Genomics Market Outlook:

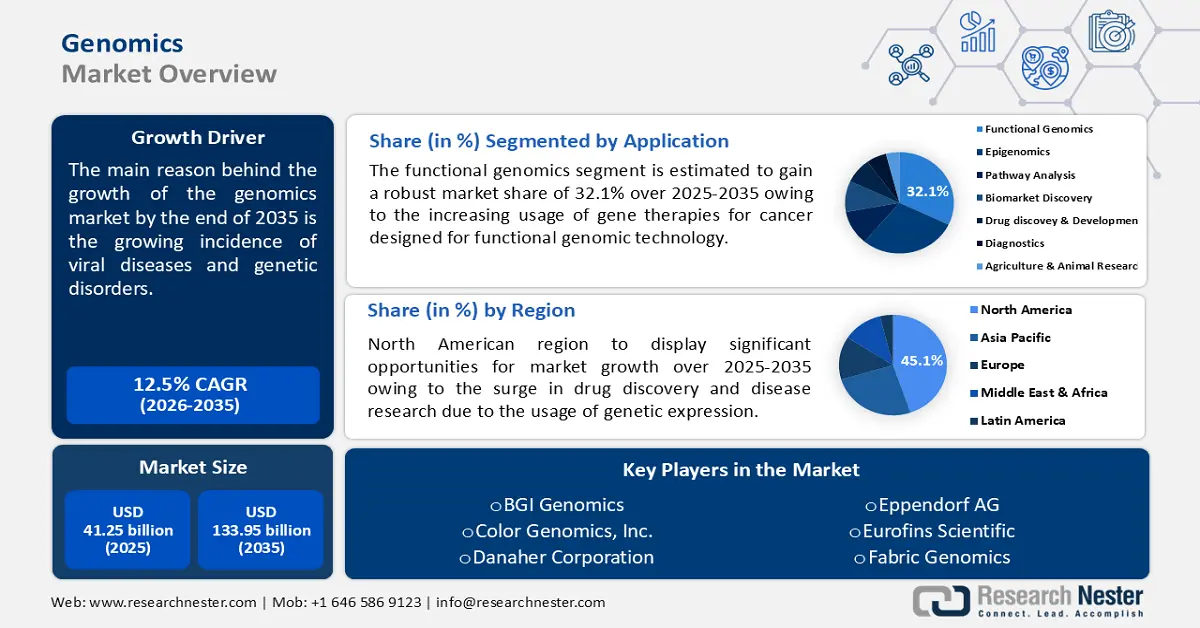

Genomics Market size was valued at USD 41.25 billion in 2025 and is set to exceed USD 133.95 billion by 2035, expanding at over 12.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of genomics is estimated at USD 45.89 billion.

The genomics market revenue is booming due to the growing incidence of viral diseases and genetic disorders. The World Health Organization (WHO) published a report in 2024 that stated the mortality rate due to viral diseases such as hepatitis increased from 1.1 million to 1.3 million between 2019 and 2022. Moreover, the National Library of Medicine estimated in a report that 1 out of 3 adults globally suffer from multiple chronic conditions in their lifetime.

Key Genomics Market Insights Summary:

Regional Highlights:

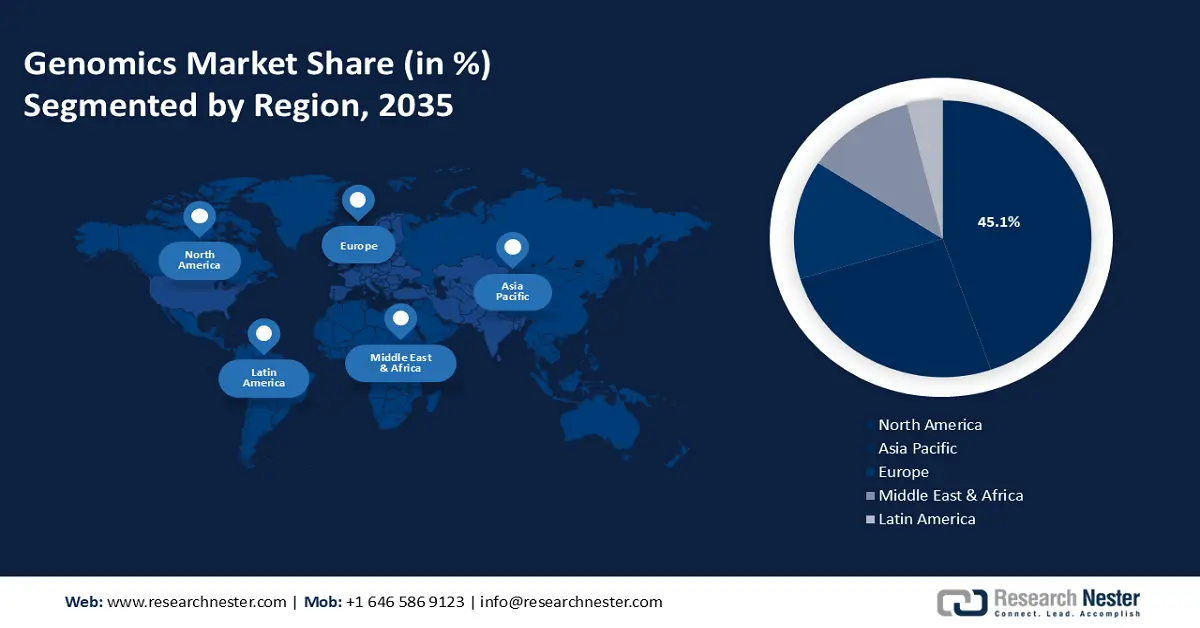

- The North America genomics market will dominate around 45% share by 2035, driven by drug discovery, research, and healthcare spending.

- The Asia Pacific market will hold the second largest share by 2035, driven by rising rare diseases requiring genome sequencing.

Segment Insights:

- The functional genomics segment in the genomics market is projected to capture a 32.10% share by 2035, augmented by increasing usage of gene therapies for cancer.

- The products segment in the genomics market is expected to experience the fastest growth till 2035, driven by boosting demand for consumables and decline in DNA sequencing costs.

Key Growth Trends:

- Rising technological advancements in healthcare

- Boost in drug discovery

Major Challenges:

- Lack of skilled technicians

- Rise of operational cost and affordability

Key Players: Bio-Rad Laboratories, Inc., BGI Genomics, Color Genomics, Inc., Danaher Corporation, Eppendorf AG, Eurofins Scientific, Fabric Genomics, Agilent Technologies Inc.

Global Genomics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 41.25 billion

- 2026 Market Size: USD 45.89 billion

- Projected Market Size: USD 133.95 billion by 2035

- Growth Forecasts: 12.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, United Kingdom, Germany, Japan

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 17 September, 2025

Genomics Market Growth Drivers and Challenges:

Growth Drivers

- Rising technological advancements in healthcare - Artificial intelligence (AI) has the potential to advance genomics capabilities to improve patient outcomes, from diagnostics to long-term care. According to a 2023 report by the World Economic Forum, AI-powered mammograms provide 30 times faster diagnostics with 100% accuracy, which reduces the requirement for invasive biopsies. Companies are striving to tap into this genomics market potential and make breakthrough innovations using AI in genomics. In May 2024, Google DeepMind and Isomorphic Labs collaboratively launched AlphaFold 3. It accurately predicts RNA, DNA, ligands, and protein structure, and how they interact using a diffusion network. Its ability to predict antibody-protein is expected to help the design of new antibodies and understand aspects of the human immune response.

AI in genomics has opened new opportunities in biotechnology and personalized medicine. AI contributes to optimizing and predicting genome editing methods such as epi-GED and CRISPR-Cas9. Machine Learning (ML) algorithms can analyze a high volume of genetic sequence datasets, which steers the development of accurate genome editing technologies. This will increase the revenue share for AI in healthcare sector. - Boost in drug discovery - Several clinical therapeutic products are being introduced by prominent pharmaceutical and life sciences companies. For instance, in May 2024, Formation Bio, Sanofi, and OpenAI entered into a partnership to build intelligent drug development lifecycles. This integration of data and technologies is projected to bring innovative medicines to patients for developing custom, purpose-built solutions across the drug development lifecycle.

Food and Drug Administration (FDA) in April 2024, cleared a prescription of CT-152, for treating major depressing disorder (MDD), similarly, CT-155 is a digital therapeutic prescription-based drug to help schizophrenia patients that got a grant through FDA in January 2024. These products are used to treat depression and schizophrenia.

The Congressional Budget Office in 2021 published a report stating that the approval of new drug sales surpassed 60% when compared to the previous decade between 2010 and 2019. Thus, rising emphasis on drug discovery is fostering genomics market expansion. - High incidence of cancer - One major factor supporting the market's growth is the incidence of cancer and the growing applications of next-generation sequencing in cancer research. A 2024 WHO study suggests that more than 35 million new cancer cases will rise by 2050, which is at a growth rate of 77% when compared to 20 million cases in 2022.

Furthermore, the diagnosis and treatment of cancer are changing as a result of genomics. Advances in genome research are improving blood sample methods for cancer diagnosis. Thanks to genomics, the number of cancer screening tests for inherited diseases is rising.

Challenges

- Lack of skilled technicians - The lack of skilled technicians is a major factor impeding the growth of the industry in developing nations, despite the enormous potential. Many developing countries are either short-staffed with technicians or lack the necessary skill set to operate complex sequencers. Aside from this, another factor limiting genomics market expansion is the high cost of instruments.

- Rise of operational cost and affordability - Even with the advances in DNA sequencing technologies, genomic analysis and testing remain costly, especially when it comes to whole genome sequencing and thorough genomic profiling. The broad use of genomics in clinical practice is hampered by the high costs of genomic testing and interpretation, particularly for settings with limited resources or for people with low incomes. The growth of the genomics market is impeded by cost considerations that also affect the availability and accessibility of genomic products and services.

Genomics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.5% |

|

Base Year Market Size (2025) |

USD 41.25 billion |

|

Forecast Year Market Size (2035) |

USD 133.95 billion |

|

Regional Scope |

|

Genomics Market Segmentation:

Application Segment Analysis

Functional genomics segment is anticipated to dominate over 32.1% genomics market share by 2035. The segment growth is augmented by the increasing usage of gene therapies for cancer which are designed for functional genomic technology. A report by IQVIA in 2024 estimated that the spending on gene and cell therapies increased by 38% as compared to 2022 and surpassed USD 5.9 billion in 2023. Additionally, the growth of the diagnostics segment is being driven by the growing number of nutrigenomics service providers who offer diet plans for disease conditions based on the unique genes of the patients.

Deliverables Segment Analysis

The products segment in genomics market is estimated to be the fastest-growing. The segment growth is attributed to the boosting demand for consumables such as centrifuges, assay kits, PCR plates, channel pipettes, assay tubes, and many more.

Moreover, there is a decline in the cost of DNA sequencing along with personalized medicine led by the launch of NGS technology which will develop new systems and products. A report by Research Nester in 2022 projected that the human genome sequence cost showed a decline from USD 1000 to USD 600 between 2007 to 2014, whereas NGS technology dominated this landscape by 35.4% of sales shares in 2021.

End-user Segment Analysis

In genomics market, clinical research segment is expected to dominate majority share by the end of 2035. It is propelled by the increased government funding for research. A 2022-2023 report on Research Funding Statistics by the University of British Columbia (UBC) states that UBC receives more than USD 700 million yearly in research funding from government, industry, and non-profit partners.

The quick application of genome analysis to treat illness and early detection is expected to support the growth of the healthcare facilities & diagnostic centers sector, owing to which clinical trials will witness a lucrative growth rate during the forecasted period.

According to the National Center for Science and Engineering Statistics (NCSES), in 2022 federal funding for research and development at universities across United States came to over USD 54 billion or 55% of total spending. Additionally, the pharmaceutical and biotechnological industries, as well as the contract research organization segment, are expected to benefit from the pharmaceutical giants' increased R&D investment in the development of novel gene therapies to treat cancer and immune diseases.

Our in-depth analysis of the global genomics market includes the following segments:

|

Application |

|

|

Technology |

|

|

Deliverables |

|

|

End-user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Genomics Market Regional Analysis:

North America Market Insights

North America industry is set to hold largest revenue share of 45% by 2035. The growth in the region is credited to the surge in drug discovery and disease research owing to the usage of genetic expression on the health of humans. This might increase the sector of the drug screening as well. The National Library of Medicine published a report in 2018 that the academic drug development and discovery success rates were more than 75% in Phase 1 and about 50% and 59% in Phase 2 and Phase 3 respectively.

In the United States, there is a tremendous impact in healthcare advancements along with the spending on healthcare, as the American Medical Association in 2024, estimated that the total health spending in the U.S. will increase by 4% when compared to 2022.

Research on cancer in Canada has been increasing which will fuel the genomic startups. National Institutes of Health published a report in 2024 estimates that in 2024 the cancer cases and deaths might cross 247100 and 88100 respectively.

APAC Market Insights

Asia Pacific genomics market and will account for the second position owing to the increasing presence of rare diseases that demand whole-genome sequencing. Asia Pacific Economic Cooperation published a report in 2018 estimating that 6-8% of the population was affected by several rare diseases, which is predicted to be about 200 million people in the APAC region.

In China, several genomic techniques are at surge to treat increasing genetic disorders such as diabetes, cancer, and many more. The National Institutes of Health (NIH) predicted in 2023 that the presence of diabetes in China will cross 9.7% by 2030.

Japan is predicted to have high healthcare expenditures which will increase the genomics market size expansion of the healthcare staffing sector. A report in 2022 concluded that there was about 2.2 times growth over the last 30 years in Japan from 1990 to 2015 in healthcare expenditure.

Genomics Market Players:

- Myriad Genetics, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bio-Rad Laboratories, Inc.

- BGI Genomics

- Color Genomics, Inc.

- Danaher Corporation

- Eppendorf AG

- Eurofins Scientific

- Fabric Genomics

- Agilent Technologies Inc

Most of these companies are continuously making agreements, collaborating, expanding, and joining ventures for the growth of this industry and are estimated to be the major key players in this sector.

Recent Developments

- In October 2023, Fabric Genomics collaborated with Oxford Nanopore Technologies and DNAnexus to implement CLIA/CAP labs in pediatric and neonatal intensive care units. The labs will investigate genetic disorders in infants using platforms from Oxford Nanopore.

- In January 2023, Agilent Technologies Inc. declared the purchase of Avida Biomed, a business that creates target enrichment workflows for clinical researchers using next-generation sequencing (NGS) techniques to investigate cancers.

- Report ID: 6263

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Genomics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.