Gastroenterology Disposables Market Outlook:

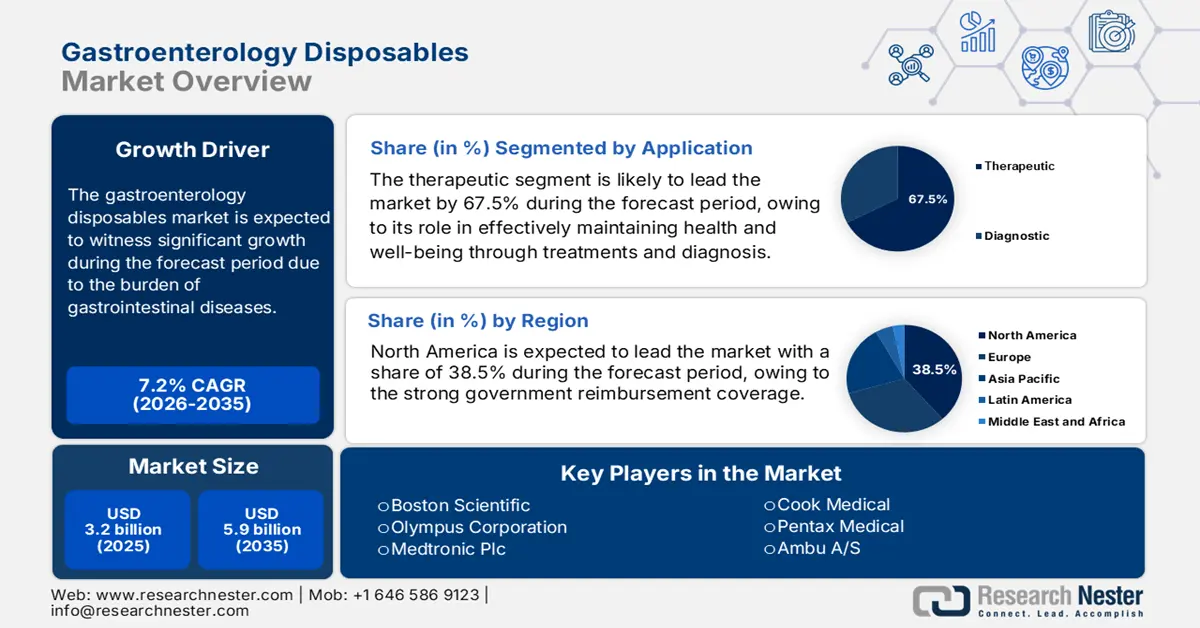

Gastroenterology Disposables Market size was USD 3.2 billion in 2025 and is anticipated to reach USD 5.9 billion by the end of 2035, increasing at a CAGR of 7.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of gastroenterology disposables is assessed at USD 3.4 billion.

The international market is effectively driven by the increased burden of gastrointestinal diseases. According to an article published by the CDC in December 2024, 14.8 million adults are readily diagnosed with ulcers, which is almost 5.9% of the population. In addition, 35.4 million visits to physician offices have been recorded for diseases associated with the digestive system, while the number of emergency department visits accounts for 8.8 million. Besides, as stated in the 2025 Memorial Care Organization article, over 20% people in the U.S. are affected with GERD, which is also positively impacting the market’s growth globally.

Furthermore, an increase in the rise of patient pool has equally necessitated the robust supply of disposable medical devices for different treatments, including endoscopy, biopsy, and polypectomy, which is suitable for the development of the gastroenterology disposables sector. Meanwhile, in the case of the supply chain, gastroenterology disposables cater to raw polymers procurement, sterilization, injection molding, and distribution. As stated in the July 2024 AHA Organization article, the U.S. has successfully imported USD 14.9 billion of medical equipment as of 2024, in comparison to USD 14 billion the previous year, which is also positively impacting the market’s growth across different nations.

Key Gastroenterology Disposables Market Insights Summary:

Regional Insights:

- North America is anticipated to capture a substantial 38.5% share of the Gastroenterology Disposables Market by 2035, owing to rising procedural volumes, stringent infection control standards, and favorable reimbursement policies.

- Asia Pacific is expected to witness the fastest growth through 2026–2035, stimulated by increasing gastrointestinal disorder prevalence, accelerating adoption of single-use devices, and expanding government-led healthcare initiatives.

Segment Insights:

- The therapeutic segment in the Gastroenterology Disposables Market is projected to hold a dominant 67.5% share by 2035, propelled by its crucial role in fostering health, healing, and patient well-being through advanced therapeutic relationships and treatments.

- The hospitals segment is estimated to secure the second-largest share by 2035, supported by its comprehensive infrastructure and capacity to handle complex gastrointestinal procedures and rising patient influx for diagnostic and therapeutic interventions.

Key Growth Trends:

- Expansion in Medicaid and Medicare healthcare budgets

- An upsurge in quality care at low expenses

Major Challenges:

- Impact of price caps in health and medical services

- Disruptions in supply chain and raw material sourcing

Key Players: Boston Scientific (USA),Olympus Corporation (Japan),Medtronic Plc (Ireland/USA),Cook Medical (USA),Pentax Medical (Japan),Ambu A/S (Denmark),Conmed Corporation (USA),Steris Plc (USA),KARL STORZ (Germany),FUJIFILM Healthcare (Japan),Nipro Corporation (Japan),B. Braun Melsungen AG (Germany),Smith & Nephew (UK),VESCO Medical (USA),Hoya Corporation (Japan),Sterimed Group (France),Alpha Biomed (India),EndoChoice (USA),BioMed Global (Malaysia),Medical Developments International (Australia).

Global Gastroenterology Disposables Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.2 billion

- 2026 Market Size: USD 3.4 billion

- Projected Market Size: USD 5.9 billion by 2035

- Growth Forecasts: 7.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Mexico, Indonesia

Last updated on : 30 September, 2025

Gastroenterology Disposables Market - Growth Drivers and Challenges

Growth Drivers

- Expansion in Medicaid and Medicare healthcare budgets: In this regard, the Medicare Part B spending in the U.S. has increased, particularly for gastrointestinal diagnostic tests, which include upper GI procedure endoscopies and colonoscopies. According to an article published by the America College of Gastroenterology in February 2025, the valuation for the conversion factor for Medicare accounts for USD 32.3, which reflected a 2.8% decrease from 2024. However, to combat this, the Medicare Patient Access and Practice Stabilization Act was successfully introduced and proposed a 6.6% increase in the physician fee schedule, thereby denoting an optimistic outlook for the overall market.

- An upsurge in quality care at low expenses: This growth factor depicts that high-volume hospitals are readily utilizing single-use biopsy valves as well as hemostasis clips, which are suitable for bolstering the market globally. For instance, in March 2025, Olympus declared the successful launch of the Retentia HemoClip, which is the latest hemostasis clip to assist in catering to the demand of GI endoscopists. This particular clip provides a complete 360-degree rotation, along with an intuitive one-step implementation to control and accommodate different closure applications.

- Sudden shift towards minimally invasive procedures: These procedures make use of small incisions, which results in less pain, rapid recovery times, short hospital accommodations, diminished risk of complications, and minimal scarring, thus suitable for boosting the market. As stated in the January 2025 NLM article, the rate of MIS increased in hospitals from 56.1% to 57.0%, while with the introduction of robotic-assisted surgery, there was also a surge in the MIS rate from 60.5% to 65.8%. Therefore, with the incorporation of these procedures in hospitals, there is a huge opportunity for the market to flourish internationally.

Pharmaceutical and Medical Equipment Import Boosting the Market (2022)

|

Countries |

Import Share |

|

Ireland |

15.9% |

|

Germany |

11.3% |

|

China |

9.2% |

|

Switzerland |

8.5% |

|

Mexico |

7.0% |

|

Italy |

4.2% |

|

Canada |

4.0% |

|

India |

3.7% |

|

Japan |

3.6% |

|

Singapore |

3.5% |

|

Rest of the world |

28.9% |

Source: NIH

Colorectal Cancer Screening by Race Uplifting the Market (2023)

|

Detailed Race Trends |

Adults (%) |

95% Confidence Interval |

|

All races and ethnicities |

72.6 |

71.6 to 73.7 |

|

Non-Hispanic white |

75.3 |

74.2 to 76.4 |

|

Non-Hispanic black |

72.5 |

69.5 to 75.2 |

|

Hispanic |

62.9 |

59.6 to 66.1 |

Source: National Cancer Institute

Challenges

- Impact of price caps in health and medical services: The presence of rigid price controls is readily imposed by governments in countries, particularly through healthcare systems, which negatively impacts the gastroenterology disposables industry demand. In Germany and France, the DRG system reimbursement caps have focused on supplier and innovation margins. For instance, Olympus experienced constraints in profitability, especially in France, and in 2023, the organization joined hands with localized health authorities and managed to increase prices in public hospitals through value-specific contracts.

- Disruptions in supply chain and raw material sourcing: The market is extremely vulnerable to international supply chain shocks since these devices depend on medical-grade and specialized raw materials, such as nitinol, stainless steel, and polymers. Besides, disruptions tend to halt production, resulting in critical shortages for the market’s upliftment. Meanwhile, the CDC has effectively documented that those disruptions can directly impact patient care by causing delays in essential procedures. Manufacturers are witnessing rising logistical instability and expenses, which can deliberately erode margins and damage consumer relationships, thereby negatively impacting the market.

Gastroenterology Disposables Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.2% |

|

Base Year Market Size (2025) |

USD 3.2 billion |

|

Forecast Year Market Size (2035) |

USD 5.9 billion |

|

Regional Scope |

|

Gastroenterology Disposables Market Segmentation:

Application Segment Analysis

Based on the application, the therapeutic segment in the gastroenterology disposables market is anticipated to garner the largest share of 67.5% by the end of 2035. The segment’s upliftment is highly attributed to its role in promoting health, well-being, and healing through communication, treatments, and therapeutic relationships. According to an article published by NLM in May 2023, pancreatic cancer is an aggressive neoplasm, with a 5-year survival rate ranging from 5% to 8% within 5 months. Therefore, to combat this, a robust therapeutic alliance is required to foster trust, efficient care, and standard treatment to help patients create coping techniques, thus suitable for the segment’s development.

End user Segment Analysis

Based on end user, the hospitals segment in the gastroenterology disposables market is projected to account for the second-largest share during the forecast duration. The segment’s growth is highly driven by its role as the primary facility for high-acuity and complicated therapeutic procedures, including emergency interventions and endoscopic mucosal resection (EMR) for GI bleeding. This requires wide-ranging infrastructure and multidisciplinary teams. Besides, increased patient footfall for gastroscopies and diagnostic colonoscopies ensures significant volume, making it suitable for the segment’s upliftment.

Procedure Segment Analysis

Based on the procedure, the colonoscopy segment in the gastroenterology disposables market is expected to constitute the third-largest share by the end of the projected timeline. The segment’s development is highly fueled by its importance to prevent and screen colorectal cancer by identifying and overcoming pre-cancerous polyps, and also aids in treating and diagnosing intestinal disorders. As per the April 2025 National Cancer Institute article, 72.6% of adults aged between 50 and 75 years were affected by colorectal cancer as of 2023, and received standard screening based on current medical guidelines. Besides, there will be an increase in the adult population by 74.4% to receive colorectal screening test, thus driving the segment’s exposure.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

End user |

|

|

Procedure |

|

|

Product |

|

|

Usability |

|

|

Level of Care |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Gastroenterology Disposables Market - Regional Analysis

North America Market Insights

North America in the gastroenterology disposables market is anticipated to garner the highest share of 38.5% by the end of 2035. The market’s upliftment in the region is highly attributed to an increase in procedural volumes, strict infection control measures, and the presence of robust government reimbursement coverage. According to an article published by NIH in May 2022, a clinical study was conducted on 13,134 adults with Medicaid insurance coverage, and it was identified that 63.6% had insurance and received colonoscopy screening, thereby positively impacting the market.

The gastroenterology disposables industry in the U.S. is growing significantly, owing to a surge in procedural volumes with expansion in policy accessibility and preventive GI. As stated in the May 2025 Gastro Journal article, the healthcare spending for gastrointestinal diseases totaled USD 111.8 billion in the country. This included 14.5 million emergency department visits, along with 2.9 million hospital admissions. Besides, the country also witnessed 315,065 latest GI cancer diagnoses as well as 281,413 deaths, based on which the market is continuously gaining increased importance in the overall country.

The gastroenterology disposables market in Canada is also growing due to the aspect of federal budget allocation, provincial expenditure, and the existence of provincial health plans to cover GI-based endoscopic procedures and associated disposables. As per the 2024 Fraser Institute Organization data report, federal and provincial governments tend to spend USD 81.8 billion on interest payments as of 2024. Besides, residents of Labrador and Newfoundland observed the highest combined interest payments of USD 3,225 per person, while Manitoba accounts for USD 2,728 per person, thereby denoting a huge growth opportunity for the market in the country.

Federal and Current Expenditure in North America (2023-2024)

|

U.S. |

Canada |

|||

|

Quarters |

Billions of Dollars |

Cities |

Interest Costs (USD) |

Interest Costs in % Revenue |

|

Q2 2023 |

896.6 |

British Columbia |

3,257 million |

4.2 |

|

Q3 2023 |

968.3 |

Alberta |

3,157 million |

4.2 |

|

Q4 2023 |

1,030.7 |

Saskatchewan |

823 million |

4.2 |

|

Q1 2024 |

1,067.3 |

Manitoba |

2,193 million |

10.1 |

|

Q2 2024 |

1,096.7 |

Ontario |

13,449 million |

6.7 |

|

Q3 2024 |

1,116.9 |

Quebec |

9,867 |

6.6 |

|

Q4 2024 |

1,124.4 |

New Brunswick |

548 million |

4.4 |

|

|

|

Nova Scotia |

790 million |

5.3 |

Sources: FRED; Fraser Institute Organization

APAC Market Insights

Asia Pacific in the gastroenterology disposables market is expected to emerge as the fastest-growing region during the projected timeline. The market’s exposure in the region is highly fueled by an increase in gastrointestinal disorder cases, a sudden shift towards single-use devices for infection-based procedures, and government-based initiative screening programs. Japan and China are deliberately leading the market in the overall region due to massive volumes of procedures and an aging population. As indicated in the September 2024 Frontiers Organization article, there has been an upsurge in the public financial resources allocation to healthcare from 141.8 billion yuan to 2,254.2 billion yuan as of 2023. In addition, there has been an increase in healthcare spending at a 47.5% growth rate, thus suitable for the market’s growth.

The market in China is gaining increasing traction, owing to the existence of NMPA, government-specific expenditure on gastroenterology disposables, as well as the utilization of single-use hemostasis clips and biopsy valves. As per an article published by NLM in February 2024, a single cone-beam computed tomography (CBCT) imaging protocol tends to acquire almost 600 images within one C-arm rotation, based on the regional expertise for aiding pulmonary nodules, which, in turn, is deliberately contributing towards the overall market’s development in the country.

The gastroenterology disposables market in India is also developing due to the presence of governmental schemes to offer suitable healthcare coverage to the majority of citizens, an increase in diagnostic procedure accessibility, and generous private sector investments. As per the November 2023 NLM article, gastric cancer is considered the fifth most common cancer type, constituting 7.2% of overall cancer incidences. Besides, a clinical study was conducted on 1,033 patients to evaluate endoscopic procedures, which resulted in 59.7% of dyspepsia, 7% of chronic anemia, and 5.5% upper GI bleeding, thus catering to the market’s upliftment.

Europe Market Insights

Europe in the gastroenterology disposables market is expected to experience steady growth by the end of the projected duration. The market’s exposure in the overall region is highly subject to a rise in aging demographics, compulsory early colorectal cancer screening, along with standard infection control measures. In addition, the aspect of placing disposable medical instruments and regional governments' strategies is also driving the market’s development in the overall region. According to an article published by FFG in 2025, the ERA4Health, which was unveiled in 2022, readily focuses on enhancing the health of the overall population by achieving funds from 22 countries, which positively impacts the overall market’s growth.

The gastroenterology disposables industry in Germany is gaining increased exposure, owing to the largest market with an upsurge in expenditure for health and medical services. As stated in the 2024 Fresenius annual report, there has been an increase in group revenue, accounting for €21.5 billion as of 2024, denoting an 8% growth in the overall revenue. In addition, operational earnings rose by 10%, with a valuation of €2.5 billion, along with a further increase in operating cash flow by 16%, constituting €2.4 billion. Therefore, developments in pharma organizations in the country cater to huge growth opportunities for the overall market.

The gastroenterology disposables market in France is also growing due to the existence of a wide-ranging national health insurance system that tends to cover preventive care, an increase in government spending, and an effective focus on advanced medical devices to ensure improved patient outcomes. As per the 2024 Euro Health Observatory article, the statutory health insurance (SHI) system deliberately finances overall health and medical expenditure as well as complementary private health insurance (VHI), which caters to more than 95% of the population. Additionally, nearly 20% of the population benefits from VHI, which permits complete coverage of medicines and services, thus suitable for the market’s growth.

2023 Medical Instruments Export and Import in Europe

|

Countries |

Export |

Import |

|

Germany |

USD 18.4 billion |

USD 13.1 billion |

|

Netherlands |

USD 9.3 billion |

USD 14.1 billion |

|

Ireland |

USD 9.0 billion |

USD 1.9 billion |

|

Switzerland |

USD 4.5 billion |

USD 2.9 billion |

|

France |

USD 3.9 billion |

USD 6.4 billion |

|

Belgium |

USD 3.2 billion |

USD 4.5 billion |

|

Italy |

USD 3.1 billion |

USD 4.6 billion |

|

UK |

USD 3 billion |

USD 4.4 billion |

Source: OEC

Key Gastroenterology Disposables Market Players:

- Boston Scientific (USA)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Olympus Corporation (Japan)

- Medtronic Plc (Ireland/USA)

- Cook Medical (USA)

- Pentax Medical (Japan)

- Ambu A/S (Denmark)

- Conmed Corporation (USA)

- Steris Plc (USA)

- KARL STORZ (Germany)

- FUJIFILM Healthcare (Japan)

- Nipro Corporation (Japan)

- B. Braun Melsungen AG (Germany)

- Smith & Nephew (UK)

- VESCO Medical (USA)

- Hoya Corporation (Japan)

- Sterimed Group (France)

- Alpha Biomed (India)

- EndoChoice (USA)

- BioMed Global (Malaysia)

- Medical Developments International (Australia)

The international market for gastroenterology disposables is effectively competitive, with the presence of notable players, including Medtronic, Olympus, and Boston Scientific. These players effectively make the market demand by successfully scaling the manufacturing, boosting research and development (R&D), and enhancing the global reach to be competitive in the market scenario. Besides, firms in Japan, such as Fujifilm and Pentax, are focusing on precision-engineered disposables, while Conmed and Ambu A/S are focusing on infection control through single-use technologies. Meanwhile, players in the APAC region are following tactical approaches, including regional partnerships, manufacturing localization, and product innovation, thereby boosting the market exposure.

Here is a list of key players operating in the global market:

Recent Developments

- In November 2024, Cardinal Health declared that it has entered into a tactical deal to successfully acquire two organizations that accelerated the company’s growth areas and enhanced patient care services.

- In October 2024, Medtronic plc notified the newest innovations in artificial intelligence (AI) for endoscopic care by launching ColonPRO, which is the current software generation for the GI Genius intelligent endoscopy system.

- Report ID: 3998

- Published Date: Sep 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Gastroenterology Disposables Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.