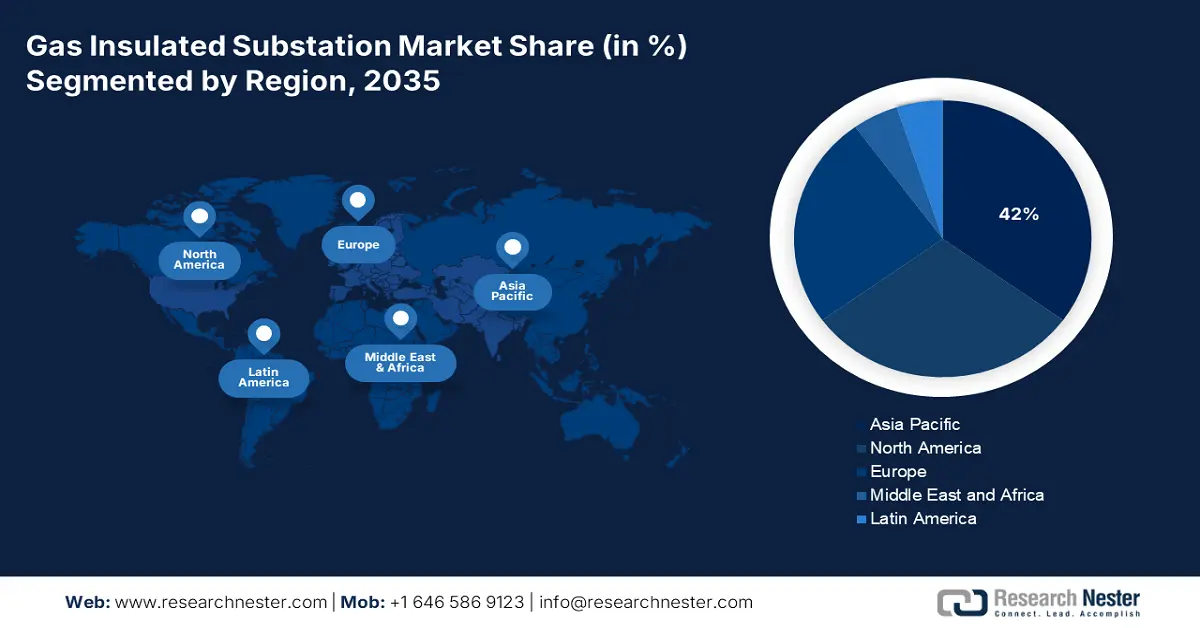

Gas Insulated Substation Market Regional Analysis:

APAC Market Insights

The Asia Pacific gas insulated substation market is projected to hold the largest revenue share of 42% by the end of 2035. Rapid industrialization in countries such as China, India, Japan, South Korea, and Southeast Asia has increased the demand for gasoline engines in the region. Gas engines play a crucial role in meeting this demand, particularly in electricity generation, gas-fired power plants, including combined cycle power plants that are increasingly being deployed in the region to provide efficient and reliable electricity. Furthermore, the combination of natural gas reserves, supportive initiatives and environmental policies, renewable energy transition, and infrastructure development has created a favorable environment for the adoption and expansion of gas engines in numerous applications such as mechanical drives, power generation, cogeneration, etc. across the globe.

China gas insulated substation (GIS) market is a key share holder and plays a vital role in raw material exports on the global map. The west region has several hydropower plants and the north west has wind resources. The key end users reside in the southeast regions, requiring high-power transmission and long distances of tens of ±800 kV, ±1,100 kV, and ±500 kV HVDC systems are presently operated in China. The transmission lines provide more than 1000 GW of electricity, connecting the rural northwest to economic southeast areas. The country is home to several large power transformer (LPTs) manufacturers comprising Baoding Tianwei Baobian Electric Co. Ltd. In 2020, the U.S. spent USD 3 billion on power/distribution/specialty transformers imports, of which China accounted for 7%, followed by South Korea. Of USD 108 million import value of insulated copperwinding wire imports in the U.S., 11% came from China and Vietnam, finds the U.S. DOE.

North America Market Insights

North America gas insulated substation market growth trajectory is attributed to Canada’s core manufacturing capabilities. 6% of total U.S. transformer oil imports were from Canada and is among the top LPT producers. LPTs from Canada are 10% less expensive than their counterparts domestically developed in the U.S. Moreover, the growing demand for renewable sources of energy in the region, along with retrofitting of the aging power grids is a significant factor gas insulated substation market expansion in the region.

The domestic manufacturing potential in the United States is promising. Presently, the technologies required to entirely replace SF6 are under development, and by 2027 systems up to 550 kV are anticipated to be deployed by domestic manufacturers. It is critical to recognize rising focus on environmental sustainability would be crippling to the existing SF6-based equipment. The Hitachi, GE, and Siemens companies have the most comprehensive product offerings in the U.S. Hitachi offers production-line interoperability allowing customers to SF6 capacity to non-SF6. The United States, as per the DOE, aims to deploy 30 GW of offshore wind by the end of 2030 and 86 GW by 2050.