey done by Research Nester in 2021, estimated that the searches for “online gift” witnessed a lucrative growth of 80% from the year 2019 to 2020.

Canada showed that companies and retailers that use gift cards as promotions are highly expected to have more loyal customers. A report published in 2024 based on a survey, that more than 80% of the people who received corporate gifts in the last 2 years felt closer to their company. Furthermore, about 25% of the surveyors said it's the best way to connect with customers.

APAC Market Insights

Asia Pacific will also encounter a huge growth in the gift cards market value during the forecast period. This region will account for the second position in this landscape owing to the surge in internet penetration along with the internet literacy in this region. The Mobile Economy Asia Pacific 2022 estimated that in 2021 internet users surpassed by 1.2 billion in APAC, which is about 45% of the APAC population.

In China, there has been an increase in disposable income coupled with the increase in population which prioritizes personalized and occasion-based gifting. According to a report in

The ICT infrastructure in Japan is improving which improves the gift cards market demand in this country.

Gift Cards Market Players:

- Walmart

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Paytronix Systems

- Blackhawk Network

- Fiserv Inc.

- Amazon

- InComm Payments LLC

- Givex Corporation

- PayPal

- American Express

- Foodpanda

Gift cards market expansion is estimated to witness a lucrative share during the forecast period. The competitive environment is attributed to the tremendous spike in the demand for personalized gifting options. More companies are entering this sector owing to the potential growth opportunities. In the forecast period, the market will observe emerging competitors and a growing demand for gift cards around the world.

Some of the key players include:

Recent Developments

- In December 2023, Foodpanda announced their new gift card feature which is available for corporate customers ‘Foodpanda for business’.

- In 2023, American Express published a report estimating that about USD 1 million will be given to the 25 US historic independent restaurants as part of the Backing Historic Small Restaurants grant program, according to an announcement made by American Express and the National Trust for Historic Preservation.

- Report ID: 6387

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Gift Cards Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.