Gas Treating Amine Market Outlook:

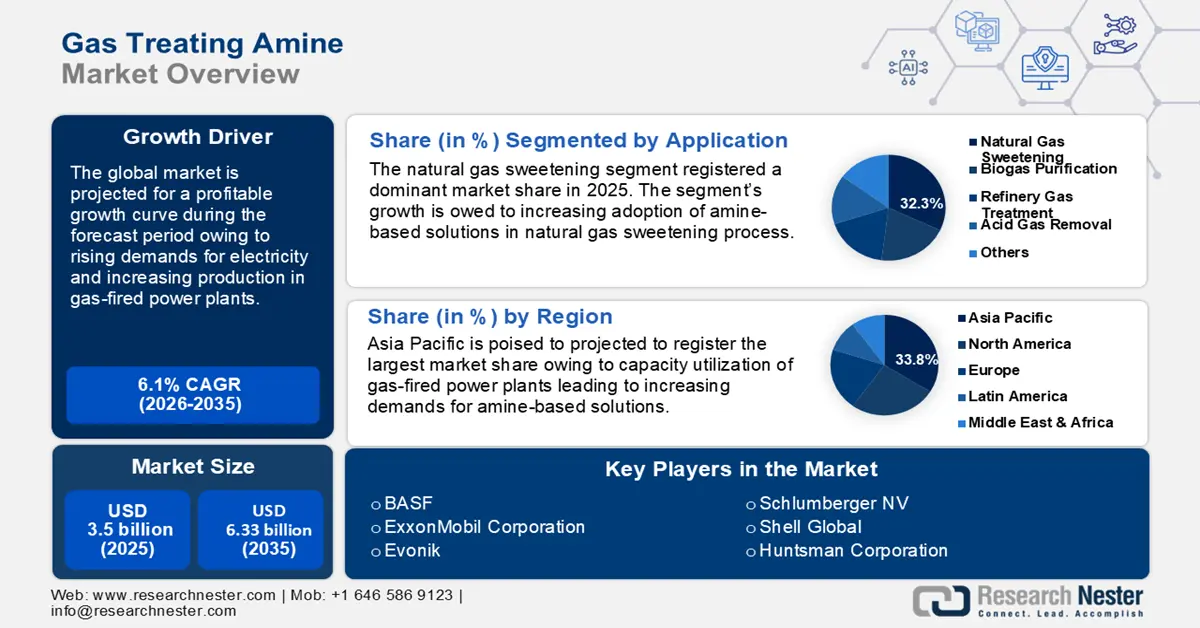

Gas Treating Amine Market size was over USD 3.5 billion in 2025 and is poised to exceed USD 6.33 billion by 2035, growing at over 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of gas treating amine is estimated at USD 3.69 billion.

The gas treating amine market’s growth curve is attributed to rising demands for natural gas and the global push to reduce carbon footprint. In October 2024, the International Energy Agency (IEA) forecasted the global gas demand to rise more than 2.5% in 2024. The IEA expects the rise in demand to remain stable in 2025 with Asia leading in demand and Europe contributing to the surge. Despite the fragile balance between demand and supply for natural gas, the gas treating anime market is projected to benefit enormously from the surge in demand.

The rapid expansion of industrial and power sectors in emerging economies drives demands for gas treating technologies that can reduce carbon footprint and comply with stringent environmental regulations. Amine-based gas treatment has large-scale applications in oil and gas industries to remove contaminants such as carbon dioxide (CO2) and hydrogen sulfide (H2s). Additionally, the surge in global demand for electricity correlates with the increase in production from gas-fired power plants that require amine-based gas treatment, fueling the market’s robust growth. For instance, the IEA forecasts global electricity demand to surge by 3.4% annually from 2024 to 2026. Global Energy Monitor’s Global Oil and Gas Plant Tracker (GOGPT) estimated the capacity of oil and gas-fired power stations under development globally to have grown by 90 GW (13%) in July 2023. The trends of growth in gas plants are positioned to fuel the gas treating amine market’s growth by the end of the forecast period.

The gas treating amine market presents opportunities to key players through innovations in gas processing technologies as global consumers as well as organizations push for renewable energy solutions. Key market players are positioned to benefit from the surge in demands for high-performance amines that can efficiently capture and treat CO2 emissions. The rise of biogas and syngas production opens new segments for amine-based solutions. For instance, in June 2023, Imerys reported the construction of a new onsite recovery plant in Belgium that can turn syngas into electricity. The continued expansion of the gas sector is poised to continue offering opportunities for global and local gas treating amine market players in the gas treating amine sector.

Key Gas Treating Amine Market Insights Summary:

Regional Highlights:

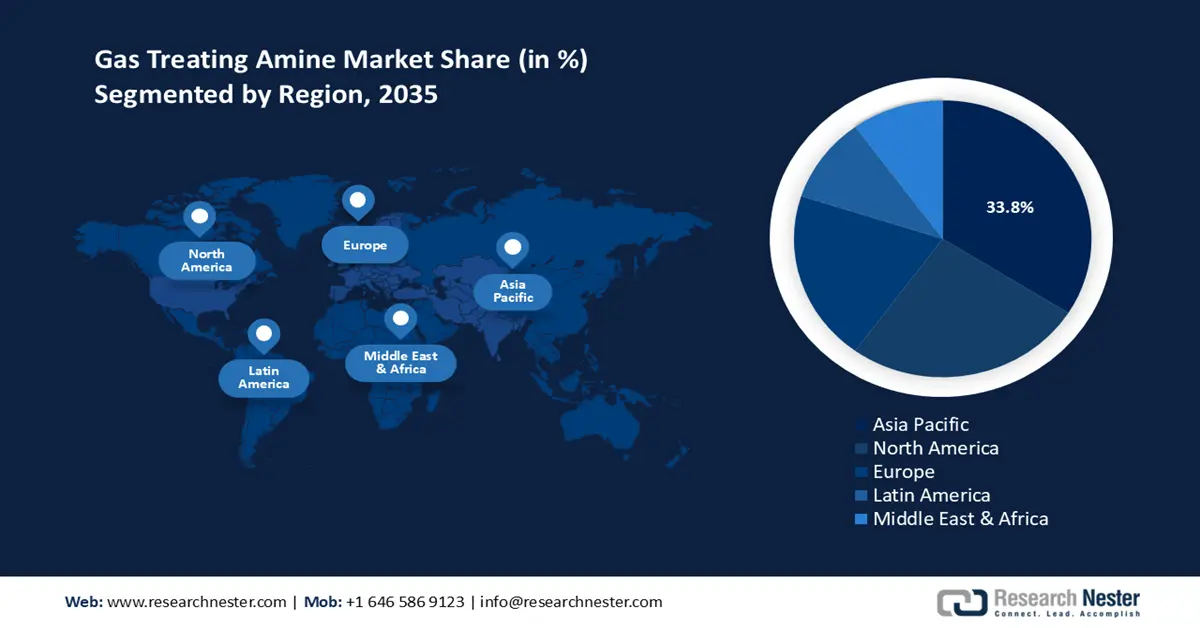

- Asia Pacific leads the Gas Treating Amine Market with a 33.8% share, propelled by rising demands for natural gas in countries such as China, India, and Southeast Asia, supporting robust growth through 2026–2035.

- North America's Gas Treating Amine Market will see significant growth by 2035, driven by large-scale production and consumption of natural gas in the U.S. and Canada.

Segment Insights:

- The Biogas Purification segment is anticipated to see increased growth from 2026 to 2035, propelled by rising investments in biogas plants and the efficiency of amine-based purification solutions.

- The Natural Gas Sweetening segment is expected to hold a 32.3% share by 2035, propelled by the widespread use of amine-based treatments for CO₂ and H₂S removal.

Key Growth Trends:

- Increase in biogas and renewable energy production

- Increase in gas power plant capacity

Major Challenges:

- Competition from alternative treatment technology

- Volatile raw material prices

- Key Players: GE Vernova, BASF, Schlumberger NV, Amines & Plasticizers Ltd., Shell Global, ExxonMobil Corporation, Dow Chemical Company, Air Products and Chemicals, Inc., Evonik, Chevron Phillips Chemical Company LLC, Arkema, Huntsman Corporation, Axens, Pall Corporation, and Mitsubishi Gas Chemical Company.

Global Gas Treating Amine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.5 billion

- 2026 Market Size: USD 3.69 billion

- Projected Market Size: USD 6.33 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (33.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Gas Treating Amine Market Growth Drivers and Challenges:

Growth Drivers

- Increase in biogas and renewable energy production: The global shift towards renewable energy sources has increased investments in biogas and syngas production. This presents a unique opportunity for the gas treating amine market due to the use of amine-based solutions for purifying biogas. Market players are projected to benefit from the expanding green energy industry owing to the increasing use of amine-based treatments for renewable energy applications.

Additionally, amine treatment significantly increases the methane content of biogas, improving its valuation as a fuel. It can enhance the calorific value and combustion properties of syngas, making it a more efficient fuel. Research and development of amine-based CO2 capture is poised to increase the adoption rate of amine-based treatments. - Increase in gas power plant capacity: Globally, heat waves are pushing gas-based power plants capacity utilization increasing demands for amine-based solutions. The increase in construction of gas-fired power plants is owed to meet the rising energy demands globally, led by APAC countries, and to reduce dependency on thermal power plants. Gas-fired power plants require high-quality natural gas free from impurities such as CO2 and H2S to maintain optimal capacity utilization. The gas treating amine market benefits from the adoption of amine-based treatment to ensure natural gas in the plants meets the necessary purity standards.

Additionally, global data indicates the construction and development of new gas-fired power plants that will significantly benefit the gas treating amine market. For instance, in March 2023, the Global Energy Monitor indicated a surge in the development of gas-fired power plants with a 22% increase in global capacity compared to the previous year. The gas power plants in pre-construction and construction phases would add an estimated 748 gigawatts (GW) of new capacity and capital expenditure was estimated at USD 601 billion. - Stringent enforcement of environmental regulations: Increasing government and international agencies' scrutiny over greenhouse gas emissions in power generation and industrial sectors has fueled the adoption of amine-based gas treatment solutions. Consumer behavior trends globally have shifted to demands for sustainable supply chains, and companies with end-products utilizing supply lines with greater GHG emissions are under greater scrutiny. In December 2023, The United Nations Climate Change Conference (COP28) recognized the science indicating GHG emissions to be cut by 43% by 2030 to limit global warming. This fuels the demand for effective amine-based gas-treating solutions boosting the robust growth of the gas-treating amine sector.

Additionally, stringent fines associated with violations of environmental decrees are hastening the adoption of amine-based gas treatment. For instance, in May 2022, more than 30 companies were issued with fines amounting to USD 35.2 million by the Environment Agency under the European Union Trading System.

Challenges

- Competition from alternative treatment technology: The gas treating amine market faces fierce competition from alternative gas treatment technologies such as gas membrane separation that can be more cost-effective. Gas membrane technologies can prove to challenge the adoption of amine-based solutions in certain regions and stymie the gas treating amine market growth. Manufacturers look for gas treating solutions that are less labor-intensive and cost-efficient. Market players are positioned to answer the challenge by offering innovative amine-based solutions that can be cost-effective and with reduced environmental impacts.

- Volatile raw material prices: The fluctuating cost of raw materials can challenge the growth of the gas treating amine market. Monoethanolamine (MEA), Duethanolamine (DEA), Trierhanolamine (TEA) are primary raw materials used in amine-based gas treating solutions. Price volatility of these chemicals can adversely affect production costs and profit margins, making it difficult for manufacturers to maintain competitive pricing. These trends can adversely affect the sector’s steady growth.

Gas Treating Amine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 3.5 billion |

|

Forecast Year Market Size (2035) |

USD 6.33 billion |

|

Regional Scope |

|

Gas Treating Amine Market Segmentation:

Application (Natural Gas Sweetening, Biogas Purification, Refinery Gas Treatment, Acid Gas Removal, Others)

The natural gas sweetening segment registered a 32.3% gas treating amine market share in 2025 and is poised to increase its revenue share by the end of the forecast period. The segment’s growth curve is attributed to its growing usage of amine-based treatments to remove carbon dioxide and hydrogen sulfide. Amine-based solutions have solidified itself as the most commonly used process in natural gas sweetening. Monoethanolamine (MEA) and diethanolamine (DEA) are widely used in the sweetening process owing to their efficiency in separating and absorbing acidic gasses from natural gas streams. The rising global demand for natural gas as an alternative to coal is projected to continue the growth of the segment. Additionally, advancements in new formulations to improve energy efficiency in the natural gas sweetening process will fuel a profitable growth curve by the end of 2035.

The biogas purification segment by application of the gas treating anime market is poised to increase its revenue share during the forecast period. Biogas plants are attracting significant investments that boost the application of amine-based solutions for biogas treatment. For instance, in February 2024, Gasum announced investments of USD 67.8 million in a new biogas plant in Sweden. Amine-based solutions are effective in removing impurities such as carbon dioxide, hydrogen sulfide, and water vapor from biogas to upgrade them to biomethane for use in power generation. The World Biogas Association estimates that 700 biogas plants have upgraded to biomethane globally.

End user (Oil & Gas Industry, Refining Industry, Power Generation, Renewal Industry, Others)

The oil and gas industry is projected to be the largest end-user of amine-based treatments and increase the revenue share in gas treating amine market by the end of the forecast period. The segment’s growth is attributed to the reliance on amine-based solutions for gas purification. Additionally, the segment is under scrutiny from national and international organizations to reduce emissions of greenhouse gases, necessitating the adoption of gas treatment solutions. This leads to a steady application of amine-based solutions in the oil and gas industry. The rising investments in the oil and gas industry are positioned to increase demand for amine-based treatment solutions. For instance, in September 2024, Oil India announced plans to expand the oil refinery capacity in Assam, India, to 1800000 bpd by March 2027.

Our in-depth analysis of the gas treating amine market includes the following segments:

|

Application |

|

|

End user |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Gas Treating Amine Market Regional Analysis:

APAC Market Forecast

Asia Pacific gas treating amine market is expected to capture revenue share of over 33.8% by 2035. The market’s robust growth is attributed to rising demands for natural gas in countries such as China, India, and Southeast Asia. The growing liquefied natural gas sector in APAC contributes to the rise in demand for amine-based solutions to combat emissions of GHGs. For instance, the IEA estimates the global gas demand to grow by 2.5% in 2024 owing to the expected colder winter in 2024 increasing demands for space heating. The global fall in natural gas prices will also boost the recovery in gas demands. IEA’s report estimated a higher gas burn in the Asia Pacific that will enable the growing adoption of amine-based treatments in the region.

China is projected to dominate the gas treating amine market share in Asia Pacific. For instance, IEA reported that China was the global leader in LNG imports in 2023 while demand grew by 7%. The large-scale LNG imports correlate with the increasing demand for electricity in the country. For instance, the IEA 2024 Executive Summary estimates the electricity demand of China to have grown by 6.4% in 2023 and experienced a minor slowdown with a 5.1% increase in 2024. The per capita electricity consumption in the country is higher than in the European Union. This creates a continuous demand for electricity leading to greater production work in gas-powered plants that necessitates advanced amine-based treatment solutions. Additionally, the construction of new gas-powered plants in the country is poised to provide new opportunities for manufacturers to provide amine-based solutions. For instance, in July 2024, GE Vernova announced the beginning of commercial operation of the CHP plant in Huizhou, China.

India is projected to increase its market share by the end of the forecast period in the APAC gas treating amine market. The growth in the country is attributed to investments in new gas-fired plants and the imposition of environmental regulations to curb GHG gases that increase the adoption of amine-based treatments. A major driver of the gas treating amine market is the intense heat wave in the region that has increased the capacity utilization of gas-fired plants in India. For instance, in May 2024, power plants in Goa, India reported a plant load factor (PLF) of 28.7% due to rising demands for cooling solutions.

Additionally, the demand for natural gas has increased in the country to cater to rising power demands. The IEA reported that in 2022, domestic gas production had a 54.7% share while imports had a 45.3% share. The increasing dependency on natural gas to produce electricity to cater to surging demands is poised to create a steady need for amine-based treatment solutions. Local and global manufacturers and distributors in the country are positioned to offer new formulations of amine-based solutions to offer advanced gas sweetening solutions to boost the market’s growth.

North America Market Analysis

The gas treating amine market in North America is projected to have the fastest growth during the forecast period. The rapid growth is attributed to the large-scale production and consumption of natural gas. The U.S. and Canada lead the market growth in North America. For instance, the Global Oil and Gas Plant Tracker (GOGPT) reported in 2024, that 556728 oil and gas plants were currently operational in the U.S. while 34731 were in development or under construction. In Canada, GOGPT reported 26389 oil and gas plants to be operational and 7042 under construction. The large numbers of oil and gas plants lead to surging demands for amine-based treatments as the region looks to cut down on GHG emissions, leading to the growth surge of the gas treating amine market.

The U.S. leads the profit share in North America owing to the country’s position as the largest exporter of natural gas globally along with being the largest producer of natural gas domestically. This positions the country to have lucrative opportunities in the gas treating amine market owing to a large number of gas-fired plants requiring novel treatment solutions. U.S. has been actively pushing for a reduction in GHG emissions owing to the country ranking second in CO2 emissions globally behind China. In July 2024, the U.S. Environmental Protection Agency estimated the power sector in the country to be the second largest source of GHG emissions. T

he presence of multiple gas-fired power plants and the increasing percentage of GHG emissions is necessitating the rapid adoption of amine-based solutions. Key market players in the country are positioned to provide innovative treatment solutions to increase their profit share by the end of the forecast period.

Canada is projected to increase its revenue share by the end of the forecast period. The growth is attributed to the large-scale use of natural gas for the power sector leading to growing demands for gas treatment solutions. For instance, in June 2024, the Canada Energy Regulator estimated natural gas production in the country to have hit a record high in 2023 as production reached 18.8 Bcf/d. Higher capacity utilization of gas-fired plants boosts demand for amine-based solutions in the market. The IEA estimates a 40.8% share of gas in the energy supply of Canada in 2023 accounting for a 63% increase from 2000 to 2023. With an increasing dependency on natural gas for energy solutions, the gas treating amine market is projected to maintain its robust growth.

Key Gas Treating Amine Market Players:

- GE Vernova

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF

- Schlumberger NV

- Amines & Plasticizers Ltd.

- Shell Global

- ExxonMobil Corporation

- Dow Chemical Company

- Air Products and Chemicals, Inc.

- Evonik

- Chevron Phillips Chemical Company LLC

- Arkema

- Huntsman Corporation

- Axens

- Pall Corporation

The global gas treating amine market is poised to register a profitable growth curve during the forecast period. The market is characterized by global and local player vying to increase their profit share. Key market players are positioned to provide effective gas treating solutions with amine-based formulations along with investments in research and acquisitions to improve their market share.

Here are some key players in the market:

Recent Developments

- In May 2024, Global Energy reported that global gas-fired power generation grew by 0.8% in 2023. The increase was led by the United States with an increase of 115 TWh and China with 25 TWh.

- In February 2022, the U.S. Department of Energy awarded USD 5.7 million for a GE-led carbon capture technology integration project targeted to achieve a 95% reduction of carbon emissions.

- Report ID: 6582

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Gas Treating Amine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.