Genetic Cardiomyopathies Market Outlook:

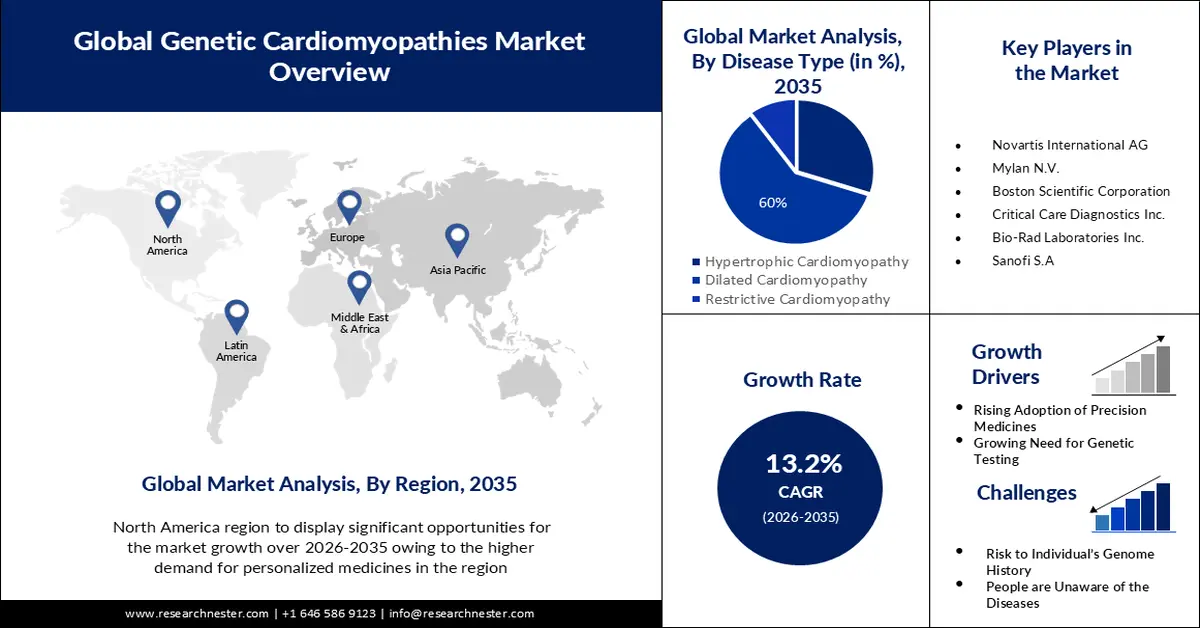

Genetic Cardiomyopathies Market size was over USD 2.51 billion in 2025 and is projected to reach USD 8.67 billion by 2035, witnessing around 13.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of genetic cardiomyopathies is evaluated at USD 2.81 billion.

The growth of the market can be attributed to the increasing instances of genetic cardiomyopathies. There were over 2 million instances of myocarditis, nearly 1.6 million cases of arrhythmogenic cardiomyopathy, and approximately 4 million cases of other cardiomyopathy worldwide. Genetics has played a significant part in the identification of various cardiomyopathies, and the area of heart failure (HF) genetics is quickly expanding.

In addition to these, factors that are believed to fuel the growth of genetic cardiomyopathies market are the approval of new drugs for effective treatment. The Food and Drug Administration (FDA) granted the novel treatment, known as Camzyos, breakthrough therapy and orphan drug designations in April. Patients with obstructive hypertrophic cardiomyopathy (oHCM) of New York Heart Association class II-III are eligible for treatment to enhance exercise capacity and symptoms. Patients raved about how it improved their quality of life by reducing symptoms such as palpitations, shortness of breath, leg oedema, and diminished exercise ability. Mavacamten minimizes the likelihood that these patients will require a more substantial treatment, such as septal myectomy, an open heart surgery that eliminates a portion of the thickened septum, or alcohol septal ablation.

Key Genetic Cardiomyopathies Market Insights Summary:

Regional Highlights:

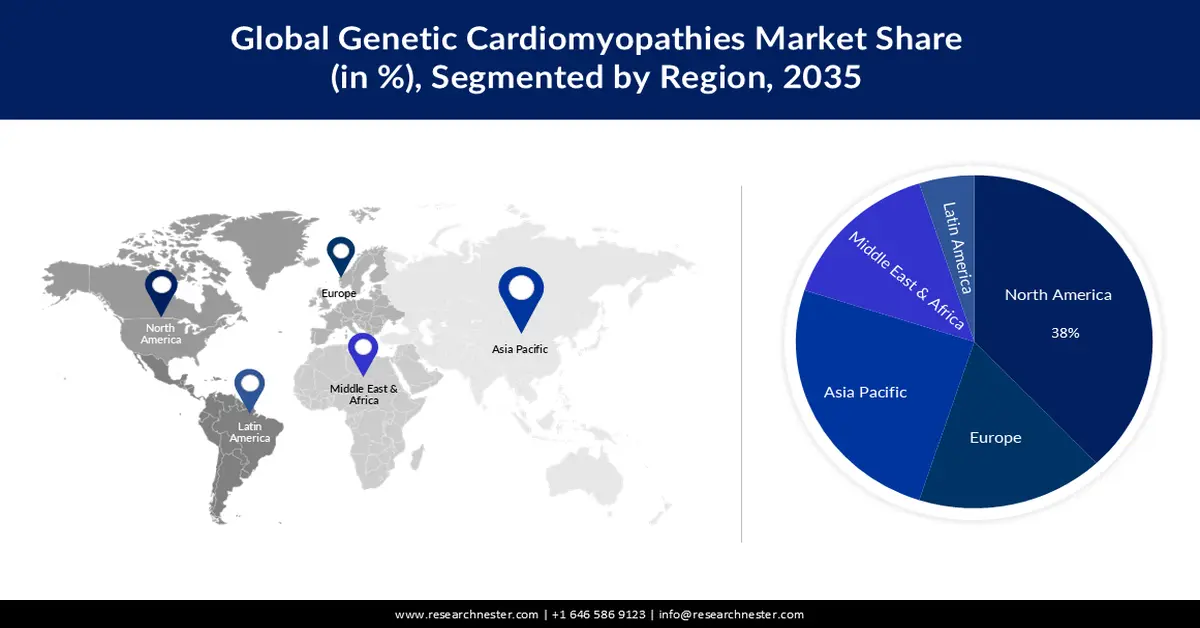

- North America genetic cardiomyopathies market is expected to capture a 38% share, underpinned by escalating investment in gene therapy research and development.

- By 2035, the Asia Pacific region is projected to hold a 25% share, sustained by the intensifying cardiac health burden associated with rising atmospheric pollution.

Segment Insights:

- By 2035, the dilated cardiomyopathy segment in the genetic cardiomyopathies market is anticipated to command a 60% share, propelled by the growing prevalence of this inherited cardiac condition.

- The hospital segment is slated to secure around a 46% share by 2035, fostered by the increasing rate of hospital admissions for heart-related disorders.

Key Growth Trends:

- Growing Need for Early Screening

- Rising Development in Genetic Testing

Major Challenges:

- Privacy Concerns about the Genetic Information of an Individual

- Low Awareness about the Disorder among the Common People

Key Players: Novartis International AG, Merck & Co., Teva Pharmaceuticals Industries Ltd., Bristol Myers Squibb Company, Mylan N.V., Boston Scientific Corporation, Critical Care Diagnostics Inc., Bio-Rad Laboratories Inc., Roche Holding AG, AstraZeneca PLC, and Sanofi S.A.

Global Genetic Cardiomyopathies Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.51 billion

- 2026 Market Size: USD 2.81 billion

- Projected Market Size: USD 8.67 billion by 2035

- Growth Forecasts: 13.2%

Key Regional Dynamics:

- Largest Region:North America (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Indonesia

Last updated on : 26 November, 2025

Genetic Cardiomyopathies Market - Growth Drivers and Challenges

Growth Drivers

-

Growing Need for Early Screening– Unless early screening criteria are satisfied, current guidelines of the American College of Cardiology recommend starting family screening for hypertrophic cardiomyopathy (HCM) after the age of 10 or 12 years. The researchers wanted to see if existing screening guidelines missed early-onset illness. Patients and families benefit from a multidisciplinary approach to clinical genetic screening for cardiomyopathies that includes genetic counselling as well as clinical genetic testing. Patients with hereditary cardiomyopathy can begin guideline-directed medical therapy earlier, increasing their chances of improving predictions and health results.

-

Rising Development in Genetic Testing – Recent developments in sequencing technology have enabled wide genetic testing on an individual patient basis within clinically meaningful timeframes, using exome and genome sequencing. Exome tests sequence the whole protein-coding portion of the genome, which accounts for less than 2% of the genome but contains around 85% of known disease-causing variations, whereas genome sequencing not only includes the exome but also all non-protein-coding DNA. Initially, similar tests were used in clinical research investigations such as the Deciphering Developmental Disorders project, but exome sequencing has lately been used as a clinical diagnostic test. Initially, similar tests were used in clinical research investigations such as the Deciphering Developmental Disorders project, but exome sequencing has lately been used as a clinical diagnostic test.

- Growing Emergence of Novel Therapies– Since there are complications such as the variability of human pathogenic variations, gene and transcript sizes, and other criteria that affect practicality, a variety of alternative molecular techniques have been created to address these issues in genetic cardiomyopathies. A few of the emerging novel therapies for hypertrophic cardiomyopathy and dilated cardiomyopathy are, exon skipping, siRNA, gern line CRISPR, trans-splicing, SERCA gene therapy, and translational read-through of stop colons. Several decades of research have shed light on the exact nature of genetic pathogenesis in many patients with these conditions, leading to novel discoveries into the molecular pathways by which pathogenic variations cause cardiomyopathies. These advancements raise the promise of new medicines that directly target gene variations or the disease-mediating proximal downstream pathways.

Challenges

-

Privacy Concerns about the Genetic Information of an Individual- Genetic testing raises moral issues about the privacy and security of an individual's genetic information. Ambiguity regarding how the data has been shared and handled is deterring some individuals from getting them diagnosed and treated. Moreover, the integration of digital health and the use of electronic health records further imposes a threat to the data, as digital security can be easily breached by hackers. Genetic testing entails the collecting of very sensitive personal information, such as a person's genetic code, therefore security should be of utmost importance in this respect.

-

Low Awareness about the Disorder among the Common People

- High Cost of the Treatment and Diagnosis

Genetic Cardiomyopathies Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

13.2% |

|

Base Year Market Size (2025) |

USD 2.51 billion |

|

Forecast Year Market Size (2035) |

USD 8.67 billion |

|

Regional Scope |

|

Genetic Cardiomyopathies Market Segmentation:

Disease Type Segment Analysis

The dilated cardiomyopathy segment is estimated to hold 60% share of the global genetic cardiomyopathies market in the year 2035. The growth of the segment can be attributed to the increasing prevalence of dilated cardiomyopathy. The most prevalent type of cardiomyopathy is dilated cardiomyopathy. Up to one-third of patients with the condition are inherited from their parents. This type of cardiomyopathy is most common in persons under the age of 50. It affects both the lower and upper chambers of the heart. Moreover, there are several research investigations for studying the dilated cardiomyopathy condition in other animals. The FDA announced External Link Disclaimer in July 2018 that it has begun examining allegations of canine dilated cardiomyopathy (DCM) in dogs consuming particular pet foods. The report was submitted by the FDA in November 2022. Furthermore, the FDA's Centre for Veterinary Medicine (CVM) and the Veterinary Laboratory Investigation and Response Network (Vet-LIRN), are continuing to look into this possible link.

End User Segment Analysis

Genetic cardiomyopathies market from the hospital segment is expected to garner a significant share of around 46% in the year 2035. The growth of the segment is majorly expected on account of the rising number of hospital admissions, especially of people suffering from heart conditions. In the previous five years, the number of persons hospitalized in hospitals for heart failure has increased by one-third. Hospital admissions in the UK are also increasing owing to the increasing prevalence of heart failure. It is estimated that over 920,000 people suffer from the illness, which places a bigger strain on the health-care system than all four of the most frequent cancers combined.

Our in-depth analysis of the global genetic cardiomyopathies market includes the following segments:

|

Disease Type |

|

|

Route of Administration |

|

|

End User |

|

|

Drug Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Genetic Cardiomyopathies Market - Regional Analysis

North American Market Insights

The genetic cardiomyopathies market in North America industry is anticipated to hold largest revenue share of 38% by 2035. The growth of the market can be attributed majorly to the rising investment in the research and development of gene therapies. Overall private equity and venture capital investment has increased in North America, with a compound annual growth rate of 18% for life sciences from 2010 to 2021. Over the same period, the average growth rate for gene therapy was 59%. Cell treatment has expanded by 63%. This indicates an increase in investment from around USD 360 million in 2020 to over nearly 70 billion in 2021.

APAC Market Insights

The Asia Pacific genetic cardiomyopathies market is estimated to be the second largest, registering a share of about 25% by the end of 2035. The growth of the market can be attributed majorly to the growing levels of pollution in the atmosphere in the region. Air pollution has been linked to negative cardiac remodelling in patients with dilated cardiomyopathy. Women appear to be more vulnerable to these impacts. Almost 90% of the Asia-Pacific region's population habitually breathes air deemed unhealthy by the World Health Organization (WHO). Air pollution is responsible for more than 7 million premature deaths worldwide, with the Asia-Pacific area accounting for two-thirds of those mortality.

Genetic Cardiomyopathies Market Players:

- Becton Dickinson and Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Novartis International AG

- Merck & Co.

- Teva Pharmaceuticals Industries Ltd.

- Bristol Myers Squibb Company

- Mylan N.V.

- Boston Scientific Corporation

- Critical Care Diagnostics Inc.

- Bio-Rad Laboratories Inc.

- Sanofi S.A

- Roche Holding AG

- Astella Pharma

Recent Developments

- April 2023: Bristol Myers Squibb announced that the European Medicines Agency's (EMA) Committee for Medicinal Products for Human Use (CHMP) suggested approval of CAMZYOS® (mavacamten) for the treatment of symptomatic (New York Heart Association, NYHA, class II-III) obstructive hypertrophic cardiomyopathy (HCM) in adult patients. The European Commission (EC), which has the competence to approve medicines for the European Union (EU), will now assess the CHMP opinion.

- July 2023: Novartis AG has revealed that the US Food and Drug Administration (FDA) has authorized a label update for Leqvio® (inclisiran) to allow for earlier usage as an addition to diet and statin therapy in patients with elevated LDL-C who are at increased risk of heart disease1. This patient group comprises patients with comorbidities such as hypertension and diabetes who have not yet experienced their first cardiovascular event. Leqvio is the first and only small interfering RNA (siRNA) medication to decrease LDL-C, and it was approved by the FDA in December 2021.

- Report ID: 5386

- Published Date: Nov 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Genetic Cardiomyopathies Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.