Furniture Rental Market Outlook:

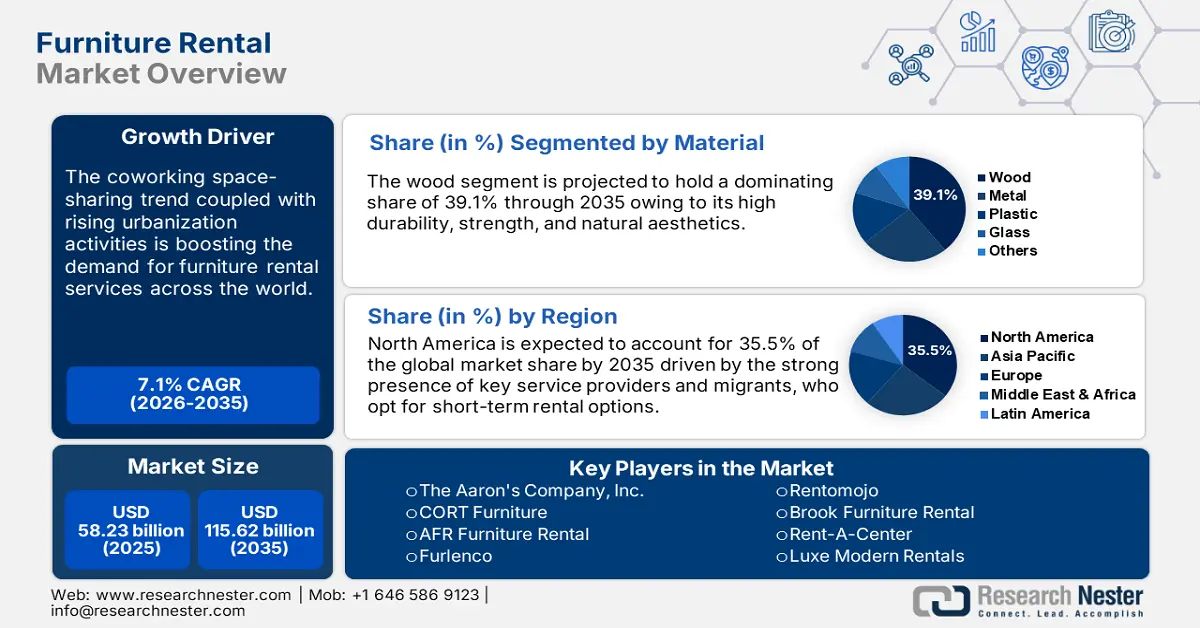

Furniture Rental Market size was over USD 58.23 billion in 2025 and is poised to exceed USD 115.62 billion by 2035, witnessing over 7.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of furniture rental is evaluated at USD 61.95 billion.

The corporate sector is a major end user of furniture rental services, the companies rent furniture rather than purchase, especially to cut down infrastructure costs, during office relocations, or restructuring. This rental aspect enables businesses to maintain flexible workspaces without heavy capital investment in furniture assets.

Rent-A-Center a brand of Unbound Group, a leader in the furniture rental market revealed a total revenue earning of USD 1.06 billion in its third quarter 2024 report. Shared office spaces or co-working spaces are the most trending aspects benefiting furniture rental companies to earn high profits. Research Nester estimates that numerous people are working in co-spaces, driving sales of furniture rental services. Shared office spaces are designed to cater to various businesses, from start-ups to medium-sized enterprises and rental furniture is a perfect cost-effective option as these businesses can avoid long-term commitments and costly investments in office furnishing.

Key Furniture Rental Market Insights Summary:

Regional Highlights:

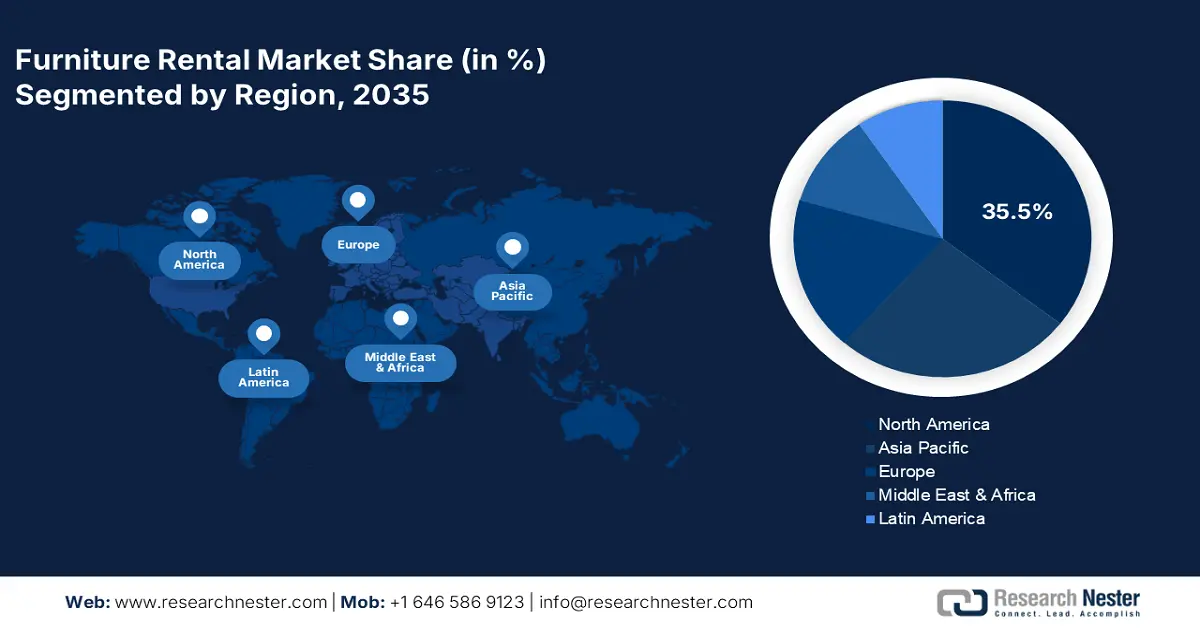

- North America’s 35.5% share in the furniture rental market is propelled by the high presence of migrants, driving growth through 2026–2035.

- Asia Pacific's furniture rental market is projected to grow at a healthy pace through 2026–2035, fueled by increasing urban activities, industry giants' expansion, and shared office space trends.

Segment Insights:

- The Bed segment is anticipated to achieve a notable share by 2035, driven by high bed prices and demand for cost-effective rental solutions amid urban migration.

- The Wood segment is poised for substantial growth from 2026-2035, driven by the durability, strength, and aesthetic appeal of wooden furniture.

Key Growth Trends:

- Rising urban activities

- Teleworking trend

Major Challenges:

- Operational complexity

- High competition

- Key Players: The Aaron's Company, Inc., CORT Furniture, AFR Furniture Rental, and Furlenco.

Global Furniture Rental Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 58.23 billion

- 2026 Market Size: USD 61.95 billion

- Projected Market Size: USD 115.62 billion by 2035

- Growth Forecasts: 7.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Furniture Rental Market Growth Drivers and Challenges:

Growth Drivers

- Rising urban activities: The rising urban population and job relocations particularly among millennials and Gen Z are fostering high demand for temporary housing solutions including rental furniture. The United Nations estimates that the global urban population is set to increase to 68% by 2050. This demographic is expected to invest more in renting high-quality furniture than purchasing due to their short-term needs. Individuals who shift to urban areas in search of jobs or education are often with limited budgets. Investing in furniture appears to be a significant financial challenge for them. Thus, urban population growth is anticipated to offer lucrative opportunities to furniture rental market players in the coming years.

- Teleworking trend: The remote work trend is positively influencing the demand for rental furniture, especially among individuals setting up home offices. Many prefer renting ergonomic furniture for home office setups rather than committing to long-term purchases due to their cost-effectiveness. For instance, in December 2023, the U.S. Bureau of Labor Statistics revealed that around 1 in 3 employees in professional, management, and other related occupations are teleworking. This high shift in remote working directly drives the demand for home-office furniture such as tables, cabinets, and chairs. Instead of investing heavy amounts in fixed assets, individuals opt for rental furniture services. The rental furniture option is profitable for users in multiple ways such as in reducing logistics costs, easy installation and return options, and availability of the latest products.

Challenges

-

Operational complexity: In the furniture rental sector the efficient management of inventory, delivery, installation, and maintenance of rental products is the most challenging aspect. New companies entering the furniture rental market should ensure efficient supply chain management for a smooth customer experience. Also, since rental furniture is used multiple times by various customers, the maintenance of product quality is a must. Damaged or worn furniture hampers the brand’s reputation, leading to lower demand.

-

High competition: The presence of established companies and the continuous emergence of start-ups are increasing the furniture rental market competitiveness. Bad service and poor marketing can hinder the revenue growth of the companies. Also, as the competition increases, some industry giants offer furniture rental services at competitive prices, which can hamper their profit shares to some extent.

Furniture Rental Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.1% |

|

Base Year Market Size (2025) |

USD 58.23 billion |

|

Forecast Year Market Size (2035) |

USD 115.62 billion |

|

Regional Scope |

|

Furniture Rental Market Segmentation:

Product (Bed, Sofa & Couch, Table & Desks, Chairs & Stools, Wardrobe & Dressers, Others (Ottomans, Kitchen Islands, Nightstands, Storage Benches))

Bed segment is anticipated to hold over 31.6% furniture rental market share by the end of 2035. The high prices of beds are major reasons why individuals are opting for rental options to cut upfront investment costs. Also, homeownership is increasingly becoming unaffordable due to high property prices and mortgage rates. This is making individuals moving to urban cities in search of jobs or education opt for the more viable option of renting. This factor is also directly augmenting the demand for cost-effective furniture rental solutions including beds.

Material (Wood, Metal, Plastic, Glass, Others (Vinyl, Leather))

By the end of 2035, wood segment is set to hold over 39.1% furniture rental market share. Wood rental furniture is often opted by end users due to its durability, strength, and natural aesthetics. Today, modern wood-based furniture can be easily assembled at the location into a finished product. This ease appeals to consumers as the furniture is delivered and set up quickly. Also, the home office trend is augmenting the demand for rental wooden furniture products such as chairs, tables, shelves, and cabinets, as individuals can set up a professional home office with limited upfront costs. China, India, Malaysia, and Vietnam are some of the lucrative marketplaces for wooden rental furniture, as consumers in these countries widely opt for wooden furniture compared to other materials.

Our in-depth analysis of the global furniture rental market includes the following segments:

|

Product |

|

|

Material |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Furniture Rental Market Regional Analysis:

North America Market Forecast

North America furniture rental market is projected to capture revenue share of around 35.5% by the end of 2035. The high presence of migrants, the popularity of the shared economy, and the existence of key service providers are positively influencing the market growth in the region. The young generation is the major contributor to the rental furniture demand.

In the U.S., the presence of renters is high as many people migrate to this developed economy in search of jobs, education, and a better standard of living. In September 2022, the U.S. Bureau of Labor Statistics revealed that over 44 million households in the country are living on rent. This information aids in understanding how the high rental population positively influences rental furniture sales growth, as this is the most cost-effective approach for this demographic.

Similar to the U.S., Canada witnesses a high presence of migrated people, mostly for educational purposes. For instance, according to Statistique Canada, around one-third of Canadians rent their primary residence. The students living on rent in the country for a short-term period, prefer investing in rental furniture rather than purchasing. Thus, the country is expected to witness a steady demand for rental furniture during the forecast period.

Asia Pacific Market Statistics

The Asia Pacific furniture rental market is driven by the increasing urban activities, expansion of industry giants, and shared office space trends. Corporate companies are highly investing in the co-space renting of offices and furniture as it offers long-term benefits without high upfront capital expenditure. Furthermore, the demand for rental furniture is set to expand at a healthy pace in India, China, Japan, and South Korea during the projected period.

In India, consumer views on purchasing furniture are changing unprecedently driven by their modified spending decisions. Rental furniture is emerging as easy and affordable options to set up their homes. The high price of properties, expensive mortgage loans, and the rise in the millennial population are collaboratively augmenting the adoption of furniture rental solutions in the country.

In China, the urbanization rates are consistently rising, which is increasing the demand for flexible living arrangements such as rental furniture. Young workers and international workers prefer renting furniture rather than purchasing long-term assets due to the transient nature of their stay. Furthermore, the increasing emergence of start-ups is set to promote the awareness of rental furniture in the country.

Key Furniture Rental Market Players:

- The Aaron's Company, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- CORT Furniture

- AFR Furniture Rental

- Furlenco

- Feather

- Rentomojo

- Brook Furniture Rental

- Rent-A-Center

- Luxe Modern Rentals

- The Everest

- Fernished Inc.

- Athoor

- Fashion Furniture Rental

Key players in the furniture rental market are employing various tactics such as dynamic pricing models, new product offerings, expansion into high-potential regions, branding, and mergers & acquisitions. Subscription-based pricing is aiding companies to attract a wider consumer base. In this model, customers pay a fixed monthly fee for furniture use, which provides a predictable and consistent revenue stream for businesses and is attractive to customers with different budgets and lifestyles.

Expansion of product offerings keeps customers engaging as these platforms offer a one-stop shop for temporary home needs. Industry giants are increasingly targeting urban locations where mobility is high and people prefer renting more than owning. Furthermore, collaboration with furniture designers and real estate companies is aiding them to expand their furniture rental market reach and bring in new customers.

Some of the key players include:

Recent Developments

- In May 2024, CORT Furniture entered into a strategic partnership with LCP Media to redefine the apartment rental experience. Through LCP Media’s technology, customers can tour and visualize apartments installed with CORT’s furniture.

- In August 2023, AFR Furniture Rental revealed the acquisition of Brook Furniture Rental’s client base and 3 warehouses. Through this acquisition, AFR is leading the rental furniture business in the U.S

- Report ID: 6768

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Furniture Rental Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.